EURO EXPERIMENT: German Steel or Schmucks?

Currencies / Euro-Zone May 21, 2010 - 11:56 AM GMTBy: Gordon_T_Long

The European Crisis is proving to be more of an unraveling than a contagion.

The European Crisis is proving to be more of an unraveling than a contagion.

I have long written that the European Monetary Union (EMU) constitution and Euro currency should be viewed in the context of a risky bet versus a sound regional monetary strategy. The odds of the EMU’s survival are presently reflected in a plunging Euro, despite a historic and unprecedented intervention. This indicates that the EMU’s existence in its current form is now a bad bet.

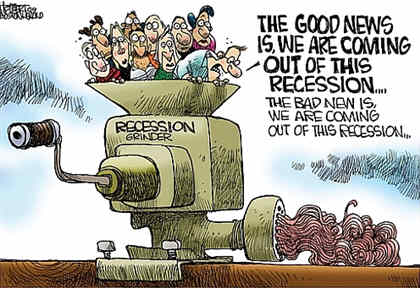

The good news is that this is becoming obvious and it suggests that the serious governance flaws of the 17 year Euro Experiment may finally be addressed. It took a crisis to see its first test, which has been the generally accepted view of when the euro experiment would prove its viability. The established momentum of the EU since its inception and its broad acceptance prove that its survival is presently a matter of European preference with most Eurozone members feeling it an absolute necessity. We’d therefore expect to see the EU constitution reformed. What should concern investors the most however is how the mechanics of what will be a ‘forced reform’ will unfold. The highly visible process will have profound implications to the stability of global financial markets and to a very tenuous global economic recovery.

The good news is that this is becoming obvious and it suggests that the serious governance flaws of the 17 year Euro Experiment may finally be addressed. It took a crisis to see its first test, which has been the generally accepted view of when the euro experiment would prove its viability. The established momentum of the EU since its inception and its broad acceptance prove that its survival is presently a matter of European preference with most Eurozone members feeling it an absolute necessity. We’d therefore expect to see the EU constitution reformed. What should concern investors the most however is how the mechanics of what will be a ‘forced reform’ will unfold. The highly visible process will have profound implications to the stability of global financial markets and to a very tenuous global economic recovery.

I see the long standing philosophical difference between Germany and France to be at the core of this potentially very public resolution. During the recent behind closed door emergency bailout negotiations, these differences are reported to have come to the fore. Additionally, Frau Merkel and Monsieur Sarkozy are very different personalities. Will Frau Merkel show German Steel or as the German tabloid Bild proclaimed on news of the Euro bailout, become ‘schmucks’? Will Sarkozy the ever populist media hound prove to be a true diplomat or display what Germans perceive as insulting French arrogance? Unfortunately, the world must wait and watch while financial markets will no doubt fluctuate wildly on the uncertainty of the outcome.

What financial markets are oblivious to is just how crafty these two politicians are. There is more going on regarding a European strategy than the media once again fails to recognize.

For the accompanying slide presentation see: Tipping Points - Commentary

WHY THE EURO EXPERIMENT IS FLAWED

The core issues with the Euro Experiment which need to be resolved are about a workable governance structure. They can be summarized as follows:

- There is no effective policing of sovereign fiscal authority.

- There are no sovereign penalties for failing to adhere to the “Eurozone Stability and Growth Pact“

- A single currency does not allow a standard depreciating currency option with which to resolve a sovereign growth or productivity failure without forcing a devastating sovereign economic austerity shock.

- There is no ability to effectively coordinate Monetary and Fiscal Policy initiatives during a financial crisis.

- The ECB is not empowered to monetize national sovereign debt. It is specifically constitutionally banned from doing so.

The International Herald Tribune outlines the issue as follows:

Europe’s consistent inability to move quickly enough to get ahead of the financial markets during the Greece crisis is shaking the euro and the foundations of the European Union itself, as critics of the euro have long predicted would happen. The question being raised with increasing urgency is whether the European Union can fashion a mechanism to speed decision-making before irreversible damage is done and the euro itself slips into history.

The delays are inevitable, most experts say, stemming from the nature of the European Union and its own institutional voids:

1 - No single government,

2 - No single treasury

3 - No effective fiscal coordination

4 - No mechanism for crisis management

Every major decision on the euro must be negotiated among member states and European institutions, a torturous process that also plays up political fissures both within and among member countries. That breeds uncertainty and even panic among investors, who already doubt that the Greek deal that the European leaders finally sealed on Friday night will forestall an eventual restructuring of Athens’ crippling debt.

“The European Union is running behind events,” said Anne-Marie Le Gloannec, a political scientist at the Institut d’Études Politiques in Paris. While, for example, the United States could “shock and awe” the markets early in the global financial crisis with the TARP bailout money and a huge stimulus program to restart the economy, there is no single European institution that can do the same. By contrast, every decision about Greece has been a painful, time-consuming bargain among the different national governments, with their own political requirements and concerns, and their own views of economic virtue.

Let’s briefly consider the leadership responses to recent issues through the lens of the first three political altercations or ‘political dances’, to see if we can get a clearer view of how this ‘forced reform’ I mentioned above will unfold.

SCORING THE FIRST 3 DANCES:

1- THE GREEK BAILOUT

1- THE GREEK BAILOUT

Germany: Takes the position this is a Greek problem and a matter for Greece to solve without EU involvement as per the EU charter.

France: Takes the position that EU aid should be given but with a plan on how austerity plans will be implemented.

SCORING: Greece has received $145B in financial support

WINNER: FRANCE

2- THE EU SHOCK & AWE “TARP”

Germany: Once again takes the position members need to solve their own problems but reluctantly is willing to support a marginal scope of effort towards a bailout.

France: Wants and demands a massive coordinated ‘shock and awe’ response to stabilize the Euro and brutally punish speculators.

SCORING: A historic $1T bailout intervention undertaken with unprecedented changes to the operation of the ECB

WINNER: FRANCE

3- GERMAN UNILATERAL NAKED SHORT BAN

Germany: Unilaterally implements a ban on naked short sales and on the shorting of specific financial institutions.

France: Completely rejects Germany’s position which makes German efforts meaningless and only further weakens the Euro.

SCORING: Euro Collapses further and global markets sell-off. Libor increases as does the Libor-OIS spread.

WINNER: FRANCE

FRAU MERKEL

POLITICAL REALITIES

- Chancellor Merkel is in a tenuous political position. Ruling with a coalition, she lost a critical election in North Rhine-Westphalia on May 8th, which was the weekend of the summit negotiations. She is acutely aware that the German people are decidedly against German financial support of spendthrift countries, especially after German experiences with East German unifications and the last 10 years of ‘belt tightening’ to make Germany globally competitive. Frau Merkel is caught in what appears to be a nearly impossible political position. She is politically exposed.

- German banks are extremely vulnerable to defaults or possible work out plans with troubled PIIGS.

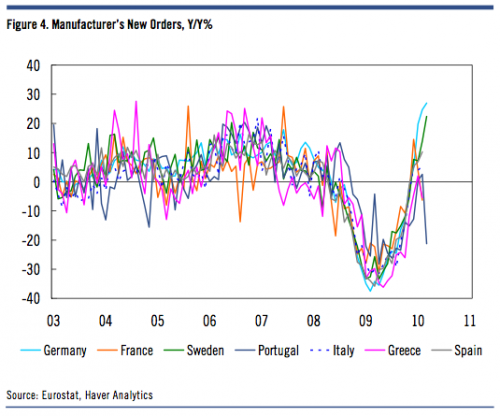

- The German economy has slowed dramatically and though not in a recession, further weakness in the euro zone will have immediate impact on the German economy.

LIKELY APPROACH TO ‘FORCED REFORM’

Germany talks of ‘economic governance’ while France talks of ‘economic government’. When you explore them you find there is a significant cultural difference. To Germany the word government implies that an outside body would control economic policy as opposed to governance that would convey the idea of structure, framework and sanctions.

According to Stratfor: "Germany now senses the opportunity to reform the euro zone so that similar crises do not happen again. For starters, this will likely mean entrenching the European Central Bank's ability to intervene in government debt as a long-term solution to Europe's mounting fiscal problems. It will also mean establishing German-designed European institutions capable of monitoring national budgets and punishing profligate spenders in the future. Whether these institutions will work in the long term - or fail as attempts to enforce Europe's rules on deficit levels and government debt have in the past - remains to be seen. But from Germany's perspective, they must."

MONSIEUR SARKOZY

POLITICAL REALITIES

- As French President he does not face election until 2012. He is politically safe.

- French banks are also heavily invested in PIIGS

- France’s deficits have ballooned and austerity plans even remotely resembling those in Greece would bring violent protests from notorious militant French unions and workers.

LIKELY APPROACH TO ‘FORCED REFORM’

It is in Monsieur Sarkozy’s interest to fight for a US like Keynesian solution with excess money printing. This would ‘kick the can down the road’ and avoid an impossible ‘austerity cuts’ war with French unions and workers. He sees what is happening in Greece as something he is likely to face in 8-12 months. The current increasing Credit Default Swap (CDS) rates for France also reflect this concern by investors.

Ulrike Guerot, senior research fellow at the European Council on Foreign Relations (ECFR) suggests that Monsieur Sarkozy would respond: 'what is so wrong with inflation of four percent? It will be competitive inflation. But for the Germans, inflation at four percent is evil".

Alexander Law, chief economist at the Xerfi consultancy in Paris believes “France and Germany will have to start speaking the same language or else the euro will disintegrate. I think that France will end up agreeing with everything Germany says, because they have to, but then they will simply continue to flout the rules as they have done in the past".

THE FORM THE CHANGES WILL TAKE

Having played the schmuck, Germany is likely to win the dance finale. With the Euro approaching its original 117 value or very near parity to secure German support (who are going to be the big taxpayers behind successful ongoing bailouts), Germany must feel ‘German Steel’ has been brought to bear in resolving the EU crisis. Even a smart Sarkozy will know when it is time to lose a hand to keep his winnings.

CRAFTY POLITICIANS & SLY CENTRAL BANKERS

Now the shocking truth – ALL THE HARD WORK HAS BEEN DONE!

Politicians and strategists always wait to employ a crisis event to enact politically difficult solutions. Whether “False Flag’ operations or just opportune timing, history is replete with them. Experienced politicians wait for the public to demand action during a crisis, and then make their move just when the public is willing to accept any action rather than no action.

A shrewdly crafted political strategy or a well coordinated plan of the central bankers or circumstances; I will let you be the judge.

The two major issues facing Europe have actually subtly been addressed and all that is now left to do is to go through the public dance of appearing to take actions to resolve the crisis. The two critical achievements that were central to an EU survival solution were:

- A massive devaluation of the Euro - DONE

- To allow the EU to be competitive globally

- To allow the southern Euro countries to regain some of their especially hurt productivity due to a strong Euro

"... the story of the eurozone economy has, in consequence, been one of divergence, not convergence. The rough external balance masked the emergence of countries with huge current account surpluses and corresponding exports of capital, notably Germany, and of others with the opposite condition, notably Spain. In countries with weak domestic demand and low inflation, real interest rates were high; in countries with strong demand and higher inflation, the reverse was true. The result is not just huge fiscal deficits, now that private-sector spending has collapsed, but a need to regain lost competitiveness. But, inside the eurozone, this is possible only with falling wages, higher productivity growth than in Germany (and so soaring unemployment), or both."

Martin Wolf’s concise description of the German economic machine is enlightening:

At one end is a powerful and highly efficient industrial export engine that generates a large trade surplus with the rest of the world, including most other countries in the eurozone. Instead of spending this new export wealth on a higher standard of living, however, parsimonious Germans prefer to save it, handing it over to thinly capitalized German banks that have proved equally efficient in destroying said wealth by investing it in risky securities issued, not coincidentally, by trading partners that need the capital to finance their trade deficits with Germany. To prevent the collapse of those banks, German taxpayers are dragooned into using what remains of their hard-earned savings either to bail out their hapless banks or their profligate trading partners.

Steven Pearlstein writes on Germany in the Washington Post:

Normally, what should happen to such a country is that, as a result of its trade surplus, wages rise, along with the value of its currency, to reflect its new wealth and productivity. That has the effect of making those exports less competitive while encouraging workers to spend their increased income on cheaper imports. And in that way, the system brings imports and exports more into balance.

That rebalancing, however, hasn't happened in Germany. It hasn't happened because much of Germany's trade surplus is with other European countries with which it shares a common currency, so the currency can't adjust. It hasn't happened because Germans, by their nature, are eager to save and reluctant to spend their newfound wealth on imported goods and services. And it hasn't happened because the European Central Bank, driven largely by German economic rectitude and fear of inflation, has followed a tight monetary policy that has reduced growth and discouraged domestic consumption and investment.

But that's not how most Germans see things. They look at the current crisis and blame their spendthrift Mediterranean neighbors for using the cover of the euro to rack up public and private debts that they now cannot support. They blame hedge funds and other speculators for making a bad situation worse and profiting from other people's misery. And they are furious that they are being told by their leaders that they have no choice but to bail everyone out.

What Germans won't accept is that they wouldn't have been able to sell all those beautifully designed cars and well-engineered machine tools if Greeks and Spaniards and Americans hadn't been willing to buy those goods and German banks hadn't been so willing to lend them the money to do so. Nor will they accept that German industry was able to thrive over the past decade because of a common currency and a common monetary policy that, over time, rendered industry in some neighboring countries uncompetitive while generating huge real estate bubbles in others.

The danger of Germans misunderstanding the causes of the current crisis is that it leads them, and the rest of Europe, to the wrong solutions.

Year End 2009

- A reconstitution of the EMU and specifically the role of the ECB regarding assumption of sovereign debt – DONE (with the Euro Bailout)

- The European banks still maintain leverage ratios over 50:1 and have not addressed toxic assets like the US

- Europe needed an immediate TARP-like solution to address a pending European banking crisis that would never have been approved across the broad EU membership without the cover of a crisis.

GEAB LEAP E2020 in GEAB #45 report:

Without knowing it, and without having asked their opinion, 440 million Europeans have just joined a new country, Euroland, of which some already share the currency, the Euro, and of which all now share the indebtedness and the joint means to solve the serious problems posed in the context of the global systemic crisis. The budgetary and financial decisions taken during the Summit of the weekend of the 8th May in terms of a response to the European public debt crisis can be evaluated differently according to one’s analysis of the crisis and its causes. Without doubt, a radical unraveling of European governance has just taken place: a collective continental governance has just brutally emerged.

According to Daniel Amerman:

What happened in Brussels over the weekend was that the nature of money changed. The nature of the euro changed, as the nature of the US dollar has fundamentally changed, as have many other currencies over the last couple of years. This in combination with radical, trillion dollar government market interventions has also fundamentally changed the very nature of the investment markets. The paradigm has changed, and everything most of us have is at risk because of this. The paradigms that governed successful investment – and the preservation of capital in the 1990s and the 2000s – are now obsolete.

With both of these key goals now secured, (which would have never been achieved in public debate) the public discussion over the wording of the reform can take place. As mentioned earlier, the ongoing volatility of the financial markets will give the politicians the cover to force these changes through their respective sovereign political apparatus.

CONCLUSION

We should likely expect the 27 member European Union to soon become more vocal since any and all decisions will have a profound impact on their economies. We’ll likely see the emergence of a couple of leaders to counterbalance German and French parochial views and lead to a more collective, cohesive EU view of itself as a political entity versus a bundle of disparate views.

What this means is we may see the final emergence of a United Sovereign States of Europe (USSE). This would be a blended version of US capitalism and Eastern European socialism. You can likely expect Merkel and Sarkozy to be strategizing to be its first President.

SOURCES:

(1) 05-16-10 GEAB N°45 is available! Global systemic crisis – From « Eurozone coup d’Etat » to the tragic solitude of the United Kingdom, the pace of global geopolitical dislocation accelerates GlobalEurope Anticipation Bulletin LEAP

(2) 05-14-10 Eurozone Rescue: Nuking the Savers to Bailout Bankers Daniel R Amerman

(3) 05-15-10 ECB Abandons Independence and Prints $1Trilion to Prevent Euro-Zone Collapse John Mauldin

(4) 05-18-10 Single currency bloc plays ‘beggar-my-neighbour’ Martin Wolf, Financial Times

(5) 05-18-10 Beggar thy neighbor: Martin Wolf is singing from my songbook Edward Harrison, Credit Writedowns

(6) 05-18-10 Germany, Greece and Exiting the Eurozone Stratfor

(7) 05-16-10 “440 Million Europeans Have Just Joined a New Country” John Rubino, DollarCollapse.com

(8) 05-19-10 The Irony Of The Euro Crisis: This Is What The World Would Be Like Under The Gold Standard The Pragamatic Capitalist

(9) 05-17-10 Here's Why Germany Really Can't Share A Currency With The Rest Of Europe Vincent Fernando, Business Insider

(10) 05-07-10 Greek Debt Crisis Raises Doubts About the European Union IHT

(11) 05-19-10 Economic governance divides France and Germany Reuters

(12) 05-21-10 Forget Greece: Europe's real problem is Germany Steven Pearlstein Washington Post

For the complete research report go to: Commentary

Sign Up for the next release in the Euro Experiment series: Commentary

The previous Euro Experiment article: EURO EXPERIMENT: EU BULLIED INTO $1T BANKING BONANZA

Gordon T Long gtlong@comcast.net Web: Tipping Points

Mr. Long is a former executive with IBM & Motorola, a principle in a high tech start-up and founder of a private Venture Capital fund. He is presently involved in Private Equity Placements Internationally in addition to proprietary trading that involves the development & application of Chaos Theory and Mandelbrot Generator algorithms.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that, we encourage you confirm the facts on your own before making important investment commitments.

© Copyright 2010 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or recommendation you receive from him.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.