Why We Hate ETFs

Stock-Markets / Stock Markets 2010 May 25, 2010 - 02:37 AM GMTBy: David_Grandey

Over the last 5 months we’ve been talking about buying the dips and selling the rips which up until recently has been the buzz. However we can now replace that with:

Over the last 5 months we’ve been talking about buying the dips and selling the rips which up until recently has been the buzz. However we can now replace that with:

“Buy in the face of fear and sell into all rallies.”

On Friday we did just that. We bought in the face of fear and thus far we’re pretty pleased with where we stand.

That said we started to look at individual stock vs ETFs and specifically index ETFs – leveraged and non leveraged.

Let’s look at last week’s buying in the face of fear from a had you bought 100 shares of SPY in the 105.50 range standpoint. Then we’ll apply that same $10,500 cost to buy equal dollar amounts of other ETFs and then onto individual stocks. We think you’ll see when we are through why we prefer individual stocks vs ETFs when all said and done.

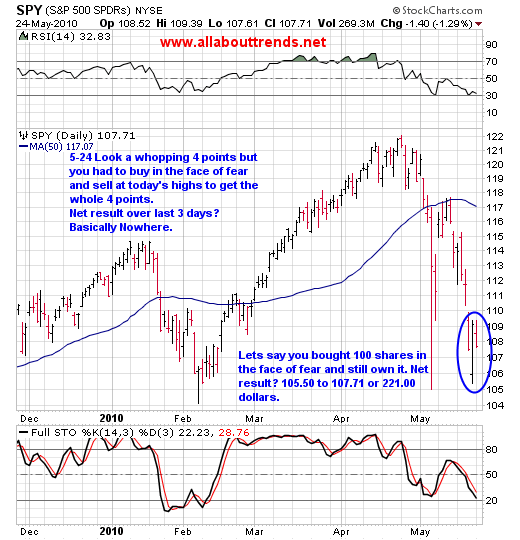

First up is the SPY

Best case — You bought in the face of fear and sold at the highs since.

105.50 to 109.50 or a whopping + 400.00 gain on 100 shares

Current Case (through May 24) — You bought in face of fear and still hold it.

105.50 to 107.71 or a whopping + 221.00 gain on 100 shares

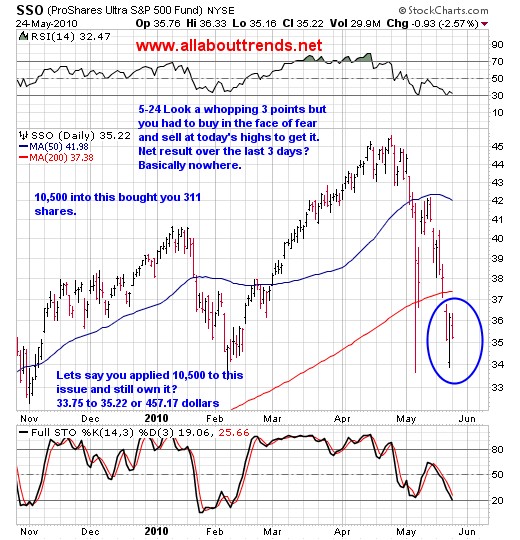

Now let’s move on to the leveraged 2 times market risk S&P 500 ETF

Best case- You bought in the face of fear and sold at the highs since.

33.75 (311 shares) to 36.75 or a whopping + 933.00 gain on a $10,500 investment.

Current Case (through May 24) – You bought in face of fear and still hold it.

33.75 to 35.22 or a whopping + 457.00 gain on 10,500 dollars worth

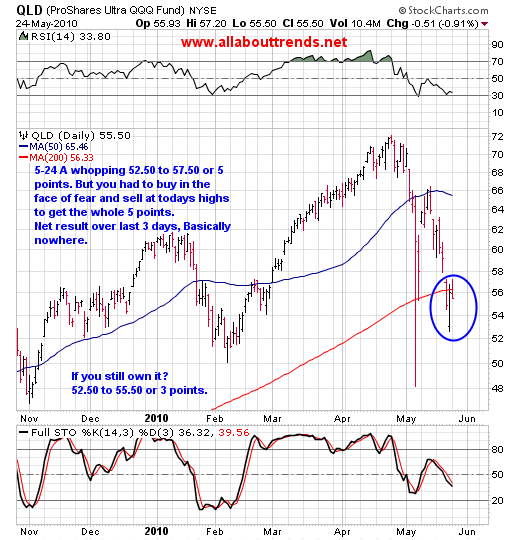

Now let’s look at another leveraged ETF, that being the QLD – Proshares Ultra QQQQ

$10,500 bought you 200 shares.

Best case — You bought in the face of fear and sold at the highs since.

52.50 to 57.50 or a whopping +1000.00 gain on a 10,500 investment. Nice.

Current Case (through May 24) – You bought in face of fear and still hold it.

52.50 to 55.50 or a whopping + 600.00 gain on 10,500 dollars worth

Not bad, but now let’s look at some individual stocks we bought in the face of fear on Friday morning.

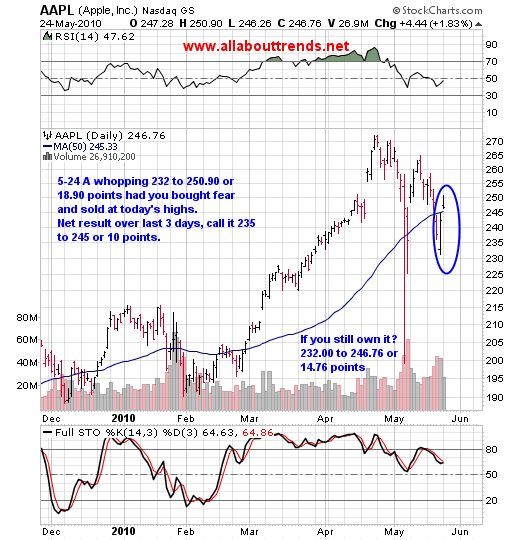

AAPL — Apple Computer

$10,500 bought you 45 shares.

Best case — You bought in the face of fear and sold at the highs since.

232 to 250.90 or a whopping +850.00 gain on a $10,500 investment. Nice.

Current Case (through May 24) – You bought in face of fear and still hold it.

232 to 246.76 or a whopping + 664.00 gain on a $10,500 investment.

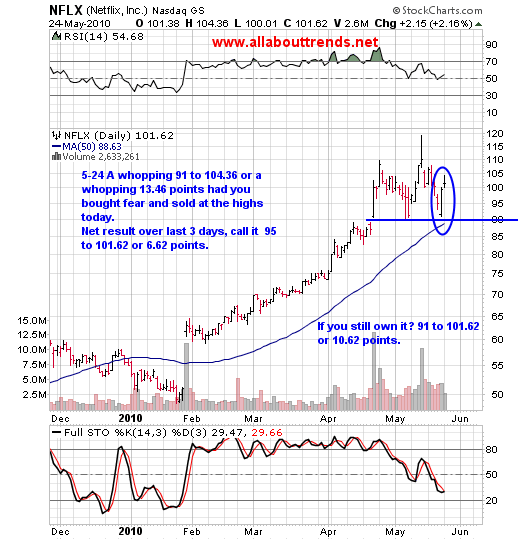

NFLX — Netflix

$10,500 bought you 115 shares.

Best case — You bought in the face of fear and sold at the highs since.

91.00 to 104.36 or a whopping +1326.00 gain on a $10,500 investment. Nice.

Current Case (through May 24) — You bought in face of fear and still hold it.

91.00 to 101.62 or a whopping + 1062.00 gain on a $10,500 investment.

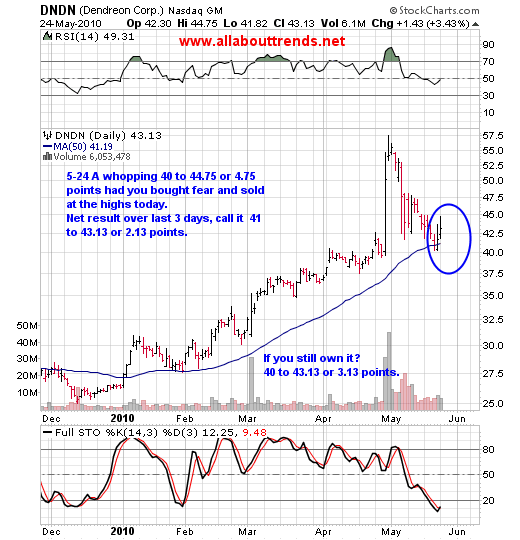

DNDN — Dendreon

$10,500 bought you 262 shares.

Best case — You bought in the face of fear and sold at the highs since.

40 to 44.75 or a whopping +1244.00 gain on a $10,500 investment. Nice.

Current Case — You bought in face of fear and still hold it.

40 to 43.13 or a whopping + 820.00 gain on 10,500 dollars worth

======================================================

SO YOU TELL US WHICH IS BETTER

SPY Best Case 400.00

SPY Current Case 221.00

SSO Best Case 933.00

SSO Current Case 457.00

QLD Best Case 1000.00

QLD Current Case 600.00

AAPL Best Case 850.00

AAPL Current Case 664.00

NFLX Best Case 1326.00

NFLX Current Case 1062.00

DNDN Best Case 1244.00

DNDN Current Case 820.00

As you can see the closest contender amongst the ETFs vs. individual stocks is the QLD proshares.

Last time we checked the reason why we all invest in the market is to make money and get the best return for our investment. And as is often the case, individual stocks get you that result over and over again.

But it’s your choice. You can settle for limited gains or you can choose to invest in individual stocks, learn the chart patterns and buy them at alternative entry points that minimize risk and maximize returns.

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.