Gold Rises to New Record High in Euros and Swiss Francs

Commodities / Gold and Silver 2010 Apr 26, 2010 - 07:59 AM GMTBy: GoldCore

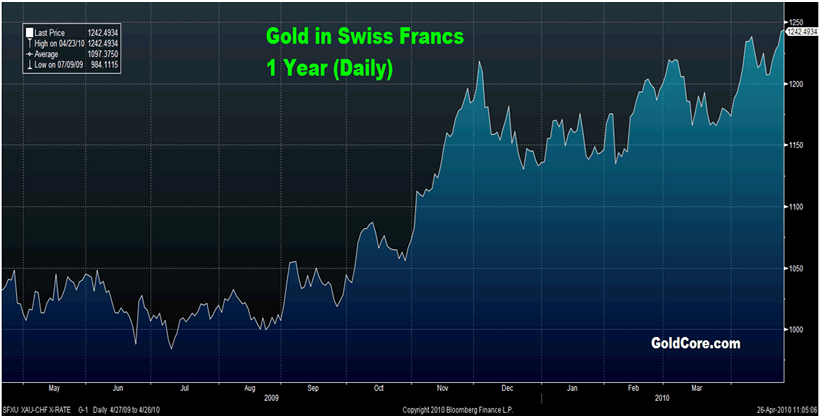

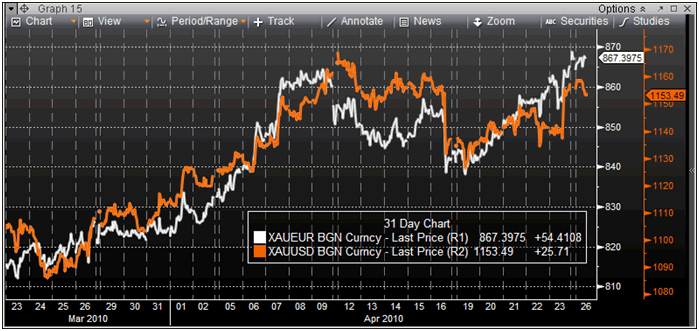

Gold dipped to $1,135/oz early in New York before dipping rising sharply to close with a gain of 0.95%. Gold closed last week some 2% higher in dollars and 3% higher in euros. It has dipped from $1,159/oz to $1,155/oz in Asian and European trading this morning. Gold is currently trading at $1,155/oz and in euro and GBP terms, at €867/oz and £748/oz respectively. Gold has surged to new nominal record highs in Swiss francs and in euros (see charts).

Gold dipped to $1,135/oz early in New York before dipping rising sharply to close with a gain of 0.95%. Gold closed last week some 2% higher in dollars and 3% higher in euros. It has dipped from $1,159/oz to $1,155/oz in Asian and European trading this morning. Gold is currently trading at $1,155/oz and in euro and GBP terms, at €867/oz and £748/oz respectively. Gold has surged to new nominal record highs in Swiss francs and in euros (see charts).

The risk of a serious and contagious sovereign debt crisis is increasing and understandably this is leading to safe haven demand for gold. A Western European country has not defaulted on its debt since World War II so the implications of such a default are momentous.

The Swiss National Bank (SNB) has been intervening in currency markets in order to depreciate their national currency. Like the Japanese central bank, the SNB has adopted currency interventions to prevent the Swiss franc from appreciating too much against the euro, and other currencies. Switzerland's central bank cut its benchmark interest rate to 0.25 percent in March 2009 to help fight the worst recession in decades. Despite Switzerland exiting recession, interest rates are still at record historic lows. The central bank has warned that ultra-low rates could lead to a housing bubble and to inflation.

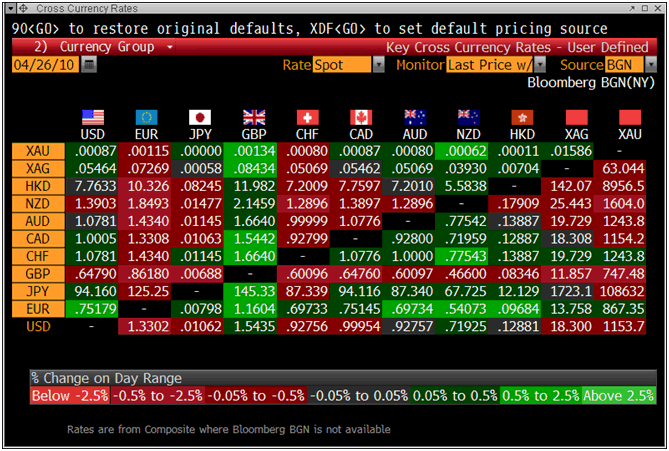

The euro has come under further pressure this morning (see cross currency table) as Greek government bonds fell again (two-year government notes sank, sending the yield up 364 basis points to 14.6 percent; the 10-year bond yield climbed 90 basis points to 9.70 percent). The euro has now fallen against the dollar for eight days in a row time on concern the European Union-led Greek bailout plan will face challenges. The German Finance Minister Wolfgang Schaeuble said yesterday that his Germany's aid for Greece can still be rejected.

The risk posed by competitive currency devaluations, as governments and central banks attempt to inflate their way out of the global debt crisis, is real and this is why gold has risen to new record highs in euros and Swiss francs.

Silver

Silver has range traded from $18.28/oz to $18.41/oz this morning in Asia. Silver is currently trading at $18.31/oz, €13.73/oz and £11.85/oz.

Platinum Group Metals

Platinum is trading at $1,754/oz and palladium is currently trading at $570/oz. Rhodium is at $2,950/oz. Palladium for immediate delivery rose a strong $9.70/oz, or 1.7 percent, to $572.70 an ounce, the highest price since March 4, 2008.

News

Gold may also receive a boost from the increasing resource nationalism being practiced by President Chavez. Venezuelan President Hugo Chavez has threatened to nationalize the country's gold mines, adding them to the oil, utility and metal assets already taken control of. Chavez accused mining companies of destroying the environment and violating workers' rights. Mr Chavez harshly condemned the holders of gold mining concessions, calling them "crazy people" driven by capitalist greed who laid waste to Venezuela's pristine jungles and exploited employees. He suggested mining concessions could be revoked. Mr Chavez has nationalised businesses in the steel, telecommunications, electricity, cement and oil sectors. His government repeatedly clashed with international and national gold-mining companies in recent years over permits.

Venezuela's central bank is considering selling a government bond backed by future gold production, former Mining Minister Rodolfo Sanz recently said. The central bank will increase its gold reserves this year and will buy more than half the estimated 20 metric tons of domestic production, former bank director Jose Khan recently said. Khan is the new mining minister. Given Venezuela's tense relationship with the US, it could be that Chavez and his government are using gold as a geopolitical weapon against Washington and the US dollar.

Demand for gold in India, the largest consumer, is expected to rise as weather office has forecast normal monsoon rains, which would boost purchasing power in rural India, home to two-thirds of the population. India is estimated to have imported 339.8 metric tons of gold last year, data from the Bombay Bullion Association (BBA) showed, while imports for the first three months to March have risen 30% on year to 90.5 metric tons. Silver imports, which were placed at about 1,300 metric tons last year, are also seen jumping. Most Indians live in rural areas, where farming is the primary source of income and gold is a major form of investment due to lack of banking facilities. India's weather office expects normal rainfall in the June-September monsoon season, raising hopes of a rebound in farm output after last year's severe drought. Rainfall is likely to be 98% of the long-term average, said the weather office, whose forecast is closely watched by commodities and financial markets as well as the government, which is battling to rein in inflation against a backdrop of intense protests over rising food prices (Reuters).

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.