Attacking Eurozone Core, USD Index and Swiss Knife

Currencies / Forex Trading Jun 11, 2010 - 12:15 PM GMTBy: Ashraf_Laidi

The 1.2% decline in US April retail sales deals a rude awakening to the low-volume rally in equities as well as the recent bounce in the euro. Just when EURUSD was attempting to make its 4th daily increase (EUR hasnt had more than 3 straight daily gains since December), the risk aversion stands in the way. EURUSD would have had to close Friday above $1.21 in order to overcome its inability to post 4 consecutive daily gains this year.

The 1.2% decline in US April retail sales deals a rude awakening to the low-volume rally in equities as well as the recent bounce in the euro. Just when EURUSD was attempting to make its 4th daily increase (EUR hasnt had more than 3 straight daily gains since December), the risk aversion stands in the way. EURUSD would have had to close Friday above $1.21 in order to overcome its inability to post 4 consecutive daily gains this year.

Once again, this won't happen. And despite Fitch positive remarks on Hungary, stating that the central bank has sufficient funds to cover its financing needs into the rest of 2010, the euro continues to struggle below $1.21. But the impact of risk aversion on the single currency has extended losses towards a prelim target of $1.2040 (morning report to clients). Frequent readers of my analysis and followers on twitter are familiar with my $1.1650 target in EURUSD. Todays failure to regain $1.21 is another step into that objective.

EURUSD The only time when we saw the opposite of the above situation i.e. (rising euro, falling stocks and falling gold) was three weeks ago, when Chancellor Merkels ban on naked short selling, prompted the Swiss National Bank to intervene aggressively. As a result, EUR rallied across the board, dragging gold against it (and rest of currencies), while global equities sold off. We expect the single currency to head back below the $1.1870 later this month, before calling up our interim target of $1.1660. Selling the rallies remains the name of the game, only this time, the rebounds are short-lived and the reasons to attack core-nations more plentiful.

Attacking the Core

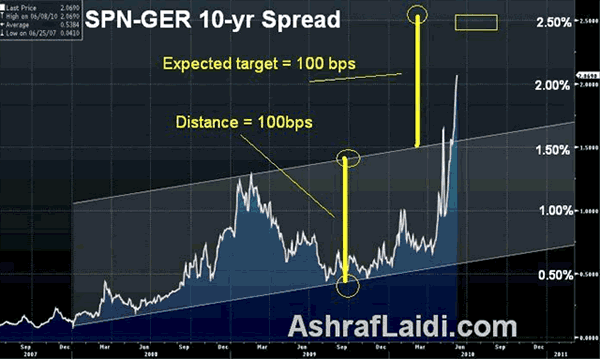

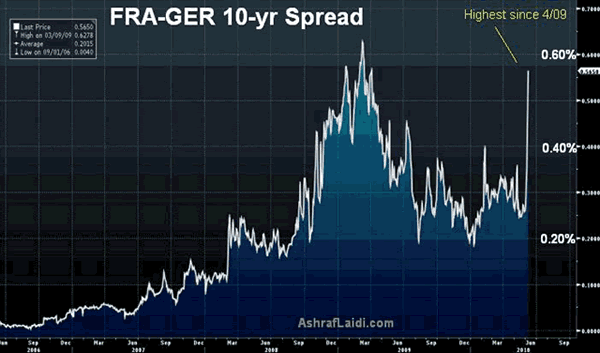

If we get more days like June 7-8, then the Eurozone area may be unfolding into a mini-contagion. Selling is intensifying in the bonds of core Eurozone nations as the yields on French and Italian government bonds soar relative to their German counterparts. French-German 10-year spreads have doubled to 57 bps in less than a week to reach their highest since March 2009, while the Italian-German 10-year spread hit a euro-life time high of 179 bps. Spains 10-year spread with Germany hit 214 bps and is expected to surpass the 250-bp mark.

One striking component of the attacks on core nations' bonds is that spreads in Greek and Portuguese bonds are less than half their May highs of 1000-bps and 350-bps respectively. Such are the embryonic signs of a contagion, which prompts traders to force the hand of healthier sovereign bonds.

Rumours of substantial derivatives losses at Societe Generale and of an Italian downgrade were unsubstantiated but are far from impossible. The more immediate danger is the reality that French banks account for half of the EUR 76bn in Greek debt lent by the Eurozone, with German banks accounting for about a quarter of that.

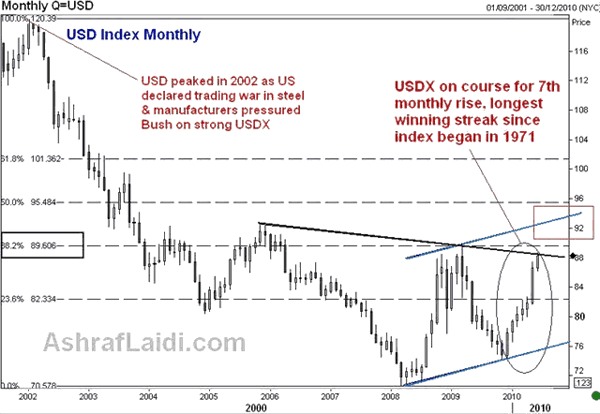

USD Index Eyes Record Gains

The US dollar index is set to post its 7th monthly consecutive increase, the longest winning streak since the history of the 39-year old index. The USDX is basket of 6 currencies (EUR 57%, JPY 14%, GBP 12%, CAD 9%, CHF 4% and SEK 4%). The chart below shows the USDX is testing the trend line resistance at 88.10, extending from Jan 2006 high. More importantly, right above it, is the 88.60-70 resistance, which is the 38% retracement of the decline from the February 2002 high to the March 2008 low. This level also coincides with the March 2009 high (stocks bottom). A double top in USDX would likely emerge by fresh dosage of Fed-driven liquidity boost and a resulting equity rally. A break above 90 would encounter preliminary resistance at 92, until the key obstacle of 95.50 stands out. Bear in mind that a break above 90 is a price equivalent to sub $1.1700-1.1650 in EURUSD.

Setting euro price action aside, non-USD currencies remain handicapped as long as the elusive 200-day MAs in S&P500 (1107) and Dow-30 (10309) are not breached. Both levels have acted as key obstacles since May 20, coinciding with fading gains EUR, AUD and other risk currencies. Speaking of AUDUSD, the pair remains unable to regain the 0.8550 resistance since May 19, which failed at 3 occasions (May 28, June 3 and June 11). Selling the rallies at 0.8540-50 in AUDUSD is equivalent to the double top in NZDUSD at 0.6890. I continue to expect a retest of 0.8410 trend line, before 0.8280 emerges as interim foundation.

Swiss franc Knife Still Sharp

Aside from the strikes in Spain protesting the barely passed austerity policies, increased evidence of the Swiss National Banks failure to follow through on its euro-supporting interventions is adding to the losses in the euro. EURCHF knifed through new record lows of $1.3740, 10% below the so-called line-in-the-sand from last May of last year. Recent Swiss data has shown decent figures, including a 2.2% annual increase in Q1 GDP growth. Consequently, markets anticipate a more passive SNB, which only exacerbates the sell-off in EURCHF.

But rather than chasing the pair below 1.35, it is more viable to use CHF longs against USD to hedge out the risk aversion longs in the US currency. This is also supported by the struggling weekly USDCHF chart, whose technicals increasingly suggest 1.1080 to be a reality before summer end. Reconciling a struggling USDCHF with a drifting EURUSD implies renewed downside for EURCHF. But dont rush into selling EURCHF below 1.40. The weekly chart appears oversold, which suggests another 200-300-point bounce before downside resumes.

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi is the Chief FX Analyst at CMC Markets NA. This publication is intended to be used for information purposes only and does not constitute investment advice. CMC Markets (US) LLC is registered as a Futures Commission Merchant with the Commodity Futures Trading Commission and is a member of the National Futures Association.

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.