Spain Clears Funding Hurdle But US Jobs Data Disappoints

Stock-Markets / Stock Markets 2010 Jun 17, 2010 - 09:56 AM GMTBy: PaddyPowerTrader

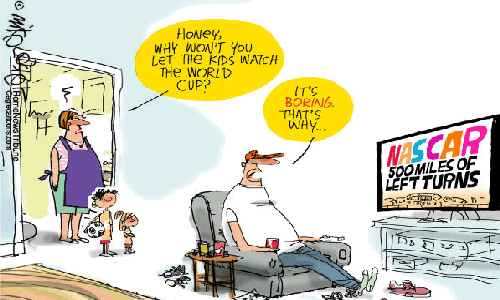

Spain is again the focus both on and off the pitch Wednesday with the Spanish bond market like their defence, beginning to resemble a Swiss cheese. With nerves about Spain’s financing situation rattled ahead of Spain’s bond auctions today and a heavy period of debt redemptions coming up in July totalling €25bn, the spread between Spain and Germany’s 2-year yields rose another 15 bp to another new EMU high of 279 bp a 40 bp rise so far this week and nearly 150 bp rise in the past month. Seems the contagion spread to the football team last night. There are also worries that the release of the results of the recent stress test results for European banks will confirm the markets very worst fears about the level of leverage/under capitalization still lingering nearly 2.5 years into the crisis. I personally think quite the opposite and that the stress test results will focus attention on German banks who have been getting away with being undercapitalized/over leveraged for years.

Spain is again the focus both on and off the pitch Wednesday with the Spanish bond market like their defence, beginning to resemble a Swiss cheese. With nerves about Spain’s financing situation rattled ahead of Spain’s bond auctions today and a heavy period of debt redemptions coming up in July totalling €25bn, the spread between Spain and Germany’s 2-year yields rose another 15 bp to another new EMU high of 279 bp a 40 bp rise so far this week and nearly 150 bp rise in the past month. Seems the contagion spread to the football team last night. There are also worries that the release of the results of the recent stress test results for European banks will confirm the markets very worst fears about the level of leverage/under capitalization still lingering nearly 2.5 years into the crisis. I personally think quite the opposite and that the stress test results will focus attention on German banks who have been getting away with being undercapitalized/over leveraged for years.

It had all stared out fairly well yesterday but then around lunch time , there was a wave of bad news. Firstly FedEx reported numbers, which although were pretty much in line were negative on outlook. This was swiftly followed by Nokia (-9%) lowering handset margin guidance, and then a worst than expected US Housing starts figure (poor figure had been expected, post expiry of tax credit, but inventories are “lean” so should limit downside in coming months). Fannie Mae and Freddie Mac sank more than 38% as regulators ordered them to delist their stock from exchanges. US PPI numbers provided a modest upside surprise (+5.3% vs +4.9%). And a very strong Industrial Production report (rebound in utility output) calmed nerves a little and we just about scraped into positive territory on the day.

Today the eagerly awaited latest litmus test of eurozone sovereign credit worthiness the Spanish bond auctions went fairly well this morning (probably due to the arm of officialdom being put on domestic institutions to buy it). None the less European bourses have been heartened, heaved a sigh of relief, and pushed ahead.

At an investors presentation in Copenhagen by the Spanish Tesoro (their NAMA) they mention that they have €17bn in cash balances before this weeks auctions which raised another €8.5bn. The implication of this is that Spain will not be forced back into funding mode in July i.e. they have enough monies to meet redemptions of €25bn which fall due. This should be good for risk appetite and spreads (and Spanish banking stocks.

Stocks on the move this Thursday include of course BP (Barack Petroleum!), up 7% plus on their “settlement” with the US administration. But to the downside we have the UK’s biggest games retailer the aptly named Game Group shed 6% after announcing that sales were down 12% in the 19 weeks to June 12th.

The release of the weekly US jobless and continuing claims numbers at 13.30 BST has taken some of the shine off the Dow futures as they both disappointed with initial first time jobless claims rising to 472k. As a rule of thumb employment only tends to increase when initial claims fall below the 400k mark i.e. the data doesn’t point to any improvement in the jobs market 7 since the workers temporarily hired for the census will be cut again there is a distinct chance we get a minus number on Non farm Payrolls for June

Today’s Market Moving Stories

•The current Spanish administration seems to be more tactically astute and to react under pressure better than their over hyped defensive soccer team. As demonstrated by the Bank of Spain’s unilateral decision which I wrote of yesterday to raise the bar and publish the results of stress tests on the nation’s lenders may force European neighbours to follow suit as investors demand more disclosure of the risks on banks’ books. “Pressure is increasing and now European countries need to consider whether to follow Spain,” said Daniel Hupfer. The Bank of Spain will make the findings public to give investors more information on the state of the banks, said Miguel Angel Fernandez Ordonez, the central bank governor. Spain’s second-largest bank, added to concern about the nation’s lenders this week when he said capital markets were closed to most Spanish companies and banks. He advocated “doing and publishing” stress tests. Note that Germany’s Commerzbank is the most leveraged in Europe on numbers that I’ve seen. Indeed there has been a lot of chat that these stress tests will show the entire German (and possibly methinks the Austrian due to their huge Eastern European exposures) banking industry in a very poor light.

•Indeed the moves seems to have paid dividends already as we learn that the European Central Bank will publicize the results of stress tests by individual banks, going beyond a previous plan to issue the information on a country-by-country basis, test results will begin to be published in the next couple of weeks, beginning with European Union member Spain.

•In an interview with FT Deutschland, ECB board member Jose Manuel Gonzales Paramo says the ECB will continue its bond purchases programme, even when the SVP kicks in.

•Separately fellow council member Italian Bini Smaghi said that the ECB may expand the range of securities they are buying to include CP (commercial paper). This would be highly significant and take short term liquidity pressure off the PIIGS.

•Chancellor of the Exchequer George Osborne said he will abolish the Financial Services Authority and give most of its power to the Bank of England, undoing the regulatory system set up by Gordon Brown in 1997. Osborne will also set up a Financial Policy Committee at the bank and establish a consumer protection and markets agency. He’s blamed the system established by former Labour Prime Minister Brown for failing to prevent a financial crisis that saddled taxpayers with liabilities of as much as 1.4 trillion pounds.

•June’s UK CBI industrial trends survey released this morning provides yet more evidence of a robust recovery in the manufacturing sector.

•In other data today the ONS estimates that UK retail sales volumes (excluding auto fuel) rose by 0.5% m on m, a much stronger outturn than the market had expected. On the whole, today’s retail sales outturns are in keeping with the upbeat economic data we have recently been seeing.

•The US Federal Reserve will keep its benchmark interest rate unchanged for a “very extended period” as Europe’s austerity measures curb world demand, said Paul McCulley of Pacific Investment Management.

•Overnight in Japan the manufacturers’ sentiment index in the Reuters Tankan rose by 17 points to +9 in April, its highest since February 2008. The index is expected to climb a further five points to +14 in September.

•The Nikkei reports that the government will encourage foreign firms to relocate their Asian headquarters to Japan with tax breaks and subsidies on investment. The measurers will be included in a growth strategy that the government is set to announce on Friday.

BP In 20 Billion Compensation Deal.

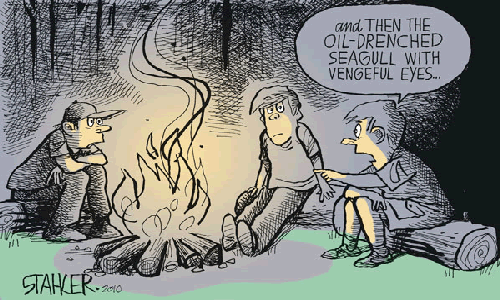

The WSJ reports that BP is under intense legal and political pressure from President Barack Obama, and agreed on Wednesday to put $20 billion into a fund to compensate victims of the Gulf oil spill, and said it will cancel shareholder dividends for the first three quarters of this year to offset that cost. BP said it will pay another $100 million to a separate fund to help oil-industry workers sidelined by the Obama administration’s deepwater drilling moratorium. The payments far exceed the letter of U.S. law, which caps oil spill liabilities at just $75 million. BP agreed to waive that limit. As part of an agreement hammered out in a four-hour White House bargaining session, BP agreed to “set aside” $20 billion in U.S. assets as a guarantee that it will be good for the promised $20 billion in cash by 2013. To raise the cash it needs, BP will make a “significant reduction” in capital spending and will speed asset sales to generate about $10 billion over the next twelve months. The move could cost BP shareholders–many of them U.K. pension funds–roughly $7.5 billion during the next three quarters. BP said it would consider resumption of dividend payments in 2011, but it could face pressure to cancel them until the Gulf is fully recovered.

Company / Equity News

•Over the next few months, Sony and its competitors will introduce a new generation of Web connected televisions and services that will stream movies, TV shows, and music over the Internet and onto those sets. The idea is to make it easier for consumers to bypass cable and effectively create their own personal TV channels. That may sound a lot like what many people already are doing by tapping into YouTube, Hulu, and other entertainment websites.

•Australia’s resource tax rate will be 40% and won’t be set at different levels for various commodities, Resources Minister Martin Ferguson said as companies look for a compromise on how the levy will be applied. “We’re not talking about different tax rates,” Ferguson told Australian Broadcasting Corp. radio today. There will be “generous transitional arrangements” for existing projects and “there will be a headline rate of 40 percent.” So bad new for Rio Tinto, BHP Billiton etc

•But better news for basic resource and mining names from China as Baosteel Group Corp., China’s second-biggest steelmaker, has agreed to accept a 23 percent increase in iron ore prices from Rio Tinto Group and BHP Billiton, said research company UC361.com. The steelmaker will pay about $147 a metric ton, excluding freight charges, for July quarter contracts.

•Volkswagen benefiting from both the positive demand environment in Western Europe, China and North America, VW expects to exceed expectations for H1 sales, operating profits and earnings.

•An article in The Times pours fuel on the longstanding speculation of Nestle taking over L’Oreal. The article is about secret tapes by a butler of 87 year old heiress Liliane Bettencourt’s private conversations, which allegedly show that she is “psychologically fragile”. The backdrop is a legal dispute between the heiress and her daughter which is set to be ruled on next month, which relates to gifts totalling EUR1bn made by Lilian Bettencourt to a French photographer.

•Spanish papers reported that Santander was interested in acquiring M&T yesterday. The story did not mention the AIB stake, only interest in the total M&T bank. The report coincides with the confirmation that Colm Doherty, AIB’s MD, will step down from the board at M&T. Also on the AIB disposal front, PKO Bank Polski may not be asked for a dividend from the Polish Treasury in order to preserve capital for an acquisition of Bank Zachodni and yesterday the Polish Treasury Minister Alexksander Grad said that a Polish buyer of BZ WBK would be greatly appreciated. AIB’s Polish stake continues to garner significant interest across the European banking sector, however Bank Handlowy, the Polish unit of Citigroup, confirmed it has no interest in the M&T stake.

•C&C Group’s Magners cider sales volumes at U.K. bars and restaurants increased 24% in the four weeks to April 17, compared with the same period last year, securities firm Davy said in a research note, citing data from CGA Ltd. Magners “significantly” outperformed the rest of the British market, which was flat during the month, Dublin-based Davy said. C&C Magners sales by value climbed 28 percent, it said. Next up is the disposal of the spirits unit.

•Biogen overnight disclosed six further cases of PML in Tysabri cases bringing the total number of cases to 55 up to June 7. Of the cases reported 20 were in the US while 32 were in the EU. Biogen put the overall global rate of PML infection at 0.77 per 1,000 patients well inside the drugs 1 in 1000 risk label. Yesterdays update however now implies a rate of 1.24 cases per 1000 patients on the drug for over a year and a rate of 1.76 for those on the drug at least two years. The increasing evidence from the data flow is that higher exposure to the drug increases the rate of PML outside the boundaries of the current risk label.

A dispute between UK Department for Transport (DFT) and Stagecoach has been resolved via arbitration. The two items in dispute – over the timing of when revenue support from the DfT should begin in the year 2010/11 and whether car parking revenue should be including in calculating franchise payments were resolved in favour of.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.