Gold Edges Higher in Major Currencies on Debt and Inflation Concerns

Commodities / Gold and Silver 2010 Apr 21, 2010 - 08:14 AM GMTBy: GoldCore

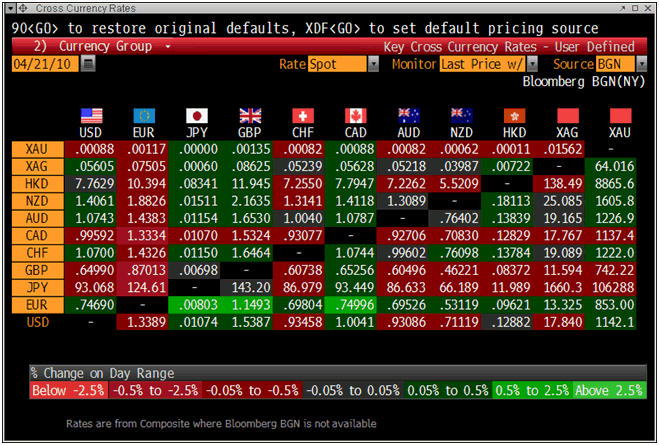

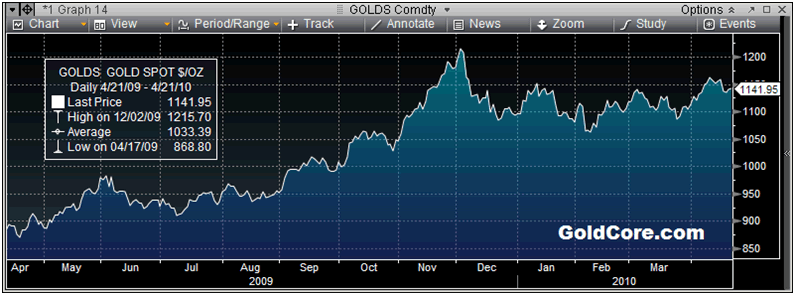

Gold went up to $1,145/oz for a gain of over $10 early in New York but it then fell back off ending with a gain of 0.34%. It has range traded from $1,140/oz to $1,146/oz in Asian and early European trading this morning. Gold is currently trading at $1,143/oz and in euro and GBP terms, gold is trading at €851/oz and £742/oz respectively.

Gold went up to $1,145/oz for a gain of over $10 early in New York but it then fell back off ending with a gain of 0.34%. It has range traded from $1,140/oz to $1,146/oz in Asian and early European trading this morning. Gold is currently trading at $1,143/oz and in euro and GBP terms, gold is trading at €851/oz and £742/oz respectively.

The euro's fall this morning has seen gold prices in euro remain firm and gold in dollars remain flat to slightly positive. The euro has weakened against all currencies and gold and gold, the yen, British pound, Canadian dollar and Hong Kong dollar are all marginally stronger today.

Gold has edged forward today likely due to buying on concerns about inflation and the risks of fiat currencies being devalued. The inflation numbers in the UK and Germany were higher than expected yesterday and traders await the US PPI to see whether inflation may be taking hold in the US. The US producer price index is set to be reported tomorrow and is expected to be higher (possibly as much as 0.5%) after seeing a drop of 0.6 percent the month before and this could lead to buying in the gold pits. Should the figure be higher than expected than gold will likely rise and some traders in the pits will question Fed Chairman Ben Bernanke assertion last week that inflation "appears to be well controlled".

There have also been signs of inflation in China, India and other emerging economies which is leading to continuing physical demand internationally. Holdings in ETFs internationally remain high with no major liquidation and there are a number of new physical gold bullion products coming to market. Gold assets in the exchange-traded product of ETF Securities Ltd. in Switzerland jumped 39 percent yesterday alone.

Risk appetite has returned again but concerns that sovereign debt issues could soon surface in other European states and some US states could lead to risk aversion again in the coming weeks (the IMF warned today that rising public debt levels could threaten the global financial system - see News). Gold's safe haven credentials have seen it outperform most assets (in most currencies) since the start of the financial crisis in 2007 clearly showing that gold benefits from risk aversion. However, in the very short term speculative short term players can liquidate all positions leading to falls in gold in the futures market due to short term risk aversion. The fiscal problems facing California, Illinois, New York, Florida and many other US states have been ignored recently with all the focus on the eurozone and the unfolding "Greek tragedy" but at some stage the very poor and deteriorating fiscal positions of the US states will become an issue and should lead to dollar weakness and a further rise in the gold price. Indeed it could be the impetus that propels gold to the 30 year old inflation adjusted record high near $2,400/oz.

The Icelandic volcano has not had any impact on gold prices. If the volcano was to intensify or the second larger Icelandic volcano erupt, then that could lead to safe haven demand for gold.

Silver

Silver has range traded from $17.86/oz to $17.99/oz this morning in Asia. Silver is currently trading at $17.92/oz, €13.34/oz and £11.63/oz.

Platinum Group Metals

Platinum is trading at $1,738/oz and palladium is currently trading at $563/oz. Rhodium is at $2,950/oz. Platinum for immediate delivery rose to $1,741.65 an ounce, the highest since August 2008. Palladium gained to the highest level in more than two years on speculation that rising vehicle sales will boost demand as the global economy recovers according to Bloomberg. Palladium for immediate delivery gained for a third day, advancing as much as 1.5 percent to $560 an ounce which is the highest price since March 6, 2008.

News

The economic crisis could be entering a "new phase" with rising public debt threatening to undermine the stability of the global financial system, the International Monetary Fund warned Tuesday. In a biannual report on economic stability, the IMF said the latest challenge to the world's rocky financial system came as banks were regaining their footing amid the nascent global recovery. "Risks to global financial stability have eased as the economic recovery has gained steam, but concerns about advanced country sovereign risks could undermine stability gains and prolong the collapse of credit," the report said.

Unemployment increased by 43,000 between December and February to 2.5m, according the last set of official figures released before the General Election. The number of Britons out of work now stands at a 16-year high, while the number of people classed as economically inactive also reached record levels.

Goldman Sachs (NYSE: GS) has been charged with fraud by the Securities and Exchange Commission. Here is the latest news and analysis. Fabrice Tourre the bond trader at the heart of Goldman Sachs' fraud case was on Tuesday barred from working in the City of London in the first 'victory' for financial regulators on both sides of the Atlantic.

Oil climbed above 84 dollars in trade today as European governments reopened their airspace to more flights. Prices also had a boost from equities markets, which were buoyed by a slight rise in US stocks. New York's main contract, light sweet crude for delivery in June, jumped 59 cents to 84.44 dollars a barrel. Brent North Sea crude for June rose 60 cents to 85.40 dollars

Figures from the Swiss National Bank (Swiss Central Bank) in Zurich show that March official reserve assets rose to over 33.44 million troy ounces.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.