Euro Crash, ECB Losing Credibility as it Prints Money When It Said It Wouldn't

Currencies / Euro May 14, 2010 - 03:06 AM GMTBy: Charles_Maley

If you really think about it, the Euro is as much of an experiment as it is a currency. As I mentioned in my previous post, the Euro idea was that 16 different countries could join hands under one united monetary policy. The trick is to accomplish this under separate cultures, political structures, and economic climates. How’s that working out?

If you really think about it, the Euro is as much of an experiment as it is a currency. As I mentioned in my previous post, the Euro idea was that 16 different countries could join hands under one united monetary policy. The trick is to accomplish this under separate cultures, political structures, and economic climates. How’s that working out?

Anyone who looks at this situation like a human being and not an academic analyst realizes it’s a tough task.

The three amigos, Angela Merkel (Chancellor of Germany), Nicolas Sarkozy (President of France), and Jean-Claude Trichet (head of the European Central Bank) have engineered a $962 billion rescue package. Impressive as it sounds however, the rescue package still has major flies in the ointment, and essentially buys nothing more than time.

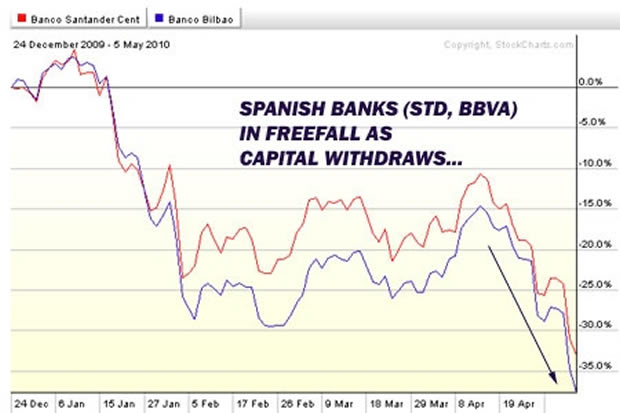

Europe is effectively borrowing huge sums from itself. The “PIGS” do not just have a debt problem; they have an economic growth problem, which means they must get more productive and export more. Spain and Portugal are still hemorrhaging and the 20% unemployment will sure put a cramp in any growth. This means a lower Euro if the economy wants to survive.

And why is no one talking about France? Italy owes France $511 Billion (20% of their GDP) on top of Ireland at $60 billion, Greece at $75 billion, Spain at $220 billion and Portugal at $45 billion. That’s a total of $911 billion (over 35% of their GDP) owed to them by questionable countries.

If things continue to deteriorate in Italy and Spain how can’t France suffer. Also, who does France owe and how much? It seems endless.

Ludwig Von Mises, the father of Austrian economics said “There is no means of avoiding the final collapse of a boom expansion brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

To add to the problem the ECB is losing credibility. Last week they said debt monetization (buying bonds) was not even under discussion. Then they did exactly that a few days later. If you change horses in mid stream investors might just get the impression that you’re not to be trusted. They may trust you even less when they realize the solution will be funneled through a “special purpose vehicle”, which is a way concealing questionable accounting by removing debt from the balance sheet and moving it elsewhere.

What is this, three-card monte?

Move it where you like, it’s still there, under one of those cards. Citicorp and Enron attempted to solve their problems through “special purpose vehicles” and look how well that worked out.

Now, finally I would like to take a moment to clear up all this confusion of exactly who owes who what.

Here is a breakdown of the “PIG” debt structure as of December 31st, and expressed in Dollar terms.

Ireland, Spain, Portugal and Greece all owe Italy. Hold on though, because Italy owes all of them money too, plus Italy owes France, Germany and Great Brittan. I owe you, but you owe me less, but he owes me more than you. If I get him to pay me some, I can pay you some, if you can get the other guy to pay you some, so you can pay me some.

It reminds me of the great Abbott and Costello comedy skit “Who’s on First?” (Click here to view video)

Enjoy this article? Like to receive more like it each day? Simply click here and enter your email address in the box below to join them. Email addresses are only used for mailing articles, and you may unsubscribe any time by clicking the link provided in the footer of each email.

Charles Maley www.viewpointsofacommoditytrader.com Charles has been in the financial arena since 1980. Charles is a Partner of Angus Jackson Partners, Inc. where he is currently building a track record trading the concepts that has taken thirty years to learn. He uses multiple trading systems to trade over 65 markets with multiple risk management strategies. More importantly he manages the programs in the “Real World”, adjusting for the surprises of inevitable change and random events. Charles keeps a Blog on the concepts, observations, and intuitions that can help all traders become better traders.

© 2010 Copyright Charles Maley - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.