Gold, Soveriegn Risk and Austrailian Super Tax Redesign

Commodities / Gold and Silver 2010 Jun 16, 2010 - 08:53 AM GMTBy: Neil_Charnock

Europe is not “all better” by a long shot and the net result will be more turmoil and attraction to gold as a safe haven investment. Volatility is the other most important trend this year as we ebb and flow between risk aversion and risk appetite. Each new “revelation” about German and French bank US$958B, or total European bank US$1.6T exposure to the PIGS of Europe will bring on the volatility. UK has exposed themselves to US$370B in loans to just Spain and Ireland.

Europe is not “all better” by a long shot and the net result will be more turmoil and attraction to gold as a safe haven investment. Volatility is the other most important trend this year as we ebb and flow between risk aversion and risk appetite. Each new “revelation” about German and French bank US$958B, or total European bank US$1.6T exposure to the PIGS of Europe will bring on the volatility. UK has exposed themselves to US$370B in loans to just Spain and Ireland.

What many people fail to understand is that Greek debt has been reduced to junk status meaning that banks have to account for these bonds as 100% risk weighted capital. Their reserves have to match Greek exposure on a one for one basis even if the bonds are trading at below par. This means that banks cannot afford to carry Greek debt. The fall out is again like watching a slow motion train wreck.

Gold is going to keep on keeping on – the rally will continue for years to come. All quality gold stocks have extremely bright futures as long as the new world reality is adjusted to. This adjustment is unwilling and painful because it involves difficult decisions which can only really be forced upon governments in the face of disaster.

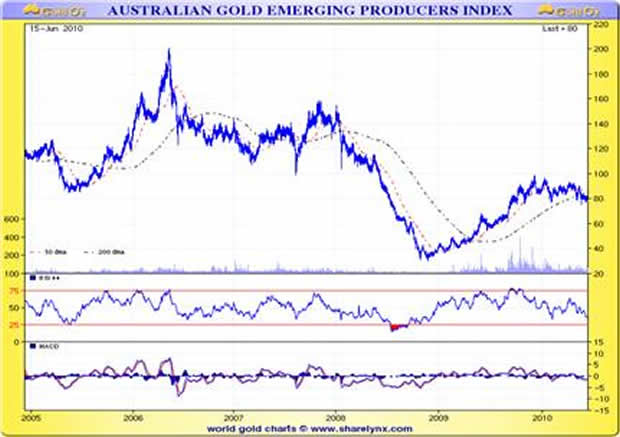

Quality gold stocks have great ground positions, long mine life or a highly likely potential of such, robust production, low to zero debt and low to medium cash costs. A quality position is built in such a company during periods of depressed share price which precede an era of strong price appreciation. Gold stocks in Australia are in such a period after gradually awakening in response to higher AUD gold prices from late 2005 as seen below.

I will keep this simple because a picture is worth a thousand words. Here is a chart of the emerging producers and I want you to compare the recent price action of the chart above to the one below. To state that there has been a ‘disconnect’ or that this is overdone is an understatement. How long this might last and when we should pounce on this opportunity is what we need to cover for the rest of the article.

This article must therefore include a follow up to “Disaster and Opportunity” which I penned last week. Investors should never miss out on a good opportunity. I do not down play the current damage done to the Australian mining industry by our current government; instead I am providing coverage on the investment angle.

Anglogold Ashanti have come out and stated Australia is on the bottom of their list for investment at present. Morgan Stanley has stated that they have remodelled the BHP Olympic Dam Expansion and believe it will not be viable under the tax. This is at the heart of the real problem as long as this proposal is on the table because investment in mining requires stability and certainty.

This hits new projects on Australian soil more than anything as the uncertainty caused by the delay on the final policy format bites. This does force the banks to look at all funding based on the worst case scenario; which would be the current government re-elected and tax in current format passed into legislation.

Last weeks article delved into the opportunity and this week I want to update investors on the developments. Should this proposal fail then we will have a reversal on the depressed share prices for many companies. The major opportunity lies in depressed prices of gold miners that are fully funded and or currently producing. So what chance is there that this tax proposal will ultimately fail?

Let’s put it this way opportunity has already begun to rise like the phoenix from the disastrous policy proposal blunder made by our current Government here in Australia. I am sincerely a non-partisan writer simply because politics is not my field. I have therefore covered the RSPT here from a viewpoint of support for investors and miners and I make no apology for that.

It would seem the Federal Labor Government is going to be forced to back away from the ill fated super tax proposal and water down their plan. I say this even though they are saying they will “tough it out”. There is talk of raising the ludicrous “fair return” threshold from 6% to above 10%. There is also talk in The Australian newspaper about exemptions of whole sectors of the industry and other major changes as this policy farce disintegrates.

After crunching the numbers the government have quickly realized this means almost certain defeat at the next election. The latest WA opinion poll by Westpoll came in as the worst ever of all time for the Federal Labor Party even though they just pledged to spend billions of dollars on infrastructure in the State.

The primary vote was polled at just 26% compared to the opposition’s 52%. There are calls to get rid of the Prime Minister yet this incredibly misguided proposal has been sanctioned and loudly supported by the Deputy PM Julia Gillard, the Treasurer Wayne Swan and Resources Minister Martin Ferguson. In other words they are all responsible.

The PM did a trip to WA to “attempt to put out the fire” however he did no radio interviews, no public appearance, failed to meet the press or even the Premier. Apparently he has won no support back as a result of the visit which is telling as we attempt to analyse if we will actually have to deal with the tax at all.

Would this really weaken mining in Australia if it went ahead, or is the government right? I was talking to an insider in the oil industry today who told me that there has been no local oil exploration since the introduction of the oil tax. The few petroleum engineers that remain employed are mostly in the universities now and there have been no petroleum geologists coming through the system for years. We have gone from self sufficient in oil to an importer. The answer is yes you bet this would weaken mining and exploration and hurt the economy.

Sovereign risk status

There has been talk that our first class sovereign risk status has been irreparably ruined however I would argue that over time we might look back and consider this an important test. I hope the world will soon see that even a misguided Federal Government does not have the power to over rule or even attempt to destroy mining here in Australia because it is literally a major part of our national backbone.

I visit a major investment network forum that briefly put up an advertisement from the government promoting the RSPT however they removed the advertisement due to the uproar from members. This shows a true democracy in action where a company knocks back the government in support of its own clients.

Did this proposal ever have any hope of being approved? Mining has literally formed and shaped Australia’s history and is a hugely important part of our cultural in economic identity. The industry and many special interest sectors of the population were never going to accept any proposal that would weaken mining.

I would argue that Australia could never become a Hugo Chávez led Venezuela with nationalised industry and mining and this is incredibly strong for our sovereign risk status. Imagine if the political system in Venezuela had allowed the people and miners there to stop Chávez in his tracks. This is part of the fail safe mechanism here in Australia and this essential fact should not be overlooked by the international investment and mining communities. In the meantime they will sit back and await the verdict of the next election. They will quite rightly sit back and see what happens.

Contrarian opportunity, takeover mania

In the meantime at GoldOz we continue to structure our services to suit the situation because we can see the massive opportunity presented here. If the Australian public actually votes back the incumbent political party, which I seriously have to doubt from current indications and trends, then we get takeover mania and all sorts of chaos. We are preparing for this scenario just in case the unthinkable happens.

We have separated the companies with offshore operations and listed the proportional onshore production for all mining stocks. We have been building an offshore data file on the global industry. We also have some more plans and programs that will be announced once they are complete.

If we get rid of the government and or the tax then some of these stocks will play catch up and represent excellent leverage. We will be presenting this opportunity as part of our normal operation but I want to say this – there are some screaming bargains here in our gold sector.

Offshore investors marvel at how cheap some of these producers are compared to North American stocks. When you look at how far the AUD gold price ran correlated to the movement in the ASX listed gold stocks you can not only see the damage the tax proposal has done you can see the glaring opportunity.

The AUD gold price was up 25% from $1200 to $1500 and now we are consolidating up at the $1430 level which is up around 19%. During this same period the larger producers, emerging producers and juniors are down 8%, 11% and 12.5% respectively. Remember many of these companies are unhedged producers with zero debt or low gearing – join up with us now and examine this situation for yourselves.

This divergence between the AUD price of gold, rising price of USD gold and falling Australian gold stocks will not last. I am urging investors to get educated about this so they can book some exceptional profits when statistical normality eventually returns.

Good trading / investing.

Regards,

Neil Charnock

GoldOz is currently developing a Member area and has added further resources for free access. We have stepped up our research and stand by to assist investors from all walks of life. We sell an updating PDF service on ASX gold stocks from only $AUD35 for 3 months – the feedback is grateful and enthusiastic because we are highlighting companies that have growth potential and offering professional coverage of the sector. GoldOz web site is a growing dynamic resource for investors interested in PGE, silver and gold companies listed in Australia , brokers, bullion dealers and other services.

Neil Charnock is not a registered investment advisor. He is a private investor who, in addition to his essay publication offerings, has now assembled a highly experienced panel to assist in the presentation of various research information services. The opinions and statements made in the above publication are the result of extensive research and are believed to be accurate and from reliable sources. The contents are his current opinion only, further more conditions may cause these opinions to change without notice. The insights herein published are made solely for international and educational purposes. The contents in this publication are not to be construed as solicitation or recommendation to be used for formulation of investment decisions in any type of market whatsoever. WARNING share market investment or speculation is a high risk activity. Investors enter such activity at their own risk and must conduct their own due diligence to research and verify all aspects of any investment decision, if necessary seeking competent professional assistance.

Neil Charnock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

PJ

16 Jun 10, 17:55 |

Australia

Australia, the white man's Nigeria! |