E.U. Finance Ministers Battle to Defend the Euro Against Speculators

Currencies / Euro May 09, 2010 - 05:11 AM GMTBy: Mike_Shedlock

EU finance ministers are meeting this weekend in a mad race to Defend the Euro, whatever it takes.

EU finance ministers are meeting this weekend in a mad race to Defend the Euro, whatever it takes.

On Friday, French President Nicolas Sarkozy Vowed to "Confront Speculators Mercilessly" via Secret Plans he could Reveal.

On Saturday, Sarkozy said "When the markets re-open Monday, we will have in place a mechanism to defend the euro. If you don’t think that’s significant, you haven’t been to many EU summits."

It seems secrets were needed on Friday, but not on Saturday, meaning of course there were no plans on Friday, secret or not.

Stabilization Fund Created - Undisclosed Amount

Bloomberg describes the setup in EU Finance Ministers Race to Ready Euro Fund Before Asia Opens

European Union finance ministers meet today to hammer out the details of an emergency fund to prevent a sovereign debt crisis from shattering confidence in the 11- year-old euro.

Jolted into action by last week’s slide in the currency to the lowest in 14 months and soaring bond yields in Portugal and Spain, leaders of the 16 euro nations agreed to the financial backstop at a May 7 summit. They assigned finance chiefs to get it ready before Asian markets open later today European time.

“We will defend the euro, whatever it takes,” European Commission President Jose Barroso told reporters in the early hours yesterday after the leaders met in Brussels.

European officials declined to disclose the size of the stabilization fund, to be made up of money borrowed by the EU’s central authorities with guarantees by national governments.

“When the markets re-open Monday, we will have in place a mechanism to defend the euro,” French President Nicolas Sarkozy said. “If you don’t think that’s significant, you haven’t been to many EU summits.” Sarkozy cancelled a planned trip to Moscow today to deal with the crisis.

In Brussels, German Chancellor Angela Merkel stepped up German calls for a closer monitoring of government finances and more rigorous enforcement of the deficit-limitation rules, originally drafted by Germany in the 1990s.

Europe will send “a very clear signal against those who want to speculate against the euro,” Merkel said.Speculators Did Not Cause This Crisis

Speculators are not responsible for unsustainable Greek pension plans. Speculators are not responsible for unsustainable public union salaries in Greece.

Speculators did not lie to the EU or hide Greek debt so that Greece could get into the EU.

It is not speculators fault the EU looked the other way when the EU admitted Greece, knowing its budget was a sham.

Goldman Sachs Did Not Cause This Problem Either

Did Goldman front run trades against Greece?

Did Goldman peddle bad wares or dump garbage on Greece?

Did Goldman go to Greece and say "Hey Greece let me hide some of your debt?"

The answers are ...

No

No

No

It is easy to piss and moan about everything Goldman Sachs did, simply because Goldman did so many things wrong. However, its actions in Greece are not among them.

Greece went to Goldman, wanted some debt restructured. Goldman Sachs obliged.

Greece then misrepresented that debt under EU rules to the EU. No one can (at least no one should) blame Goldman for that. Greece committed fraud, not Goldman Sachs.

Moreover, there is evidence the EU understood Greece was not exactly in good shape, but they wanted Greece in. So the existing EU member countries they looked the other way.

The EU certainly should have done a better job of investigating Greece's finances before letting Greece into the EU.

100% of the blame for this goes to Greece and the EU.

0% of the blame goes to Goldman Sachs and CDS speculators.

What is the EU Really Defending?

Think about the rally cry “We will defend the euro, whatever it takes.”

What is it the finance ministers are defending? It surely is not the Euro. They are defending their piss poor decision to let Greece into the EU. Moreover, they are printing money to do so.

Is that supposed to help?

Massive problems in Portugal and Spain are on deck, so defending Greece (not the Euro) sets a bad precedent for still more bailouts.

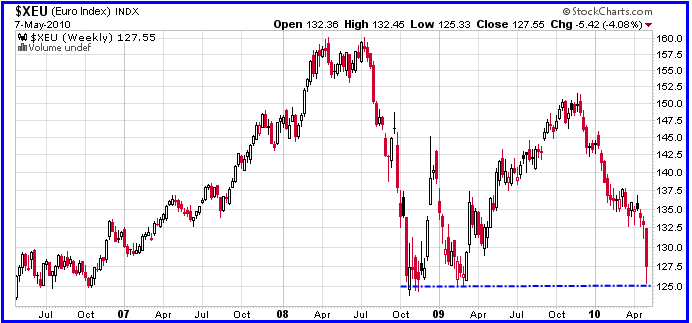

Euro Extremely Oversold

The biggest thing the EC has going for it right now is that speculative bets against the Euro are the most lopsided in history. There is currently something like a record low 3% Euro bulls now.

Everyone was a Euro bull when I was dollar bullish with the US dollar index well below 80. Now there are no defenders of the Euro.

Sentimentwise, the Euro can easily bounce here.

However, please remember crashes come from oversold conditions, not overbought conditions. We saw a bit of that action on Thursday in the equity markets but first in the currency markets.

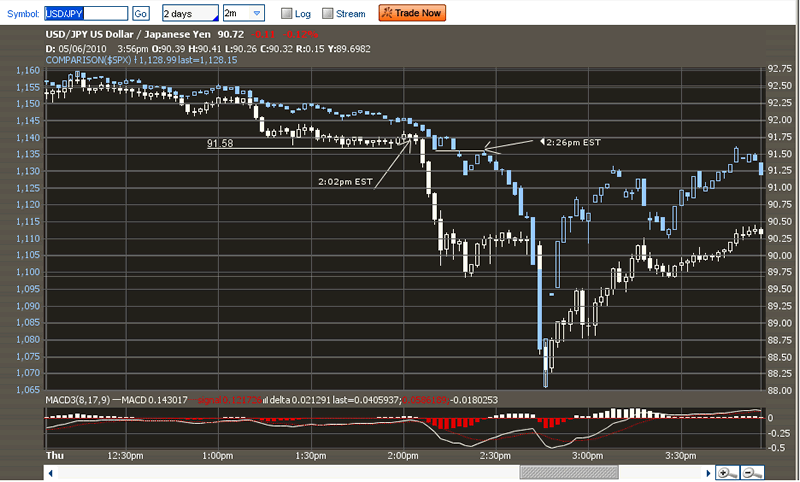

Here is the chart that shows what happened as described in Equity Plunge Yen Connection; Reflections on Ponzi Markets and Program Trading.

S&P 500 vs. Yen

45 minutes before US equities went into a waterfall dive, the Yen went into a skyrocket rally vs. the US dollar (inverted on the above chart).

The Yen and the stock market magically stabilized at exactly the same time, right at the equity bottom.

Please click on the above link for more details.

Euro on Strong Technical Support

Sentimentwise the Euro could easily bounce. The same holds true technically.

Thus, please remember that when the EU comes out blazing with their big plan to "defend the euro" on Sunday and the Euro bounces, it will not be because of the announcement, but because technically and sentimentally it was ready to bounce anyway.

Certainly it will be very revealing if the Euro and stock markets do not bounce.

Longer term, the "stabilization fund" is a reminder of the destabilizing structural problems in the EuroZone countries.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.comClick Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.