Gold and Subprime US Dollar Backlash

Interest-Rates / Subprime Mortgage Risks Sep 06, 2007 - 07:42 PM GMTBy: Jim_Willie_CB

A certain nerve has been struck a few times in recent reading on my part by the description of the USDollar as a subprime currency. How true!!! When a debtor has poor credit history, inadequate income, and shoddy assets, the borrower is deemed to be subprime, which means less than good, not up to snuff, of second rate standard. The entire world is growing in its disgust for having been defrauded. While US banking and economic leaders are smugly claiming containment of the problem, foreign officials are acting according to the opposite conclusion. Every single denial of the problem, whether from press pundits, corporate titans, banking officials, government ministers, agency heads, trade representatives, and central bankers, has been incorrect.

A certain nerve has been struck a few times in recent reading on my part by the description of the USDollar as a subprime currency. How true!!! When a debtor has poor credit history, inadequate income, and shoddy assets, the borrower is deemed to be subprime, which means less than good, not up to snuff, of second rate standard. The entire world is growing in its disgust for having been defrauded. While US banking and economic leaders are smugly claiming containment of the problem, foreign officials are acting according to the opposite conclusion. Every single denial of the problem, whether from press pundits, corporate titans, banking officials, government ministers, agency heads, trade representatives, and central bankers, has been incorrect.

My article of this June entitled “Absolute Bond Contagion” (click here ) might have seemed like a wild-eyed universally indictment, but now we see that the contagion is spreading in almost every conceivable bond cranny on a global basis. The contagion seems absolute in more clear fashion. At risk next are commercial mortgages and corporate bonds in the immediate crosshairs of trouble. Foreign banks are clearly affected in profound ways, the extent of which will have to be seen. French, British, German, Japanese, and Chinese banks have been harmed from ingesting falsely labeled food items. What was sold as ‘AAA' rated milk products was actually highly toxic acid, more suitable for cleaning automotive grease and other industrial coatings than entering delicate human digestive systems. Heck, that milk aint even homogenized, but rather has layers of fat, scum, heavy acid, even mold.

While US-based players and coaches display a cocky swagger that all will work out just fine, that credit supply will continue endlessly, foreigners might be in the early stages of calling for a boycott of US$-based financial assets. It started with subprime mortgages and their incredibly flawed credit derivatives called collateralized debt obligations. These CDO products are the wares of conmen, fraud artists, and hucksters. The next step is for other US$-based debt securities to face a gradual shun. Such bonds peddled by American shell game criminals cannot be trusted by foreigners who have valuable savings.

In 1999 they were burned with overpriced tech, telecom and dotcom stocks whose values were suspect, whose forward earnings guidance was absurd, whose PE ratios were lofty. In the case of the dotcom stocks, their value models were nonsensical, based upon eyeballs, clicks, and sticky websites, and not tried & true fundamentals. This bond debacle fraud perpetrated upon the world is 50 to 100 times larger, in an extreme display of financial crime worthy of the description, Weapons of Mass Destruction. The conspiracy among Wall Street, the US Federal Reserve, and Debt Rating Agencies involved the sale of asset-backed bonds which very clearly, vividly, and lethally constituted weapons that dole out mass destruction to banking systems. The most obvious victim is the US banking system, whose problems are far from over.

GOLD SURPASSES 700 MARKMany signals are flashing positive for gold lately. Gigantic futures options point to professionals anticipating a substantial move up in the gold price this autumn, probably early autumn. These bets are not placed by amateurs, and they do not stand as contrary indictors. Here were are, only three trading past the Labor Day holiday, and gold has jumped past 700. The 3-month USTreasury Bill yield remains a full 1% below 5.25% and the Fed Funds target. The corporate bond yield spreads are showing distress, the B-rated yield much higher than the AAA-rated yield. The USFed is stuck on policy. They must address the problem of overnight bank loan rates being out of whack, where money for intra-bank loans is too expensive to meet demand. Gold has responded also to statements made by the Euro Central Bank today, as they announced no rate hike, but stern vigilance for monitoring inflation. In other words, they stand ready to hike soon again. They nodded in respect to the USFed, giving their beleaguered colleagues a pass.

Gold should be viewed not so much with chart points from peaks last year. They disturb the pattern. In the last twelve months, two parallel trend channels are evident. Their trendlines are clearly defined, with touch points relevant from the last twenty months. We have a pathway for a march to new highs. Today gold jumped past the 700 mark easily. Hardly anyone noticed. That is actually great news for gold investors. Hype produces a peak price. The public will be involved later on, like when 775 is reached.

John Hathaway has been an inspiration to me over the past few years. In his recent work from late August “A New Chapter for Gold” (click here ), he points out how the weak hands have been flushed out of gold and mining stocks. Those who abused margin are out of stock positions. He judges the path for much higher gold price has been hewn. He fully acknowledges that the finance sector leads the USEconomy. Thus it is in trouble. He highlights how the homestead is a sacred cow, now endangered. Soon he expects home prices to be directly assisted with official policy.

He heralds the upcoming presidential election as an opportunity for easy money to be restored, which always hurts currencies and helps gold. He regards the current distress in financial markets as an order of magnitude worse than in 1998 when the LongTerm Capital Mgmt blew up and was rescued. He cites the troubles for gold mining firms, such as heavy government interference, worker strikes, higher costs, and more challenging ore deposits. My past work has analyzed how the cover of hedge books diverts important funds from operations. Money should go into producing ore and refining it to bullion. These factors all fortify the argument that gold supply is extremely inelastic. Higher gold prices have not resulted in higher gold output!!!

CONTAGION WILL SPREADThe contagion is absolute. The only varying parameter is the level of ingestion and acceptance of acidic mortgage bonds into foreign bank systems. The Arab nations were the smart guys, since they bought none. The Chinese were the dupes, since they bought a mountain of them, inexperienced in managing huge trade surpluses. They will learn fast. The Europeans, being of similar ethnic and genetic strain, having decades of trusted successful encounters with their colonialist cousins, also bought a raft of them. In the eyes of foreigners, the con game has roots extended way back in time. The Americans conned foreigners into buying USTreasurys back in the 1970 decade, as interest rates soared past 10%. There has always been a general motive to participate in the American Engine of global economic growth.

However, in the latest two rounds of pure premeditated calculated (unprosecuted) criminal bond peddling, the degree of the fraud is orders of magnitude greater. No justice will be meted out. The criminals are the henchmen to the USGovt itself, which might include the Dept of Treasury (aka Goldman Sachs), the US Federal Reserve (aka JPMorgan), who together control the levers like the Securities & Exchange Commission, the Commodity Futures Trading Commission, and the Debt Rating Agencies. The level of incest and collusion is suffocating. Foreigners cannot expect to have any restoration of losses due to misrepresentation and concealed mislabeling of products. They will resort to what they can do, stop buying bonds.

Foreigners will next reconsider the purchase and investment of other US $-based bond securities. That is their only recourse in pursuit of justice from a nation which has declared before the world that treaties do not apply to them, laws even from a Constitution are to be scoffed at, and world institutions are designed to exploit for US gain. My perspective of the USGovt and USMilitary working in coordinated fashion toward a protection racket has been described. Shadowy US agencies play a key role. The current Administration goes so far as to boast they are capable of producing their own reality. Well, the rest of the world can oblige with an exercise of the Third Law of Thermodynamics, that every action is met by an equal and opposite reaction.

Hegemony laced with fraud might be met by an international boycott of US$-based bonds, hidden at first, revealed as a broad strategy later, and finally boasted as a badge of honor farther down the road. Like the Roman Empire , the implosion is home grown. Its similar empire collapse has causes too numerous to cite, many beyond the scope of finance. The core source of the problem is false money, reckless management of money growth, dishonest sale of debt, compromised regulatory agencies, a central bank whose function has become to create inflation which produce bubbles. Our central bank has corrupted the monitor of monetary effects as in statistics, and fostered economic dependence upon monetary and debt inflation. The long-term victims of the colossal mismanagement have been both American workers and US industry. The standard of living has been led downhill by business capital investment overseas. Declining wages follow naturally. The factories have been dispatched to the Pacific Rim in the 1980 decade, the Mexican corridor in the 1990 decade, and the Chinese mainland in the 2000 decade.

Something big this way comes, and to American financial and economic managers, it aint gonna taste good. It is a reaction from Economic Mother Nature. Abuse of the custodial role for the world reserve currency invites retribution. The Wall Street hucksters were well aware of the foreign pipelines to recycle trade surpluses into US$-based securities. They exploited the situation for private gain, tapping into vast pools of legitimate savings, intentionally misleading the risk associated. Those who believe the entire broad multi-year promotion, sale, and purchase exercise was not loaded with fraudulent intent probably believe USGovt economic statistics, believe Wall Street analyst reports, believe USFed position statements, maybe even believe the JFKennedy lone gunman theory, and believe the 911 Commission report. The response from foreign financial organizations of diverse type will likely be a shun, a revulsion, even a boycott of many kinds of US$-based bonds.

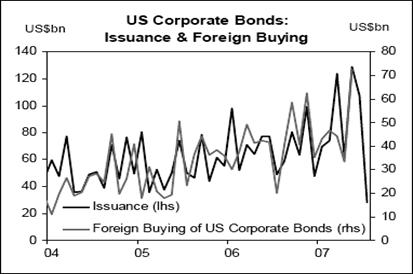

The first obvious US bond to be avoided has been mortgage bonds. No longer can they be trusted, when subprime garbage was mixed in to produce banking system hairballs large enough to cause seizures. If Wall Street insists on packaging various types of asset-backed bonds into aggregated securities, foreign investors will just say NO. Mortgage funding will be curtailed for US home buyers. To some extent corporate bonds will suffer from funding inadequacies, for two reasons. They too are mixed into CDO securities. They suffer when the USEconomy falters. The USEconomy will falter like night follows day, with the only variable of uncertainty being the length of day. Commercial mortgage bonds soon will be dragged down by the inevitable slowdown in the USEconomy. Car loans and credit card finance also depend upon the same source of funding. Notice the severe drop in foreign purchase of US corporate bonds, to nearly nil.

Lastly, the USTreasury Bonds are at risk. The entire story of a ‘Flight to Quality' has been yet another desperate distortion. To be sure, some migration has been seen from stocks to bonds, from the large cap S&P stocks to the USGovt bond securities. The sudden move in 3-month TBill yield well below 4.0% a couple weeks ago, only to recover above 4.0%, testifies to big flight into some desired haven. My personal conjecture is that the Plunge Protection Team gave a big assist to the migration into 3-month TBills, but misjudged the stock market's own desire.

The result was an over-reaction. Confirmation of the false billboard message of a supposed flight to quality can be seen in the truly pathetic lousy ‘Bid to Cover' for public auctions of new and recycled USTreasury debt. Such low bid levels have not been seen in over a decade. The public bond dealers were not in any way involved in any massive initiative to purchase USTreasury Bonds which offered supposedly safe haven!!!

In the last two years, the Asians have virtually halted USTBond purchase with recycled trade surpluses. Broad deep and pervasive regional capital investment within Asia has paid off handsomely. The United States could learn much from Asians about investment in businesses to serve consumer needs and to generate jobs. In time, like the US did at the turn of the 1900 century, the Asians will learn to instill product controls through proper regulation. Instead, the primary fostered industries in the USEconomy have been in support of the war machine.

It is ironic that the US sold China toxic bonds while China sold the US poisoned animal food and toys! Arguments of systemic benefit from wartime dominance, emphasis, and stimulus simply deny the realities of the last few wars, all of which have helped to wreck official US financial balance sheets. Wartime stimulus might lift the USEconomy out of recession, but they guarantee the next recession from an even weaker position with more dismantling of the manufacturing base. A bad lesson was learned after World War II.

The exception of China , regular investors of USTBonds and more, is likely not to continue much longer. They prefer to keep loading their sovereign investment fund in lieu of continued nobrainer USTBond and Agency bond purchases. By this time next year, their sovereign fund should reach the $2000 billion mark. They are vocal about USDollar risk as a major concern. They are acutely angry at the brewing trade disputes, easily worsening to become a trade war. China will be using the USTBond sale as a weapon to an increasing degree. The have reduced USTBond investment holdings steadily since early summer. This trend will continue. The Persian Gulf nations have stuck with the USGovt, more out of obligation than any great fraternal love or deep cultural meld or broad economic partnership. For commerce, Arabs and Iranians prefer to do business with Europe . The purchase and dependence of OPEC crude oil does not constitute a vastly integrated marriage of economies. Even that is in the process of changing. Persian Gulf nations must react to the tight US$ peg which has opened the door to price inflation.

The foreign appetite for USTreasury Bonds is next in line to suffer an important historical backlash. When Asians no longer roll trade surpluses into USTBonds, one major pillar is removed upon which the USTBond structure rests. When Persian Gulf nations respond to their own inflation infection directly related to the US $ peg, with diversification being the remedy, a second major pillar is at risk of removal for the same USTBond structure. The last pillar is but a central artery of USDollar supply flowing from a printing press pockmarked by metastasized cancer bodies. Such a central pillar is more like a spongy channel laden with bubbles which can support no more weight than shifting sand does a house foundation.

To compound matters, when the USEconomy slows and hits the brick wall in a matter of a few weeks or few months, the USDollar will lose its attractiveness, with or without official USFed rate cuts. Domestic US investors will flock from stocks to bonds in the usual parade. However, foreign investors take an entirely different view. They will expect to be required to finance ever-growing burgeoning USGovt debt. They will regard the USEconomy as constricted from credit supply problems, stalled out home equity extractions, heavily reliant upon credit card extensions in last resort, adrift amidst a housing market in decline, and absent key factory industries. Having more balanced economic structures with actual diverse industries, foreigners will quickly conclude the USEconomy is crippled and beyond remedy. THEY WILL DEEM THE USDOLLAR AS A SUBPRIME CURRENCY, AND ITS OBVERSE THE USTREASURY AS A SUBPRIME BOND. The process of downgrading US$-based bonds has started with mortgage bonds, and will continue down the risk ladder to other bonds.

The gradual penalty for exporting debt inflation over the course of a few decades is compromised sovereignty and vulnerability to credit supply interruptions. Far from the harmless effect of selling debt to ourselves, the accumulative effect has been to erode the US sovereignty itself, while relegating the USDollar to Third World currency status. The most ridiculous of self-inflicted wounds have come from the current trade sanctions directed by the US Congress against the Chinese. Imagine slapping the face of a key credit master! The Administration, whose finance function is led by Goldman Sachs and its icon Henry Paulson, sees greater wisdom in working with the Chinese, especially when vast Wall Street IPO fees lie on the table from giant stock issuances. So one branch of the USGovt has corrupted its decisions. Another branch has rendered its decisions as destructive. So two political parties offer corruption and destruction, not much choice!

US FED CORNERED LIKE A RATThe test for USFed Chairman Ben Bernanke has come. The Treasury Bond market is ordering him to cut official interest rates. The stock market eagerly awaits a return to easy money, lower bond yields, and favorable earnings yields comparisons to bonds. He seems acutely unaware of the depth of the commercial debt interruption and its guaranteed detrimental effect on US corporate production of goods and services. The corporate finance pipeline has hit a wall. Corporate paper, as it is called, is not well understood. Good companies are having trouble finding adequate funds.

It reminds me of a teenager who has a large object like a toy or bone or sock lodged in his throat. Dr Bernanke insists that the boy has not turned blue in the face yet, so no action is necessary. This crew of USFed minions has lost its way, unable to use any compass. With only one year under his belt, Little Ben has only a little less experience than most other Fed Governors. This absence of basic tools renders them as more incapable than colonial explorers, blind without scouts, lost without direction, in hostile lands with natives brandishing hatchets and knifes.

Then again, recall that the USFed acts as agent for the USGovt to sell bonds. So they harbor a little publicized vested interest in favor of recession since economic downturns favors the sale of bonds over stocks. No longer in recent weeks has the USFed focused its commentary on price inflation. Their endlessly analyzed verbage is more tilted toward economic risk. Their bias has changed away from price inflation. Committee white papers seem in crystal clear fashion to pave the way for an official rate cut. The discount rate cut usually is prelude to an official cut. Recall, when the USFed begins to cut rates, it does not cut only once. A new cycle begins. Gold will rejoice, but so will crude oil. The same are true for silver and natural gas.

This USFed needs some cover, some excuses, to justify their next inevitable rate cut. Gold and crude oil smell it, each priced in opposite correlation to the USDollar. The USFed might want to permit a stock decline in the Dow and S&P500 indexes, so as to lay the responsibility on the markets. Worse, lacking forecasting skill beyond high school mediocrity, the USFed might wait until they see the ‘whites of the eyes' for economic recession. They lack any forecasting prowess, having turned away from legitimate tools, fully reliant upon doctored distorted destroyed economic statistics. The best economic forecasters in the USGovt domain lie hidden in ignored offices and agencies, as they serve no purpose. By the time the USEconomy shows the serious stumble the Fed & minion Governors require, the medicine they administer with lower rates will be too little, too late. The rescue that comes from an official rate cut will offer a lift to the stock market in an immediate sense, NOT THE ECONOMY. Much dispute has been heard over whether a lower interest rate will do much to help housing and what ails mortgage bonds.

My view is lower rates will do nothing to stop the housing bear market for another two years. The associated mortgage bond debacle will be dictated by this decline. Little can or will be done to help ruined home owners. They are setting foreclosure records. They have no vote on Wall Street. The surprise in the next couple months, after an official interest rate cut by the cornered USFed, might be the rise in the long-term USTreasury Bond yields. The door will be opened to systemic price inflation in a big way. Good riddance to the inverted Treasury Yield Curve. It served the financial markets well, in offering nothing but confusion. Let the next chapter on gold be written.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

“My subscription is worth double what I pay. Once for the economic analysis, and once for the education in wordsmithing! I am coming to value the second one the most, as your alliteration and parable-esque style keeps me smiling even as you write about the walls crashing down!” (MichaelH in Georgia )

“I want to congratulate you and thank you for your quick and frankly stated revision on bonds [the 4.0% forecast]. That was my thinking all along, but I must say that your writing was and continues to be a most valuable input to my thinking in the first place. That type of integrity makes me value your opinion all the more and is likely to keep me as a loyal subscriber for years to come.” (ScottD in Pennsylvania )

“I am staggered by the depth and breadth of the information I now have access to in your newsletter. Just one problem, I cannot put my computer down. Reading your current reports and catching up on earlier editions you make available in your ‘library' is dominating my mornings, afternoons and evenings!” (DavidR in England )

“I believe your wit and disgust at the state of affairs stand untouched.” - (Charlie P in Virginia )

“I am currently subscribed to over 60 paid newsletters. Your analysis is by far the most accurate every time. The most impressive characteristic of your thought processes is your ability to think in multi-factorial terms. You are one of the few remaining intellectuals with such capacity intact.” -(Gabriel R in Mexico )

By Jim Willie CB

Editor of the “HAT TRICK LETTER”

www.GoldenJackass.com

www.GoldenJackass.com/subscribe.html

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise like a cantilever during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by heretical central bankers and charlatan economic advisors, whose interference has irreversibly altered and damaged the world financial system. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. A tad of relevant geopolitics is covered as well. Articles in this series are promotional, an unabashed gesture to induce readers to subscribe.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 24 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.