Short Squeeze in Coffee and Sugar Could Soon be Seen in Gold and Silver Market

Commodities / Gold and Silver 2010 Jun 29, 2010 - 07:48 AM GMTBy: GoldCore

Gold rose to nearly touch its record nominal high of $1,264/oz yesterday and reached a new record London PM fix at $1,261/oz at 1500 GMT. Gold then came under severe selling pressure despite no ostensible market moving data. Gold has traded sideways in Asian and early European trading despite stock markets falling on renewed risk aversion. European debt and funding concerns remain and are being added to by concerns about the economic recovery. China's stock market fell a very sharp 4% overnight on growth concerns and this has contributed to risk aversion.

Gold rose to nearly touch its record nominal high of $1,264/oz yesterday and reached a new record London PM fix at $1,261/oz at 1500 GMT. Gold then came under severe selling pressure despite no ostensible market moving data. Gold has traded sideways in Asian and early European trading despite stock markets falling on renewed risk aversion. European debt and funding concerns remain and are being added to by concerns about the economic recovery. China's stock market fell a very sharp 4% overnight on growth concerns and this has contributed to risk aversion.

Gold is currently trading at $1,236/oz and in euro, GBP, CHF, and JPY terms, at €1,014/oz, £821/oz, CHF 1,342/oz, JPY 109,613/oz respectively.

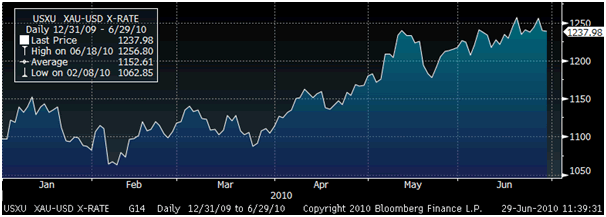

Gold in USD

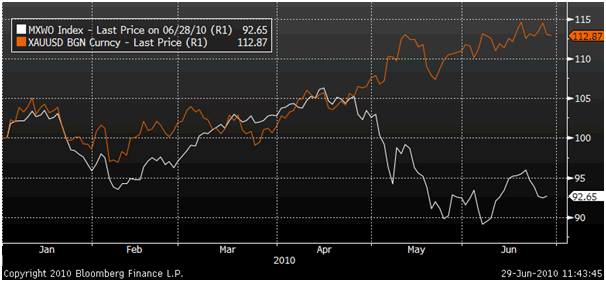

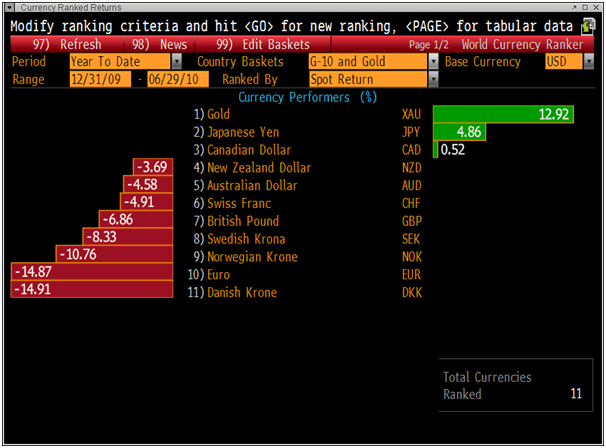

Bullion is on course for its biggest quarterly advance since the final three months of 2007 and has gained 13 percent this year, reaching a record $1,265.30 an ounce on June 21. Gold has outperformed the benchmark MSCI World Index by some 20% so far in 2010 (see chart below) and this outperformance was particularly noticeable in the last quarter. Gold has also been the top performing currency so far in 2010 with only the Japanese Yen showing gains and most currencies, especially the euro falling sharply (-14.87%).

Gold and the MSCI World Index.

The euro was under pressure today, slipping against the yen and holding near its latest record low against the Swiss franc and gold as funding concerns in the eurozone made investors nervous. Funding pressures in the eurozone on concerns ahead of bank repayments to the European Central Bank this week as well as debt auctions, were keeping investors wary.

G10 and Gold Currency Rankings - YTD.

Sugar prices surged more than 6% to a three-month high yesterday as futures players who had bet on falling prices rushed to buy back their contracts in a classic short squeeze. Sugar for immediate delivery remains scarce on the back of an international scramble to rebuild depleted inventories. This has pushed spot sugar prices to a premium above forward contracts. There are rumours that two large trading houses were holding on to long positions to take physical delivery after the expiry of the contract on Wednesday. A short squeeze is also taking place in the coffee market as prices for high-quality beans have hit 12-year highs forcing hedge funds to deliver on contracts they had sold in recent years betting on a fall in coffee prices.

There are risks that a similar short squeeze could develop in the gold and silver markets particularly if larger participants decide to take delivery of bullion. The physical gold and silver market remain very small versus their respective futures market and even a small trend towards larger players taking delivery of their bullion from the COMEX could lead to sharply higher prices.

Silver

Silver is currently trading at $18.52/oz, €15.19/oz and £12.30/oz.

Silver in USD - YTD.

Platinum Group Metals

Platinum is trading at $1,560/oz and palladium is currently trading at $465/oz. Rhodium is at $2,500/oz.

News

Gold will surge to $1,500 an ounce by the end of 2011, Bank of America Merrill Lynch said, maintaining a forecast made shortly after Lehman Brothers Holdings Inc. collapsed in September 2008. "We have been bullish on gold for over one and a half years, and we still like gold," Francisco Blanch, Merrill's head of global commodities research, said today in an interview in New York. Before today, gold gained 15 percent this year, reaching a record $1,266.50 on June 21, partly on demand for a hedge against the euro amid Europe's debt woes. This month, gold also reached all-time highs in euros, U.K. pounds and Swiss francs. "Gold is attractive not just because it's an inflation hedge," Blanch said at a press conference. "It will remain a safe haven as long as sovereign fears continue to climb." The metal will average $1,200 in 2010 and $1,350 next year, Merrill has forecast. This year's average is $1,153.61 (Bloomberg).

Vietnam exported an estimated 36 tonnes of gold in the first half of 2010, according to new figures.The data from the country's General Statistics Office show that total precious metals, precious stones and products export revenue amounted to $350 million (£233 million) in June, the second month in a row in which sales reached such a high, VietNamNet Bridge says based on a Dau Tu Chung Khoan report. Commenting on the figures, Vietnam Gold Traders' Association deputy chair Huynh Trung Khanh noted that just seven to eight tonnes of gold had been imported earlier this year. "This shows that Vietnam has been profiting from import deals and that exports could bring a high sum of foreign currencies to Vietnam," he commented. Do Xuan Quynh, manager at Bao Tin Minh Chau, recently told the Financial Times that demand for gold is growing in Vietnam because there are few other investment channels available to buyers. He predicted that Vietnamese gold consumption could rise by up to 50 per cent this year (World Gold Council).

A majority of Germans wants to scrap the euro and bring back the old currency, the deutschemark, according to a new poll. The Ipsos survey showed 51 per cent of people in Europe's top economy wanted their beloved deutschemark back, with 30 per cent wanting to keep the euro. The remainder was undecided (AFP).

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.