Will European Central Banks begin Selling Gold Again?

Commodities / Gold and Silver 2010 May 22, 2010 - 01:16 AM GMT Since the inception of the fourth Central Bank Gold Agreement last year on September 27th, sales by European central banks have been nearly non-existent. But that was before the € began to implode and fractures appeared in the Eurozone itself. Now governments have to fiercely cut back expenditures. They must do this to the extent that the reaction is certain to be social unrest.

Since the inception of the fourth Central Bank Gold Agreement last year on September 27th, sales by European central banks have been nearly non-existent. But that was before the € began to implode and fractures appeared in the Eurozone itself. Now governments have to fiercely cut back expenditures. They must do this to the extent that the reaction is certain to be social unrest.

As it is, Greece is not only suffering already but its key revenue driver, tourism is suffering badly [25% down already this year] so cutting tax revenues and making government book-balancing even more difficult. To many people out there, the gold holdings of such banks should be sold to shore up such shortfalls. Would European central banks agree?

Gold as a Reserve Asset

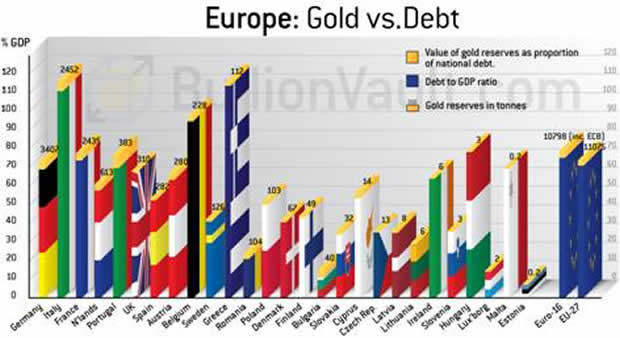

Take a look at the table here. (Supplied by the www.bullionvault.com to us.)

In all cases, the contribution that the proceeds of gold sales would make would, in all cases, barely dent the problem. So it is not a cure for a nation’s debt. You may ask, what purpose do gold reserves serve, if not to be sold when times are hard? The only way to answer this is to take an individual, as the nation. He has some gold hidden away for a rainy day. He is asked by his bank manager to repay his overdraft, but he can’t, not without a long-term plan to pay it off slowly against income. His bank manager tells him to liquidate his gold and put that into the account. He does this and finds that with that final reserve gone any emergency that hits him out of the blue from then on will simply destroy him financially.

So he decides that when those dire times hit, he will keep his gold for the time when nothing he says and does is believed or accepted. Then, when he produces gold it has a value that his actions cannot affect. It has a value everywhere to anyone. This external value is what will keep him in business and allow him to slowly recover. Essentially that is the role of gold as a reserve asset.

Why did Europe Sell Gold from 1999

Every time nations sold gold over the last 35 years it has been to try to give credibility to a new role for a currency.

- The U.S. did it in the 1970’s, as the U.S. Dollar, as well as being the petro-currency, went international [cutting its link with gold first].

- The I.M.F. did it at a time when it and the U.S. wanted the Special Drawing Rights to replace gold in the monetary system [Nations would not accept this, which is why the S.D.R. is a paper currency only in the I.M.F.’s books].

- Then Europe did the same when the € [Euro] was launched.

In the first two instances, the impression was given by the U.S. and the I.M.F. was that gold sales would go on until gold was no longer part of the system. This forced the price of gold to fall from its peak of $850 to $275. Accompanied by “accelerated production and sales” of gold in the market, this campaign [‘gold was a barbarous relic’] was believed, until this century.

But when European central banks decided to sell, they emphasized that it was still an important reserve asset and that they would sell no more than a maximum amount. The removal of the unlimited gold sales allowed the market to quantify the impact on the gold price. As a result, the gold price has moved from just under $300 to the peak of $1,250 thus far-- an average price increase of 43% per annum on the lowest price.

Now, no longer a barbarous relic, it is preserving value at a time when currencies value and credibility are losing theirs. Each week in the newsletter we report the activity of central banks in the gold market and as you can see there, selling has been minimal while buyers have bought over 350 tonnes since September of last year. Behavior was similar in 2009 when over 400 tonnes of gold were bought by central banks and sales turned to a trickle. Since February of this year, European central banks have sold just one tonne of gold.

The true value of gold for a central bank and a nation, is that when its currency is threatened, whether by deflation [and as we have seen the price of gold rise in deflationary environments] inflation, falling confidence in national currencies, or even war. What we have seen is that when all else fails, gold is exchangeable even between enemies. This quality transcends its value as just money.

Fortunately, we are not there yet. This is not such a desperate time [when all else has failed] so central banks will keep a firm grip on the gold they have, while others with too little, particularly in Asia, will do all that is reasonable to acquire more.

Gold Forecaster regularly covers all fundamental and Technical aspects of the gold price in the weekly newsletter. To subscribe, please visit www.GoldForecaster.com

![]()

By Julian D. W. Phillips

Gold-Authentic Money

Copyright 2009 Authentic Money. All Rights Reserved.

Julian Phillips - was receiving his qualifications to join the London Stock Exchange. He was already deeply immersed in the currency turmoil engulfing world in 1970 and the Institutional Gold Markets, and writing for magazines such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

What is Gold-Authentic Money all about ? Our business is GOLD! Whether it be trends, charts, reports or other factors that have bearing on the price of gold, our aim is to enable you to understand and profit from the Gold Market.

Disclaimer - This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold-Authentic Money / Julian D. W. Phillips, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold-Authentic Money / Julian D. W. Phillips make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold-Authentic Money / Julian D. W. Phillips only and are subject to change without notice.

Julian DW Phillips Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.