Yen Carry Trade to Continue Unwinding

Currencies / Yen Carry Trade Sep 02, 2007 - 09:53 PM GMTBy: Ashraf_Laidi

As per our FX forecast made on August 1st 115.60 Yen by End of August http://www.marketoracle.co.uk/Article1717.html predicting USD/JPY to reach 115.60 by end of August, the dollar hit this very level on the last day of August from its August 1st level of 119.18. We missed our EURUSD call for $1.37 by 60 pips and our GBPUSD call for $2.100 by 70 pips. In fact, USDJPY fell by more than 700 points during the month before regaining ground and closing below 117.

The August events in the currency markets dealt a severe blow to carry trades amid a sharp reduction in risk appetite impacting liquidity in a highly leveraged financial landscape . Escalating margin calls led to soaring yen moves, up as much as 6% versus the dollar, 10% versus the euro, 9% versus the pound and as much as 17% versus the Kiwi.

Despite such sharp unwinding of carry excess, we're unlikely to have seen the end of the unwinding of trades that have accumulated over the past see ½ years. Last week, yen positions against the US dollar showed the first net long amid speculators since June 2006. USDJPY has yet to retrace more than 38% of the fall from the June high of 124 to the 1-year low of 111.68. Not only the yen carry trade is unlikely to go into full recovery against the US dollar, but we also see room for further selling in USDJPY. Ongoing uncertainty in credit markets and the onset for further losses in US equities set the stage for further pullback in USDJPY especially as the Fed is forced into easing by 50 bps this year.

While this may sound counterintuitive, the Fed's inauguration of easing cycles has proven to increase equity market volatility, rather than reduce it. This would be especially the case for the current central bank whose staunch anti-inflation stance heightens the urgency of the situation once rates have eased. Selling USDJPY on the highs will gradually replace the remaining carry trades in the market as long as the short term charts continue to exhibit lower highs. A September Fed cut can potentially drive up USDJPY towards the 118 figure, but the ensuing volatility is expected to prevent a break of 119.50. The market has yet to retest the 200 day MA of 113 before end of the quarter.

Aside from the market arguments for further yen strength, there are also economic arguments for further housing-led slowdown in the US. Unlike in the market crisis of 1998 when the US economy grew 4.7% and 6.2% in Q3 and Q4 respectively, today's US economy is growing at a sub-par pace of 3.0% with housing and manufacturing recessions threatening to disrupt an increasingly fragile consumer fabric especially with oil prices and gasoline prices 320% and 200% greater than in 1998 respectively.

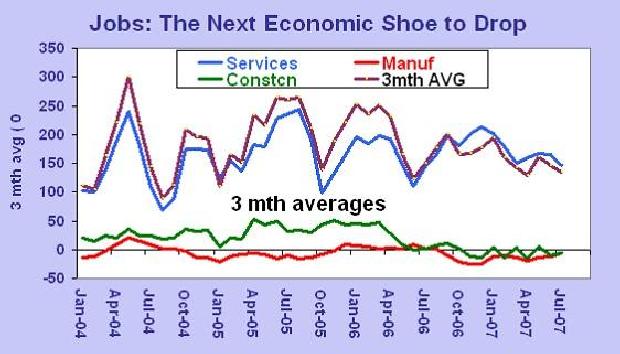

Even the much praised tightness in the labor market is now waning. Beside the fact that non-farm payrolls have fallen below their 3-month average for the last 2 months and that manufacturing, services, construction and retail payrolls have all worsened over the past 3 months, the unemployment rate is also creeping higher. Moving from 4.4% to 4.5% and 4.6% in May, June and July respectively, the trend is firmly in line with the past Fed cuts occurring after a 0.2 increase in the jobless rate. The exception to that rule took place during the inter-meeting rate cuts of fall 1998 when the argument was mainly liquidity than economy.

The other major threat to the US economy is that from falling stocks on personal expenditure. We already saw a decline in personal consumption expenditure in Q2 to 1.3% from 3.7% in Q4, the lowest since Q4 2005. When stocks fell more than 7% in Q2 2006, PCE growth slowed to 2.4%, a 45% decline. Today, with stocks down 7% in the first half of the quarter alone, the probability of PCE growth to come in flat are significant, and so are chances of a flat Q3 GDP.

FX carry trades may slowly creep into the market and equity markets head back higher as the sense of normalcy (or complacency) raises the need for a Fed easing. But with chances of a funds rate cut next month standing above 80%, a decision to leave the funds rate unchanged is likely to trigger renewed market sell-off thereby, forcing the Fed's hand. More importantly, deteriorating macroeconomic evidence is likely to be the more compelling argument for two rate cuts this year, which has been our call throughout this year.

Once US macroeconomic concerns (weaker growth) take over from market concerns (market contagion), dollar weakness will likely become broader in nature as the Fed reduces the dollar's interest rate differential by cutting rates while the ECB, BoE and BoC maintain rates unchanged rather than raise interest rates.

By Ashraf Laidi

CMC Markets NA

Ashraf Laidi is the Chief FX Analyst at CMC Markets NA. This publication is intended to be used for information purposes only and does not constitute investment advice. CMC Markets (US) LLC is registered as a Futures Commission Merchant with the Commodity Futures Trading Commission and is a member of the National Futures Association.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.