Gold Tentatively Consolidates Above $1,200/oz on Asian Demand

Commodities / Gold and Silver 2010 Jul 06, 2010 - 08:22 AM GMTBy: GoldCore

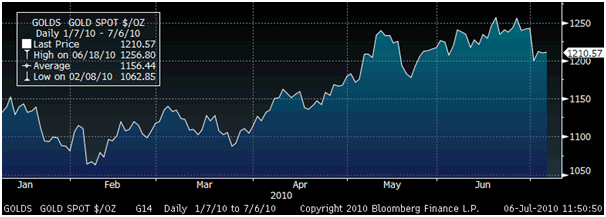

Increased risk appetite has seen equities in Asia and Europe rally strongly and gold appears to be tentatively attempting to consolidate above support at $1,200/oz. Resistance is at $1,250/oz and the record nominal high of $1,265/oz. Below $1,200/oz gold could fall to support at $1,175/oz and $1,140/oz but gold would be well supported at these levels which would likely see significant physical demand recommence. A fall to such low levels would likely be a paper driven, futures market sell off as physical demand is already being seen at these levels with demand noted in China and especially from Indonesia and Thailand.

Increased risk appetite has seen equities in Asia and Europe rally strongly and gold appears to be tentatively attempting to consolidate above support at $1,200/oz. Resistance is at $1,250/oz and the record nominal high of $1,265/oz. Below $1,200/oz gold could fall to support at $1,175/oz and $1,140/oz but gold would be well supported at these levels which would likely see significant physical demand recommence. A fall to such low levels would likely be a paper driven, futures market sell off as physical demand is already being seen at these levels with demand noted in China and especially from Indonesia and Thailand.

Gold is currently trading at $1,207.20/oz in USD terms, and €960.15/oz and £796.10/oz in euro and GBP terms respectively.

Gold in USD - 6 months (Daily)

Equities have broken down technically and commodities such as oil and copper have been correlated with equities and have fallen also (see News below). The Baltic Dry Index, a measure of commodity-shipping rates, fell 2.8 percent yesterday for a 27th consecutive retreat, the longest losing streak since August 2005 and it is now down nearly 50%. This key indicator of global economic health is flashing a serious warning signal about the prospects for the global economy which it would be unwise to ignore.

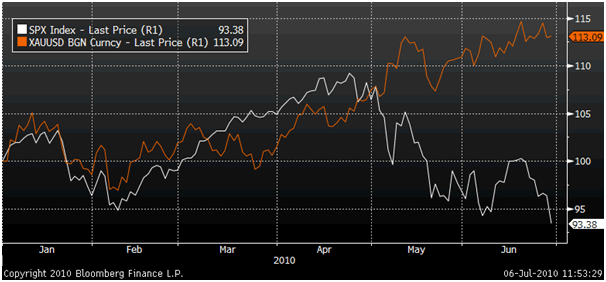

Gold in USD and the S&P 500 - 6 months (Daily)

While gold has shown periods of being correlated with equities in the short term, it has been uncorrelated in the medium term and in the long term, both recently (see chart above) and historically. More volatility and falls in equity markets could see leveraged gold players go to cash and see further falls in the gold price but would also create safe haven demand for physical which would again be supportive.

Silver

Silver is currently trading at $17.79/oz, €14.15/oz and £11.73/oz.

Platinum Group Metals

Platinum is currently trading at $1,516/oz and palladium at $436/oz, with rhodium at $2,325/oz.

News

The London Metal Exchange and LCH.Clearnet Ltd. will start a clearing service for trading gold over-the-counter in November.Contracts to be cleared will be through the LME and matched trades submitted to LCH.Clearnet for clearing, the LME said in a statement on its website today (Bloomberg).

Commodity prices are tracking swings in equities more closely than at any time on record, undermining the traditional role of investments in raw materials as a hedge against financial-market volatility, Commerzbank AG said. The CHART OF THE DAY shows the correlation between the S&P 500 Index of U.S. equities and Reuters/Jefferies CRB Index of 19 raw materials grew as investors boosted commodity holdings on prospects of rising Asian demand. Inflows into structured notes, and exchange-traded and commodity-index-linked funds reached $8.6 billion in May, the second-highest on record, taking assets under management to $291 billion, Barclays Capital said. "Investors are looking to diversify their holdings and are likely to trim their investments in commodities should the strong correlation between commodities and equities continue," Commerzbank analyst Eugen Weinberg said. "It has been at a record high in the past months. Investors are looking for de- correlated assets in their portfolios to reduce risks" (Bloomberg).

The euro has been on fire lately, today threatening to break solidly above $1.26. But pay no mind to that. According to the world's top analyst (and several who are close), the euro is still bound to tank. Shaun Osborne, chief currency strategist at TD Securities Inc. in Toronto, said the euro will depreciate to $1.13 in the third quarter, $1.08 by year-end and may near $1 in 2011 before recovering. Osborne, whose predictions were within 4.1 percent of the mark on average, according to data compiled by Bloomberg, was echoed by the nine following most-accurate forecasters anticipating a lower euro in the next two quarters. For what it's worth, we suspect there's a lot of trend-following and herding going on here, and that if the euro were to continue its run, we'd see these projections change pretty quickly. Even before this recent spike, there's clearly been a change in investor sentiment, as major names have revealed themselves as euro bulls (Jim Rogers is a good example of one) (Business Insider).

Soaring prices for cocoa have sparked allegations of manipulation in the London market from a group of European processors and traders who are threatening to turn to alternative venues for their hedging needs. In a letter sent to NYSE Liffe, the global derivatives business of NYSE Euronext, 16 cocoa companies and trade associations have complained that "a manipulation of the contract" was "bringing the London market into disrepute". Cocoa prices have risen 150 per cent since the start of 2008 as demand has outstripped supply year-after-year on the back of disappointing crops in Ivory Coast, the world's largest producer. The July Liffe cocoa contract, which expires next week, jumped almost 5 per cent to a peak of £2,625 a tonne on Thursday, its highest in nearly 33 years.

The chocolate industry faced a double-whammy of soaring cocoa prices as well as falling demand from consumers as the economic downturn prompted many to cut purchases (FT).

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.