Stock Market 2008 Deja Vu All Over Again?

Stock-Markets / Stock Markets 2010 May 11, 2010 - 01:04 PM GMTBy: PhilStockWorld

Does anything about this ride feel familiar?

Does anything about this ride feel familiar?

Oh yes, that’s right - good old 2008, when the "minor correction" of 2007 was behind us and the Dow rallied back from 11,500 to 13,200 based on stimulus packages, fake economic data and even faker earnings reports where banks, builders, automakers and retailers all lied, lied and lied (or perhaps they were just totally, densely ignorant) about their outlook and their operations and CNBC et al lied to investors and told them to BUYBUYBUY while the smart funds were SELLSELLSELLing as fast as they could.

[Click here for a larger image of chart.]

The August 5th, 2008, with the Dow at 11,500, the Fed had a meeting and decided to keep rates at 2% saying:

The August 5th, 2008, with the Dow at 11,500, the Fed had a meeting and decided to keep rates at 2% saying:

Economic activity expanded in the second quarter, partly reflecting growth in consumer spending and exports. However, labor markets have softened further and financial markets remain under considerable stress. Tight credit conditions, the ongoing housing contraction, and elevated energy prices are likely to weigh on economic growth over the next few quarters. Over time, the substantial easing of monetary policy, combined with ongoing measures to foster market liquidity, should help to promote moderate economic growth.

That gave the Dow a 332-point gain that Tuesday - kind of like yesterday’s gain. Our "friendbuddypal" Cramer says "Even after today’s run, the market is still oversold" (yes, I know, he just said "Don’t Buy Till Dow 9,000" on Friday - TFF) but I had to disagree (with Monday’s Cramer - hard to keep track…), telling Members in our Alert to cash out of longs, saying: "Don’t be greedy, 5% in a day is A LOT" and I followed up just 15 minutes later with a comment in Member Chat saying: "Time to take money and run at 5% rule - we can reload if 4% holds."

Although we did finish in the bullish end of our 5% range, we got there on a big stick into the close so my closing comment to Members was: "Very indeterminate close. Cash still king. Europe does look like they can follow through and Asia has to catch up so we SHOULD get a nice, up open tomorrow, gapping back up to and maybe over today’s highs but I’d be more inclined to come in on the short side there." It’s a difficult thing to stay on the sidelines but I think last week’s market taught many people what I mean when I say a market is "unplayable" - sometimes, it’s just not worth the bother. Sure it’s great for day trading and we do plenty of that but not for proper investing.

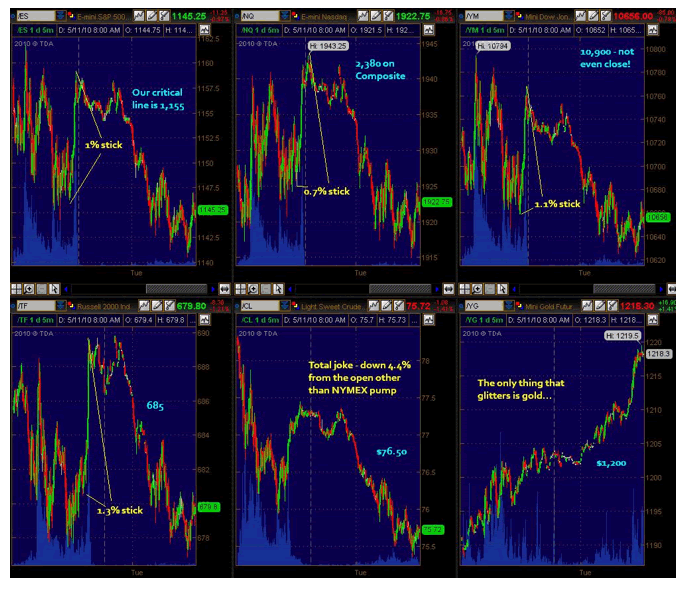

After spending the day well below the 5% bounce levels we were looking for, we were hardly impressed by the BS last-minute stick saves where "suddenly" EVERY SINGLE INDEX HAD TO BE BOUGHT! Really, you should be insulted - "THEY" are treating you like you are a 3-year old and "THEY" can say "got your nose" and you’re going to believe it! The Wall Street crooks who manipulate the markets (and if you don’t think that’s going on - don’t even read the rest) and their MSM lackeys think you are soooooo dumb, that you believe that the S&P can drift along FOR 5 HOURS under 1,150 yet suddenly, an hour before the close, on no news in particular - there is a mad rush to buy shares AT ANY PRICE into the close.

Sure, once maybe we fall for it, twice we may think it’s a coincidence, three or four times we think it’s a little strange but rational people, at around the 5th or 6th time - SHOULD PROBABLY CALL FOR AN INVESTIGATION. This is the 60th time this year people!!!! WAKE UP!!! The market is sold off mid day to scare you out of positions and force you to take losses and it’s taken up into the close so fast that you either miss it or chase the top and then it’s randomly moved around in the futures when you can’t trade. You would seriously do better trying to find the Red Queen in a New York City street hustle. Why don’t you care???

We don’t care because we accept the fact that it’s a scam and, since we know what the scam is, we can make Goldman Sachs-like piles of money by betting alongside the hustlers (do you know GS made $25M or more EVERY SINGLE DAY last quarter - NEVER a wrong bet!). Is it morally wrong? Please, with the sorry state of business and politics in this country - who can even tell any more? I do my ethical best by telling as many people as possible that it’s a scam and they can believe me or not but, in weeks like the past two, even I still get freshly outraged at the way the Banksters are destroying Western Civilization with theft and extortion disguised as capitalism in a way terrorists can only dream of doing with bombs.

US futures are down a bit, pulling back the stick saves of yesterday afternoon but Asia is reversing over 100% of Monday’s gains with the Hang Seng dropping 280 points (1.4%) back to 20,146 and the Nikkei falling 1.2% (119 points) to 10,411 and the Shanghai, who bothered us yesterday by not going up in the first place, fell another 1.9%, down to 2,647. I was interviewed on the radio yesterday and someone said to me "What about the Baltic Dry Index - it’s up 5% today?" to which I replied that I was fairly sure shipping rates or shipping volumes didn’t rise 5% in a day.

Sadly, the MSM uses speculation as evidence to back up other speculative moves we are seeing - that way, a crazy jump in the market "must be legitimate" because there’s a crazy up move in commodities and a crazy up move in shipping rates which proves the crazy up move in commodities must be right and if shipping is going up then "obviously" it’s because more commodities are being shipped and if commodities are being shipped they must be being consumed and therefore we should buy more commodities in anticipation of a shortage THAT HAS NEVER COME IN ALL THESE YEARS OF SPECULATIVE RUN UPS. It’s just scam on top of scam on top of scam - you don’t even know where the line is any more…

Sadly, the MSM uses speculation as evidence to back up other speculative moves we are seeing - that way, a crazy jump in the market "must be legitimate" because there’s a crazy up move in commodities and a crazy up move in shipping rates which proves the crazy up move in commodities must be right and if shipping is going up then "obviously" it’s because more commodities are being shipped and if commodities are being shipped they must be being consumed and therefore we should buy more commodities in anticipation of a shortage THAT HAS NEVER COME IN ALL THESE YEARS OF SPECULATIVE RUN UPS. It’s just scam on top of scam on top of scam - you don’t even know where the line is any more…

Anyway - so happy Tuesday to you! Asia’s a mess and Europe has pretty much exhausted any legitimate capital ammunition it has to stop their slide so this BETTER work but it’s already not as the EU markets give up 1/2 of yesterday’s gains as Bank Swaps and Libor are still out of whack and Jim Reid of DB agrees with my warning from yesterday’s post, saying: "Sovereign risk hasn’t gone away in the slightest. What this package has done is massively reduced the tail risk in European markets without necessarily changing the medium- to long-term dynamics of financial markets.”

“Maybe Greece won’t default in the near term or even the medium term, but the debt hasn’t gone away,” said John Anderson, head of credit at Gartmore Investments in London. “Budget deficits still need to be cut for the debt to be paid down.” Despite a totally BS poll that was taken last week during the riots (I suppose they polled the people who weren’t rioting) it does turn out that well over 50% of the Greek people reject the Government’s austerity measures and, in fact, support the protests. Never ones to let reality be their guide, the IMF is pressing Spain and Portugal to adopt similar measures to the ones the Greek people won’t put up with.

“The bedrock of dealing with these problems are the efforts of stabilization and adjustment of each of the individual countries,” IMF’s John Lipsky told reporters yesterday. “Virtually all advanced economies” will need to reduce their deficits over the next few years," he said. The IMF approved a separate 30-billion euro loan to Greece as part of that nation’s 110-billion euro package with governments from the 16-nation bloc sharing the currency. “The template for the relationship between the euro zone countries and the IMF in cases of need for support would follow the template in broad terms established in the case of Greece.”

Greece must persevere with its fiscal rehabilitation program to ensure the nation’s debt burden is sustainable, the fund said in a report published late yesterday. “With disciplined program implementation, Greece’s debt is expected to be sustainable in the medium term, and its repayment capacity to be adequate,” the IMF said. It projected Greece’s ratio of debt to GDP will peak at 149 percent in 2013 and then decline, “provided that the authorities continue to implement strong and sustained fiscal and structural reforms.”

The Euro is still below $1.30 ($1.27) and the Pound is below $1.50 at $1.48 and the Yen is catching bids at 92.5 to the dollar. Hmm, I think this is what was happening last Thursday… Well, we’re still watching and waiting until we figure out Goldman’s next move because one thing we do know is, whether the market is up 400 or down 1,000 - somehow they manage to move their Billions to the right side of the trade EVERY SINGLE DAY!

May the farce be with you…

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.