Stock Market Reversal Levels Reached

Stock-Markets / Stock Markets 2010 May 21, 2010 - 04:22 AM GMTBy: Donald_W_Dony

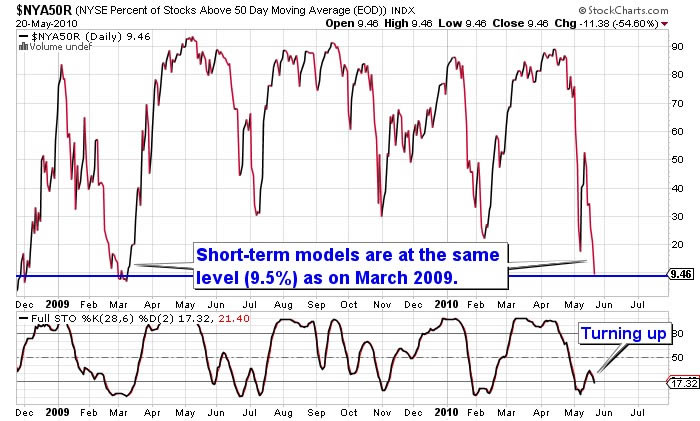

Following the May 10, 2010 Market Minute titled "Is the correction finished?", models are indicated that levels have only now been reached where major market reversals often occur. Chart 1 illustrates only 9.5% of the stocks on the NYSE are currently trading above their short-term 50-day moving averages. This percentage level is the same as on March 2009.

Following the May 10, 2010 Market Minute titled "Is the correction finished?", models are indicated that levels have only now been reached where major market reversals often occur. Chart 1 illustrates only 9.5% of the stocks on the NYSE are currently trading above their short-term 50-day moving averages. This percentage level is the same as on March 2009.

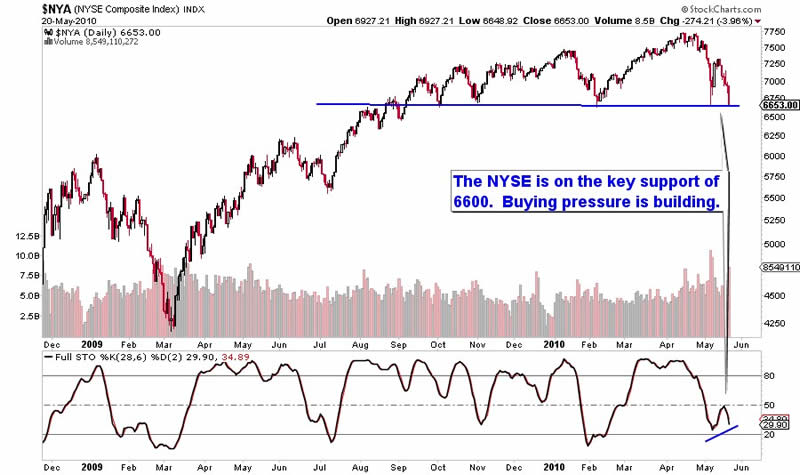

Technical evidence on the broad-based NYSE Composite (Chart 2) implies that price support has likely been met. The 6600 level has provided key support for the index since September 2009. Increased buying pressure can also be observed which adds positive evidence that investors are returning.

The important Euro 100 Index (Chart 3) is trading in a similar pattern to the NYSE. The panic selling has pushed the index down to the solid 200-205 support band.

Bottom line: The recent global selling pressure has driven stocks in the NYSE down to percentage levels that equal the March 2009 reversal. This range (only 9.5% are trending up) indicates a high probability of the index reversing its present downward trend by the end of the month. The evidence of several key indexes on major support levels adds to the likelihood that the correction is nearly complete.

Investment approach: The weakness and volatility in the markets highlights the increased risk to investors. As equity markets trade in approximate 16-week cycles, the next low is expected in September. The investing environment over the next four months should be approached with greater caution. June and July are anticipated to be positive months however August and September has a long history for developing downward pressure.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2010 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.