Gold will go very high in fiat value, that is not the problem.

Gold investors (myself included) are trapped at the end game, and they do

not even realize it yet. No physical confiscation is needed to wipeout

the gold hoarders. It is much simpler than that. At the end game, the

gold investors will throw their gold into the streets willingly (or bury

in ground forever). The physical gold will be useless. You don't think

so? I will prove it.

The blackmarket (barter) market will die in the end game. I will prove

it. And gold sales are and will be increasingly taxed. Since gold only

keeps up with inflation (due its role as the regulator of real interest

rates, see this http://www.marketoracle.co.uk/Article20263.html ), then

any tax paid on gold is a loss of purchasing power for the gold investor,

irregardless of how much the price of gold has risen:

http://www.gold-eagle.com/editorials_08/amerman061110.html

http://www.marketoracle.co.uk/Article20208.html (see concluding paragraphs

& comments)

1) Sovereign nations are socializing the debt defaults, which is

parabolically accelerating the negative direction of already negative real

interest rates. Politically and mathematically this can not stop until

the fiat system has died (irregardless of any media circus about

austerity). Understand the connection of real interest rates to gold:

2) #1 mis-allocates (destroys) private capital and shortages result. An

oversupply of production (e.g. China), does not mean necessary production,

because mis-allocation due to too low interest rates (negative real rate)

mean capital is allocated to the wrong production (a lunacy

beggar-thy-neighbor race to grab world's export marketshare at negative

real profit margins, even if nominal profits are positive). Inflation

and/or rationing creeps upwards, until eventually sheeople wakeup and

stampede to buy gold+silver and drive the sovereign bonds (and fiat

currencies) to very low value relative to gold+silver, i.e. the price of

gold+silver go very high. This is a Sinclair currency event known as

hyper-inflation. Although not yet in the hyper-inflation (sheeople

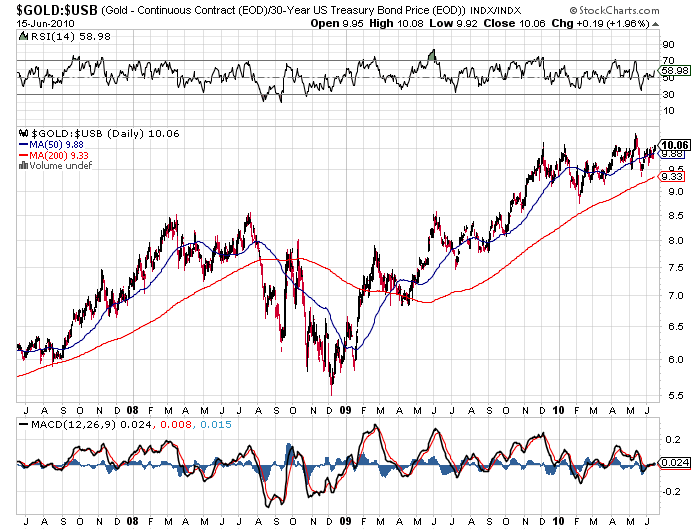

stampede) stage, this trend is already underway-- the ratio of gold to

sovereign bonds bottomed in 1998 and turned upwards since 2001:

3) #2 is a defacto high interest rate for the private sector, because even

though the govt is providing a low (negative real) interest rate to

itself, an increasing portion of the private sector can't avail of these

low rates and in some cases can't even get a loan (i.e. infinity interest

rate). Escalating credit card rates are another example. As we push to

hyper-inflation, defacto interest rates will go skyhigh (if not to

infinity, meaning credit not offered) for the private sector, because no

one wants to loan money during hyper-inflation (not even offer net 30

terms for wholesale), while the public sector can continue to print fiat

to buy its own debt at low interest rates, causing fiat to lose more value

relative gold+silver (gold+silver price to go up and up). The stampede

away from this fiat deathstar to gold+silver, is hyper-inflation.

Analysts are fooled by the low sovereign bonds rates, and they need to be

focusing on the reality that private sector interest rates are

skyrocketing.

4) #3 is armageddon, because the modern economy can not function without

debt. The hyper-inflation is a market driven mark-to-market gauntlet,

that will reveal that most of the private sector has a negative networth.

Since the hyper-inflation will inflate away the value of the debts, the

networth of the private sector will not be negative, but rather near 0.

However, money is not capital, and so much human potential, aka capital,

will have been destroyed (bad investments, wasted time, old age,

misdirected education, etc), that there will be negative capital balance

for the private sector. Hyper-inflation is a reset of the economy in

favor of the banksters:

5) However, there is a group of elite (the leaders of the banksters

wolfpack) who control the majority of the world's gold, and they are above

the law and do not pay taxes, because they print our money and they make

our laws. They were adding to their enormous historical gold hoard at the

bottom in price, when they ordered the Central Bank to sell and lease it.

I am not referring to the people we see on TV, but the untouchables such

as Rockefellers and Rothschilds, who are at the highest levels. Note I am

not making a specific allegation against any person or family, just using

those names since many people associate them with the inner elite circle.

Rothschild wrote, "he who owns the gold, makes the rules". I will add to

that, "he who owns the most gold, doesn't pay taxes, because he makes the

rules". Rothschild also purportedly wrote, "let me print a nation's

currency, and I care not who makes her laws".

Their plan is obvious, because you can safely assume they were not

allowing us to buy gold+silver without a plan to prevent us from competing

with them at the end game. When the world is wallowing in shortages and

starvation due to #4, the elite will bring out a new gold-backed currency.

Meaning this new currency will be redeemable for a fixed amount gold, and

it will be a digital currency, with each transaction tracked by strict tax

paper identification numbers. This new currency will be a great relief to

the armageddon, because it will enable the private sector to make loans

again. This is because the interest rate for a gold-backed currency must,

by free market definition, be real positive (after inflation, since gold

is the regulator of real interest rates as I explained previously).

In other words, only a circulating gold currency can arrest the

hyper-inflation and finally retire the debt. This will start to bring the

interest rates down from their very high (nearly infinity) levels, but it

won't instantly improve the networth of the private sector. Thus taxes

will be excrutiatingly high. Those of us holding gold+silver, will have

huge capital gains from the former hyper-inflation, and we will have no

way to avoid paying those taxes in order to get some of this new currency,

because the new currency will require proof of the price paid for the gold

(otherwise full value will be accessed as is the law for capital gains).

This new currency will effortlessly destroy the black (barter) market.

Let me explain why. The new currency bonds will be offering very high

real, after tax interest rates, and these gains (say 20+% per year, if not

much much higher) will be accrued in redeemable to gold! So it will be

preferable to hold the currency bonds, than to hold physical gold. So who

would have an incentive to use the blackmarket in physical gold? The

buyers (private sector-at-large) will have 0 networth, so they can only

pay in the new currency which they have borrowed, so they can not

participate in the black market. We gold+silver investors will want to

trade for something we need, and that will be difficult because the

sellers of products will want the new currency, because everyone will want

to buy the very high yielding new currency bonds, and because without

reportable sales, a business won't be able to get a loan to expand and

grow. Gold+silver holders will be trapped, either they will pay the tax

to convert to new currency, or sit on their gold forever (until the new

world order fails and elite lose all their power and gold).

There are numerous nuances and possible misunderstandings of this thesis,

which I have already debated. You can read that debate (even continue it

with me if you want) at the following links, which should make it much

more clear:

The thread at the links above contains a discussion about investments

other than gold+silver that will excel in high inflation. Realize that it

will be important to obtain these before everybody else realize. To sell

gold+silver into the hyper-inflation solves nothing if you receive fiat in

return. No matter how you slice it, the elite will end up extracting the

taxes. Some hope they will escape taxation by nationality, but the new

world currency system coming will unify taxation. The UBS incident and

the G20 movements towards closing bank secrecy and tax shelters is just

the beginning. Perhaps you may want to read my comments at bottom of the

following article:

I am not arguing that we should not retain some physical gold+silver for

small time bartering and for insurance against other possible outcomes and

if necessary to physically escape some war of fascist environment. I am

arguing that we should not have our entire networth in physical metals and

those hoarding metals hoping to become super-rich are in the words of a

Treasury official, "going to have their arms burned up to their armpits".

I am not giving tax advice, nor am I advocating breaking the law, consult

your own professional advisor for tax and legal advice.

short bio, I have published articles on FinancialSense.com, Gold-Eagle.com, SilverStockReport.com, LewRockwell.com. I am the sole or

contributing programmer of numerous (some million+ user) commercial software applications, such as Corel Painter, Cool Page, WordUp,

Art-O-Matic, etc.. I have an education in engineering and math.

Disclaimer: My writings are my personal opinions, not to be construed as statements-of-fact. Do you own research. Licenses to think and communicate have never interested me too much, so I am not a licensed research, journalism, investment, legal, nor health professional. Please consult the proper authorities for all matters covered in my writings. I disclaim all liability for what you do after reading my writings. No one can predict the future, and if there is a physical world investment that never loses value, I haven't found it yet in my 44.1 years here on Niribu.

Shelby Moore (author of this article)

15 Jul 10, 22:46

|

End is inflation, and then return to gold standard

CaseyResearch seems to agree with my assertion that we will go back to a gold backed money system (and thus at very high interest rates). http://www.caseyresearch.com/displayCwc.php

|

Shelby Moore (author of this article)

16 Jul 10, 19:30

|

Gold dealers required to report by 2012

The warning that I made in this article is now coming true: http://www.dailypfennig.com/currentIssue.aspx?date=7/16/2010 "the Health Care Bill, there's a report at numismaster.com that says... starting on January 1st in 2012, U.S. federal law will require coin and bullion dealers to report to the Internal Revenue Service all gold and silver coin purchases and sales greater than $600. Apparently this little jewel was an add-on to the national health care legislation..." I had also warned about this in 2008: http://goldwetrust.up-with.com/precious-metals-f6/how-will-we-physically-trade-gold-silver-at-5000-500-t61.htm#558 Thank you.

|

Shelby Moore (author of this article)

18 Jul 10, 03:37

|

End Game calculations

http://goldwetrust.up-with.com/precious-metals-f6/how-will-we-physically-trade-gold-silver-at-5000-500-t61-135.htm#3325 The above link contains my calculations that show silver is the best defense against the threat outlined in this article.

|

Shelby Moore

28 Jul 10, 12:00

|

61.5% silver tax

They confiscated and taxed silver at 61.5% in 1934: http://www.presidency.ucsb.edu/ws/index.php?pid=14741 Why wouldn't they do it again?

|

Shelby Moore

29 Jul 10, 18:00

|

UK 40 - 50% capital gains tax

http://news.bbc.co.uk/2/hi/uk_news/politics/8713377.stm "Capital gains tax is now 18%, but the government says it wants to raise it to a rate similar to income tax rates. That could mean tax rates for non-business assets such as the profits from second home sales more than double to 40% or 50%." =========== Note the Sprott PHYS gold trust is only capital gains taxed at 15% in USA, instead of 28% for the GLD: http://www.sprottphysicalgoldtrust.com/Investors/Tax-Information/default.aspx =========== Also regarding the prior comment on 61.5% tax on silver, vague memory is that they might not have enforced that executive order. They will having enough trouble with many people ignoring or avoiding the gold confiscation order.

|

Nadeem_Walayat

29 Jul 10, 19:12

|

Capital gains tax

That news is so old In the June 22nd budget the tax was raised to 28%. But everyone has an annual allowance of £10k, plus no CGT for ISA wrapper holdings. So if you hold your gold as GLD in an ISA you pay ZERO tax.

|

Shelby Moore

29 Jul 10, 21:19

|

Step-by-step

18% to 28% is a 56% tax hike. 40% wuld only be another 43% tax hike as fiscal abyss opens wide. But max ISA is £7k per year (coming £10k), so £100K invested in GLD with a doubling of gold price, would be 0.28 x £90k = £2or 25% net tax. Apparently UK ISA has advantage over UK IRA that withdrawals are not taxed. But at £10k, it won't help much if we go into very high inflation (unless they continue to increase it sufficiently). And it doesn't help people with average or higher net worth.

|

Shelby Moore

30 Jul 10, 17:14

|

ISA allows that?

Nadeem, indeed if ISA allows backdating the way you describe, then many of us middle class should be try to get UK citizenship! I think the ISA allowance only applied to when you purchased the investment. You are saying that if I invested 100k, then I can in future years of annual allowances backdate the ISA to year I made the original investment? Are you sure? That sounds like a very huge difference from the way an IRA works in USA. But I suspect that the future allowances apply to the current value, not to the backdated value at time of original purchase? So in that case, the numbers would look much closer to my calculation, especially with extreme levels of inflation likely ahead. I am very interested to read your next reply, because I if I am not correct on my last point, then indeed I want to start telling everyone to try to get UK citizenship. I think I may be eligible for ancestry claim. Does Ireland have the same ISA?

|

Shelby Moore

30 Jul 10, 17:36

|

ISA details

http://www.hmrc.gov.uk/isa/ http://www.hmrc.gov.uk/leaflets/isa-factsheet.pdf "You can only put money into an ISA if you are resident and ordinarily resident in the UK for tax purposes." What is the performance of the "Retail Prices Index" relative to gold since 2001? That is a critical question, because it appears that there is no backdating in an ISA as you implied. Instead, you would essentially be reclassifying a prior investment into an ISA at its _CURRENT_ (not backdated) value. If the "Retail Prices Index" is underperforming gold, then the calculations will look more similar to the dire one I provided in my prior comments. Also only 3k annually can go into "cash ISA", and you can't put physical gold and silver into stocks and shares ISA. Perhaps you can put into PHYS (surely you can put the GLD and SLV which are alleged to not have metal in them), but I am not convinced that any of these metal ETFs will perform the same as the metal does, when the important juncture comes that the whole fiat system goes into cardiac arrest. The PHYS could in theory be confiscated easily by the government as it is held by the Canadian Royal Mint. Also there is no guarantee that you won't be prevented from putting certain types of investments in an ISA in the future, or that the ISA may not be revoked, so counting future years' allowances is not certain, given the UK will go into fiscal cardiac arrest along with the USA and others.

|

Shelby Moore

30 Jul 10, 17:55

|

RPI is a lie

RPI calculator: http://www.measuringworth.com/ukcompare/ Says that £1 invested in 2001 is worth £1.23 as of 2009, a +23% rise. But in that same time frame, gold is up +300%. So your theory about using future years ISA allowances does not work mathematically. I was essentially correct with my prior calculation. And taxes will continue to rise as well. ISA is not a tax haven that can help anyone.

|

Nadeem_Walayat

31 Jul 10, 17:22

|

ISA

Bugger, deleted my earlier comment by accident. £100k invested in GLD can result in zero tax not 28% as you suggest. £10k per year in cash isa's per person So in 12months thats £40k for own and partners allowance. 2. Annual £10k CGT alllowance per person so bed and breakfast uses any gains made, again £40k in 12 months, That leaves £20k taxable that can be offsett against other losses.

|

Nadeem_Walayat

31 Jul 10, 17:29

|

ISA allowances & CGT Profits

Hi Shelby I am not understanding the backdating question ? ISA allowance is £10k per tax year per person. in addition to this you have £10k per annum CGT allowance, ( effectively £20k ina year). You can profit upto £10k per tax year without paying tax on top of ALL profits in ISA's being tax free. I am trying to interpret the backdating. If you have £100k invested in Gold in year 1 - £20k in ISA (i.e. tax year is April to April) and £80k outside. Say that has increased by 100% to a value of £200k So you have £40 in ISA, and £160k outside. To avoid paying tax, SELL £20k of gold and buy it back at the end of or start of each tax year i.e. bed and breakfasting. This resets the purchase date of THAT £20k gold to the new price and no tax is payable since you have a £10k CGT profit allowance. Split holdings between couples and you can double the annual CGT profits before tax. As an example on 5th April sell £20k Gold - Profit £10k - NO TAX. on 6th April Sell £20k Gold - Profit £10k - NO TAX. On 7th May BUY £40k Gold at CURRENT MARKET PRICE - Which is the starting price for this gold for tax purposes. Or on 6th April your SPOUSE buys £40k of Gold, Sells it on 7th May and you buy it on 7th May. Still better to maximise spouse annual CGT allowance PLUS the ISA allowances.

|

Shelby Moore

02 Aug 10, 16:25

|

Correct tax calculations

To minimize taxes in UK, don't sell the ISA covered asset prematurely, but instead let it compound in value. The CGT does not apply at the start of the tax year, but rather after sold for a gain. To minimize taxes, sell non-ISA assets with a gain equal to your CGT allowance. Thus the corrected calculation is: start: £10k basis in ISA, £0k CGT exempt gain, £90k outside with £90k basis = £0k unrealized gain, £100k total assets (£10k in ISA) 1st year: £20k basis in ISA, £10k CGT exempt gain, £170k outside with £100k basis = £70k unrealized gain, £200k total assets (£30k in ISA) 2nd year: £31k basis in ISA, £11k CGT exempt gain, £329k outside with £122k basis = £207k unrealized gain, £400k total assets (£71k in ISA) 3rd year: £43k basis in ISA, £12k CGT exempt gain, £646k outside with £146k basis = £500k unrealized gain, £800k total assets (£154k in ISA) 4th year: £56k basis in ISA, £13k CGT exempt gain, £1279k outside with £172k basis = £1107k unrealized gain, £1600k total assets (£321k in ISA) 5th year: £71k basis in ISA, £15k CGT exempt gain, £2558k outside with £202k basis = £2356k unrealized gain, £3200k total assets (£657k in ISA) You can see above that given that RPI is a lie that radically under-performs (+23% vs. +300% past decade) the appreciation of gold, and that ISA and CGT exemptions are indexed to RPI from 2011 forward, then it is impossible for the exemptions to pace with the appreciating value of your gold and thus a greater and greater percentage of your gold will be taxable. My calculations example above, assume gold would double every year (fiscal cardiac arrest coming globally next year), assume RPI increases to 10% per year, then with an initial £100k invested, and assuming one will maximize the use of the exemptions by selling each year and re-purchasing, then the mathematical series is what I wrote above. P.S. I re-iterate that apparently for physical metal, the exemption is £3k per year, not £10k. So the calculation would be much more unfavorable.

|

Nadeem_Walayat

02 Aug 10, 17:15

|

Gold

Gold double every year, in that case I would be happy to pay 28% on sale :) Will come back to analyst your figures when I have time Best,

|

Shelby Moore

02 Aug 10, 18:44

|

Tax hit varies with inflation

I had a negligible mistake in my prior calculations with basis. Corrected as follows: start: £10k basis in ISA, £0k CGT exempt gain, £90k outside with £90k basis = £0k unrealized gain, £100k total assets (£10k in ISA) 1st year: £20k basis in ISA, £10k CGT exempt gain, £170k outside with £100k basis = £70k unrealized gain, £200k total assets (£30k in ISA) 2nd year: £31k basis in ISA, £11k CGT exempt gain, £329k outside with £122k basis = £207k unrealized gain, £400k total assets (£71k in ISA) 3rd year: £43k basis in ISA, £12k CGT exempt gain, £646k outside with £144k basis = £502k unrealized gain, £800k total assets (£154k in ISA) 4th year: £56k basis in ISA, £13k CGT exempt gain, £1279k outside with £157k basis = £1122k unrealized gain, £1600k total assets (£321k in ISA) 5th year: £71k basis in ISA, £15k CGT exempt gain, £2558k outside with £173k basis = £2385k unrealized gain, £3200k total assets (£657k in ISA) You won't be happy to pay 28% on your huge appreciation in gold, if the true inflation rate was doubling every year, because it means you will have lost 28% of your purchasing power. Worse yet, I expect taxes to rise well past 50% as they apparently were in the last Great Depression (at least in USA). At the 5th year in my prior calculation, only 75% of the assets were still taxable, so overall rate would have been 0.75 x 28% = 21%. But again, I expect tax rates to go much higher, and even a 21% loss of wealth by investing in gold is not desirable. Normally gold paces with the true inflation rate. Gold has been outpacing the true inflation rate probably because it is anticipating much higher inflation in future, so true inflation may catch up to the appreciation of gold (as the we go into fiat system cardiac arrest). Let's redo the calculations to use the past 20% annual increase in gold price. Let's assume RPI is about 3% and true inflation is about 6% but will accelerate and outpace the gold appreciation (as interest rates rise near the end of this secular cycle). start: £10k basis in ISA, £0k CGT exempt gain, £90k outside with £90k basis = £0k unrealized gain, £100k total assets (£10k in ISA) 1st year: £20k basis in ISA, £10k CGT exempt gain, £98k outside with £100k basis = £0k unrealized gain, £120k total assets (£22k in ISA) 2nd year: £30k basis in ISA, £10k CGT exempt gain, £109.6k outside with £110k basis = £0k unrealized gain, £144k total assets (£34.4k in ISA) 3rd year: £40k basis in ISA, £10k CGT exempt gain, £121.5k outside with £120k basis = £1.5k unrealized gain, £172.8k total assets (£51.3k in ISA) 4th year: £50k basis in ISA, £10k CGT exempt gain, £135.8k outside with £130k basis = £5.8k unrealized gain, £207.4k total assets (£71.6k in ISA) 5th year: £60k basis in ISA, £10k CGT exempt gain, £152.9k outside with £140k basis = £12.9k unrealized gain, £248.9k total assets (£96k in ISA) So in that case the tax rate would 0.28 x £12.9k / £248.9k = 1.5% So the UK tax situation looks much better in the above scenario. So we can conclude that UK tax scenario is okay as long inflation does not rise very high, and/or the appreciation of gold outpaces the true inflation rate by more than the net tax. I am confident that society will succeed in destroying the gold investors with taxes. The scenario for very high inflation rates and very high taxes, in a global fiscal meltup, is very likely, virtually a certainty.

|

Shelby Moore

02 Aug 10, 18:50

|

Gold paces with REAL interest

I misstated in prior comment that Gold paces with true inflation. Since the nominal interest rates can not fall below 0%, then as QE goes bezerk next year, then gold appreciation will be more closely approaching true inflation rate. This is why any tax on gold will be a tax on our purchasing power. The nominal gains in gold will actually be just keeping up with true inflation.

|

Nadeem_Walayat

02 Aug 10, 22:17

|

Inflation CGT ISA

Hi Shelby I agree 100% in that inflation is a means of stealing wealth, as occurs every day to UK savers that have to PAY 20% standard rate (40% upper) tax on INTEREST that is LESS than HALVE the inflation rate (RPI). Which EQUALS THEFT from Savers. Okay we differ in what is inflation, for me the gold price rising is NOT inflation. The closest we have to a true, recognisable inflation measure in the UK is RPI which is at 5% (I would put real average inflation at about 6%). BUT, everyones inflation rate is different depending on their income and what they tend to purchase, so it can range from 5% to 10% at this time. Again Gold doubling does not equate to inflation doubling, as Gold over the last 10 years has gone up four fold, BUT no matter how much one disregards official statistics, there is NO WAY one can state that real UK Inflation has similarly gone up four fold against the actual RPI index which has gone up by about 30%. Average food baskets are NOT Four times what they were 10 years ago etc.. So as per your example, yes I would be happy to pay an average 21% tax and bank a HUGE profit in REAL terms on Gold if £100k rises to £2.5 million in 5 years ! And as you conclude the UK tax picture is not so bad if inflation does not go hyper. Also don't forget that you use spouses allowances therefore double the annual CGT and ISA allowances and when the kiddies grow up theres their allowances too ! So one can still engineer an outcome that results in zero tax.

|

Phillip Reynolds

03 Aug 10, 04:24

|

Gold

If one were to invest in British gold and silver coins which are exempt from VAT and CGT(Britannias and Sovereigns) then one would have circumvented the problems outlined in this article. Just a thought :^)

|

Michael Parker

03 Aug 10, 09:23

|

Gold taxes

If taxes on Gold become punitive then most of the worlds Gold will stay in hiding & then we will truly enter a dark depression. Surely even the authorities know that at some point they will have to re-monetise Gold & the only way they can do this effectively will be with zero or next to zero taxation.

|

Shelby Moore

03 Aug 10, 13:14

|

Gold vs. Inflation

Thanks for thought provoking comments from Nadeem and others. Nadeem I don't think the gain on gold is exceeding the loss of purchasing power parity if you measure it by the relative gains China is making in PPP, and I don't think the current measures of price inflation are in any way predictive of what is coming. There is an order-of-magnitude (10x) re-balancing of the global wages coming, and it will strike suddenly as a hyper-inflation or currency revaluation. Gibson's paradox is the theory that gold rises to offset the rate of negative REAL interest rates, because gold pays no interest. So if actual inflation is 10% and 1 year Treasury bond is paying 2%, then gold would in theory rise 8% that year. But the relationship of gold to real interest rates (interest rates and inflation) is more complex, because gold is also predicting future REAL interest rates. However gold can also be wrong, as it did in 1980, if the govt is able to raise REAL interest rates. Also gold is global, so gold at +17% per annum is I think telling us that the investment opportunity cost in Asia is about 15% higher than the interest rates being paid on bonds in the west. Gold may be saying that to hold a western bond, we are losing about 15% in opportunity cost (net of risk adjusted), as compared to if we had deployed out investments in Asia. Moreover, what I think gold is really predicting is that unlike the 1980s, the western nations will implode when interest rates rise to exceed inflation. Under positive REAL interest rates, there will be an implosion of employment and tax revenues, which (according to BIS data, see the CFR presentation I linked recently) will cause the interest payments on the treasury debt to exceed 100% of tax revenue. That is insolvency. The only way out of that is hyper-inflation or severe depression (usually a combination of both). Current projections do not show that risk (until decades out), because they are based on low nominal (negative REAL) interest rates and a bottoming in unemployment. Those projections are unrealistic. Negative REAL interest rates can not persist, they are making the problem worse. And most of the jobs in the west are not needed, as all real production has already been outsourced and accelerating as companies tighten their belts. It is purely a matter of survival, no company is going to be able to pay 10 times higher wages for the same work. The only thing holding up western civilization right now are the suppression of the gold and silver prices and the lies about the true dire situation. Once these realities become clear to the masses, there will be a massive stampede as people try to save themselves from starvation. The govt will be powerless. This was all planned. This is the way we get to a new world order. The plan was to destroy the nations with their lust for debt. We are already there, we are just in the final years of maximizing the insolvency. Agreed that punitive taxes on gold will force metal into hiding and cause a dark depression. This depression is necessary to bring the world to its knees and accept the lost of national sovereignty in favor of a new global system. But eventually the world will have no choice but to accept this new global system in order to get food back into their mouths, because once the stampede starts the shelves will be emptied. And without credit system, big farms don't produce. Westerners do not grow food locally any more. The new global system will pay very high interest rates (initially) and thus suck the metal out of hiding (or deprive the owners of that metal of compounding, sending them to great losses as 1980s did to gold holders). Why would the banksters do it any other way? Isn't it obvious they are going for it all now at this juncture? Is the fiat capital gain on British gold coins tax free in UK? Cite a reference please.

|

Shelby Moore

03 Aug 10, 13:33

|

Supporting data

http://www.marketoracle.co.uk/Article21225.html#comment93055 See the comments at link above, for data supporting my assertions in my prior comment on this page. In particular, see the alternative chaotic spiral scenario chart from the CBO (USA Congressional Budget Office)

|

Nadeem_Walayat

03 Aug 10, 20:54

|

gold coins

Yeh UK soveriegn and britania gold coins are CGT tax free as they are treated as legal tender. You can buy and sell them on ebay, though obviously they carry a premium against the gold price and very wide spreads. i.e. Royal mint is selling The 2010 UK Gold Bullion Sovereign for £245+£3pp. The gold bullion content is worth £192. Get much beatter deal elsewhere but still spreads are wide. Only really worth buying in bulk if you are super wealthy or seriously expect hyper inflation.

|

Shelby Moore

04 Aug 10, 16:25

|

UK tender is not CGT exempt

The law: http://www.hmrc.gov.uk/manuals/cg1manual/cg12602.htm http://www.opsi.gov.uk/acts/acts2006/ukpga_20060025_en_39 http://reviews.ebay.com/CGT-Capital-Gains-Tax-Exemption-on-Gold-Sovereigns_W0QQugidZ10000000001593758 "For section 21(1)(b) (definition of “asset”) substitute— “(b) currency, with the exception (subject to express provision to the contrary) of sterling,”" You all are mis-interpreting that law. What it says is that gains in the value of the sterling legal tender (i.e. deflation), are not taxable. What is means is that the sterling is the reference point of measuring gains. It does not say that gains, in the intrinsic or numismatic value of an instrument of currency, are exempt. In fact, it says currency other than the legal tender component, are taxable assets. If you had a very rare legal tender note (such as mint error), then the numismatic gain on that asset would be CGT taxable. This is the same for American Eagles. People have tried to pay wages, and use the legal tender value to avoid paying income tax on the intrinsic value, and this has been struck down by the courts. Actually one guy won a case in Nevada, but he was destroyed by the feds using other trumped up charges. There is no way the banksters will let you escape tax free. That right is reserved for them. Expatriation won't work long-term either. They are coming after the millionaires and middle class on the melt up cycle. Without their power of taxation, they can not achieve their new world order.

|

Nadeem_Walayat

04 Aug 10, 19:58

|

Gold coins Tax Free

Shelby your wrong. SPECIFICALLY - UK sovieeigns and Britainias bought as investments ARE TAX FREE. - CGT and INCOME. Your example is something else - I.e. not investment but income.

|

Shelby Moore

04 Aug 10, 21:34

|

Cite a reference please

Please cite an official reference. I have quoted the UK law verbatim, the law does not say that the gain in the intrinsic or numismatic value is tax free. It only says that the legal tender portion of the value is tax free. I was aware that the example I provided was for income and was in the USA. I am using that to show you that the theories that people had about legal tender tax free status ended up being false. Although one guy did win in a smaller court, the feds made sure that he was made an example. The banksters are happy for people to have their fantasies about tax avoidance and overpay for legal tender gold and silver coins, and they don't need to let you know you are wrong until after the hyper-inflation. Please cite an official reference, such as a court case or other proof. It seems you are basing your statement on your personal (and others gold bugs' and coin dealers') interpretation of the law. Prove to me that you have the official interpretation. It is very important matter. I have searched for more official confirmation of your interpretation and I can not find any. I do not mean to alarm you or others unnecessarily, that is why I am asking for official proof.

|

Nadeem_Walayat

04 Aug 10, 21:54

|

CG78308

CG78308 - Foreign currency: coins: legal tender Sovereigns minted in 1837 and later years and Britannia gold coins are currency but, like all sterling currency, are exempt because of TCGA92/S21 (1)(b). http://www.hmrc.gov.uk/manuals/CG4manual/CG78308.htm

|

Shelby Moore

04 Aug 10, 22:31

|

CG12602

I know that, but you are mis-interpreting the context: http://www.hmrc.gov.uk/manuals/cg1manual/cg12602.htm "TCGA92/S21 (1)(b) Currency in sterling is not an asset for capital gains purposes. It is the unit by reference to which capital gains are measured." What the law is saying is that when you exchange sterling for sterling (i.e. make change into smaller denominations or same same denomination but different form such a paper note), then there is no taxable transaction, because the sterling is the unit of measurement. But the law is not saying that the commodity or numismatic portion of the value of the asset being exchanged is tax-free: http://www.hmrc.gov.uk/manuals/CG4manual/CG78310.htm When you sell sterling gold or silver coin, you will not be taxed on the legal tender portion of the value, but you will be subject to tax on the barter exchange portion of the value of the currency instrument. The banksters have used a very tricky language to trap you. Pay attention. Unless you have a court case to prove me wrong?

|

Shelby Moore

05 Aug 10, 00:12

|

"like all sterling"

"but, like all sterling currency," They are only exempt "like all sterling currency". It says nothing about the exemption of the way they are NOT "like all sterling currency". If you take that statement of out-of-context of the entire law, you might be tempted to assume that the entire coin is exempt. But it does not say that. Remember legalese is very precise. The legalese above is only referring to the portion of the coin that is "like all sterling currency", which means the legal tender value stamped on the coin. Whereas if you widen the context, then you clearly see the law does not exempt the gold value in the coin, only the sterling currency value: http://www.hmrc.gov.uk/manuals/cg1manual/cg12602.htm "TCGA92/S21 (1)(b) Currency in sterling is not an asset for capital gains purposes. It is the unit by reference to which capital gains are measured." http://www.hmrc.gov.uk/manuals/CG4manual/CG78310.htm "CG78310 - Foreign currency: assets acquired or sold for currency A transaction in which an asset is disposed of for some consideration which is not sterling cash, but which takes the form of some other asset, is a barter transaction." When you sell a sterling gold coin for sterling, the sterling currency exchange is exempt per CG78308 , but the gain on the gold value falls under CG78310. They key word is "currency". Legally it does not mean the whole physical coin, but it means the legal tender (the markings on the coin or the paper note). I suggest you take my comments to a competent tax attorney and get the correct answer. I am not a tax attorney and I am not giving legal tax advice (merely sharing my opinion). I am confident the tax attorney will advise you that although common practice up to now may have been to ignore this, that the law is not giving you the protection of tax exemption for the gold value in the coin, only for the "sterling" value of the "currency".

|

Nadeem_Walayat

05 Aug 10, 05:12

|

EXEMPT

Shelby Your over complicating it and missing the point in that the Inland Revenue says the magic word EXEMPT. EXEMPT MEANS EXEMPT - Which is why you will not find a single case of ALL THESE PEOPLE who hold soviereigns and britannias as investments being taken to court and forced to pay tax on sales because there are NO CASES, because it is clear they are EXEMPT FROM TAX ! Eveything else is dancing around this fact. EXEMPT MEANS EXEMPT. The only way they would become taxable is if the government passes a law to DEMONETIZE them i.e. as all coins pre 1837 are. And I am no gold bug advocating mountains of gold coins because they are not the best investment to escape tax. I would have to say the best investment long term has to be your house, because you get to enjoy it and ALL gains are TAX FREE!

|

Shelby Moore

05 Aug 10, 11:57

|

Final rebuttal not exempt

This will be my final comment on this matter of whether sterling gold coins are tax exempt for anything more than their sterling value. It is important that we understand that the legal tender value of something is ONLY the markings on that thing, or prove otherwise. I have seen case law which says the legal tender value does not include the other value that may be present in thing that the legal tender value is marked on. Do you need me to go research the case law to prove this to you? My father with same name as me, was Division Attorney for Exxon (and later for the major oil company consortium T.H.U.M.S. which included BP),with his specialization being in contract law and legalese. And I can show you that the law is very specific about this. Inland Revenue (HMRC) says: "Sovereigns minted in 1837 and later years and Britannia gold coins are currency but, like all sterling currency, are exempt because of TCGA92/S21 (1)(b)." It does not say that such gold coins are ONLY sterling currency and nothing else. The HMRC quote above only says they are exempt to the extent they are like all sterling currency. It does not say they are exempt in the way they are not like sterling currency. If the law intended to say that, then it would say it. If the law does not say it, then the law can be interpreted any way that HMRC can argue in court is reasonable and justified within the greater context of the INTENT of the law. And the word INTENT is very important in a legal sense, because remember the intent of tax law is to make sure people pay the taxes. Please ask a contract law and/or tax law attorney. I am confident the attorney will tell you that there will be no ex-post facto protection should HMRC issue a clarification in future to explain that the law never provided any explicit tax shelter for the gold commodity value in coins that are also marked as sterling currency. UK HMRC Revenue has done this before: http://en.wikipedia.org/wiki/Ex_post_facto_law#United_Kingdom http://news.bbc.co.uk/2/hi/business/8496921.stm "The Revenue has just won a landmark court case which allowed the backdating of tax law. New legislation normally applies to the future, not the past. But the case of Robert Huitson may change all that. In 2001 Mr Huitson began using an artificial scheme to reduce his taxes. He thought the scheme was legal, and so did his advisers. HM Revenue and Customs (HMRC) did not agree." I also quoted for you the law TCGA92/S21 (1)(b): "For section 21(1)(b) (definition of “asset”) substitute— “(b) currency, with the exception (subject to express provision to the contrary) of sterling,”" The above says that all currency, with the exception of the sterling legal tender, is subject to the tax. It also says something very important, "subject to express provision to the contrary". That is why quoted for the expression provision to the contrary in the law: "CG78310 - assets acquired or sold for currency A transaction in which an asset is disposed of for some consideration which is not sterling cash, but which takes the form of some other asset, is a barter transaction." So it is crystal clear that only the sterling legal tender is tax exempt. And the gold commodity asset value of the coin is not covered explicitly by that exemption and is in fact covered by an expression provision to the contrary in CG78310. All HMRC has to do is clarify that in future. And I expect they would not bother to do that until after the hyper-inflation, when they can nab the most tax evaders and the most revenue. Why? Because for the very simple reason that there is very small value involved now while gold is cheap, and you won't be worried about your sterling gold coin sales being recorded, because you will think you owe no tax. So then when HMRC goes after you, they will know who you are and the gold value by that time will be worth their effort. Or in short, a trap has been laid. If there is no case law on this in UK specific to gold coins (I know for a fact there is in USA, and I also think there is in UK with respect to other forms of sterling, such as numismatic paper notes), it is because HMRC has not yet enforced it. It is quite clear to me that HMRC is laying a trap to catch tax evaders after the hyper-inflation. Of course they would not enforce it now, because then they wouldn't be able to catch their prey. They have to wait for the right time when the traps are all full with meat. You have your interpretation and I have mine. I intend no animosity. I advise each reader to not rely on you or me, because we are not registered tax advisers. And I advise readers to not rely on their own non-expert reading of the law. I advise readers to consult with a registered legal expert. I think that is the most responsible advice. You have the final comment. Thanks for letting my express my views. Thank you for your exhaustive effort to provide this website. P.S. The orthogonal Biblical truth on this matter is Jesus said "render unto Caesar what is his, render unto God what is his". And Bible says, "All gold and silver is owned by God". I include this to help some to ignore my warning and mis-label me as religious nut.

|

Shelby Moore

05 Aug 10, 22:41

|

Hyperinflation evidence

Refer to our prior discussion "Gold vs. Inflation" in comments above. And also to the discussion we had in the comments here: http://www.marketoracle.co.uk/Article21547.html#comment93344 Now the confirmation from John Williams of ShadowStats.com http://www.marketoracle.co.uk/Article21676.html "Using GAAP accounting principles, the annual deficit is running in the range of $4 trillion to $5 trillion. That's beyond containment. The government can't cover it with taxes. They'd still be in deficit if they took 100% of personal income and corporate profits." I had been aware that he originally wrote that some weeks or months ago and had quoted him at my blog (goldwetrust.up-with.com)

|

Shelby Moore

06 Aug 10, 17:45

|

Dubai no tax

Establish a corporation in Dubai, no capital gains nor income taxes: http://www.property-tax-portal.co.uk/international_property_tax_qa.shtml#8 http://blogs.thenational.ae/crane_country/2010/03/capital-gains-in-dubai-1.html http://www.dubaifaqs.com/tax-in-dubai.php http://www.wisegeek.com/is-dubai-really-tax-free.htm We need to move quickly before the hyper-inflation and capital controls take effect to get our gold and silver out of our home country and out of our personal name, and into a corporation in Dubai. I am not giving tax advice, consult your own professional adviser.

|

Shelby Moore

18 Aug 10, 22:15

|

new $100 bill

====== Subject: US Prepares For Gold Standard A new "Road to Roota Letter" has been posted about current preparations for the US to return to the Gold Standard. The article can be found here: http://www.roadtoroota.com/public/350.cfm Keep up the fight! Bix WeirRoadtoRoota.com ====== I had a private email debate with Bix Weir in 2008 about his creative destruction theory-- that Greenspan's purposely destroyed the fiat system. At the time, I think I had blown some holes in his theories, but I don't have time right now to go review that debate. Maybe I will soon and report back if I was wrong. If that new $100 bill will be used in a new gold standard, it is interesting that it is only 50% gold backed, which jives with my theories of late (we won't be able to profit because we will be taxed on the appreciation of our gold, while prices will rise too). It can only be that way if you think about it. How can we return to honest system, if all the westerners who stole for decades from the developing world with their fiat debt, are allowed to retain PPP (purchasing power parity) as we re-balance the world with gold standard? That would be theft and not a re-balancing, so mathematically it is impossible for all westerners to retain PPP value. Will a few of us by our foresight to buy metals early, thus retain PPP? I don't think so, because we obtained our wealth through the fiat theft system, and we will be forced to return our metal to that system to continue to participating it. Perhaps those who leave the fiat system permanently will profit, but I had explained in this article why I think high interest rates will kill black market in metals. Whereas, those of us who are doing some economic activity to help re-balance the world, will find we have lucrative profits on re-balancing, and that is what will retain PPP for us. Those who are hiding in bunkers with metal, are going to lose almost everything. And that is the way it should be, for being so selfish. The Parable of the Talents in the Bible applies. I do not think TPTB control all the micro events, but I think that they know riots and chaos are coming and that is part of their plan for NWO. As for how they will destroy gold and silver bugs, I have already explained that. The chaos and riots will actually reinforce their plan. Their plan can not fail, because savers love high interest rates (which come after chaos, as the way to re-mobilize capital that people are hiding in holes in the ground).

|

Shelby Moore (author of this article)

19 Aug 10, 04:58

|

IMF doubling USA tax

http://www.marketoracle.co.uk/Article21999.html "To get an idea of just how bad things are already, the IMF says that in order to fix the U.S. government budget deficit, taxes need to be doubled on every single U.S. citizen." I told you it was coming.

|

Shelby Moore

20 Aug 10, 21:51

|

metal or business?

We had discussed in past that if can get same hyper-inflated capital gain in a business value is better than metal, because we don't have to realize that gain in order to continue to garnish hyper-inflated profit.

|

Shelby Moore

28 Aug 10, 08:49

|

Hyperinflation not soon

Too much for me to write here, please select this link with your mouse and copy it to your browser address line: http://goldwetrust.up-with.com/economics-f4/inflation-or-deflation-t9-420.htm#3495

|

11 Sep 10, 00:14

|

gold theory

Irregardless is not a word. "...for the gold investor, irregardless of how much the price of gold has risen:"

|

Forrest Lane

11 Sep 10, 12:41

|

Some considerations

Hi, Shelby, Your theory certainly makes sense, though you might be putting too much faith into TPTB‘s abilities both in terms of their wits and will. But then again, they have resources and can have people to think for them, as to their will, it was quite justly pointed out that they are powerful exactly to the extent they manage to foster the weakness and greed of the herd and then parasitize on it. But I have a couple of questions: 1. If regional ‘new’ currencies floating relative or pegged to SDRs as the ‘global new currency’ in turn pegged to gold can come to existence, that is the latter - in this or that form - is not the only possible option, then the former should be digital too to tax gold bugs effectively? As far as I can see we can expect the fiat system to collapse within two years, not after 2012, in any case - those Maya dudes are really something - whether TPTB want it that soon or not. They can brainwash the mob with all their might to start hyperinflation exactly when they choose to do so, but, in fact, it seems that any, even fortuitous (consider its double-meaning in the context) event can initiate a chain reaction - not to mention some somewhat more predictable ones, like inevitably coming QE2, for instance. So will it be technically possible to accomplish it for all those regions within such a short period of time? Or are they going to channel the masses’ despair and anger, which will unavoidably follow the crash, to start wars or will otherwise provoke them (all these current preparations against Iran can be looked at from this new angle then), thus ‘fill in a lacuna‘, and gain some time through sacrificing many lives just as they probably did on the 9/11, but on a much greater scale? Besides, in a wartime it’s easier to promote any extreme legislations which are ’confiscating’ in nature. On the other hand, if regional currencies are possible, it means that those regions (or their respective TPTBs) still have different interests. Might it be that those differences can outweigh and undermine their ability to conceive and - most importantly - carry out this sinister plan on a global scale, which would require consonant action, wouldn’t it? 2. Still, what about diamonds, platinum and any crap like that to preserve one’s wealth through hyperinflation (though those things will hardly be of much help during a barter period)? Do you think that they can just easily treat any bugs in the same way that you predict for gold bugs (with silver as the only thing that possibly leaves some room for manoeuvring on the grounds you’ve mentioned)? 3. As to your Biblical references. Ezekiel 7:19They will throw their silver into the streets, and their gold will be an unclean thing. Their silver and gold will not be able to save them in the day of the LORD's wrath. They will not satisfy their hunger or fill their stomachs with it, for it has made them stumble into sin. Don’t you think that it’s just a metaphorical elaboration on and logical conclusion to that ‘camel’ thing? How ‘the day of Lord’s wrath’ can possibly be associated with the day when TPTB has finally succeeded with their horrible plan? It’s rather meant as the day when they are finally brought to justice - even if you’re inclined to take this stuff literally, isn’t it? Because it did look like you were trying to corroborate with those references your ‘The end game gold theory‘, rather than was talking in general about gold as a symbol of perishable material values.

|

Shelby Moore

11 Sep 10, 22:18

|

Good globalization

Agreed 'irregardless' is not a word, and 'regardless' was intended (had corrected that in several writings hence). I have some bad habits in my writing style, e.g. I used to always spell 'at least' as one word, etc.. Also I typically write something for publishing in about 20 - 60 minutes without a spell checker and send it, unlike many authors who devote considerable time to their articles. I am more interested in production and conceptual understanding than in reputation. If there is something very important I expect to be read by 100,000+ people, then I will get it copy edited. Forrest Lane, the west has been and still is much more open to free market capital flow than the developing world, which is the fundamental reason for the current imbalances, the resultant imbalances which are now driving the west back towards socialism and capital restriction. I urge you to read Peter Thiel's (Paypal founder) point that developing world's capital is walled off and available to the insiders (and this is my observation also while I live in Philippines): http://esr.ibiblio.org/?p=2534#comment-277956 (click sub-link to "my" aka Jocelyns's summary) So I don't expect the power players in the developing world to open their arms to our capital, rather they will spit us back to the den of socialism vipers in our own countries (there are signs this is underway, read thaivisa.com). The basic challenge of good globalization is to break down the barriers that are causing so much excess capital to lay idle. Some think (see the Protocols of Learned Elders of Zion) that the TPTB believe the only way to accomplish this is to have the most power at the center to tame the middle men ( http://www.marketoracle.co.uk/Article22404.html ), whereas some of us who believe in good globalization, think that a proliferation of technology freedom can tunnel past the middle man in ways they can not control. Some allege that the TPTB's version of NWO is one of centralized control and ultimate failure (see the Georgia Guidestones). Freedom's version of NWO is a good globalization where capital becomes free to move and a "billion differentiated flowers can bloom and interact". TPTB controlled mass media, apparently preach that complexity is caused by more possibilities and interactions (because they believe these are barriers), e.g. see Global Warming aka Climategate hoax; whereas, I explained recently that complexity is precisely the opposite: http://www.marketoracle.co.uk/Article22098.html#comment94393 But remember this. TPTB control their sphere, and to the extent that humanity still uses fiat, the fiat controllers dictate which asset classes are profitably convertible to fiat utility. As Peter Thiel suggests, the gate forward is narrow but opens wide on the other side like an hour glass. May the most important bits of sand squeeze through first.

|

Shelby Moore ("author of this article")

13 Sep 10, 10:52

|

Bankrupting global food

Bankrupting the world's food production: I now understand how the elite plan to take over the world's food production: http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/7997910/The-backlash-begins-against-the-world-landgrab.html http://www.telegraph.co.uk/news/worldnews/asia/india/5673437/India-joins-neocolonial-rush-for-Africas-land-and-labour.html ================== quote =================== "If, for example, China's land purchases in Africa result in more efficient, mechanised farming displacing subsistence farming, and in higher yields feeding not only the local population but providing valuable exports to China, that should be a good thing." It should be, but the locals are much more likely to see all the food produced, look at their meagre wages (although significantly higher than when they were subsistance farmers) and scream "colonial oppression" followed by "nationalise" ============================================ What is happening is that fiat capital (not real human capital, but the liar version of it...see my *PRIOR COMMENT* above for more on that, and http://esr.ibiblio.org/?p=2534#comment-277956 ) is being focused in speculation on land. The absentee landlords will eventually run afoul of the impoverished masses, who will at some point nationalize the land, giving control of the land to the elite who control the govt through the control of the money. This is an example of the mis-allocation of capital that is accumulating and will render us into a bad globalization NWO hell, if the good globalization can't break it soon enough.

|

Forrest Lane

13 Sep 10, 12:48

|

My above questions

I'm not under the impression that you have answered any of my questions, Shelby. Of course, if it's not a polite way to point out that they do not make any sense to you.

|

Shelby Moore ("author of this article")

13 Sep 10, 13:53

|

Your questions

Forrest Lane, I think I did answer your numbered questions: 1. You were basically asking what would be the tax outcome and how would the elite coax the various vested interests to their plan and time schedule. I answered you by saying the developing world would spit any expats back to the western world, where the elite have a strong consolidation of control in the "advanced" economies. 2. You asked if any assets could save one from being oppressed by the elite's consolidation of control, and I answered that it depends on if good globalization or bad globalization wins. Specifically I have stated (in one of the links I provided) that knowledge is the new money (asset) of good globalization, not those barbaric relics you mentioned. Physical assets are too easy for the society to control, not by raiding your private stash, but as I said, because society (the elite or political class) controls the conversion of these to fiat and fiat is what you need to transact with society. As for black markets, read this entire article, the links, and the comments. Black markets are much more likely to be in trading digital knowledge. 3. You asked if I think the Biblical references to all the merchants weeping because no one will buy their goods and the assets being thrown into the streets, applies to the final destruction of the elitest evil doers or to the masses of evil doers. My answer was both and I provided this link: http://www.marketoracle.co.uk/Article21650.html Did I miss any of your questions or points still? If you have any questions about your other comment at my other article "All Secure Websites Are A Lie", then please note them there, not here. Thanks again for your feedback.

|

Mike S

13 Sep 10, 15:03

|

Silver Price

Didn't you say in an article last week (or the week before) that silver prices are heading for a collapse? That conflicts with your article today regarding intentional price capping of silver doesn't it?

|

Shelby Moore ("author of this article")

14 Sep 10, 02:35

|

Silver price?

Mike S, did you intend to post that question to a different article and author? I have not written here about a silver collapse, although I do think silver is highly volatile and I recently became aware that perhaps much of China's personal savings may be loaned to itself and thus not exist: http://goldwetrust.up-with.com/economics-f4/inflation-or-deflation-t9-435.htm#3566 And of course we know much of China's net exports reserves are loaned to bankrupt westerners and/or heavily invested in commodities which depend on the continued boom in their economy.

|

Forrest Lane

14 Sep 10, 13:08

|

Your answers

Let’s forget about the second and the third ones. The answer to the second can be constituted by gleaning through your site, and the third one was obviously optional. As to the first one - do you mean that there is no need for regional currencies to become digital that soon, since those regions will simply phisically drive sorry PM bugs out of their jurisdictions?

|

Shelby Moore ("author of this article")

01 Oct 10, 21:42

|

digital currency timeline

Forrest Lane, apologies for the very late reply. Yes I think that digital currency does not become required by the elite planners, until the nation-state borders (national jurisdication over tax, immigration, residency, business, etc) no longer exist, i.e. after this current 20 - 30 year cycle of rebalancing the west and developing world, which probably has to end with war (search for my latest article "Perpetual Deflation Causes Inflation").

|

Shelby Moore ("author of this article")

09 Oct 10, 02:25

|

End game revisited

I don't want to be accused of not trying my best to be clear, so let me make one last attempt to explain. 1) I think readers will agree that the only way that price of gold in fiat will ever peak and decline, is for interest rates to be raised higher than the rate of debasement, so that it will be more profitable to hold a bond than to hold gold. If you don't understand or agree with that basic mathematical fact, then please study Gibson's Paradox: http://www.gold-eagle.com/editorials_01/howe082201.html http://www.marketoracle.co.uk/Article20263.html Gibson's Paradox was the observation that interest rates did not correlate with the *RATE* of change in prices as would be expected, but rather just with direction of change in the nominal price level. But as Summers pointed out, it is blatantly obvious that Gibson's Paradox only applies when everything is priced in gold units on a gold standard. So of course, if one is being paid interest in gold itself, then interest rates should be zero unless the wholesale supply and demand is changing. Whereas on a fiat standard, interest rates have to also pay back the loss in the value of the currency itself due to debasement, so thus interest rates become correlated to the *RATE* of change in prices. (P.S. that is why CPI reporting has been manipulated by "government pegging operations") 2) So if you understand that interest rates have to eventually go sky-high in order to have a fiat currency (given the implosion of production that will occur once interest rates start rising, thus sending inflation rate sky-high), and if you assume there will be a fiat currency in future, then you understand that eventually interest on bonds will be paying more than the appreciation of price of gold. At that point, gold price will decline as people dump gold to buy bonds. If people are dumping gold, and the only way to buy into bonds is to pay your taxes and document the seller tax id and purchase price to document your capital gain, then it is clear that black markets in physical gold will wither.

|

Shelby Moore ("author of this article")

03 Jan 11, 14:54

|

Avoid tax on gold & silver

Bullion is not taxed at 28%. Bullion is only taxed at normal capital gains tax rates in USA. It helps if you read the law: http://www.law.cornell.edu/uscode/html/uscode26/usc_sec_26_00000408----000-.html#m_3 As for the 10% penalty for cashing out retire accounts before they are confiscated or tax law changes, it would be better to pay 10% tax now than to pay much higher tax rates in the future. The society is bankrupt. It is inevitable. Also, with PHYSICAL metal, it my understanding that one can completely avoid paying any tax at the end game, simply by leasing the physical property. The lessee might convert it to fiat and use it, but must return it to you as silver. My understanding is that what the lessee does with the property does not matter as long as the property is returned to you per the lease contract. Provided that the lease payments are periodic and the term is not sufficiently long (I saw 12 years in case law?) to be construed as a transfer of property ownership (disposition), then no capital gain taxable event has occurred (other than they lease rents being taxable passive income). Disclaimer: I am not providing tax advice, consult your own professional tax attorney.

|

BruntFCA

10 Jan 11, 11:48

|

Oh Dear..

Oh dear... So the new bonds will pay 20% interest, and also be redeemable in gold? So they will just magic 20% extra gold out of their hat? Your English is terrible; please don't begin a sentence with the conjunction, "and". Moreover what does, "irregardless of any media circus about austerity" mean? I think you meant "regardless". The whole article was just hyperbole.

|

Shelby Moore ("author of this article")

02 Feb 11, 00:46

|

What is fiat?

Fiat is a fractional reserve system, it means by definition there is not enough gold to repay all the depositors. You failed your history lesson: http://goldwetrust.up-with.com/t129p15-god-s-governance#4102 (read the "Usury" section of that post) BruntFCA wrote: "So the new bonds will pay 20% interest, and also be redeemable in gold? So they will just magic 20% extra gold out of their hat? The whole article was just hyperbole" It happened before in the 1980s. Bonds paid double-digit interest rates in the USA, and gold was declining in price too, and the dollar was convertible to gold. Thus the effective gains in gold were much higher than the nominal interest rates, more like 20+%. Most people don't convert those gains to gold, so the fractional reserve is allowed to run amok as it did since then. Actually I did the entire calculation from 1980 until now: http://goldwetrust.up-with.com/t33p285-silver-as-an-investment#4028 +492% (5.922 times) compounded interest, 21 years 1979 to 2000 Average annual prices for silver peaked around $35 per ounce in 1979 and bottom around $5 in 2000. So that means if you had leased out your silver in 1979 at $35 average price basis in fiat (I doubt many timed the exact high price of $50, some sold early, some too late), and had charged the bond rate of interest until 2000, then your compounded revenue would have been: 4.922 x $35 = $172 per ounce leased. Therefor for each ounce you leased, you would have +4.922 extra ounces by 2000, thus your purchasing power would have been in 2000: $5 x 5.922 = $29.61. So your purchasing power in fiat basis would have declined only -15% from $35 to $30 (rounded), but your ounces of silver would have increase 492%. By 2011, your fiat value would have been $31 x 5.922 = $184!! And your lessee's would be very happy, because they would be getting a lower than market interest rate, because when they repay the silver ounces, they buy silver cheaper than when they borrowed it from you.

|

Trail of tears and broken dreams (delusions) lies ahead...

Trail of tears and broken dreams (delusions) lies ahead...