How To Trade Stocks and Indices Cup With Handle Patterns

InvestorEducation / Learn to Trade Jun 14, 2010 - 11:28 AM GMTBy: David_Grandey

With regards to cup and handles, it helps to know what exactly the components of a cup and handle pattern are. Before you can have a completed cup, you have to have the left side of a cup (usually some sort of downtrend or pulling back chart action). Then comes the bottom of a cup (sideways consolidation, double bottoms, etc.). After that it’s what we call coming up the right side of the cup. The latter is the area we want to key in on today.

With regards to cup and handles, it helps to know what exactly the components of a cup and handle pattern are. Before you can have a completed cup, you have to have the left side of a cup (usually some sort of downtrend or pulling back chart action). Then comes the bottom of a cup (sideways consolidation, double bottoms, etc.). After that it’s what we call coming up the right side of the cup. The latter is the area we want to key in on today.

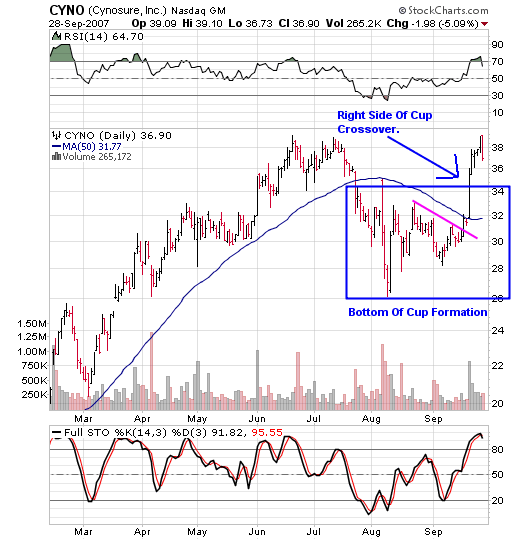

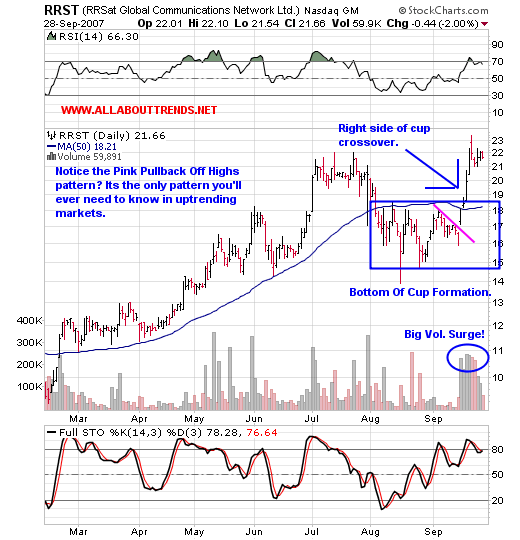

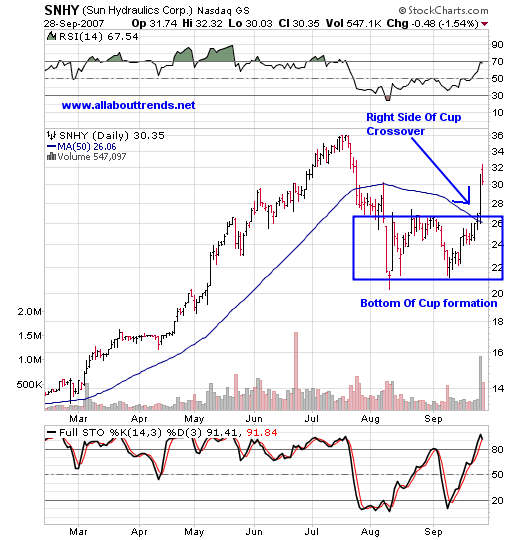

The best way to explain them is to look at a couple of examples of issues that have staged “Right Side Of Cup Crossovers”

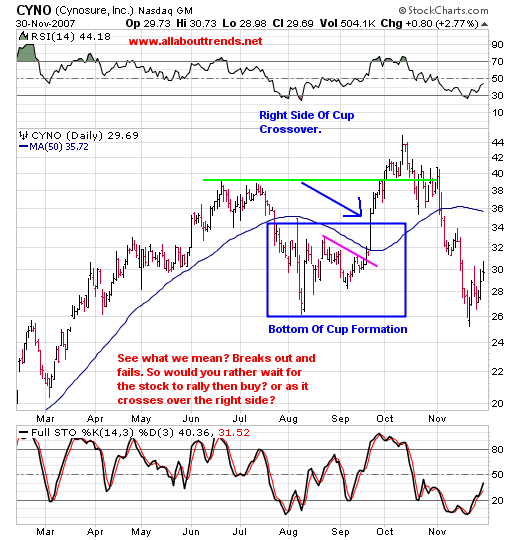

CYNO

Be on the lookout for these patterns in times where the “M” in CANSLIM is in your favor, they can be very powerful patterns for swing traders and investors alike when a move is first starting and from the looks of a lot of charts this weekend there is a good possibility that we are going to start working higher from here.

There is also a good possibility that should we get a full blown summer rally that a lot of names that are currently in the bottom of cups will trigger right side of cup crossovers and lanch higher.

But here is the catch, you want to work with this alternative entry pattern more than you do the traditional cup and handle break out. Why?

Two fold.

1. By the time traditional IBDer’s start to look at them as hey, here’s a cup and handle. We’ll already by up 15-30%

2. Because just about the time you see everyone talking about cup and handle breakouts AFTER we’ve ran for a month or two that’s about the time the market tops.

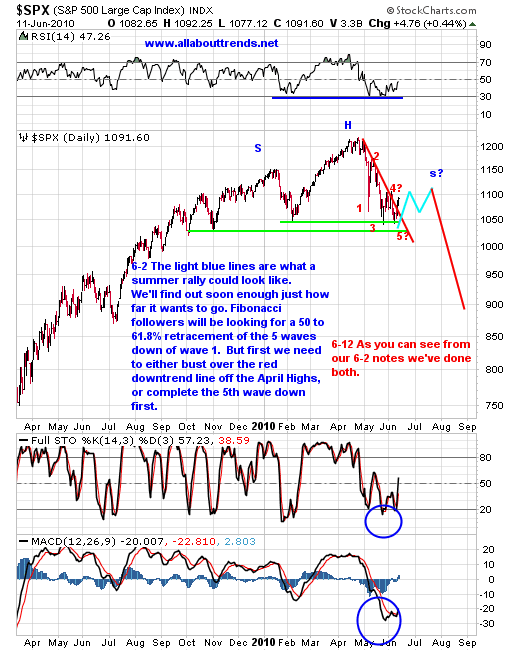

Remember we’ve still got a right shoulder on the S&P 500 that we’ve been talking about for weeks that needs to develop and don’t be suprised should that scenario transpire as shown below.

Sure we’ll see names on our watch list take off out of the bottom of cup pattern, retest highs and two things will happen, one is that they fail at major resistance and the other is they break out into new highs and top right there.

We’ve seen it before a lot in the past and given that we at some point are going to be entering the Wave 2, ABC up, summer rally and the Right Shoulder of a MASSIVE Head And Shoulders pattern building those that start working theyre way up the right side of a cup ought to stage the completed cup and handle patterns just about the time the rally is finishing its move.

This is how traditional canslimer’s get sucked in and buried. That’s then and this is now and let’s make hay while the sun shines.

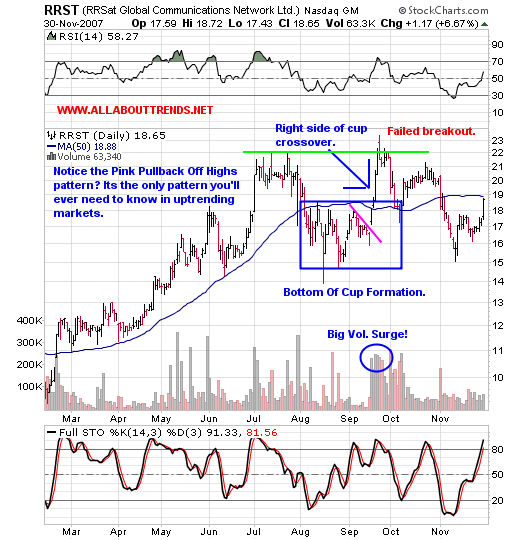

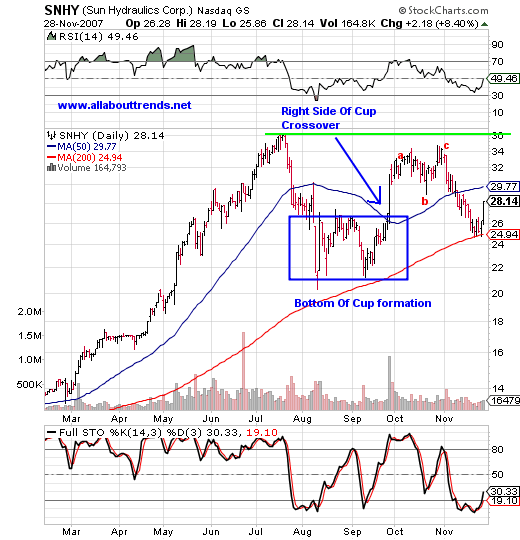

To give you a clue as to what that would look like let’s revisit a few of our examples above AFTER they put in traditional IBD cup and handle breakouts or even just breakouts.

CYNO

RRST

SNHY

Notice how each example AFTER it staged a right side of cup crossover made a run to retest their highs and all failed? It’s what we want to be on the lookout for when the summer rally ends and the right shoulder of the Head And Shoulders Top in the market completes itself.

You would do yourself well to realize that the cup and handle pattern is a great pattern BUT only when we are in a rip roaring bull market. Not now.

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.