Commodity Markets Analysis - Gold Demand Continues to Rise

Commodities / Gold & Silver Sep 03, 2007 - 01:29 PM GMTBy: Gold_Investments

Gold

Spot gold was trading at $672.20/672.70 an ounce as of 1215 GMT.

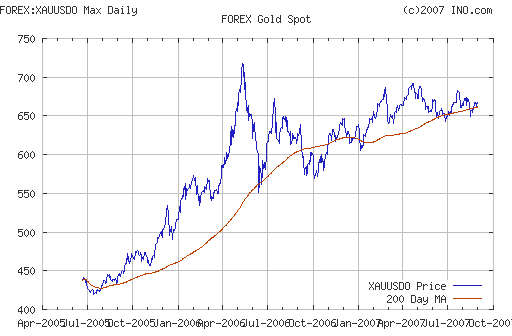

Gold has traded sideways in Asian and European trading after last week's strong performance with gold rallying to a 3 week high. Gold again showed its safe haven qualities in August and was up 1.3% for the month after being up 2% in July.

Gold is looking healthy and strong but needs to rise above the resistance at $675. Since the start of August it is in a tight range between $648 to $675 and gold needs to convincingly breach the $675 mark prior to challenging $700 in the coming weeks.

It is important to focus on the big picture and long term prices and thus inter day and intra day movements are of less significance than weekly and monthly and yearly performance and closing prices. Gold's close last Friday was the third highest monthly close for gold ever. This is especially bullish as it was achieved in gold's traditionally weaker summer seasonal period. Thus, the autumn months should lead to higher gold prices especially considering the continuing very strong fundamentals.

Global gold demand continues to confound the bears with world demand for gold rising about three per cent to 822 tonnes in the first quarter of 2007 from the same period last year and by more than 19 per cent to 922 tonnes in the April-June period, according to the World Gold Council.

According to global jewlery industry analysts, China's jewelry industry alone totaled $18 billion last year, up 35% from 2001. It is the third largest consumption item among Chinese, after automobiles and housing. By 2010, the country is expected to have the biggest jewelry market in the world.

According to the weekly Bloomberg survey of gold analysts, investors and analysts are in favour of buying gold because of “mounting losses from U.S. sub-prime mortgages” and it represents “a haven from more risky financial assets”. Some 75 per cent of those surveyed advised buying gold.

Trade is likely to be thin today with the U.S. out for Labour Day holidays.

Silver

Spot silver is trading at $12.08/12.10 an ounce (1215 GMT).

PGMs

Platinum was trading at $1266/1272 (1215 GMT).

Spot palladium was trading at $330/334 an ounce (1215 GMT).

Forex and Gold

Nervousness continues and events on global credit and stock markets are likely to continue to set the overall tone again this week. The Nikkei and Strait Times in Singapore were down overnight (while most stock markets in Asia were up) and European stock markets started up but have deteriorated somewhat in the course of the morning. With a host of key U.S. data due for release, traders could start to focus more on the economy and the potential damage that the credit crisis may have caused.

Bernanke's comments on Friday, reassuring markets that the Federal Reserve was prepared to take all necessary steps to protect the economy from market volatility, haven't really inspired markets with the dollar near a three week low against a basket of major currencies. U.S. data later this week includes manufacturing activity in August on Tuesday, the Fed's beige book summary of the economy's performance on Wednesday and the monthly jobs report on Friday. From the UK BRC retail sales are due tomorrow, consumer confidence data on Wednesday, Industrial and Manufacturing production on Thursday and finally house price data on Friday. With recent market volatility in mind, economic fundamentals will become more and more important as investors seek a reduction in risk.

Europe will also be in the limelight this week, with the ECB meeting on Thursday amid much uncertainty regarding the outcome of its discussions. Last week's comments from Trichet left the door open to a pause in the tightening cycle. If this does prove to be the case, the ECB is likely to signal at the press conference that it remains vigilant on inflation and that a rate hike has just been postponed. Thus, the impact on the euro should be limited.

In the UK, the BoE is also expected to leave rates on hold. Rates may be increased to 6.00% but a move is more likely to come later in the year. Data of note for release over the week include August's manufacturing and services CIPS, as well as the BRC retail sales survey.

Oil

Crude oil traded near a four-week high in New York as a Hurricane Felix continued on its path toward the Gulf of Mexico, home to more than a quarter of U.S. oil output. Felix is now a Category 5 hurricane, the strongest on the Saffir-Simpson scale of intensity. At 1200 GMT, London's benchmark Brent crude contracts for October delivery were up to 73.43 USD per barrel. New York crude contracts for October delivery were up 28 cents at 74.33 USD per barrel in electronic trades.

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@goldinvestments.org Web www.goldinvestments.org |

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Fair Use Notice: This newsletter contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of financial and economic significance. At all times we credit and attribute the copywrite owner and publication.

We believe this constitutes a 'fair use' of any such copyrighted material as provided for in Copyright Law. The material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for economic research purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

Gold Investments Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.