Get Outside the Equity Style Box with ETFs

Companies / Investing 2010 Jun 17, 2010 - 08:33 AM GMTBy: Ron_Rowland

You’ve likely heard these investment buzzwords on TV or read them in the business section of your newspaper: Buy small-cap value! Look for opportunities in mid-cap growth! Go to large-caps for safety!

You’ve likely heard these investment buzzwords on TV or read them in the business section of your newspaper: Buy small-cap value! Look for opportunities in mid-cap growth! Go to large-caps for safety!

So you may be asking: What are they talking about?

Today I’m going to take the mystery out of these terms — and then explain why your best chance for profit may actually be in none of these categories. Sometimes it’s better to think outside the box.

Unpacking the Style Box …

Stocks can be sorted and categorized in many ways. The most common is by size, or “capitalization,” which means the number of outstanding shares times the share price. Relatively big companies are considered “large-cap,” smaller ones are “small-cap” and those in between are “mid-cap.”

You can also group stocks according to their fundamental characteristics …

“Growth” stocks are expanding businesses. People buy them because they think the above average growth of the company will translate into a higher stock price soon.

“Value” stocks are different … the shares might not be going anywhere, and may even be falling.

People who buy value stocks are looking for a bargain. They think the stock is really very valuable and will go much higher once the rest of the world sees the light.

Then, of course, there are stocks that lie somewhere in between growth and value. We call these the “blend” stocks.

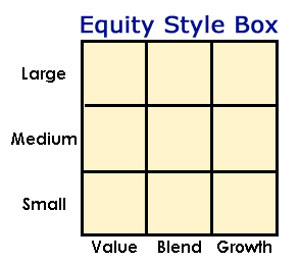

Morningstar, the well-known research firm, invented the “Style Box” to categorize mutual funds according to the type of stocks in their portfolios. It looks like a 9-square checkerboard. The vertical axis indicates the size (large, mid, or small) and the horizontal axis is the risk style (value, blend, or growth).

What you get is nine different boxes, or categories:

|

| The Style Box has nine different squares. |

- Large-cap value

- Large-cap blend

- Large-cap growth

- Mid-cap value

- Mid-cap blend

- Mid-cap growth

- Small-cap value

- Small-cap blend

- Small-cap growth

Equity investment managers tend to specialize in one or two of these categories. And investors often try to diversify their holdings by making sure their portfolio is exposed to all nine boxes.

There is, of course, a fair amount of wiggle room in exactly where you draw the lines …

That’s because stock analysts have different standards for what constitutes each category, such as “value” or “small-cap.” Therefore, not every style-based exchange traded fund (ETF) looks alike. Nonetheless, there is a broad consensus: Funds in any given category tend to be highly correlated with each other.

The Extreme Edges of the Box …

Now you’re probably asking, “Ok, Ron, which category is your favorite?” The answer is “All and none.” I’m a trend-follower — so I look for the trends and try to follow them. And at one time or another, I’ve liked ETFs from all the style categories.

However, there’s more to stock investing than the Style Box. Sometimes you want to look outside the grid by going to the extremes of each axis.

Consider size …

|

| ExxonMobil is a top mega-cap stock. |

The three large-cap style boxes represent the average capitalization of all the stocks held by the funds in those boxes. As you move to the lower end of the box you will eventually move into mid-cap territory. But what if you move the other direction?

There are large-cap stocks and then some SUPER-large cap stocks …

When you reach the upper edge of the large-cap style boxes you have arrived at the biggest of the big. Sometimes they’re called “mega-caps.” These are the multinational oil companies, banks and other huge firms that operate on a global scale.

There are relatively few of these companies, but they account for a relatively large portion of overall market capitalization.

A couple of ETFs that truly represent this group for U.S. stocks are:

- iShares S&P 100 Index Fund (OEF) and

- Rydex Russell Top 50 (XLG).

For global mega-caps there’s:

- SPDR Dow Jones Global Titans (DGT) and

- iShares S&P Global 100 (IOO).

It is also possible to get mega-cap ETFs in value and growth flavors from iShares and Vanguard.

At the extreme bottom of the Style Box are “micro-cap” stocks: Companies too tiny to qualify as small-cap but still worthwhile.

My favorite ETF covering this group is iShares Russell Micro Cap (IWC) because it is the most liquid, and it tracks the most widely followed benchmark.

Others to consider are:

- PowerShares Zacks Micro Cap (PZI) and

- First Trust Dow Jones Select Micro Cap (FDM).

As for growth vs. value, you can go to the extremes on them, too. And when either style is in favor it often makes sense to go to the extreme version of that style.

Several ETFs tighten the criteria and get rid of the mushy middle, leaving you with a smaller number of stocks that are super-growth or super-value. For instance, Rydex has a family of six “pure growth” and “pure value” ETFs — holding stocks that are at the extreme left and right edges of the style box.

Am I saying all these funds are a good buy now? Of course not.

Recently, however, some of my indicators are starting to show a shift in momentum away from the riskier small-cap and mid-cap groups in favor of some of the large-cap and mega-cap ETFs named above.

And I think it’s a trend worth watching to see if it gains traction over the next few weeks.

Best wishes,

Ron

P.S. Are you on Twitter? If so, please follow me at http://www.twitter.com/ron_rowland for frequent updates, personal insights and observations about the world of ETFs.

This investment news is brought to you by Money and Markets. Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.