Global Financial Maelstrom Continues, Government Policies of Insolvency

Interest-Rates / Global Debt Crisis Apr 19, 2010 - 02:25 PM GMTBy: Ty_Andros

The global financial maelstrom continues to unfold as public serpents, central banks and crony capitalists continue to pour gas on the fires. It is set to continue. The collapse of FIAT paper wealth storage is unfolding with breathtaking speed. Asset bubbles continue to emerge in the emerging world and collapse in the developed world as capital FLEES. Today’s missive covers the deep insolvencies in the developed world and the definitions of solvency of Austrian Economics. The inflationary depression still lies in our futures.

The global financial maelstrom continues to unfold as public serpents, central banks and crony capitalists continue to pour gas on the fires. It is set to continue. The collapse of FIAT paper wealth storage is unfolding with breathtaking speed. Asset bubbles continue to emerge in the emerging world and collapse in the developed world as capital FLEES. Today’s missive covers the deep insolvencies in the developed world and the definitions of solvency of Austrian Economics. The inflationary depression still lies in our futures.

First let’s look at the definition of insolvency, courtesy of Jim Sinclair’s www.jsmineset.com:

The Austrian School’s Seven Commandments:

The Austrian free-market economists use common sense principles.

- You cannot spend your way out of a recession.

- You cannot regulate the economy into oblivion and expect it to function.

- You cannot tax people and businesses to the point of near slavery and expect them to keep producing.

- You cannot create an abundance of money out of thin air without making all that paper worthless.

- The government cannot make up for rising unemployment by just hiring all the out of work people to be bureaucrats or send them unemployment checks forever.

- You cannot live beyond your means indefinitely.

- The economy must actually produce something others are willing to buy.

Thank you Jim, and to my readers I highly recommend this website. This is part of the definition of INSOLVENCY or solvency, depending on whether your government behaves in the opposite manner.

“By a continuous process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. The process engages all of the hidden forces of economic law on the side of destruction, and does it in a manner that not one man in a million can diagnose.” - John Maynard Keynes, 1920

We are in the end stages of the societal and financial system destruction. When you get to the end of a fiat currency system, more and more elements of it become a fraud. Asset values, bombs ….er, bonds, the idea of money that does not store wealth.

Over the weekend it was announced that the Greek BAILOUT has been formalized at the insistence of the BOND vigilantes which are trashing the Greek bond markets, and why shouldn’t they? They are trash, worth no more than the worthless trillions of toxic assets already sitting on bank balance sheets. How deliciously ironic that banksters will fall to their doom based on junk bond issuance by their SOVEREIGN partners in crime.

Greek banks are SHUT OUT of the overnight swap markets, thus they are OUT OF BUSINESS until they recover the ability to do so. But the risks are far greater as GOVERNMENT BOMB’s… er, BONDS of all euro zone sovereigns litter the balance sheets of ALL of the continent’s banks; US banks hold worthless US treasuries (never has a dime been repaid, only rolled over with new borrowing). As one by one they succumb to the structural insolvencies which they have implemented and built into their economies, financial systems and governments. They are sand castles just waiting for the tide of insolvency to engulf them.

Watch this episode closely as it is a story which will be REPLAYED over and over again. As usual, the GLOBAL illuminati will address this episode the same way they have in the past and will in the future: THEY WILL PRINT THE MONEY and steal what little purchasing power you still have in your bank accounts. For them this is the easy way out just as it has been since Bretton Woods II severed the last few strings to “SEMI-” sound, reserve-backed money and unleashed their UNBRIDLED greed.

The greatest transfer of wealth from those who hold it in paper to those who don’t is UNDERWAY, a Crack-up Boom looms. This is set to accelerate until the final crisis in which the public understands they have been the victims of the greatest FRAUD in history, also known as UNSOUND Fiat money…. Courtesy of the governments and banking systems in which they have MISPLACED their trust.

This is the greatest OPPORTUNITY in history for prepared investors, and the greatest THREAT to those who are not. As REALITY is priced into markets, VOLATILITY will expand and push markets UP and DOWN to price in the NEW NORMAL of no growth except through misstated inflation. Restoring the functions of money so you can ONCE again store wealth in paper, and then teaching about diversifying into absolute-return alternative investments with the potential to thrive in unfolding market conditions -- this is what I do.

Just as King Canute FAILED to stop the tide, modern day public serpents in the Eurozone will FAIL to stop the tide of INSOLVENCY (moral and fiscal bankruptcy) running through the continent. Men believe that they can triumph over Mother Nature and Darwin with political DICTATES; unfortunately they cannot find Mother Nature and KILL her, and DARWIN’s truth of survival of the fittest did not end with his death.

Greek short- and long-term rates (2 through 10 year) hit the mid 7% range in trading late last week. In a triumph of POLITICS over prudence, the European Union and the IMF are set to pony up approximately 40 to 60 billion Euros to PAPER over the deep STRUCTURAL problems which must be resolved before any REAL ECONOMIC recovery can take place.

Current Greek interest rates of 5% (subsidized level) on $300 billion is $15 billion annually before one cent of principle is repaid, for a country with the population of New York city. The money and borrowing they are guaranteeing is MISPRICED for the risk in defiance of the marketplace. This new lending and most of what has gone before it will NEVER BE REPAID.

These are political solutions rather than the proper solution of default, now, before more money is lost. Remember, the something for nothings will borrow until they are cut off, then print money until people will no longer accept it. Just as anyone in Zimbabwe….

Citizens of the developed world have been betrayed by their leaders, and their governments will not SAVE them; they can’t, they are the engineers and beneficiaries of the crisis.

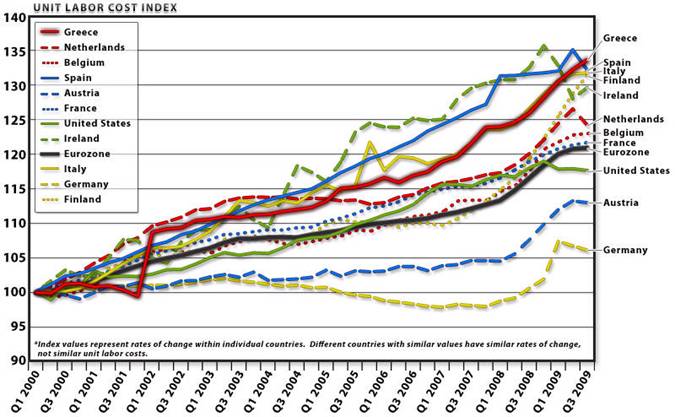

This is only the first of many as the European Union falls to its demise upon POLITICAL solutions implemented to address practical problems for over five decades. It’s a tough task creating the conditions of wealth creation and growth and they have failed for decades. Take a look at this chart showing the lack of competitiveness of European labor (courtesy of www.thegartmanletter.com ):

Do you really think that these countries’ economies are going to recover without getting more competitive? Who is going to overpay for their products? It is clear why Germany’s export sector is still surviving and thriving. Their customers get more goods for less money. Until these other countries get their employment costs GLOBALLY competitive, as well as their taxes and energy costs (green energy is multiple times more expensive than traditional sources such as coal, natural gas, nuclear and oil) they won’t recover.

Mandated energy solutions, salaries and benefits only mandate ONE THING, your competitor who does not have the mandate and who gets the business. EVERYONE is poorer for it in the developed world, and this is why these governments try EXPORTING their own poor economic and environmental policies to the developing world; only now the emerging economies are stronger than the G7’s and they are able to say… NO.

Just last week, the minions of the chosen ones at the labor department in Washington decided that the INTERNS (college students and recent graduates) COULD not voluntarily work for free in exchange for the real world EXPERIENCE and REFERENCES for future employers they gather for doing so. Mandating wage and salaries at the behest of those UNION supporters of theirs. Millions of hours of production which benefits both parties (intern and small business) ended with this. This is WEALTH creation in REVERSE.

The social welfare states are falling to their doom as intensifying debt spirals suck the wind out of capital markets and misallocate capital from wealth/income creation and production to government-directed consumption (support for bloated state and municipal governments and green energy, aka crony capitalism and higher taxes, etc) investment and entitlements. This is misallocation of capital on a massive scale, barricades to future prosperity and anchors of debt on all levels of society.

Driving more nails into the economic coffins in which economic and income growth have been placed. This is but a small fire drill in preparation for the coming total financial system destruction which looms. Next up: Italy, Spain, Portugal and every developed G7 nation (UK, US, France, Switzerland, Germany, everyone in Europe); all socialist welfare-state economies in everything but name as they and the mainstream press try and pin the tail of the current crisis on capitalism, which has been systematically destroyed by socialist progressives, private and public sector unions, crony capitalists and banksters.

Everyone is crowing about GROWTH in the developed-world economies, but if you SUBTRACT government spending (which they are calling growth), the G7 Economies are STILL COLLAPSING at rates of 5 to 10% per year. Diffusion indexes, such as the Purchasing Managers, are paraded to the public as evidence that the economy has RECOVERED, when it merely signifies that the economies are expanding from last month’s and last year’s low levels. This is a statistical recovery; incomes are not growing in the private sector, thus the ability to service the ever-increasing public debt and entitlements becomes further and further away.

"The patient that's on the floor with the cardiac arrest is not Wall Street. It's the American economy."

-- Warren Buffett

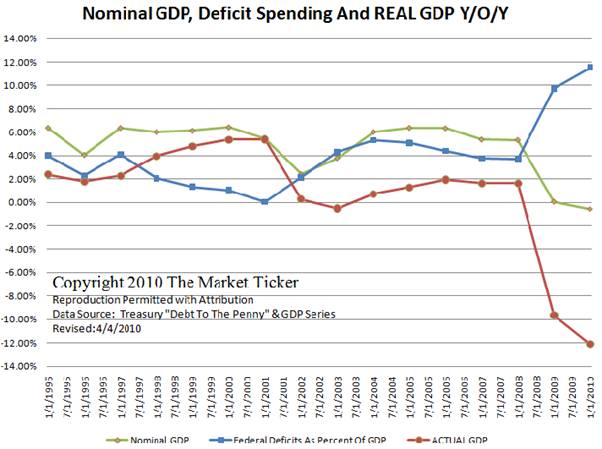

To illustrate the grotesque proportion to which the government is going to MASK the collapse in the economy and to understand the enormous implications of the death, er… debt spiral, look at this chart by Carl Denninger at http://market-ticker.denninger.net and his comments:

“That red line is the REAL GDP in the economy going back to the early 1990s. It is final private demand on a y/o/y basis. You will note that it is in fact down more than 20% from the peak (these are compound annual change rates.)

The reason we have not seen an all-on collapse - yet - is that the government has stepped in and has borrowed and spent a literal $3 trillion over the last two years for the purpose of hiding the insolvency of virtually every bank and a good number of citizens in this nation [political entrepreneurs and crony capitalists] along with virtually every pension plan, annuity and other "defined benefit" plan and institution. They also changed the rules of the game regarding asset valuations - that is, they cheated.

This gambit has produced a veneer of recovery.

There was no meaningful recovery from 2003-2007. GDP growth in the private sector never went over 2%. Never. The Federal Government literally borrowed and spent from $500-600 billion every single year from 2003 - 2008, when the banking system essentially collapsed. This "support" allowed the markets to croon on about 5% GDP growth rates (quite healthy) that were in fact false. This, in turn, led to the misallocation of credit that resulted in home prices spiking higher as credit was granted to people who had no ability to pay.

That debt, by and large, still exists. Only a tiny fraction of it has been defaulted or paid down, as I cover every single month in the Federal Reserve G.19 (and quarterly Z1) reports.

So now you have "economic recovery", you say? Like hell. You have an economy that is literally bleeding from the femoral artery as the nation's left leg has been severed above the knee by a bunch of homicidal maniacs on both Wall and K Streets. The patient is alive only because they are pumping in blood at a rate that exceeds that which is spraying all over the floor while you're calling the patient "healing"?” – Carl Denninger

Thank you Carl; I highly recommend this website for people that want to KNOW the truth. If properly measured, the depression is still in full swing and accelerating. Just think about what the above chart would look like if it was properly adjusted for INFLATION; it would be 1/3rd WORSE.

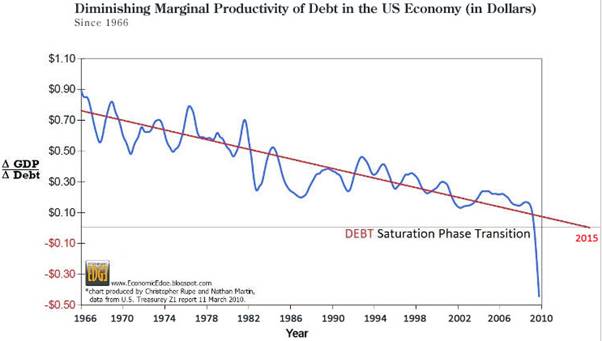

Now let’s take a look at a chart of the effectiveness of borrowing in creating GDP. In 1966, borrowing a dollar created 90 cents of GDP; at the top of the credit mania in 2006, it took almost 6-7 dollars of new lending to create a dollar’s worth of GDP. Now a dollar’s worth of borrowing SUBTRACTS 50 cents from GDP. Take a look at this breathtaking chart (courtesy of Nathan’s Blogspot www.economicedge.blogspot.com/ ):

The Government is borrowing $1.5 trillion this year, YOU DO THE MATH. THIS DEFINITELY ILLUSTRATES YOU CANNOT BORROW AND SPEND your way out of a RECESSION or DEPRESSION. ESPECIALLY NOW! G7 governments are RAISING taxes and creating mountains of smothering regulations to take advantage of the crisis and EXPAND government. Next year, taxes are increasing almost 20% in the United States -- that is roughly $350 billion. According to studies by Ob@ma’s Chief Economist Christina Romer, $1 of increased taxes results in $3 in reduced economic activity. That is $1.15 trillion sliced RIGHT OFF THE TOP of the US economy, about 10%.

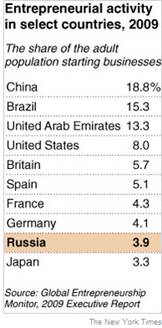

An interesting chart made its way into the New York Times; I call it the crony capitalism index and it illustrates entrepreneurial activity. It is showing why income and business growth in the developed world is a PIPE DREAM as public serpents, unions, crony capitalists and banksters combine to KILL the new private-sector challengers by eliminating new business start ups:

An interesting chart made its way into the New York Times; I call it the crony capitalism index and it illustrates entrepreneurial activity. It is showing why income and business growth in the developed world is a PIPE DREAM as public serpents, unions, crony capitalists and banksters combine to KILL the new private-sector challengers by eliminating new business start ups:

This is why the G7 cannot grow, nor can incomes increase because creative destruction is short-circuited by GOVERNMENT and their special interests. The virtues of MORE goods and services for LESS money have been replaced by LESS goods and services for MORE money by government mandates and regulations requiring you do business with the crony capitalists.

This is what capitalism in the developed economies USED TO deliver before it was KILLED. PONZI finance IS NOT Capitalism, don’t confuse them. Ponzi finance is a function of fiat currency with nothing behind it and printed endlessly. When Bretton Woods II ended, semi reserve-backed currencies’ unbridled Ponzi finance was BORN.

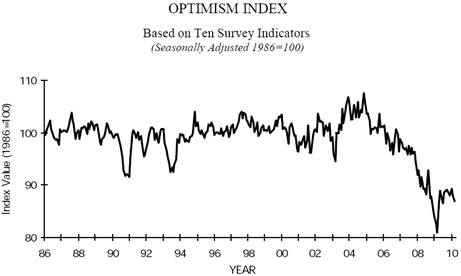

Now comes a business survey from the NFIB (National Federation of Independent Business), you remember them don’t you? They were excluded from the economic and jobs summit by the chosen one. Let’s look at small business confidence. If a recovery in small business is at hand, we should see it in their confidence surveys which normally signal a private-sector recovery, but is not signaling one now:

Notice how it signaled every previous recovery during the period illustrated? It has turned back down, and a break of the most recent low signals a test of the lows early last year.

Notice how it signaled every previous recovery during the period illustrated? It has turned back down, and a break of the most recent low signals a test of the lows early last year.

Now add the message from the chart illustrating debt saturation and it signals ECONOMIC collapse dead ahead. Very few of these small business owners are planning hiring or expanding anytime soon. From where are economic and income growth going to come? Nowhere. They are waiting for the guns of socialist Marxist government to shoot them.

Great plan Mr. President, right where you want it to be under the Cloward Piven strategy of collapsing the economy, which is being implemented by the legislative and executive branches of the US Government as quickly as possible.

When I covered the REPO 105 that Lehman Brothers used to mask their financial condition, I mentioned that all I could think of was Dennis Gartman’s Roach Hypothesis -- that there is never just one, and low and behold the www.wsj.com reports 18 more of them:

“Major banks have masked their risk levels in the past five quarters by temporarily lowering their debt just before reporting it to the public, according to data from the Federal Reserve Bank of New York.

At the end of each of the past five quarters (in billions $), large banks reduced their net short-term borrowings in the repo market, lowering risk profiles they release to the public, before boosting their borrowings in the middle of each successive quarter. The highlighted bars indicate the end of each quarter

A group of 18 banks—which includes Goldman Sachs Group Inc., Morgan Stanley, J.P. Morgan Chase & Co., Bank of America Corp. and Citigroup Inc.—understated the debt levels used to fund securities trades by lowering them an average of 42% at the end of each of the past five quarterly periods, the data show. The banks, which publicly release debt data each quarter, then boosted the debt levels in the middle of successive quarters.” _www.wsj.com

This is what the committee to save the world (Larry Summers, Robert Rubin and Alan Greenscam) brought you when they REPEALED the Glass Steagal Act (Hedge funds in DISGUISE). Understating debt levels by 42%, this is hidden leverage of unbelievable proportions. It is also a fraud on investors. There was not one word about this on Monday morning out of the regulators or Washington DC; Enron, WorldCom, Lehman Brothers, Bear Stearns had nothing on these BANKSTERS. Why aren’t the regulators and auditors FLYING into action? We know the answer, it’s because they are in BED TOGETHER! Screwing YOU!

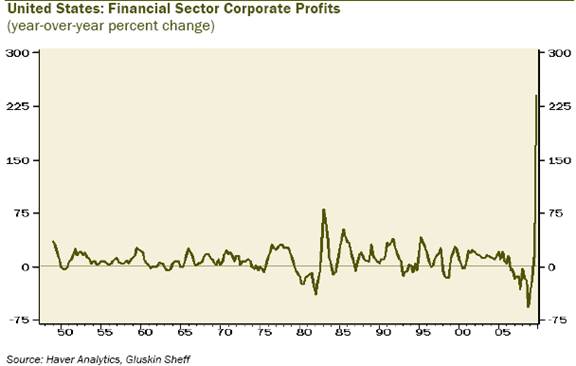

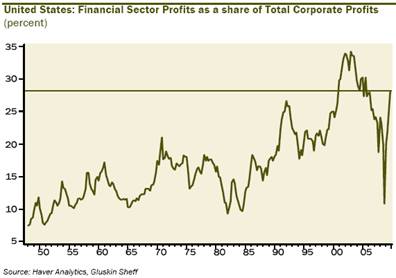

In view of this information, can we believe anything we have been told about the condition of the nation’s banks? No. How about their profits as a percent of assets? Almost NONE -- properly-calculated BIG LOSSES for which they just print money to cover. On top of this is the huge rise in profits as a percentage of total S&P 500. Take a look at this breathtaking surge fostered by Ben Bernanke to rescue the cartel of banks which constitute “too big to fail” -- also known as the masters of the economy, government and crony capitalists everywhere (courtesy of David Rosenberg and www.gluskinsheff.com ):

WOW, these are the earnings that savers should collect but which are transferred to the banks, courtesy of Helicopter Ben and ZERO interest rate policies. Now let’s look at it as a total share of corporate profits (courtesy of David Rosenberg and www.gluskinsheff.com ):

Subtract what the banks are earning from the total S&P earnings and the recovery in the private sectors is severely diminished. This is obscene, but it just emphasizes what everybody, except the public at large, already knows: The public is STILL bailing out the banks.

Subtract what the banks are earning from the total S&P earnings and the recovery in the private sectors is severely diminished. This is obscene, but it just emphasizes what everybody, except the public at large, already knows: The public is STILL bailing out the banks.

"In questions of power, then, let no more be heard of confidence in man, but bind him down from mischief by the chains of the Constitution."

--Thomas Jefferson

Occasionally the slip of a tongue (a Freudian slip?) reveals the TRUTH of the matter, as this Illinois Congressman, Phil H@re, expresses his lack of concern for the oath of office to UPHOLD and DEFEND the constitution:

"I don't worry about the Constitution on this. ... What I care more about, I care more about the people dying every day that don't have health care." --Rep. Phil Hare (D-IL), on video talking about health care (www.youtube.com/watch?v=k2iiirr5KI8).

This man should be recalled immediately, but you can say that of every congressman EXCEPT Ron Paul. 535 elected representatives sworn to uphold and DEFEND the constitution, Benedict Arnolds, all. The checks and balances in the constitution between the three branches of government have been completely short circuited by these rascals, or should I say scoundrels. Bar@ck Ob@ma is on the record expressing his contempt for the constitution and now he is MISUSING his power to take the final steps to REMOVING it. He called the constitution a document of NEGATIVE rights, a Marxist Socialist in sheep’s clothing.

The CONGRESSIONAL progressives are preventing any defense of the constitution and letting the executive branch trash the constitution and their sworn oaths. These are treasonous terrorists and radical Marxists and there is no law above them. Pray to GOD. Absolute power corrupts absolutely and that is where we are; the race to take your freedoms and socialize the economy will take on immense proportion between now and the elections and the lame ducks afterwards will do so as well.

In today’s Wall Street Journal an opinion piece outlines the great job done by New Jersey Governor Chris Christy in taking on the bureaucrats, unions and their pet local congressmen. For examples of the criminality to which Democrats have sunk in order to insure LABOR UNION SUPPORT, consider this:

“One state retiree, 49 years old, paid, over the course of his entire career, a total of $124,000 towards his retirement pension and health benefits. What will we pay him? $3.3 million in pension payments over his life, and nearly $500,000 for health care benefits—a total of $3.8 million on a $120,000 investment. Is that fair?"

Multiply this by 32 million state, local and federal government workers and you know why unions march the GOOSESTEP to the Democratic Party. Trillions of dollars of UNEARNED benefits just move these salaries and benefits in line with the PRIVATE sector and most the BUDGET PROBLEMS disappear. They are looting the public and private sector and transferring it to their CAMPAIGN contributors.

Just yesterday it was announced that the Public Pension Administration’s Calper and Calster programs are not underfunded by an estimated $50 billion (50 thousand million), they are underfunded by $500 billion (that is 500,000 million), whoops. Another part of the short fall is politically-correct investing rather than investments based on their merits. The public servants sold out the public to these immoral bureaucrats and union supporters; these are the policies of insolvency (more on this in a coming missive).

Just yesterday, a new rule went into effect MANDATING federal construction work to contractors which are UNIONIZED, effectively ELIMINATING 85% of the contractors in the US which are not. So now the 85% are PENALIZED for deciding to forgo union membership. Oh, and did I tell you this will cost the taxpayers another 10 to 20% in increased costs and reduced effectiveness in the deployment of their tax dollars? These are the policies of insolvency; PAY more and GET less while criminals game the system to your detriment. Crony contracts are the only contracts made by Government at all levels, federal, state and municipal. These are the policies of insolvency…

Today’s Chicago Tribune reports Illinois is $4.5 billion in arrears to their suppliers in the private sector (bankruptcies loom and any bank that loans against these receivables probably WON’T BE PAID), diverting all available funds to the day-to-day operating expenses of the state government (public-sector unions have demanded this). These political entrepreneurs are getting it good and hard as they should; they are delivering goods and services which are highly overpriced and woefully under delivered for the dollar due to prevailing wage, and other nonsense, regulation which guarantees the state overpays for EVERYTHING.

Speaking of moral insolvency, check out the words of White House Economic Advisor, Larry Summers about unemployment benefits and the endless extension of them:

"The second way government assistance programs contribute to long-term unemployment is by providing an incentive, and the means, not to work. Each unemployed person has a 'reservation wage'—the minimum wage he or she insists on getting before accepting a job. Unemployment insurance and other social assistance programs increase [the] reservation wage, causing an unemployed person to remain unemployed longer."

Republicans eagerly embrace the Tea Parties, but I caution you: DON’T BE FOOLED. The only difference between the two parties is the difference between the Gotti’s and Gambino’s, organized crime families. Look no further than Senator Lindsey Gr@ham to see this on full regalia.

Healthcare is just a SMALL part of the problems: The final straw on the road to serfdom to government. Do any one of these right-wing progressives speak of restoring SOUND money? NO. Do they speak of simplifying the legalized corruption of the 10,000,000 words of the T@x code (10 million words of PAYOFFS, social engineering, theft from their public slaves and economic distortions and goodies for campaign contributors, past and present)? NO. There is a lot of work to do to create the structural conditions for economic and income growth, and we hear not a word from them on these important issues. BUYER BEWARE…

Everyone inside the beltway is NOTHING but big government progressives. The healthcare bill is outrageous, but can you name me one law that has been REPEALED? I do not think so. They will repeal small portions of it and leave the taxes in place. Why? They need the money, and as reported here: IT IS A TAX BILL, disguised by the mainstream media and weasel wordsmiths to FOOL YOU! Of course government never returns freedom to its constituents.

“It is seldom that liberty of any kind is lost all at once,”… “Slavery has so frightful an aspect to men accustomed to freedom that it must steal in upon them by degrees and must disguise itself in a thousand shapes in order to be received.” -- 18th century philosopher David Hume

Think: Healthcare, cap and tax, financial reform, relentless new taxes and regulations that transfer your wealth to crony capitalists and banksters. These are but a few of the policies of insolvency….

In closing: We all live in the MATRIX (if you have not, you should watch the movie) and POTEMKIN villages: economically, monetarily, politically and personally. Illusions are generally accepted as facts, and dumbed-down “useful idiots,” as Lenin called them, march to their doom at the behest of the global illuminati and their constituents (YOU ARE NOT ONE OF THEM), also known as public serpents, crony capitalists, central bankers and their “To big to fail” bankster partners. The main stream media gives the useful idiots a big voice to FOOL you!

Not one policy initiative in the developed world is designed to increase incomes, produce wealth and economic activity. In fact, they destroy it; they are the POLICIES of INSOLVENCY. The collapse of the economy, incomes and banks is still unfolding; prepare for the worst and hope for the best. Sounds like doom and gloom but it is FULL of OPPORTUNITY for prepared investors. Government WILL NOT SAVE YOU!

Volatility is set to explode as REALITY is priced into markets around the world. BUY and HOLD is DEAD. Learn about the indirect exchange by Von Mises and absolute-return alternative investments (this is what I do) with the potential to thrive in up and down markets and diversify your portfolio. Learn how to restore the functions of money as a store, measure and standard of value and purchasing power.

“US government debt is a safe haven the way Pearl Harbor was a safe haven in 1941.” -- Niall Ferguson

Bonds and PAPER currencies are toxic BOMBS. The currencies will be printed and bonds issued until they collapse in the REALIZATION they are IOU’s denominated in IOU’s, with NO intrinsic value and not enough income to repay them. Greece would be printing money like toilet paper if they could. The countries that can will do so. DO NOT STORE WEALTH in them. You can fix them, restore the functions of money and then invest it. This is what I do.

Take a look at this missive “Ob@mas Make Believe Life” by Alan Caruba at:

www.intellectualconservative.com/2010/01/02/obamas-make-believe-life .

The president, himself, is a Potemkin man, a modern day Pinocchio; virtually none of his history is publicly available, only the whitewashed version, I wonder who Gepetto is? Please do not email me on this; let’s just see how history unfolds…

Mother Nature and Darwin are ISSUING a WAKE UP call to the USEFUL IDIOTS and the public at large and there is no way that the global illuminati can defeat them. The collapse of the developed world and its governments, banks and crony capitalists is UNAVOIDABLE. I have outlined only a few of the STRUCTURAL problems. Every policy initiative consumes more than it produces and further buries the private sector in new costs while doing nothing to increase income. Not a recipe for job and income growth, it is, in fact, a considerable barrier. Healthcare is an unfolding nightmare.

Government-sponsored enterprise update: Government Motors announced their results and it was a bloodbath: a $4.3 billion loss. This government-sponsored enterprise will NEVER be profitable and the decision to SAVE it was a payoff to the aforesaid unions. Unions destroy EVERYTHING they touch and are the enablers of socialist progressives, also known as socialist Marxists. Government Motors was and is again a dead man walking, we are just waiting for them to stiff the investors and creditors again, then transfer more PUBLIC funds to these morally and fiscally bankrupt enterprises and crony capitalists. The list is long and growing daily: AIG, GMAC, Chrysler, the 19 too-big-to-fail banks, etc.

The policies of insolvency, your public servants and governments guarantee the final destination: Hyperinflationary depression with bouts of deflation in malinvestments until the current monetary and financial systems fall to their demise. The path there is unknowable, the final result unavoidable!

The policies of insolvency, your public servants and governments guarantee the final destination: Hyperinflationary depression with bouts of deflation in malinvestments until the current monetary and financial systems fall to their demise. The path there is unknowable, the final result unavoidable!

Thank you for reading Tedbits. If you enjoyed it...

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2010 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.