Stock Market Stalls At Resistance

Stock-Markets / Stock Markets 2010 Jun 18, 2010 - 03:28 AM GMT U.S. stocks rose as a late-day rally in technology, consumer-staples and industrial companies

helped the market overcome an early slump spurred by economic reports that cast doubts on the

strength of the recovery.

U.S. stocks rose as a late-day rally in technology, consumer-staples and industrial companies

helped the market overcome an early slump spurred by economic reports that cast doubts on the

strength of the recovery.

The Standard & Poor’s 500 Index increased 0.1 percent to 1,116.01 at 4 p.m. in New York and remained above its 200-day average for a third day. The Dow Jones Industrial Average gained 24.71 points, or 0.2 percent, to 10,434.17, erasing a drop of as much as 90 points. Both gauges did not turn higher until the final minutes of trading.

Did the BP Oil Well Really Blow Out in February, Instead of April? The Deepwater Horizon blew up on April 20th, and sank a couple of days later. BP has been criticized for failing to report on the seriousness of the blow out for several weeks. However, as a whistleblower previously told 60 Minutes, there was an accident at the rig a month or more prior to the April 20th explosion.As Bloomberg reports today, problems at the well actually started in February: “BP Plc was struggling to seal cracks in its Macondo well as far back as February, more than two months before an explosion killed 11 and spewed oil into the Gulf of Mexico.”

That may explain Goldman’s and the BP executives’ massive sale of shares in March. ICI Reports Another Massive Equity Outflow (ZeroHedge) As we predicted previously, in the past week domestic equity mutual funds experienced another whopper of a redemption. ICI reports that for the week ended June 9, domestic equity mutual funds saw $3.7 billion in outflows, 3 times the prior week's outflow, the sixth sequential outflow in a row, and $27 billion in outflows year to date.

The VIX makes a new low.

-- It seems as if the VIX and the

dollar are paired together in their

cycles. Both have pivot days due

tomorrow. The VIX remains below

its intermediate-term Trend Support

at 31.18 today. We had been due for

a Trading Cycle low last Friday, but

it seems that the VIX is off by a full

pivot cycle. It may have to do with

options expiration, since a decline in

equities this week would have caused

a lot of damage.

-- It seems as if the VIX and the

dollar are paired together in their

cycles. Both have pivot days due

tomorrow. The VIX remains below

its intermediate-term Trend Support

at 31.18 today. We had been due for

a Trading Cycle low last Friday, but

it seems that the VIX is off by a full

pivot cycle. It may have to do with

options expiration, since a decline in

equities this week would have caused

a lot of damage.

The CBOE Put-Call Ratio for equities ($CPCE) rose to .89 today. The pros remained resumed a neutral position in the $CPCI at .94 at the end of the day. The 10- day average is still 1.44. The NYSE Hi-Lo index closed up 16 points today to 44. The Hi-Lo index remains in bearish territory. Bullish territory begins at 95.

SPY remain stalled above intermediate-term Resistance.

Action: Sell/Short/Inverse

-- The SPY stayed above

intermediate-term Trend Resistance

at 111.55 today. There is strong

overhead Model and Fibonacci

Resistance at 113.20-113.26,

although SPY may not choose to

challenge it. All of the common

wave relationships have been met in

this rally, so technically it is finished.

Monday’s pivot day was also the top

of a five-wave pattern. What

happened since then appears to be a

double zig-zag extension. This may

have served two purposes. First, to

fill the gap left in the May decline,

and second, to keep shares elevated

through options week.

Action: Sell/Short/Inverse

-- The SPY stayed above

intermediate-term Trend Resistance

at 111.55 today. There is strong

overhead Model and Fibonacci

Resistance at 113.20-113.26,

although SPY may not choose to

challenge it. All of the common

wave relationships have been met in

this rally, so technically it is finished.

Monday’s pivot day was also the top

of a five-wave pattern. What

happened since then appears to be a

double zig-zag extension. This may

have served two purposes. First, to

fill the gap left in the May decline,

and second, to keep shares elevated

through options week.

QQQQ closes above intermediate-term Trend Resistance.

Action: Sell/Short/Inverse

-- Today QQQQ made a small gain

above its intermediate-term Trend

Resistance at 46.25 again.

The rally in the last half-hour to close

the market on a positive note is

something one would expect in a

market like this. Notice how we are

not getting any more “sneak peeks”

into expected earnings due to be

released next month. I wonder why?

Action: Sell/Short/Inverse

-- Today QQQQ made a small gain

above its intermediate-term Trend

Resistance at 46.25 again.

The rally in the last half-hour to close

the market on a positive note is

something one would expect in a

market like this. Notice how we are

not getting any more “sneak peeks”

into expected earnings due to be

released next month. I wonder why?

XLF stalled below Resistance.

Action: Sell/Short/Inverse

-- XLF remains stalled just below its

intermediate-term Trend Resistance

at 14.97. The very weak rally gives

many indications that it may be

finished here as an irregular

correction.

Action: Sell/Short/Inverse

-- XLF remains stalled just below its

intermediate-term Trend Resistance

at 14.97. The very weak rally gives

many indications that it may be

finished here as an irregular

correction.

Today’s action left a probable reversal pattern in both the hourly and daily charts. Remember, XLF has been the “lead dog” in the decline.

FXI makes a small pullback.

Action: Buy/Long

-- FXI took a rest in its rally as shortterm

Trend Support rose to 39.60

today. Short-term Trend Support has

made a bullish cross. Although I do

not expect a larger correction yet,

there is a good probability that shortterm

Trend Support will be our

safety net for a while, now that the

rally is underway.

$SSEC has attempted to cross shortterm

Trend Resistance at 2573, but

has not yet succeeded.

Action: Buy/Long

-- FXI took a rest in its rally as shortterm

Trend Support rose to 39.60

today. Short-term Trend Support has

made a bullish cross. Although I do

not expect a larger correction yet,

there is a good probability that shortterm

Trend Support will be our

safety net for a while, now that the

rally is underway.

$SSEC has attempted to cross shortterm

Trend Resistance at 2573, but

has not yet succeeded.

GLD’s attempted a breakout.

Action: Buy/Long

-- GLD very nearly succeeded at its

attempted break-out today. It

remains above its short-term Trend

Support at 120.13. It’s funny what a

24-hour time span in the market will

do.

Two observations come to mind.

The first is that the GLD cycle seems

to be paired with TLT, its diametric

opposite. You almost have to be a

manic-depressive to own both. The

second item is that GLD could have a

nice run once it breaks out again.

However, 126 is a strong resistance

area. I would like to see what

happens when GLD gets there.

Action: Buy/Long

-- GLD very nearly succeeded at its

attempted break-out today. It

remains above its short-term Trend

Support at 120.13. It’s funny what a

24-hour time span in the market will

do.

Two observations come to mind.

The first is that the GLD cycle seems

to be paired with TLT, its diametric

opposite. You almost have to be a

manic-depressive to own both. The

second item is that GLD could have a

nice run once it breaks out again.

However, 126 is a strong resistance

area. I would like to see what

happens when GLD gets there.

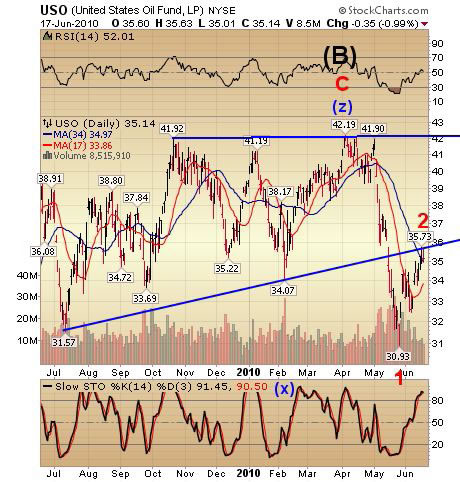

USO back-tested its trendline.

Action: Sell/Short/Inverse

-- USO eased down from a back-test

of its year-old bearish wedge

trendline to its intermediate-term

Trend Resistance at 34.97, giving

credence that the rally is all but over.

It just happens that Cycle Resistance

is at 35.70 as well. The reversal

pattern in the hourly chart got its

follow-through today. The wave

pattern is also complete.

Action: Sell/Short/Inverse

-- USO eased down from a back-test

of its year-old bearish wedge

trendline to its intermediate-term

Trend Resistance at 34.97, giving

credence that the rally is all but over.

It just happens that Cycle Resistance

is at 35.70 as well. The reversal

pattern in the hourly chart got its

follow-through today. The wave

pattern is also complete.

USO may be entering a prolonged decline that could last up to six weeks, since the next Primary Cycle low is scheduled to come in the last week of July.

TLT emerged above its triangle pattern.

Action: Buy/Long

-- TLT has emerged above its

triangle pattern and short-term Trend

Support at 97.10. The triangle

pattern virtually assures new highs

with a minimum potential target of

100.70.

My model still suggests a high of

105.40. However, the 61.8%

retracement level is 104.20. Another

major newsletter is calling for an

even higher number, but I will stick

to my range for now.

The message for now is that TLT

will make a new high before we must

be concerned about a reversal.

Action: Buy/Long

-- TLT has emerged above its

triangle pattern and short-term Trend

Support at 97.10. The triangle

pattern virtually assures new highs

with a minimum potential target of

100.70.

My model still suggests a high of

105.40. However, the 61.8%

retracement level is 104.20. Another

major newsletter is calling for an

even higher number, but I will stick

to my range for now.

The message for now is that TLT

will make a new high before we must

be concerned about a reversal.

UUP prepares for a pivot day.

Action: Buy/Long

-- UUP pulled back below

intermediate-term Trend Support at

25.11 today. It has also made a

reversal pattern using Cycle Support

at 24.90 today. The next UUP pivot

is tomorrow.

Action: Buy/Long

-- UUP pulled back below

intermediate-term Trend Support at

25.11 today. It has also made a

reversal pattern using Cycle Support

at 24.90 today. The next UUP pivot

is tomorrow.

Putting it all together, this suggests that the reversal will happen no later than Monday and the crash scenario that I have been discussing will get underway either on June 21st or June 28th.

Have a great evening!

Tony

Anthony M. Cherniawski

Traders alert: The Practical Investor is currently offering the daily Inner Circle Newsletter to new subscribers. Contact us at tpi@thepracticalinvestor.com for a free sample newsletter and subscription information.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.