Stock Market Crash Third Leg - Fingers of Instability Part Four

Stock-Markets / Financial Crash Sep 04, 2007 - 07:15 PM GMTBy: Ty_Andros

In This Issue – 2 Fingers of Instability

Reversion To The Mean

Amen Corner

Many in the economic and financial commentary business are calling what's unfolding the big one, the event that brings down the worlds booming economy and a systemic failure of the financial system. While I believe this is a serious blow up and will create lots of opportunities both “Long and short” in many markets I truly believe this is a financial problem only. It is a repricing of risk and a correction of many ill advised investments but not the end of the world. There is TOO MUCH MONEY out there to cushion the downside. The financials sectors and banks are going to get it good and hard, as they should as they tried to reach too far into the cookie jar.

But the G7 will do what's necessary to underpin these sectors as they are the basis of the “Asset backed economies” they practice. The amount of money that is vaporizing is enormous but as a percentage of the world economy a teacup full. Fingers of Instability are when asset classes get ahead of themselves and crash. But the “Crack up Boom” is alive and well. Many in the financial world will be carried out on a stretcher and that will set the stage for next round of reflation. When they expire there are many in the world that are flush with cash ready to pick up the pieces.

Chairman Bernanke and the Federal Reserve have made clear they stand ready to underpin the financial and banking communities, just as the European Ce ntral bank does as well. They have plowed 100's of billions of dollars and euros into the lending windows. This is inflation pure and simple. The financial losses are still to be revealed, while to date the announcements have been in the 10's of billions, when it's through you can expect 150 to 350 billions of dollars in losses. So the cockroaches have yet to emerge. As the cockroaches appear some will be squashed and some will be saved. Those that took the leverage too far, overleveraged themselves and took foolish risks will perish and those that are considered the foundations of the financial system will be saved.

Existing homes for sale last week rose to their highest level of inventory ever, at over a nine month supply and are set expand by up to 25% or more. Millions of people are headed for bankruptcy, but that is maybe 1% of the total population of the United States . Although there are problems around the world for people holding asset backed securities of one sort or another, Greenspan was right about one thing, the risks have been widely distributed and the losses will be widely distributed as well. This is a financial event to this point not a main street affair. The people who are frightened are in the financial community and it is their books and investments that are vaporizing, talk to the man on the street and he is oblivious to the turmoil. Slower growth and tighter credit going forward in the G7 will definitely cause problems, but lending going forward will be on far more stable grounds.

Reversion To The Mean

It is clear that lending standards have been thoroughly tightened; purchasing homes for investment purposes will suffer a convulsion as previous mal-investment are flushed out. These investors are going to be the primary areas of defaults. Of course they were the source of the bubble in housing in the first place as easy credit allowed the to speculate on someone else's dollar, they had no skin in the game, the second group of defaults will be those who just plainly were allowed to buy homes they could not afford and reached for the brass ring, or were convinced by predatory lenders that they could do so with impunity as inflation would make them OK. First lets take a look at home prices going back to the early 1970's, keep in mind that in purchasing a home you should not borrow more than 3 times you normal yearly income and we can see this clearly in the illustration:

![[The Song of Bernanke]](../images/Ty_Andros_4_9_07_image001.gif) As you can easily see this fall in prices has a long way to go. IT WILL REVERT to previous levels, and probably over shoot to the downside. So get ready for some turmoil and the opportunities it create as it works through this process. In previous editions of “Fingers of Instability” we outlined the enormity of the number of ARM resets (adjustable rate mortgages) that are unfolding over the next year, the number is close to a trillion dollars and it involves almost 2 million homes. Considering that there are a little over 4.6 million existing homes already on the market you can look for the number to swell to unbelievable amounts of new inventory. New home inventories are at 9 month levels as well, so its bombs away for home prices for the foreseeable future. While the bombs these mortgages represent hit investor's balance sheets you can expect the financial sectors of the world's economies to reprice lower. These are the seeds of the continuing correction going on in the global stock markets. The sooner these cockroaches hit the headlines the sooner they can be priced into the stock markets. Look for ugly surprises over the next 60 days.

As you can easily see this fall in prices has a long way to go. IT WILL REVERT to previous levels, and probably over shoot to the downside. So get ready for some turmoil and the opportunities it create as it works through this process. In previous editions of “Fingers of Instability” we outlined the enormity of the number of ARM resets (adjustable rate mortgages) that are unfolding over the next year, the number is close to a trillion dollars and it involves almost 2 million homes. Considering that there are a little over 4.6 million existing homes already on the market you can look for the number to swell to unbelievable amounts of new inventory. New home inventories are at 9 month levels as well, so its bombs away for home prices for the foreseeable future. While the bombs these mortgages represent hit investor's balance sheets you can expect the financial sectors of the world's economies to reprice lower. These are the seeds of the continuing correction going on in the global stock markets. The sooner these cockroaches hit the headlines the sooner they can be priced into the stock markets. Look for ugly surprises over the next 60 days.

The leading edge of the debacle is coming from Investors, amateur speculators, Ninja (no income, no job or assets) and liar loans (lied about income and was not verified). And they are enormous percentages of the amount of mortgages issued in 2005 and 2006 when the sure thing of home ownership was at its highest frenzy. Let's take a look at a snapshot of this:

![[Walking Away]](../images/Ty_Andros_4_9_07_image002.gif) As you can see these people are just dropping off the “Keys to the House” as outlined in a previous edition of “Fingers of Instability”, this will only grow as home prices are not going to rise anytime soon as can be seen in the first illustration. The keys to the house will only accelerate the momentum of the down move in home prices which has just begun. These default rates are only going to grow and accelerate to the upside.

As you can see these people are just dropping off the “Keys to the House” as outlined in a previous edition of “Fingers of Instability”, this will only grow as home prices are not going to rise anytime soon as can be seen in the first illustration. The keys to the house will only accelerate the momentum of the down move in home prices which has just begun. These default rates are only going to grow and accelerate to the upside.

Many vulture funds are standing at the ready to buy these distressed properties and mortgages then repossess them. THEY ARE WAY TOO EARLY! The real estate sector in the United States is a problem, but real estate in many areas of the world is still very solid. And those areas do not have the investor and liar loan problems endemic in the US . When people bought in other areas of the world lending requirements were still solid. This is a US centric problem to this point. In the rest of the world 10 to 30% deposits and income verification remain firmly in place.

The commercial paper market is in freefall as it has contracted over 10% in the last 6 weeks, quickly shutting out securities linked to these loans, as they should as they have far less value then they purport to. As outlined in Roach motel (See Tedbits archives at www.TraderView.com ) , these securities have no way to discover their worth. It is clear that the banks and securitized products sections of the big brokerages knew this trash was included in these securities; it will be interesting how the regulators deal with their masters in New York . If you and I did that with full knowledge of the poor quality of the product it would be premeditated FRAUD. Bernanke was quite specific in his speech last Friday that the discount window operation was the solution to the evaporation of the liquidity in the commercial paper markets.

Part of the problem with the asset backed securities markets is GRADE INFLATION from the rating agencies such as S&P and Moody's. An editorial in the financial times had this to say:

“Although there is evidence that Moody's and S&P remain relatively conservative when rating structured products, it is clear that even Moody's has allowed its ratings scale for securitised products to become inflated. Bloomberg Markets reported in July that: “Corporate bonds rated Baa, the lowest Moody's investment grade rating, had an average 2.2 per cent default rate over five-year periods from 1983 to 2005, according to Moody's. From 1993 to 2005, CDOs with the same Baa grade suffered five-year default rates of 24 per cent, Moody's found.” In other words, long before the current crisis, Moody's was aware that its Baa CDO securities were 10 times as risky as its Baa corporate bonds.

Given the different and shifting meanings of Baa and other ratings as measures of risk and given the high rate of financial innovation and the lack of transparency inherent in multi-layered structured finance deals, it is not surprising that investors underestimated risks so badly leading up to the recent crisis.”

Ten times more risky? That is 1000% reduction in quality for the same grade. Can you say bought and paid for? Between the securitizer's of these obligations and their rating agencies cohorts it is nothing less than fiduciaries choosing to look the other way. Now many of these instruments sit on bank balance sheets as reserves, and in pension funds, institutions, insurance companies, etc. as they have relied on the fiduciary responsibilities of their counterparties. These are enormously powerful interests aligned against each other. The buyers and sellers of the products are not the little guy. The fireworks as they square off will be a spectacle to behold; when it is over we will know who really holds the power in these markets. The bad boys in the financial community in New York or the regulators who are their hand maidens, while giving lip service to protecting the public. As we can see from this Tedbits there are people holding investments who believe the quality of their holdings to be far greater then their actual worth. The process of repricing them will be the genesis of the stock market turmoil we anticipate.

Amen Corner

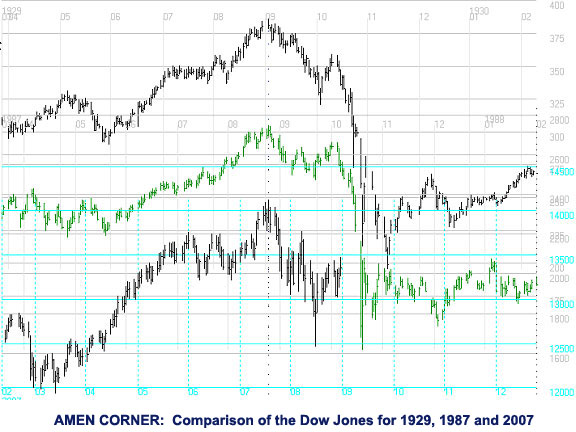

We are now entering what I call amen corner in the stock market. This is the window 40 to 60 calendar days after the stock market makes a high, in this case the tops scattered from July 19 th to the 23 rd depending on the stock index market you are viewing. In several years where the stock market has crashed, the crashes typically begin the second leg and most powerful down moves during this period. These are comparisons of the Dow Jones industrials in 1929, 1987, and 2007 in that order at the 40 day corners in those years. (**** important note, this is in no way a trading recommendation).

(THIS IS NOT A TRADING RECOMMENDATION. Any use by a reader is solely their own responsibility!!).

This is no suggestion that this is going to happen, just an interesting observation and fits the patterns seen in previous 40 to 60 day windows. This chart is courtesy of Georg e Slezak, to see his work and the analogs to different crashes and periods in history over the last century go to www.stockindextiming.com . It is fascinating work. The rallies we have seen in stocks and the carry trade are nearing Fibonacci retracements levels in both time and price. The bad news is directly in front of us. These are opportunities for the prepared investor.

In conclusion , this is a giant “finger of instability” unfolding at this moment. Fingers of Instability occur in periods when markets get way ahead of themselves based on the mountains of liquidity created over the many years of Alan Greenspan and now the rest of the world. They are opportunities for prepared investors and pitfalls for the unprepared. Usually they provide opportunities on the short side then opportunities on the long side in markets where the fundamentals have not changed. For instance, commodities are not going to suddenly become abundant after years of capacity constraints, Oil may sell off, but it is an opportunity to buy it on a pullback. If the fundamentals have changed the opportunities are still present but must be approached differently.

In areas where the excesses in real estate such as Florida , California and Nevada will take much longer to recover then compared to areas where there are no excesses such as many parts of the European Union and the emerging world. Those economies have real estate bull markets front and center, but lending requirements were not thrown out the window. There are also many opportunities in markets that are effected by the spillover, the Yen carry trade being one of them, it is convulsing as deleveraging and outright liquidation are doing the predictable, but you can rest assured it is not over as deflation in Japan is still a front burner issue.

You can look for these to bubbles appear and then collapse over and over again as fire hoses of hot money rotate into and out of surging and retreating markets as they are affected by them. Whether it is property in Hong Kong collapsing years ago or in the United States now the story is the same: “FIAT” money and credit creation. It's where central banks and financial officials pile yen on yen, dollars on dollars, British pounds on British pounds, Yuan on Yuan, rubles on rubles, etc. causing rolling bubbles and “Fingers of Instability”. Its here to stay so figure out how to benefit from it. Thank you for reading Tedbits.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

Ty Andros LIVE on web TV. Don't miss Ty interviewed live by Michael Yorba from Commodity Classics. Catch Ty's interview every Wednesday at www.MN1.com or www.CommodityClassics.com at 4pm Ce ntral Standard Time .

By Ty Andros

TraderView

Copyright © 2007 Ty Andros

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.