Global Debt Crisis Future Public Debt Trajectory Protections

Interest-Rates / Global Debt Crisis May 02, 2010 - 04:47 AM GMTBy: John_Mauldin

There Had to Be a Short

There Had to Be a Short

How Should Our Institutions Invest?

The Future Of Public Debt

The Future Public Debt Trajectory

Debt Projections

Everyone and their brother intuitively knows that the current government fiscal deficits in the developed world are unsustainable. They have to be brought under control, but that requires some short-term pain. Today we look at a rather remarkable piece of research from the Bank of International Settlements (BIS) on what the fiscal crisis may morph into in the future, how much pain will be needed, and what will happen if various countries stay on their present courses. Some countries could end up paying north of 20% of GDP just on the interest to serve their debt, within just 30 years.

Of course, the markets will not allow that to happen, long before it ever gets to that level. And what makes this important is that this is not some wild-eyed blogger, it's the BIS, a fairly sober crowd of capable economists. We will pay some attention. Then I'll throw in another few paragraphs about Goldman.

But first, I want to bring a very worthy cause to your attention. For my Strategic Investment Conference last weekend, Jon Sundt and I bought some mighty fine wine for our guests. That of course, is to be expected. But each of those bottles also bought a wheelchair for someone in a most needy part of the world. Here's the story.

Gordon Homes at Lookout Ridge Winery in Napa Valley has gotten five cult winemakers to create special wines for him. These are winemakers whose production is sold out well in advance - they're the all-stars of wine (like Screaming Eagle). And while they can't sell them from their own wineries, they blend these special signature wines for Lookout Ridge.

Each bottle sells for $100, well below what it would take to get one of these cult artists' bottles - even if you could get them. And then Lookout Ridge donates the entire amount to buying a wheelchair for someone who can't afford one in a less-developed country. Attendees at our conference bought enough to send 200 chairs to people desperate for mobility all over the world. Part of it was, I am sure, that it is a very worthy cause, and part of it is that the wines are damn good.

The web page is http://www.lookoutridge.com/... Click on "wine for wheels" on the top bar, and then on some of the links on the page that comes up. Look at the smiles on the faces of people who got a chair! And then order a few bottles. You will thank me when you drink it, and someone in need of mobility will thank you. Now, on to the letter.

There Had to Be a Short

Somebody needs to brief Senators before they get on TV and ask irate questions which demonstrate they have no idea what they are talking about. Expressing shock that someone was short on the trade in question shows you don't understand the trade. Let me see if I can offer some clarity.

Normally, you think of a Collateralized Debt Obligation (CDO) as a pool of mortgages. This pool is broken into anywhere from 6 to 15 tranches. The highest-rated tranches get their money back first, and the rating agencies made them AAA. While the lowest level would be called the equity portion and be first in line to lose, in theory it paid a very high yield. It was usually not rated. But the level just above that is BBB (just barely investment-grade), and that was typically about 4% of the total deal, but paid a much higher yield than the "safe" AAA portion.

Now, here is where it gets interesting. Investment banks would take the BBB portions of these Residential Mortgage-Backed Securities, which were not as easy to sell, and combine them in a CDO, which the rating agencies then rated using models based on data provided by the investment banks themselves. Since this combining of BBB tranches supposedly created diversification that the rating firms' models indicated would drastically limit delinquencies and defaults, the AAA tranche of the CDO was jacked up to 75% of the total capital structure, with 12% rated AA. Only 4% was typically considered BBB. So pools of mortgages that probably should have been rated below BBB were miraculously turned into a CDO with 87% of its capital structure rated AAA and AA and only 4% rated BBB, with a chunk as equity. (I wrote about this in January of 2007, based on material from Gary Shilling and others, plus my own research, although I think I wrote about it in an earlier letter as well.)

Who would buy this stuff? Mostly institutions that were reaching for yield in what was, in 2007, a very low-yield world. Yield hogs. And institutions that trusted the rating agencies.

But the CDO in the Goldman case was not this type of CDO. It was hard to find enough BBB pieces to put together a CDO of the type described above, and the demand was high. Remember, everyone knew that housing could only go up. So, what's an investment bank to do? They create a synthetic CDO. Follow this closely. The various investment banks - it was way more than just Goldman; rumors are it was up to 16 of them - would construct an artificial CDO fund based on the performance of BBB tranches in other deals.

Let me see if I can simplify this. It is as if I had a very negative view about a particular industry for which there was no future or index or liquid security. We could go to an investment bank and ask them to create a "hypothetical" index that would mirror the performance of this industry. I would be willing to short that index. But unless the bank wanted to be long that index, they would have to find a buyer who would take the long position. Presumably the buyer would have a different view than me.

Now, by definition there has to be a short for the long, and vice versa. This is a synthetic index. It exists only as a spreadsheet and performs in conjunction with the components it's modeled upon.

Numerous hedge funds did not think the rating agencies knew what they were talking about when it came to the mortgage ratings. They also believed we were in a housing bubble. So they went to a number of investment banks and asked them to construct synthetic (derivative) CDOs that they could short. And there were buyers on the other side who wanted the yield, who trusted the agencies, and who believed that housing could only go up.

As to the Goldman deal, the buyers had to know there was someone short on the other side. By definition there was a short. Besides, they had a guarantee from ACA on the AAA portion (which of course went bad, as I wrote about later that year) - there was a guaranteed AAA yield a few points higher than with normal AAA debt. What could be better? Except of course that it was too good to be true. Learn a lesson, gentle reader. Don't reach for yield.

The hedge funds that shorted the synthetic CDOs took real risk. They had to pay the interest on the underlying tranches to the investors who were long. And if the housing market continued to rise, and the bubble did not burst, they could easily lose a lot, if not all, of their money. No one knows when a bubble will burst. The markets can be irrational longer than you can remain solvent.

Let's be very clear. This was purely gambling. No money was invested in mortgages or any productive enterprise. This was one group betting against another, and a LOT of these deals were done all over New York and London.

The SEC alleges that there was material lack of disclosure. I must admit that I would want to know that the person who was taking the short position had a hand in the creation of the pool of BBB paper I was buying. And if Fabrice Tourre told someone that Paulson was $200 million long when they were actually net short, that could be problematic. Now, if he just said that Paulson bought the equity portion of the synthetic CDO (there has to be one), that will be a different matter.

The prosecutor for the SEC is by all accounts a very solid and serious person who would not move this case forward if he did not think they would win. This is not one the SEC will want to lose. On the other hand, I hope that Goldman takes this to the Second Circuit Court of Appeals (the final decision maker in a long and arduous process), as there are some very interesting aspects to this case that I would like to see resolved, as an individual in the industry. On someone else's legal bill.

I wonder why Goldman's witnesses seemed ill-prepared. Did their lawyers tell them to keep it simple and not get into a spirited defense? My instinct says that a lot more will come out about this case. If it was just this one deal, then Goldman should pay the fine and walk away. Done all the time. I suspect there is more here. Or maybe it was just that they didn't want to explain why they were doing a synthetic CDO. We'll see when someone writes the book.

How Should Our Institutions Invest?

However, the larger and far more critical question is, why were institutions buying synthetic CDOs in the first place? This is an investment that had no productive capital at work and no remotely socially redeeming value. It did not go to fund mortgages or buy capital equipment or build malls or office buildings. It seems to me there is a certain social responsibility when you have institutional capital and manage pensions. It's one thing to buy a gambling stock; it's quite another to be the gambler, especially if it is not your capital at risk, and by being a yield hog you increase your bonuses. The hedge funds were risking their capital. The institutions were risking other people's money. And let's be clear, the counterparties in the Goldman deal, at least, were very knowledgeable players. They knew exactly what they were buying.

OK, enough. Let's move onto the BIS paper.

The Future of Public Debt

For the rest of this letter, and probably next week as well, we are going to look at a paper from the Bank of International Settlements, often thought of as the central bankers' central bank. This paper was written by Stephen G. Cecchetti, M. S. Mohanty, and Fabrizio Zampolli. (http://www.bis.org/publ/work300.pdf?noframes=1)

The paper looks at fiscal policy in a number of countries and, when combined with the implications of age-related spending (public pensions and health care), determines where levels of debt in terms of GDP are going. The authors don't mince words. They write at the beginning:

"Our projections of public debt ratios lead us to conclude that the path pursued by fiscal authorities in a number of industrial countries is unsustainable. Drastic measures are necessary to check the rapid growth of current and future liabilities of governments and reduce their adverse consequences for long-term growth and monetary stability."

Drastic measures is not language you typically see in an economic paper from the BIS. But the picture they paint for the 12 countries they cover is one for which drastic measures is well-warranted. I am going to quote extensively from the paper, as I want their words to speak for themselves, and I'll add some color and explanation as needed. Also, all emphasis is mine.

"The politics of public debt vary by country. In some, seared by unpleasant experience, there is a culture of frugality. In others, however, profligate official spending is commonplace. In recent years, consolidation has been successful on a number of occasions. But fiscal restraint tends to deliver stable debt; rarely does it produce substantial reductions. And, most critically, swings from deficits to surpluses have tended to come along with either falling nominal interest rates, rising real growth, or both. Today, interest rates are exceptionally low and the growth outlook for advanced economies is modest at best. This leads us to conclude that the question is when markets will start putting pressure on governments, not if.

"When, in the absence of fiscal actions, will investors start demanding a much higher compensation for the risk of holding the increasingly large amounts of public debt that authorities are going to issue to finance their extravagant ways? In some countries, unstable debt dynamics, in which higher debt levels lead to higher interest rates, which then lead to even higher debt levels, are already clearly on the horizon.

"It follows that the fiscal problems currently faced by industrial countries need to be tackled relatively soon and resolutely. Failure to do so will raise the chance of an unexpected and abrupt rise in government bond yields at medium and long maturities, which would put the nascent economic recovery at risk. It will also complicate the task of central banks in controlling inflation in the immediate future and might ultimately threaten the credibility of present monetary policy arrangements.

"While fiscal problems need to be tackled soon, how to do that without seriously jeopardising the incipient economic recovery is the current key challenge for fiscal authorities."

They start by dealing with the growth in fiscal (government) deficits and the growth in debt. The US has exploded from a fiscal deficit of 2.8% to 10.4% today, with only a small 1.3% reduction for 2011 projected. Debt will explode (the correct word!) from 62% of GDP to an estimated 100% of GDP by the end of 2011. Remember that Rogoff and Reinhart show that when the ratio of debt to GDP rises above 90%, there seems to be a reduction of about 1% in GDP. The authors of this paper, and others, suggest that this might come from the cost of the public debt crowding out productive private investment.

Think about that for a moment. We are on an almost certain path to a debt level of 100% of GDP in less than two years. If trend growth has been a yearly rise of 3.5% in GDP, then we are reducing that growth to 2.5% at best. And 2.5% trend GDP growth will NOT get us back to full employment. We are locking in high unemployment for a very long time, and just when some one million people will soon be falling off the extended unemployment compensation rolls.

Government transfer payments of some type now make up more than 20% of all household income. That is set up to fall rather significantly over the year ahead unless unemployment payments are extended beyond the current 99 weeks. There seems to be little desire in Congress for such a measure. That will be a significant headwind to consumer spending.

Government debt-to-GDP for Britain will double from 47% in 2007 to 94% in 2011 and rise 10% a year unless serious fiscal measures are taken. Greece's level will swell from 104% to 130%, so the US and Britain are working hard to catch up to Greece, a dubious race indeed. Spain is set to rise from 42% to 74% and "only" 5% a year thereafter; but their economy is in recession, so GDP is shrinking and unemployment is 20%. Portugal? 71% to 97% in the next two years, and there is almost no way Portugal can grow its way out of its problems.

Japan will end 2011 with a debt ratio of 204% and growing by 9% a year. They are taking almost all the savings of the country into government bonds, crowding out productive private capital. Reinhart and Rogoff, with whom you should by now be familiar, note that three years after a typical banking crisis the absolute level of public debt is 86% higher, but in many cases of severe crisis the debt could grow by as much as 300%. Ireland has more than tripled its debt in just five years.

The BIS continues:

"We doubt that the current crisis will be typical in its impact on deficits and debt. The reason is that, in many countries, employment and growth are unlikely to return to their pre-crisis levels in the foreseeable future. As a result, unemployment and other benefits will need to be paid for several years, and high levels of public investment might also have to be maintained.

"The permanent loss of potential output caused by the crisis also means that government revenues may have to be permanently lower in many countries. Between 2007 and 2009, the ratio of government revenue to GDP fell by 2-4 percentage points in Ireland, Spain, the United States and the United Kingdom. It is difficult to know how much of this will be reversed as the recovery progresses. Experience tells us that the longer households and firms are unemployed and underemployed, as well as the longer they are cut off from credit markets, the bigger the shadow economy becomes."

We are going to skip a few sections and jump to the heart of their debt projections. Again, I am going to quote extensively, and my comments will be in brackets [].Note that these graphs are in color and are easier to read in color (but not too difficult if you are printing it out). Also, I usually summarize, but this is important. I want you to get the full impact. Then I will make some closing observations.

The Future Public Debt Trajectory

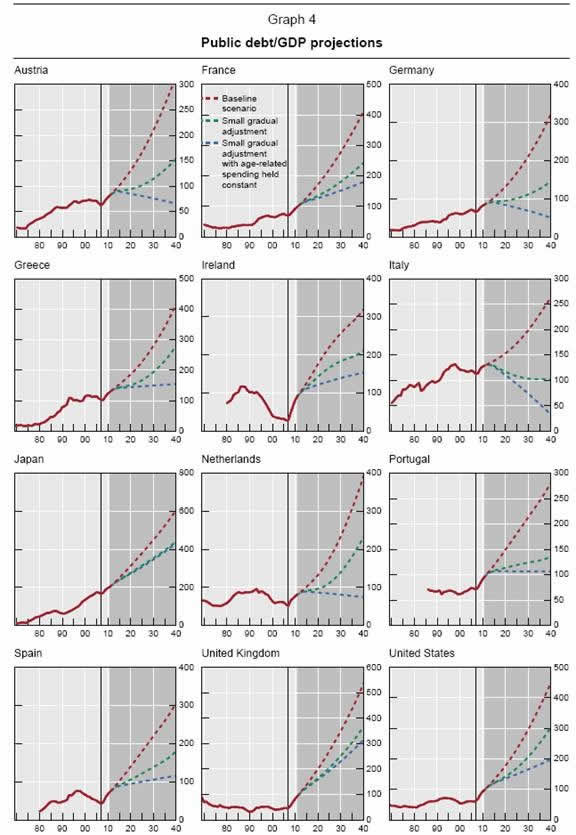

"We now turn to a set of 30-year projections for the path of the debt/GDP ratio in a dozen major industrial economies (Austria, France, Germany, Greece, Ireland, Italy, Japan, the Netherlands, Portugal, Spain, the United Kingdom and the United States). We choose a 30-year horizon with a view to capturing the large unfunded liabilities stemming from future age-related expenditure without making overly strong assumptions about the future path of fiscal policy (which is unlikely to be constant). In our baseline case, we assume that government total revenue and non-age-related primary spending remain a constant percentage of GDP at the 2011 level as projected by the OECD. Using the CBO and European Commission projections for age-related spending, we then proceed to generate a path for total primary government spending and the primary balance over the next 30 years. Throughout the projection period, the real interest rate that determines the cost of funding is assumed to remain constant at its 1998-2007 average, and potential real GDP growth is set to the OECD-estimated post-crisis rate.

[That makes these estimates quite conservative, as growth-rate estimates by the OECD are well on the optimistic side.]

Debt Projections

"From this exercise, we are able to come to a number of conclusions. First, in our baseline scenario, conventionally computed deficits will rise precipitously. Unless the stance of fiscal policy changes, or age-related spending is cut, by 2020 the primary deficit/GDP ratio will rise to 13% in Ireland; 8-10% in Japan, Spain, the United Kingdom and the United States; [Wow!] and 3-7% in Austria, Germany, Greece, the Netherlands and Portugal. Only in Italy do these policy settings keep the primary deficits relatively well contained - a consequence of the fact that the country entered the crisis with a nearly balanced budget and did not implement any real stimulus over the past several years.

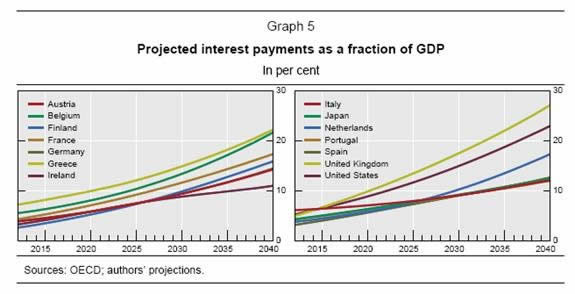

"But the main point of this exercise is the impact that this will have on debt. The results plotted as the red line in Graph 4 [below] show that, in the baseline scenario, debt/GDP ratios rise rapidly in the next decade, exceeding 300% of GDP in Japan; 200% in the United Kingdom; and 150% in Belgium, France, Ireland, Greece, Italy and the United States. And, as is clear from the slope of the line, without a change in policy, the path is unstable. This is confirmed by the projected interest rate paths, again in our baseline scenario. Graph 5 [below] shows the fraction absorbed by interest payments in each of these countries. From around 5% today, these numbers rise to over 10% in all cases, and as high as 27% in the United Kingdom.

"Seeing that the status quo is untenable, countries are embarking on fiscal consolidation plans. In the United States, the aim is to bring the total federal budget deficit down from 11% to 4% of GDP by 2015. In the United Kingdom, the consolidation plan envisages reducing budget deficits by 1.3 percentage points of GDP each year from 2010 to 2013 (see eg OECD (2009a)).

"To examine the long-run implications of a gradual fiscal adjustment similar to the ones being proposed, we project the debt ratio assuming that the primary balance improves by 1 percentage point of GDP in each year for five years starting in 2012. The results are presented as the green line in Graph 4. Although such an adjustment path would slow the rate of debt accumulation compared with our baseline scenario, it would leave several major industrial economies with substantial debt ratios in the next decade.

"This suggests that consolidations along the lines currently being discussed will not be sufficient to ensure that debt levels remain within reasonable bounds over the next several decades.

"An alternative to traditional spending cuts and revenue increases is to change the promises that are as yet unmet. Here, that means embarking on the politically treacherous task of cutting future age-related liabilities. With this possibility in mind, we construct a third scenario that combines gradual fiscal improvement with a freezing of age-related spending-to-GDP at the projected level for 2011. The blue line in Graph 4 shows the consequences of this draconian policy. Given its severity, the result is no surprise: what was a rising debt/GDP ratio reverses course and starts heading down in Austria, Germany and the Netherlands. In several others, the policy yields a significant slowdown in debt accumulation. Interestingly, in France, Ireland, the United Kingdom and the United States, even this policy is not sufficient to bring rising debt under control.

[And yet, many countries, including the US, will have to contemplate something along these lines. We simply cannot fund entitlement growth at expected levels. Note that in the US, even by "draconian" estimates, debt-to-GDP still grows to 200% in 30 years. That shows you just how out of whack our entitlement programs are.

Sidebar: This also means that if we - the US - decide as a matter of national policy that we do indeed want these entitlements, it will most likely mean a substantial VAT tax, as we will need vast sums to cover the costs, but with that will come slower growth.]

[Long before interest rates rise even to 10% of GDP in the early 2020s, the bond market will have rebeled. This is a chart of things that cannot be. Therefore we should be asking ourselves what is the End Game if the fiscal deficits are not brought under control.]

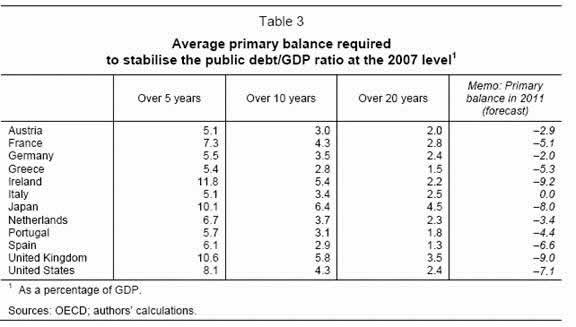

"All of this leads us to ask: what level of primary balance would be required to bring the debt/GDP ratio in each country back to its pre-crisis, 2007 level? Granted that countries which started with low levels of debt may never need to come back to this point, the question is an interesting one nevertheless. Table 3 presents the average primary surplus target required to bring debt ratios down to their 2007 levels over horizons of 5, 10 and 20 years. An aggressive adjustment path to achieve this objective within five years would mean generating an average annual primary surplus of 8-12% of GDP in the United States, Japan, the United Kingdom and Ireland, and 5-7% in a number of other countries. A preference for smoothing the adjustment over a longer horizon (say, 20 years) reduces the annual surplus target at the cost of leaving governments exposed to high debt ratios in the short to medium term.

[Can you imagine the US being able to run a budget surplus of even 2.4% of GDP? $350 billion-plus a year? That would be a swing in the budget of almost 10% of GDP.]

That is enough for today. We will delve further next week.

Montreal, New York, Connecticut, and Italy Join Me in Paris

I have to tell you, the conference last week was awesome. The energy in the room was great. The speeches and conversations were amazing. We are working on getting them transcribed so we can share a few of them. You really want to make plans to be there next year. There is not any investment conference in the country that matches it for quality. My thanks to the hard-working staff of Altegris for doing such an outstanding job of making it all go so smoothly. And my apologies to all those who waited to the last minute to sign up and couldn't get in. When I say this conference will sell out, I really do mean it. So, next year, don't procrastinate.

I am home for most of May. I have a 24-hour trip to Montreal to be with Tony Boeckh for his private Club X conference. Tony will be the author of next Monday's Outside the Box, where he will discuss the themes in his new (and should be bestseller) book, The Great Reflation. I also get to go out and party when I land with David Rosenberg. That should be fun!

The next week I am back in New York for a day, then two nights in Stamford, Connecticut, speaking to Pitney Bowes execs, and then home, where I will stay until June 3, when the whole family (seven kids and spouses, grandbabys) takes a vacation to Italy for two weeks.

I am going to stay over and speak at the Global Interdependence Center Conference in Paris June 17th and 18th, with my good friend David Kotok and other luminaries. There will be a lot of central banker types, and if you want to get a feel for what's happening in Europe you should come. Information is at www.interdependence.org.

It is time to hit the send button. It's late and this letter is overlong. Thanks for hanging with me! Have a great week.

Your worried about the debt analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2010 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.