The Greek Debt Tragedy From Banks to Sovereigns Back to Banks

Interest-Rates / Global Debt Crisis Apr 27, 2010 - 02:12 AM GMTBy: John_Mauldin

Back and recovering from my Strategic Investment Conference this weekend (where I decided to give myself permission not to write my usual letter, but I promise I will be back at it this next Friday!) I have spent some time pondering what we learned. It was a fabulous conference. Lacy Hunt, Dr. Gary Shilling, David Rosenberg, Niall Ferguson, Paul McCulley, George Friedman, former Fed Senior Economist Jason Cummins (who is now Chief Economist for Brevan Howard, the largest European hedge fund, and who was quite impressive), Jon Sundt of Altegris, and your humble analyst were all in top form. I must admit with a little pride that I think this is the finest speaker lineup for ANY investment conference anywhere. We were given a lot to think about.

Back and recovering from my Strategic Investment Conference this weekend (where I decided to give myself permission not to write my usual letter, but I promise I will be back at it this next Friday!) I have spent some time pondering what we learned. It was a fabulous conference. Lacy Hunt, Dr. Gary Shilling, David Rosenberg, Niall Ferguson, Paul McCulley, George Friedman, former Fed Senior Economist Jason Cummins (who is now Chief Economist for Brevan Howard, the largest European hedge fund, and who was quite impressive), Jon Sundt of Altegris, and your humble analyst were all in top form. I must admit with a little pride that I think this is the finest speaker lineup for ANY investment conference anywhere. We were given a lot to think about.

Let me give you a few key points as an intro to this week's Outside the Box. First, there is a bubble building and it is in sovereign debt. It threatens to be a worse bubble than subprime or the credit crisis. Second, at one panel where we were asked what is our main worry, Paul McCulley said "Europe," which triggered an intense discussion, both in the panel and later that night over dinner. I agreed, of course, as I have written that very thing.

Let me give you a few key points as an intro to this week's Outside the Box. First, there is a bubble building and it is in sovereign debt. It threatens to be a worse bubble than subprime or the credit crisis. Second, at one panel where we were asked what is our main worry, Paul McCulley said "Europe," which triggered an intense discussion, both in the panel and later that night over dinner. I agreed, of course, as I have written that very thing.Both Paul and Niall think the consequences of a euro breakup could be severe, not only for Europe but for the world. I agree. That is why I have focused so much space in my writing and in Outside the Box on the European and especially the Greek situation. Everyone is hopeful that a major breakup can be avoided, but the problems the Mediterranean countries face are serious. I got the sense that most everyone expects the euro to fall further over the coming years.

In my opinion, there is little hope that Greece can resolve its fiscal crisis in a way that is less than draconian. I see almost no way out without a default of some kind. There will be band-aids and other measures to postpone the day of reckoning, but not to avoid it. They have just gone too far down a road of bad decisions.

Today we look at two short essays on Greece, one from Stratfor (George Friedman was in rare form this weekend) and the other from my friends Eric Sprott and David Franklin of Sprott Asset Management. Sprott gives us some details on a brewing Greek banking crisis and then closes with some thoughts on sovereign debt. He throws this little bon mot at us:

" ... [the US Government Accounting Office] goes on to state, however, that using reasonable assumptions, 'roughly 93 cents of every dollar of federal revenue will be spent on the major entitlement programs and net interest costs by 2020.'"

That is an example of the economic truism that if something can't happen, then it won't. Long before we get to 2020, massive change will be forced upon the US. The question is, do we do it willingly or do we become Greece?

And before I turn you over to the capable hands of Stratfor and Sprott, I have to end with what I think was the best one-liner of the conference (and there were so many). Paul McCulley noted that the debt crisis (the shadow banking system, subprime mortgages, SIVs, etc.) was the equivalent of an under-age drinking party with the rating agencies handing out fake IDs.

Have a good week. (And a special thanks to Lee Stein and David Malcolm for being so generous with their homes and wine cellars, respectively.)

Your feeling like I was drinking information through a fire hose analyst,

John Mauldin, Editor

Outside the Box

The Making of a Greek Tragedy

From Stratfor

Greece has not had many good days in 2010, but Thursday was a particularly bad day. First, Europe's statistical office (Eurostat) revised up the Greek 2009 budget deficit, which placed Athens' accounting shenanigans in the spotlight again. The bottom line is that the situation is even worse than previously thought, and the budget deficit may very well be adjusted up as more Greek accounting malfeasance comes to light. Following the announcement, credit rating agency Moody' s dropped Greece's credit rating one notch, immediately prompting a rise in Greek government bond yields, thus increasing Athens' borrowing costs.

The yield on a Greek 10-year bond shot above nine percent, while a two-year bond rose above 11 percent, both record highs since Greece joined the eurozone. Particularly daunting is the fact that short-term debt financing is now more expensive than long-term funding. This situation is referred to as an "inverted yield curve," and it is generally considered a harbinger of financial doom. This means that investors are sensing that Athens is more likely to experience problems sooner rather than later.

Higher yields mean that Greece is facing increasingly larger interest payments on an increasingly larger stock of debt. This all but confirms that Athens' claim that its stock of public debt will peak at 120 percent of gross domestic product (GDP) is simply wishful thinking. Worse still, Greece is also facing continued economic recession, induced in part by Athens' austerity measures designed to reduce its budget deficit. Given this vicious dynamic, we cannot see how Greece's debt level will stabilize at anything below 150 percent of GDP range.

The point is that the financial writing is now on the proverbial wall; some form of default is simply unavoidable. Exactly how the Greek default will unfold is unclear, but the bottom line is that the question now is not "if" but "when." Under "normal" circumstances, when the IMF becomes involved with a country in a situation similar to Greece's, the standard procedure is to devalue the local currency. By lowering the relative prices within the economy, the devaluation increases the competitiveness of the country's export sector and helps to reorient the economy toward external demand. Devaluation is also politically expedient because regaining competitiveness does not require employers to slash employees' wages, as the devaluation adjusts the relative costs silently and discreetly.

However, Greece does not have the option of devaluation because it is locked into a monetary union. The eurozone's monetary policy is controlled by the Frankfurt-based European Central Bank. The fact that Greece is locked in the "euro straitjacket" raises two questions, the first being how the Greek debt crisis will play out.

Without the option of devaluation, the Greeks will have to implement and endure draconian austerity measures - in addition to the ones it has already enacted - similar to what Latvia and Argentina endured as part of their IMF programs. Argentina in 2000 and Latvia in 2008 also could not go the currency devaluation route because neither country controlled its monetary policy. In Argentina' s case, the austerity measures were so severe that they caused considerable social unrest - including a brief period of outright anarchy in late 2001, which saw the country go through five heads of government in about two weeks - ultimately culminating in the country's partial debt default in 2002. To this day, Argentina is still dealing with the fallout of that financial calamity.

Latvia is a case of more recent vintage. In late 2008, Latvia agreed to what the IMF itself has called one of the most severe austerity programs since the 1970s. To accomplish it, Latvia has done everything from slashing public sector wages by 25 to 40 percent, increasing taxes, reducing unemployment and maternity benefits and cutting the defense budget. The crisis has already cost the Latvian prime minister his job and stoked social unrest. Despite all of that, the budget deficit has not budged much, remaining around eight percent of the GDP mark. Spending has been cut to the bone, but Latvia is simply too small of an economy to emerge from recession on its own.

Since the broader European economic recovery remains moribund at best, less government spending has translated directly to less growth. Less growth means less tax income, and less tax income means that the country' s budget deficit remains stubbornly high. Latvia has essentially become a ward of the IMF, and will remain so until either the broader European economic recovery is more robust or the Baltic state is fast-tracked into the eurozone itself.

An EU-IMF bailout of Greece would ultimately give Athens the choice of becoming either an Argentina or a Latvia. A financial assistance program that does not involve substantial structural reform on Greece's part would lead to a default a la Argentina. A bailout that forces Greece to get serious about reforms would mean Greece becomes an IMF-ward like Latvia, with default still a serious possibility down the line. In either case, Greece will essentially lose control over its destiny.

The next question is what the rest of Europe will look like, and there is no shortage of impacts. Europe, and Germany in particular, must decide whether and to what extent it should "bail out" the Greeks. How that might happen is now the topic of the day in Europe. Driving the urgency is this simple fact: In the absence of substantial (and subsidized) financial assistance, Greece will inevitably default on its debts, thus generating write-downs for all those who hold Greek government debt (mostly European banks).

The Greek default therefore is no longer an isolated problem, but a problem that threatens to aggravate an already weakened European banking sector. One of the most misunderstood facts of the international financial world is that even at the peak of the U.S. subprime crisis, in the dark hours when American hedge funds seemed to be snapping like matchsticks, Europe's banks were in even worse shape. As the Americans stabilized, so did their banks. But Europe never cleaned house, and now a Greek tsunami is poised to wash over the whole mess. [emphasis mine - JM]

Weakness Begets Weakness: from Banks to Sovereigns to Banks

By: Eric Sprott & David Franklin -

Sprott Asset Management

The Greek debt situation has been an interesting case study for students of the sovereign bond markets. If there's a lesson to be learned from Greece's experience thus far it's that sovereign bailouts are far more complicated than bank bailouts. They require more sophisticated negotiations and proposals and involve an extra layer of diplomacy that makes them especially difficult to accomplish. As we write this, the European Union has recently announced new lending terms to support the Greek government, with great efforts made to assure the markets that these new terms do not constitute a 'bailout'. The problem with the Greek situation is that an actual bailout would involve an almost impossible coordination among all the major powers within the EU. It would require the unanimous pre-approval of all the EU heads of state. It would involve the European Commission, the European Central Bank and the International Monetary Fund (IMF) all visiting Greece to perform financial assessments. And finally, it would involve at least seven EU countries affirming support through parliamentary votes - all of this before a single euro is spent.

A true bailout involves an almost impossible number of hurdles that essentially guarantee nothing will happen until all other avenues of rescue are exhausted. However, judging by the recent increase in yields on 10-year Greek bonds, Greece may soon need more than a loan package proposal to solve its fiscal problems.

One aspect of the Greek situation that has been obscured by all the recent political wrangling is the crisis' impact on the Greek banks. Although the banks were supposed to be rock solid after all the government-injected capital they received (not to mention zero-percent interest rates and generous lending terms from the European Central Bank), data shows that Greek bank deposits have fallen 8.4 billion euros, or 3.6 percent, in two months since December 2009. With no restraints on capital flows within the European Union, Greek savers are free to transfer their assets elsewhere. Given that bank deposit guarantees in Greece are the responsibility of the national government rather than the European Central Bank, we suspect Greek citizens are pulling money out of their banks because they question their government's ability to honour its domestic deposit guarantees. We envision Greek depositors asking themselves how a government that can't raise enough money to stay solvent can then turn around and guarantee their bank deposits? It's a fair question to ask.

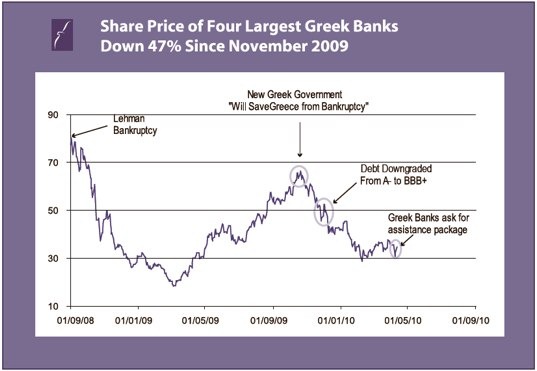

The Greek bank stocks have been thoroughly punished throughout the crisis. Chart A plots an index consisting of the four largest Greek bank stocks and shows an average decline of 47% since November 2009. The deposit withdrawals from these banks have been so damaging to their respective balance sheets (remember bank leverage?) that the Greek banks have asked to borrow 17 billion euros left over from a 28 billion euro support program launched in 2008.3 You see the connection here? Greece experienced a financial crisis, followed by a sovereign crisis, followed by another financial crisis. There is no doubt that the Greek crisis has helped drive the gold spot price to its recent all time high in euros. Gold is a prudent asset to own in times of crisis, and it's possible that a portion of the Greek deposit withdrawals were reinvested into the precious metal. The fact remains, however, that if the Greek government cannot stem the outflows of deposits soon, the EU will have no other choice but to undertake a real sovereign bailout with all its bells, whistles and arduous protocols.

It's a vicious spiral from financial crisis to sovereign debt crisis to banking crisis, and there is no reason it can't spread to other European countries suffering from similar fiscal imbalances. With Spain and Portugal next in line with their own sovereign debt issues, we can expect depositors in these countries to make similar runs to the bank for their cash. "Guaranteed by Government" is truly beginning to lose its potency in this environment. The International Monetary Fund (IMF) seems to be preparing for such a scenario with its recent announcement of a tenfold increase in its emergency lending facility. The IMF's New Arrangements to Borrow (NAB) facility is designed to prevent the "impairment of the international monetary system or to deal with an exceptional situation that poses a threat to the stability of that system." The NAB facility has grown from US$50 billion to US$550 billion with the mere stroke of a pen. Does the IMF know something that the market doesn't? Is this a pre-emptive measure to repel an attack by bond vigilantes' on Europe's fiscally-weakened countries?

Sovereign Debt

In our examination of the Greek situation this past month, we kept coming across various sovereign credit ratings. In an effort to better understand the Greek situation, we decided to look at how the ratings agencies generate their actual rankings and built our own model to determine a country's credit risk.5 We used common metrics such as GDP per Capita, Government Budget Deficits, Gross Government and Contingent Liabilities, the inflation rate and incorporated a simple debt sustainability metric in order to generate our own sovereign ratings. What we discovered in the process was quite puzzling.

It should first be noted that the rating agencies are in the business of offering their 'opinions' about the creditworthiness of bonds that have been issued by various kinds of entities: corporations, governments, and (most recently) the packagers of mortgages and other debt obligations. These opinions come in the form of 'ratings' which are expressed in a letter grade. The best-known scale is that used by Standard & Poor's ("S&P") which uses AAA for the highest rated debt, and AA, A, BBB, BB, for debt of descending credit quality.

In our opinion, as they relate to sovereign debt, the ratings provided by the agencies are highly suspect. While these agencies claim to provide ratings that consider the business credit cycle, there appears to be very little forward-looking information actually factored into their credit models. In some cases, the agency ratings end up looking absurdly optimistic. This of course should come as no surprise - we all remember the subprime mortgages that were rated AAA that are now worth pennies on the dollar.

While there were some similarities in our rankings (for example, our model ascribed AAA ratings to the local currency debt of Australia, Canada, Finland, Sweden, New Zealand which matched the ratings given by S&P), we found some glaring inconsistencies in the rating results for less fiscally prudent countries that left us scratching our heads. A good example is South Africa. The agencies currently rate South Africa an A+ entity, while our model calculated a 'BBB-' rating for its debt using our estimates. 'BBB-' is the lowest 'investment grade' rating for local currency sovereign debt - one level above junk. We arrived at this rating without having factored in South Africa's resource endowment. A significant contributor to South African GDP is derived from mining, particularly gold mining. While South Africa has been the largest producer of gold until very recently, their below-ground reserves have not been revised since 2001 when the country held 36,000 tonnes of gold (or about 40% of the global total).

Recent stats from the United States Geological Survey (USGS) estimate that South Africa now has only 6,000 tonnes worth of economic gold reserves remaining. Further review by Chris Hartnady, a former associate professor at the University of Cape Town, using similar techniques to those of M. King Hubbert (the Peak Oil theorist), suggests that South Africa could have only half of the gold reserves estimated by the USGS.7 If these new estimates are correct, South Africa could have 90% less gold than claimed - and it's not even factored into our BBB- rating! So what's South African debt really worth? An 'A+' from the ratings agencies seems far too generous based on our cursory review of the country's fundamentals.

The rating agencies' ranking of the United States is even more disconnected from reality. To believe that the US sets the benchmark for sovereign debt credit ratings is preposterous. While we have written ad nauseam about the excessive debt issuance by the United States, we found a recent update written by United States Government Accountability Office (GAO) to be particularly instructive. The update noted the US's budget deficit equivalent to 9.9% of GDP in 2009 - the largest 10 since 1945 - and stated that without significant policy changes the US government would soon face an "unsustainable growth in debt".

This was not news to us. It goes on to state, however, that using reasonable assumptions, "roughly 93 cents of every dollar of federal revenue will be spent on the major entitlement programs and net interest costs by 2020." This is news! In less than ten years, using reasonable assumptions, there will essentially be no money left to run the US government - 93% of all tax revenues the US government collects will go to pay social security, Medicare, Medicaid and the interest costs on their national debt. This implies no money left over for defense, homeland security, welfare, unemployment benefits, education or anything else we associate with the normal business of government. And the US government is rated AAA!?

The historian Niall Ferguson recently wrote that, "US government debt is a safe haven the way Pearl Harbor was a safe haven in 1941." It's hard not to agree given the foregoing statements by the GAO. The risk inherent to investors, of course, is what happens when the bond market begins to realize and react to this new level of risk. In a speech earlier this month, Jürgen Stark, who is a member of the board of the European Central Bank, stated, "We may already have entered into the next phase of the crisis: a sovereign debt crisis following on the financial and economic crisis."

The activities of the IMF would confirm this statement. The question we must now ask ourselves is whether "backed by government" actually means anything anymore. In the depths of the 2008 crisis it was the governments that stepped in to provide a guarantee on financial assets. It was the governments that backed our savings accounts, money market funds, day-to-day business banking accounts, as well as debt issued by US banks. But what happens when confidence in the government guarantee begins to erode? We've seen what happened to Greece. Leverage inherent in the banking system elevated a bank run, equivalent to a mere 3.6 percent of deposits, into another full blown banking crisis. In our view it's time for investors to acknowledge sovereign risk. The ratings agencies can opine all they want, but it seems clear to us that the only true AAA asset to protect your wealth is gold.

April 2010AGEMENT LP

John Mauldin

Editor, Outside the Box

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2010 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.