U.S. Anemic GDP Growth Rate Not Good Enough

Economics / US Economy May 06, 2010 - 06:54 PM GMTBy: Hans_Wagner

In normal times, a 3.2 percent GDP growth rate for the United States is good. In the 1980’s the U.S. suffered another severe recession. During that recovery, GDP grew at a 7 to a 9 percent rate for more than one year. A 3.2 percent GDP annual growth rate barely creates enough jobs to keep up with the expanding population. It does nothing for all those who lost their jobs and are looking for work. The U.S. unemployment rate is 9.7 percent and the underemployment rate, a more accurate measure of the true unemployment situation is running at the 16.5% level.

In normal times, a 3.2 percent GDP growth rate for the United States is good. In the 1980’s the U.S. suffered another severe recession. During that recovery, GDP grew at a 7 to a 9 percent rate for more than one year. A 3.2 percent GDP annual growth rate barely creates enough jobs to keep up with the expanding population. It does nothing for all those who lost their jobs and are looking for work. The U.S. unemployment rate is 9.7 percent and the underemployment rate, a more accurate measure of the true unemployment situation is running at the 16.5% level.

What can we learn from the Bureau of Economic Analysis (BEA) report on the GDP growth rate that might be helpful to investors?

Jobless growth

“Okun’s rule of thumb” points toward an economy that must grow at the 3.0 – 3.5 percent level to maintain current employment levels. If the U.S. economy was operating at full employment status, a 3.0-3.5 percent growth rate works just fine. The problem is the U.S. has 9.7% unemployment and 16.5% underemployment. We will get another look at the employment situation when the Bureau of Labor statistics (BLS) releases the number for April on May 7, 2010.

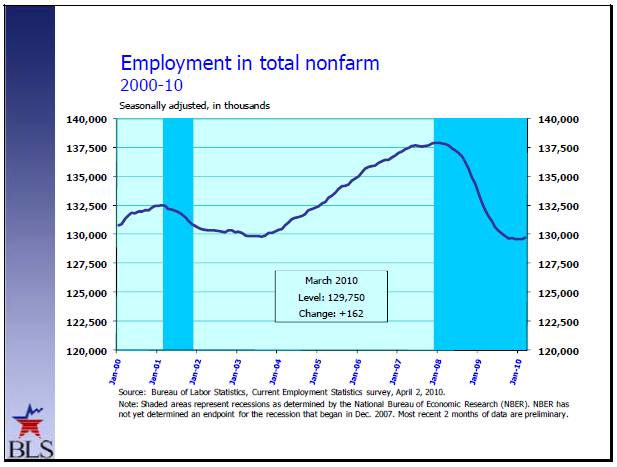

The chart below from the BLS report for March 2010 shows that the total employment for the U.S. is back where it was at the end of the recession that ended in January 2003. If the U.S. GDP only achieves growth at 3.0 to 3.5 percent growth rate, the level of employment will only cover the expansion of the population, leaving 7.5 million still unemployed. This does not count those that are working part time or in jobs that pay less than their skills, the underemployed.

Source: Bureau of Labor Statistics, Employment in total non farm

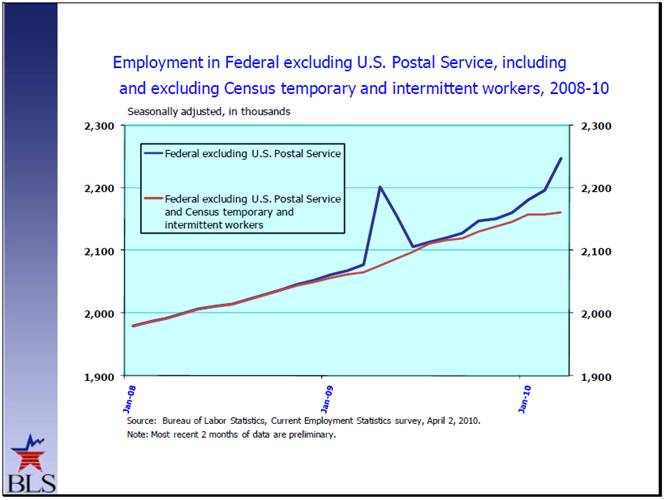

All sectors of the economy are experiencing negative growth or slight up ticks. However, employment in the federal government continues to expand as shown in the chart below. Expansion of the federal government contributes to the growth in the deficit. One of the problems with government employment is it is very difficult to scale it back once the positions are in place. Just look at the trouble state and local governments are having as they try to balance their budgets by cutting people.

Source: Bureau of Labor Statistics, Federal employment

A Jobless Growth GDP

A jobless growth economy will be constrained in its ability to expand. Personal consumption increased at a pace of 3.6 percent. However, almost that entire growth came from savings not from higher incomes. As many people become more confident in their job situation, they are willing to spend more. Since personal disposable income barely rose, a drop in the saving rate can explain the strength of household spending almost entirely. Unless income grows more strongly, we should expect slowing spending trends over the next few quarters as government stimulus payments to the private sector taper off.

The companies increased the value of goods on their warehouse and store shelves by $31 billion in the quarter, contributing 1.6 percentage points to growth due to higher inventories. Should consumer spending slow as expected this is likely to produce only small gains during the rest of the year. Without an expansion in consumer income to fuel growth in spending, consumers will dip into savings. Without growth in spending, inventories will reverse course cutting the GDP growth rate further. Without expansion of inventories, the country’s GDP looses an important growth driver.

Exports and imports climbed in the first quarter, as global trade continues to bounce back from its lows during the financial crisis. However, imports rose faster. As a result, net exports withdrew about 0.6 percentage point from the GDP growth rate. The problems in Europe will restrict expansion of exports from the U.S. due to the rise in the price of the dollar and the slow growth Europe will experience in 2010 and 2011. Expansion of exports is one of the growth engines for the economy. Lower sales to Europe will limit the ability of the U.S. to grow more rapidly.

Helping to counter part of this export question is the expansion of the emerging markets. Industries and sectors that benefit from the rapid growth of countries like China, India, Brazil and Indonesia, will experience success. Mining and commodity processing equipment is one sector that is thriving. Technology, especially mobile communications and the wireless internet is another where U.S. companies can leverage their expertise and skills of their engineers.

Residential investment fell 10.9 percent as the housing sector continues to suffer despite the first-time homebuyer credits that ended on April 30, 2010. This raises the question whether housing can recover sufficiently to add to the growth of the economy.

Equipment and software jumped about 13 percent though this was down from Q4's 19 percent consistent with what we have seen in orders/shipments for capital goods, especially primary metals, over the last six months.

Federal spending over the short run as countercyclical fiscal stimulus is welcome. Since this is the second year of the President’s stimulus package, it will be difficult to justify more, especially to an electorate tired of handouts to everyone but themselves. The large deficits and how to pay for them will be an election issue. Many people are upset that we are leaving our children saddled with an enormous debt that will reduce their living standards as they struggle to pay for our excesses. We will see rates climb, as investors grow leery of the never-ending deficits that are limiting private investment. Hopefully we won’t see riots in the street.

The Bottom Line

The anemic GDP growth rate will force investors to pick their opportunities carefully as a jobless growth economy will limit the opportunities. In this case, the tide has risen and it can no longer float all boats. While the tide might not be going out, it will not carry investors forward. This means stock pickers and well founded sector rotation strategies will carry the day.

By Hans Wagner

tradingonlinemarkets.com

My Name is Hans Wagner and as a long time investor, I was fortunate to retire at 55. I believe you can employ simple investment principles to find and evaluate companies before committing one's hard earned money. Recently, after my children and their friends graduated from college, I found my self helping them to learn about the stock market and investing in stocks. As a result I created a website that provides a growing set of information on many investing topics along with sample portfolios that consistently beat the market at http://www.tradingonlinemarkets.com/

Copyright © 2010 Hans Wagner

If you wish to learn more on evaluating the market cycles, I suggest you read:

Ahead of the Curve: A Commonsense Guide to Forecasting Business and Market Cycles by Joe Ellis is an excellent book on how to predict macro moves of the market.

Unexpected Returns: Understanding Secular Stock Market Cycles by Ed Easterling. One of the best, easy-to-read, study of stock market cycles of which I know.

The Disciplined Trader: Developing Winning Attitudes by Mark Douglas. Controlling ones attitudes and emotions are crucial if you are to be a successful trader.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.