The "Eurozone Coup d’Etat", Trend Towards Global Systemic Economic Crisis

Economics / Euro-Zone May 18, 2010 - 08:40 AM GMTBy: Global_Research

Just as anticipated by LEAP/E2020 in issues N°40 (December 2009) and N°42 (February 2010), spring 2010 really marks a tipping point of the global systemic crisis, characterized by a sudden expansion due to the intolerable size of public deficits (see issue N° 39, November 2009) and the inexistence of the recovery, so often announced (see issue N°37, September 2009). Besides, the dramatic social and political consequences of this development clearly reflect the beginning of the process of global geopolitical dislocation as anticipated in issue N°32 (February 2009).

Just as anticipated by LEAP/E2020 in issues N°40 (December 2009) and N°42 (February 2010), spring 2010 really marks a tipping point of the global systemic crisis, characterized by a sudden expansion due to the intolerable size of public deficits (see issue N° 39, November 2009) and the inexistence of the recovery, so often announced (see issue N°37, September 2009). Besides, the dramatic social and political consequences of this development clearly reflect the beginning of the process of global geopolitical dislocation as anticipated in issue N°32 (February 2009).

Finally, the Eurozone leaders’ recent decisions confirm LEAP/E2020’s anticipations, contrary to the dominant chatter of these last few months, of the fact that not only will the Euro not « explode » because of the Greek problem but, on the contrary, a strengthened Eurozone will emerge from this stage of the crisis (1). One could even consider that, since the Eurozone decision, a kind of « Eurozone coup d’Etat » supported by Sweden and Poland, to create a huge apparatus to protect the interests of the 26 EU member states (2), the geopolitical deal in Europe has changed radically. Because it runs contrary to the prejudices which fashion their vision of the world, several months will be needed by the majority of the media and players to accept that, behind the appearance of a purely European budgetary-financial decision, lies a geopolitical split with worldwide impact.

Eurozone coup d’Etat in Brussels: The EU founding states regain control

In this issue N°45, we analyse in detail the numerous consequences for Europeans and for the world from what could be called the Eurozone « coup d’Etat » within the EU. In the face of the worsening crisis, the sixteen have indeed taken control of the EU reins of power, creating new tools and instruments which leave no other choice for the other members but to follow or find themselves isolated.

Ten out of the eleven other member states have decided to follow, such as the two most important of them, Sweden and Poland, who have chosen to actively participate in the apparatus put into place by the Eurozone (the other eight are currently either in the course of negotiating their Eurozone entry, like Estonia from 2011 (3), or receiving direct help from the Eurozone, like Lithuania, Hungary, Romania, for example…). It is a (r)evolution that our team has clearly anticipated for over three years and we had even stated recently that events would rapidly unfold in the Eurozone once the German regional elections and the British general election had taken place. However, we would never have thought that it would happen in just a few hours, neither with such boldness as to the amount (750 billion Euros, or one trillion USD) and the character (EU control taken by the Eurozone (4) and a leap ahead in terms of economic and financial integration).

The fact remains that without knowing it, and without having asked their opinion, 440 million Europeans have just joined a new country, Euroland, of which some already share the currency, the Euro, and of which all now share the indebtedness and the joint means to solve the serious problems posed in the context of the global systemic crisis. The budgetary and financial decisions taken during the Summit of the weekend of the 8th May in terms of a response to the European public debt crisis can be evaluated differently according to one’s analysis of the crisis and its causes.

LEAP/E2020 will roll out its own analyses on the subject in this issue N°45 but, without doubt, a radical unraveling of European governance has just taken place: a collective continental governance has just brutally emerged, ironically 65 years after the end of the Second World War, moreover celebrated with a big display in Moscow the same day (5) as the holiday celebrating the creation of the European Coal and Steel Community, the common ancestor of the EU and Euroland. This simultaneity isn’t a coincidence (6) and marks an important step forward in global geopolitical dislocation and the reconstitution of new global balances. Under the pressure of events set off by the crisis, the Eurozone has thus undertaken to grasp its independence with regard to the Anglo-Saxon world still expressed via the financial markets. This 750 billion Euros and this new European governance (of the 26) constitutes, at the one and the same time, the putting in place of the fortifications against the next storms caused by draconian Western indebtedness, and which will affect the United Kingdom and then the United States (cf. issue N°44 causing disturbances of which the « Greek crisis » has only given a small preview.

The EMF will, in the long run, deprive the IMF of 50% of its major contributions: those of the Europeans

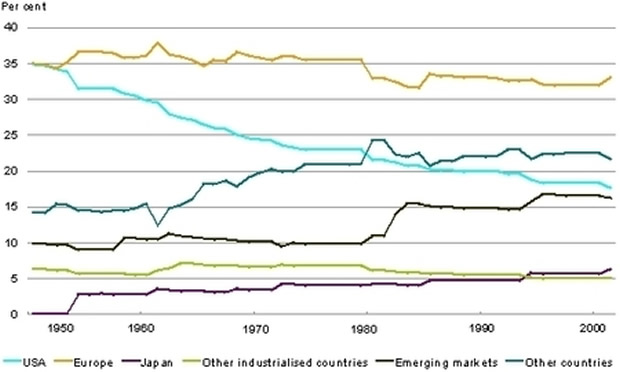

Concerning this, LEAP/E2020 reminds readers of a fact that the majority of the media has been oblivious of for many weeks. Contrary to the prevailing discussion, the IMF is first and foremost European money. In effect one out of three IMF Dollars is contributed by Europeans, compared to only one in six by the USA (their share has been cut in half in 50 years) and one of the consequences of the European decisions of these last few days is that it will not be the case for very much longer.

Our team is convinced that, within three years at the latest, when it is time to formalize the integration of the intervention fund created on the 8th and 9th May 2010 into the European Monetary Fund, the EU will reduce its contribution to the IMF by a similar proportion. One could guess already that this reduction in the European contribution (UK excluded) will be in the order of 50% at least. That will allow the IMF to become more globally representative by automatically rebalancing the BRIC share and, in the same breath, requiring the USA to abandon its right of veto (7). But that will equally contribute to it becoming heavily marginalized since Asia has already created its own emergency intervention fund. It is an example which illustrates just how many of the European decisions of the beginning of May 2010 are full of wide sweeping geopolitical changes which will scale out in all of the coming years. In fact, it is unlikely that the majority of the decision makers involved in the « Eurozone coup d’Etat » have clearly understood the implications of their decisions. But no-one has ever said that history was largely made by those people who knew what they were doing.

Countries’ and markets’ IMF contributions (1948-2001) - Source: IMF / Danmarks National Bank - 2001

The United Kingdom: isolated in the face of an historic crisis

One of the simultaneous causes and consequences of this development is the complete marginalization of the United Kingdom. Its increasing weakness since the beginning of the crisis, along with that of its US sponsor, has created the possibility of a complete takeover, without concessions, of the march forward of the European project by the continental countries. This loss of influence reinforces, in return, Great Britain’s marginalization because British leaders are trapped in a denial of reality which they have made their people share as well. None of the British political parties, not even at this point the Liberal Democrats, even though showing greater clarity than the other political parties of the country, could consider reconsidering the decades of diatribe accusing Europe for all the ills and dressing-up the Euro for all the losses. Indeed, even if their leaders were aware of the folly of a strategy consisting of isolating Great Britain a little more day-by-day, even when the world crisis has moved up a gear, they will collide with this public Euroscepticism which they have fostered over the course of the past years.

The irony of history was, once again, clearly shown during this historic weekend of the 8th/9th May 2010: in refusing to participate in the Eurozone’s joint defensive and protective measures, the British leaders have, de facto, refused to catch the last lifeline within their grasp (8). The European continent will now content itself with watching them try to find the 200 billion Euros which their country needs to balance this year’s budget (9). And if the leaders in London think that City speculators will have any qualms breaking the Pound sterling and selling Gilts, it is because they haven’t understood the basics of global finance (10), nor checked the nationalities of these same players (11). Between Wall Street, which will do anything to attract the world’s capital (one only needs to ask the Swiss market what it thinks of the war that world markets are currently delivering one another), Washington, which is knocking itself out to hover up all the world’s available savings, and a European continent which has, from now on, placed itself under the protection of a common currency and debt, the dice have been cast. At this stage, we are still in the drama, because the major English players have not yet realised that they are caught in a trap; a few weeks from now, we will move on to the British tragedy because, this summer, the whole country will have discovered the historic trap into which the country, on its own, has fallen.

So, at the moment when Euroland emerges in Brussels, the United Kingdom struggles with a hung parliament, compelling it to move on to the first coalition government since 1945 and which will take the country to a further election between now and the end of the year.

The British and their leaders in trouble, who are going to have to « think the unthinkable »

Whatever the supporters of the coalition now running the country may tell, LEAP/E2020 thinks it highly unlikely that this alliance will last more than a few months. The very different structure of the two parties involved (Conservatives and Liberal Democrats are divided on a number of issues), combined with unpopular decisions, is leading this team straight to internal crises for each party and, then, to a government collapse. The Conservatives will play this card because, unlike the Liberal Democrats, they have sufficient funds to « finance » a new electoral campaign between now and the end of the year (12). But the most dangerous underlying stumbling-block is intellectual: to avoid the tragedy which portends, the United Kingdom is going to have to « think the unthinkable », i.e. reconsider its basic beliefs on its insular outlook, its transatlantic « relationship », its relationship with a continent now on the road to complete integration, while, for centuries, it has thought of the continent as a disunion. However the problem set is simple: if the United Kingdom has always thought that its power depended on a divided European continent, then logically, considering current events, it must now admit that it is heading to a state of impotence... and draw the necessary conclusions, i.e. that it too should make a « quantum leap ». If Nick Clegg seems intellectually equipped to make such a leap, neither David Cameron’s Conservatives, nor the British leaders altogether, seem mature enough yet. In such a case, Great Britain, sadly, must take the « tragic » path (13).

In any case, this weekend of the 8th/9th May 2010 in Europe dips a number of its roots directly into the Second World War and its consequences (14). It is, besides, one of the features of the global systemic crisis as foretold by LEAP/E2020 in February 2006 in issue N°2: it brings to « an end the West as one has known it since 1945 ».

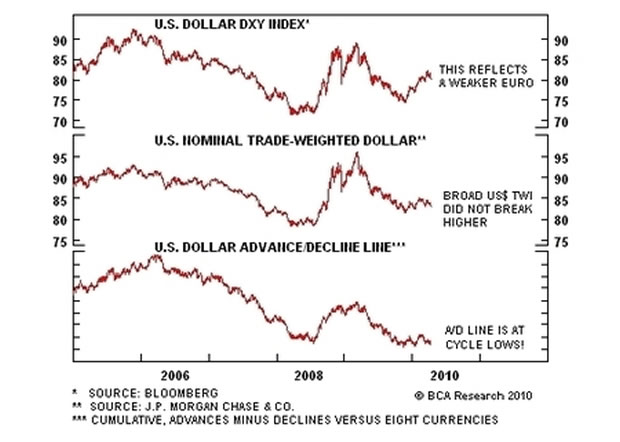

Another of these features is the take-off in the gold price (compared to the US Dollar especially), in the face of the growing distrust in all fiat currencies (see issue N°41, January 2010 (15)). Indeed, whilst all the world speak of the Euro/US Dollar exchange rate, the Dollar remains at its historically lowest levels compared to its major trade partners (see chart below), a sign of the US currency’s structural weakness. In the coming months, as GEAB anticipated, the Euro will climb back to its medium-term equilibrium level of above 1.45/€.

In this issue, before giving our recommendations on currencies, the stock exchange and gold, LEAP/E2020 will analyse in greater detail the US pseudo-recovery which internally is basically a vast focused news operation aimed at re-starting household spending (an impossible task now) and externally at avoiding panicking foreign investors (at best, several quarters can be gained). Thus the United States maintains that it will be able to escape brutal austerity treatment, like the other Western countries, whilst, in fact, the recovery is an « unrecovery » as Michael Panzner, with a touch of humour, called his excellent article of 04/27/2010, published in Seeking Alpha.

Notes

(1) The strong relative weakness of the Euro compared to the US Dollar constitutes a huge advantage for Eurozone exports and, on the contrary, once again handicaps American attempts to reduce the country’s trade deficit (as a matter of fact, the US trade deficit increased in March 2010). The next few months will see this deterioration become more pronounced. Source: AP/NDTV, 05/12/2010

(2) The United Kingdom is de facto positioned outside this protection. For our team, it is one more step taken by the United Kingdom in the direction of the historic crisis with which it will have to grapple, on its own, from the summer of 2010. Even the Financial Times repeats this growing risk. If one has to make a comparison with the 2008 banking system crisis, the United Kingdom looks more and more like Lehman Brothers, support of a system which refuses to accept that a key player could be so dangerously weakened and which finished by causing the collapse of the system itself. To take the analogy a step further, ask yourself who will play the part of AIG in the weeks and months to come? Source: CNBC, 05/11/2010

(3) The final decision will be taken in July 2010. Source: France24, 05/12/2010

(4) On the 9th May 2010, the 27 European finance ministers were indeed summonsed to endorse the decisions of the Eurozone summit which, the previous day, had brought together the sixteen heads of state and government of the Eurozone, failing which the Eurozone would act alone and so leave the eleven other countries without any protection from the financial crisis. Only the United Kingdom, as a reflex action and because of its own political crisis, refused the « diktat » but without being able to oppose it as it would have been able to do a year ago, before its influence hadn’t started to collapse.

(5) Source: RFI, 05/09/2010

(6) Not that Moscow would have had anything to do with the decisions taken in Brussels on the 8th and 9th May.

(7) Source: Bretton Woods Project, 03/19/2008

(8) On this subject, LEAP/E2020 wants to debunk the monetary fairy tale which is circulating in the economic media and parroted by the majority of economists: the fact of being able to devalue one’s currency « at will » is not at all a sign of independence nor a useful tool to get out of a crisis, it’s exactly the opposite. On the one hand, these devaluations are imposed by the « markets », that is to say external forces whose last thought are the interests of the people affected by the devaluation; on the other hand, these devaluations inevitably lead to an impoverishment of the country and its growing reliance on its partners with the strongest currencies which, in a system of freely circulating capital, can buy the « family jewels » of the country cheaply. The process currently taking place in the Eurozone which imposes strong austerity measures, is undertaken collectively with the objective of allowing the states affected to re-establish healthy public finances whilst, at the same time, retaining the major balances of the European socio-economic model. Facing the Eurozone, the IMF is only a secondary player which is only there to provide a bit of technical expertise and some tens of billions of Euros in small change, tens of billions which are really a small part of the major contribution the Europeans made to the IMF in 2010: more than 30% of the total, against barely 15% for the United States.

(9) And that’s not because a Frenchman said it in public, namely Jean-Pierre Jouyet, President of the French Financial Markets Authority and former Minister for European affairs, that it must be untrue. Source: Le Figaro, 05/11/2010

(10) As Paul Mason quite rightly emphasized in his BBC article of 05/11/2010 market reaction will affect the United Kingdom and, when it comes to bonds, unlike shares, the size of the players can make all the difference.

(11) It will be very interesting to follow the hostilities with the City, the coalition in power openly wanting to show its authority by announcing that it wishes to break up the giant British banks over the next year. Source: Telegraph, 05/12/2010

(12) Source: DailyMail, 05/04/2010

(13) And we won’t even linger on the growing emergence of the « English question » at the core of a country becoming more and more disunited following successive « devolutions » which give increasing power to Scotland, Wales and Ulster. Tim Luckhurst’s article of 05/09/2010 in The Independent is a necessary read on this subject.

(14) And even beyond, since David Cameron (at 43 years old) is the youngest British Prime Minister for 200 years and George Osborne (38) the youngest Chancellor of the Exchequer for 125 years. Will that suffice? Nothing is less certain because GEAB readers know that we believe that the crisis questions a world order established nearly four hundred years ago, when the City of London became the world’s financial market place. Maybe it will be necessary to go and seek out British leaders with qualities not seen for over four hundred years? Source: Telegraph, 05/12/2010

(15) As a sign of the times, the Emirates Palace, the most luxurious hotel in Abu Dhabi, has just installed the first ATM dispensing 10 gram gold bars instead of notes. Source: CNBC, 05/13/2010

Global Europe Anticipation Bulletin

Global Research Articles by Global Europe Anticipation Bulletin

© Copyright Global Europe Anticipation Bulletin -, Global Research, 2010

Disclaimer: The views expressed in this article are the sole responsibility of the author and do not necessarily reflect those of the Centre for Research on Globalization. The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible or liable for any inaccurate or incorrect statements contained in this article.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.