Gold Reaches New Record Nominal Highs in USD, EUR, CHF and GBP

Commodities / Gold and Silver 2010 Jun 08, 2010 - 07:49 AM GMTBy: GoldCore

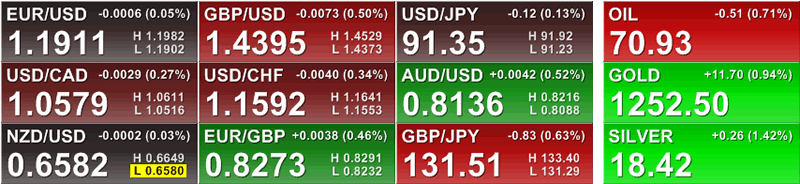

Gold has risen to new record nominal highs as concerns that the European debt crisis could lead to contagion increases. Gold rose to $1,251.85/oz in London and futures reached $1,254.50/oz in New York as risk aversion rose. Bullion advanced to all-time highs in dollars, euros, sterling and Swiss francs as the euro and equity markets again came under pressure.

Gold has risen to new record nominal highs as concerns that the European debt crisis could lead to contagion increases. Gold rose to $1,251.85/oz in London and futures reached $1,254.50/oz in New York as risk aversion rose. Bullion advanced to all-time highs in dollars, euros, sterling and Swiss francs as the euro and equity markets again came under pressure.

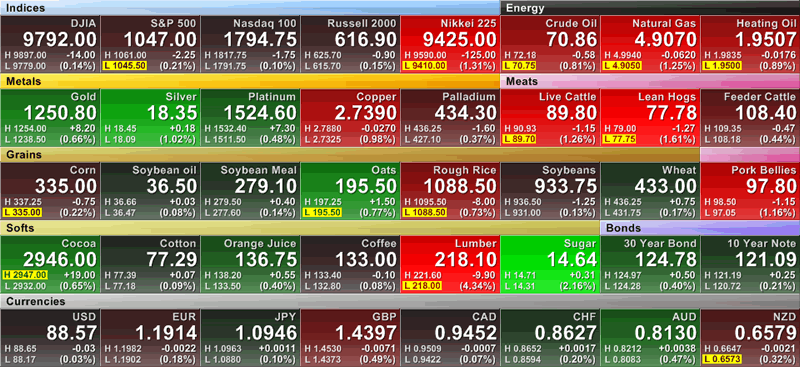

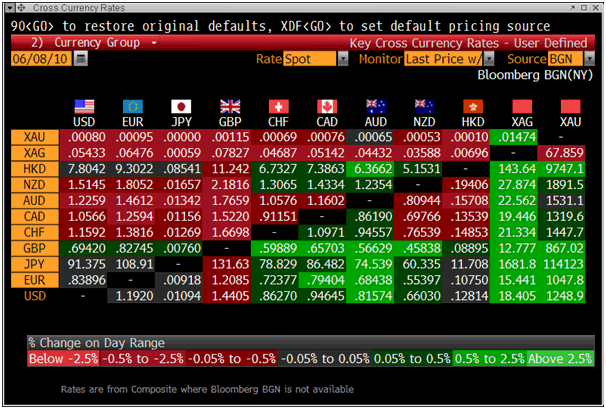

Gold for immediate delivery climbed to a record €1,044.19 euros an ounce and to a record 1,447.641 Swiss francs an ounce. The higher weekly close last week was bullish technically after May's higher close and could set gold up for a test of the psychological $1,300/oz level in the coming days. Gold is currently trading at $1,250/oz and in euro, GBP, CHF, and JPY terms, at €1,048.60/oz, £868/oz, CHF 1,447/oz, JPY 114,553/oz respectively.

Gold's new record highs are primarily due to that fact that contagion appears to be gradually taking place - with the problems of smaller periphery nations now starting to affect larger, more important economies. Fitch has warned regarding the UK's fiscal position, and bond market spreads on French, Belgian, Dutch, Austrian and Finnish bonds over German bunds have risen sharply. France's 10 year bond spread over German bunds has nearly doubled in a week as the weakest AAA nation in the eurozone comes under the scrutiny of the bond vigilantes.

Gold in EUR at New Record Nominal Highs. Click on image to view full size.

Sterling has fallen against the euro after Fitch ratings agency described the fiscal challenge facing the UK as "formidable". Fitch said "the scale of the UK's fiscal challenge is formidable and warrants a strong medium term consolidation strategy - including a faster pace of deficit reduction than set out in the April 2010 Budget". Sterling fell more than half a cent against the dollar, diving to a low of $1.4382 while the euro rose to 82.91 pence. The Fitch announcement has done nothing to ease concerns in already jittery currency and sovereign debt markets.

Cross Currency Rates - 1 Day at 1100 GMT. Click on image to view full size.

Silver

Silver is currently trading at $18.33/oz, €15.35/oz and £12.70/oz.

Platinum Group Metals

Platinum is trading at $1,520/oz and palladium is currently trading at $431/oz. Rhodium is at $2,450/oz.

News

Gold, trading within 1 percent of a record, may rally to an all-time high as investors seek a haven for their wealth, including protection from a possible double- dip recession in the global economy, according to GFMS Ltd. The metal is expected to trade between $1,050 and $1,300 an ounce for the rest of the year, and may climb to as much as $2,000 should the sovereign-debt crisis spread beyond Europe, possibly to the U.S., Chief Executive Officer Paul Walker said in an interview. Gold may also surpass platinum prices, he said.

Gold has increased 13 percent this year as Europe's fiscal crisis has weakened the euro and rattled global financial markets. Deutsche Bank AG said June 3 that gold may surge to $1,700 as currencies slump, according to Michael Lewis, head of commodities research at Germany's biggest lender. "What's happening in Europe at the moment increases the probability that we will see a double dip," said Walker, who joined the independent, London-based research company in 1995 (Bloomberg).

Silver is being overlooked by investors in the rush for precious metals, but the price could outstrip gold in the coming months, according to Moonraker Fund Management. Gold outperformed silver by 46 per cent over the three years to 31 May 2010 but silver, given the long term correlation between the two metals, is expected to catch up. The uncertainty around the global financial situation means investors are seeking safe havens and precious metals have a historic role as a store of real value in times of crisis.

Silver tipped to rise as industrial demand rises - May-27India's Hindus take a shine to silver - May-14Hurricane warnings push up commodities - May-28Fund managers, Moonraker, believe gold and silver are far from being in a bubble situation. They predict that the deteriorating confidence in Western currencies will continue, with the Euro currently under pressure because of the debt crisis and sterling next in line. Western currencies will continue to be de-rated versus the currencies of non-indebted countries such as China and Brazil.

Jeremy Charlesworth, manager of the Moonraker commodities fund, said: "If you mass produce something then it will lose value at some stage. Quantitative easing is undermining the value of Western currencies and assets yet the European Union has decided that the solution to the debt crisis is even more debt and confidence in the recovery package has now evaporated. "When people abandon bonds and Western currencies they will look for real assets, which can't be created at the touch of a button. Investors will continue to invest in such assets, including property, equities and commodities such as gold and silver. Charlesworth believes that silver, which is currently trading around $18-$19 an ounce, has an additional attribute over gold in that it is continually consumed for industrial purposes.

He said: "Silver has lots of practical applications and is widely used for example in plasma screens, mobile phones and for coins. I am more bullish on silver than gold in that when it moves it shifts very quickly and it is due a catch-up with gold. Platinum is important, too. China is producing new cars that cost $5,000 so they will sell in enormous numbers and these all use platinum for catalytic converters." Charlesworth believes that gold, now trading around $1,225 per ounce, is set to go much higher, quite possibly in excess of $5,000, although it is impossible to predict for certain. "The gold market really does have the bit between its teeth at the moment but a pullback in prices would only be a buying opportunity. It won't be until gold is going up $150 a day that the bubble will burst. It might only reach $5,000 or more for one day but at that point there will be a real crisis of confidence in Western currencies caused by colossal debt and governments will be forced to bring their deficits under control."

In a survey of US hedge fund managers in July 2009, Moonraker found that 20 out of 22 were buying gold to protect their personal wealth for fear that the quantitative easing programme being seen in the Anglo Saxon economies would eventually result in a bout of excessive inflation (Financial Times).

Risks for platinum and palladium prices are on the downside as euro zone debt woes weigh on demand prospects, London-based metals consultancy GFMS said on Monday. Of the two precious metals, palladium has more promising fundamentals as demand is concentrated outside of Europe and investor buying is expected on dips, GFMS senior consultant Peter Ryan said in a Tokyo briefing about forecasts issued in April. "I think $400 (an ounce) will be well supported by investors," Ryan said, referring to palladium prices which stood at $418.50 per ounce on Monday, adding that the likely range would be $400-$500 most of the time this year. A GFMS report on platinum and palladium released on April 22 forecast palladium between $400 and $675 an ounce this year. GFMS also said platinum could rise to $1,900 an ounce on investor demand and would likely stay above $1,400 this year.

GFMS said on Monday that it has basically maintained the earlier price forecasts despite a heavy sell-off across the commodity markets recently prompted by the euro zone's debt problems. Among the hardest hit included NYMEX platinum futures. "I would say the risk at the present time is more to the downside," Ryan said, referring to platinum prices. On Monday, spot platinum stood at $1,491, down 15 percent from around $1,750 in late April. Platinum prices are sensitive to the diesel automobile market where Europe is dominant. In contrast, palladium prices are more linked to gasoline-powered vehicles and often benefit from a shift from more costly platinum, Ryan said.

Separately, GMFS said imports of more than 11 tonnes of platinum by China in March, a sharp jump from 6.1 tonnes in February, was likely speculative buying, adding there was little chance it was all for either jewellery or autocatalyst use. GFMS CEO Paul Walker said in the same briefing that investors will remain the principal driver of gold prices this year, adding that without their interest current levels around $1,200 per ounce would be difficult to maintain (Reuters).

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.