Hybrid Car Purchases, Economics and Investment Capital Growth Implications

Personal_Finance / Money Saving Apr 18, 2010 - 02:22 AM GMTBy: Richard_Shaw

For the young person just starting out on a periodic savings and investment program with many years of compounding ahead, several thousand additional dollars put into their savings over the holding period of each car they own creates a significant capital value over a lifetime. The conventional versus hybrid car purchase choice can provide that extra investment capital.

For the young person just starting out on a periodic savings and investment program with many years of compounding ahead, several thousand additional dollars put into their savings over the holding period of each car they own creates a significant capital value over a lifetime. The conventional versus hybrid car purchase choice can provide that extra investment capital.

Looking purely at the economics of purchasing a hybrid car versus a conventional gasoline only car, we can’t justify the hybrids. There may or may not be environmental benefits, and there may or may not be rare earth scarcity issues for lithium batteries, and there may or may not be other important social or climatic issues that are outside of our competencies and the realm of direct cost analysis. However, we are well versed in basic arithmetic and the importance of time in the math of compounding.

With that in mind, from a purely economic perspective, conventional gasoline cars make a better investment than a hybrid car . We don’t debate non-economic issues, such as environmentalism or climate change, so if those trump economics for you, read no further. This is about economics only.

If you have non-economic values that are more important to you than economic issues, and you can afford those values, then press on with hybrid purchases if that’s what suits you best.

However, if economics is a reasonable concern in your value system, or a necessity in your budget, for young people in the early stages of a savings and investment program avoiding a $7,000 to $9,000 hybrid-to-conventional purchase price differential over a couple of auto purchases could make a whopping difference 40 years later at retirement.

We don’t advise small accounts or periodic savings programs, but several young people have asked this author about whether hybrids make economic sense to the car owner, so we thought it might be interesting to some readers to see some figures. In terms of direct expenses, the answer is “NO”, hybrids don’t make sense.

The market obviously shares our view. For example, in March 2010 Toyota sold 23,199 conventional Camry’s and only 2,554 hybrid Camry’s, an approximate 9:1 ratio of conventional to hybrid cars.

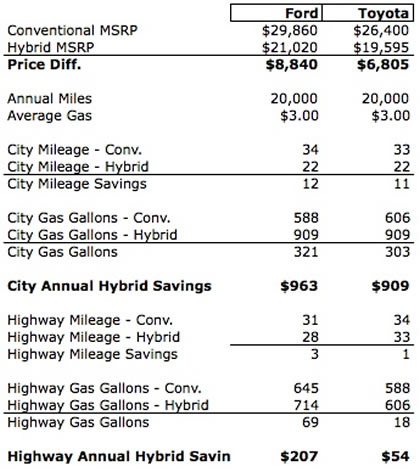

Consider two car makers, FORD (F) and TOYOTA (TM). The Ford Escape SUV comes in conventional and hybrid form with an $8,840 difference in base MSRP. The Toyota Camry comes in a conventional and hybrid form with a $6,805 difference in base MSRP. Those figures don’t include the fact that a more expensive car generates more sales tax cost, more property tax costs and more insurance costs.

Looking solely at the difference in base prices and the differences in city and highway mileage ratings, hybrid car purchasers will not recover the cost difference over the average holding time, assuming constant gasoline prices. Of course, gasoline won’t stay at a constant cost, but then money saved and invested won’t stay constant either. We assume a wash between those two factors.

The city/highway mileage advantages for the Ford models are 12 mpg and 3 mpg. The mileage advantages for the Camry models are 11 mpg and 1 mpg.

If you assume a 20,000 miles per year driver, and a $3.00 per gallon average price (today’s New England average is $2.84 and the West Coast average is $3.06), the Ford hybrid would save $963 per year with 100% city driving or $207 per year for 100% highway driving. The Toyota hybrid model would save $909 for city driving or $54 for highway driving.

If you assume a 5 year average holding time for a car, there is no net savings owning a hybrid. So the gasoline mileage argument is bogus for those with economic motivation, although attractive to those with non-economic motivations.

The purchase cost avoidance put into well selected investments on a monthly dollar-cost-averaging basis, instead of higher monthly purchase loan payments (at interest) to a bank, would probably result in a handsome asset at the end. The car would move on to the used car auction market (or the scrap metal heap), while the savings would continue to grow at compound rates for a few decades until retirement.

Going one step further, buying a low mileage certified pre-owned car with a good warranty, is an even better way for the young person to get a jump on lifetime savings and investment. Even if the buyer gives up a few miles per gallon between a new and certified pre-owned car, the net capital savings is still likely to be substantial and to generate significant investment benefit.

Legislation may someday remove the conventional versus hybrid choice (it has already removed the trans-fat versus no trans-fat food choice in some areas, and the home temperature choice may well be made for you by the government when central electricity use monitoring and control technology is implemented), but for now there is a choice, which from an economic perspective favors conventional, non-hybrid cars.

When the plug-in electric only cars become available, the same general economics may hold true. The car companies need to make the hybrid auto purchase price competitive with conventional cars, or the government needs to make it illegal to make and sell conventional cars, for the economics to either work or the economic choice to cease to exist.

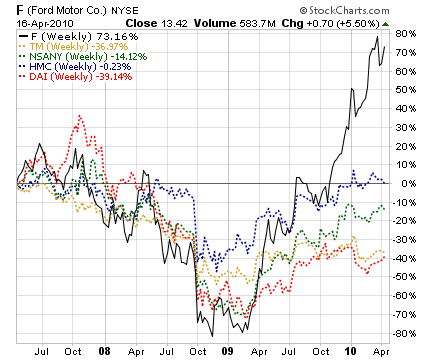

Some current hybrid car makers with public shares are: TM, F, NSANY, HMC, DAI

Holdings Disclosure:

As of April 16, 2010, we do not have current positions in any securities discussed in this document in any managed account.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2010 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.