Signs of Cooling U.S. Economy in ISM and Jobs Data

Economics / US Economy Jul 06, 2010 - 11:22 AM GMTBy: Mike_Shedlock

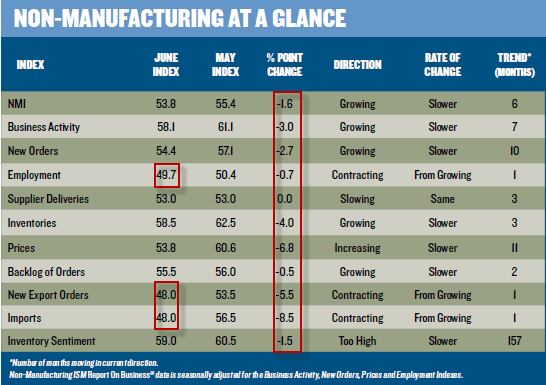

In yet another sign the economy is cooling substantially, three components of the June Services ISM are now in contraction, with the overall index declining much faster than economists expected.

In yet another sign the economy is cooling substantially, three components of the June Services ISM are now in contraction, with the overall index declining much faster than economists expected.

From the June 2010 ISM Report On Business:

In June, the NMI registered 53.8 percent, indicating continued growth in the nonmanufacturing sector for the sixth consecutive month, but at a slightly slower rate than in May. A reading above 50 percent indicates the non-manufacturing sector economy is generally expanding; below 50 percent indicates the non-manufacturing sector is generally contracting.

Employment activity in the nonmanufacturing sector contracted in June after one month of growth. ISM’s Non-Manufacturing Employment Index for June registered 49.7 percent.

Orders and requests for services and other non-manufacturing activities to be provided outside of the United States by domestically based personnel contracted in June after three consecutive months of growth.

ISM’s Non-Manufacturing Imports Index contracted in June after three consecutive months of growth.The above link also contains the Manufacturing ISM.

Recovery Withers on the Vine

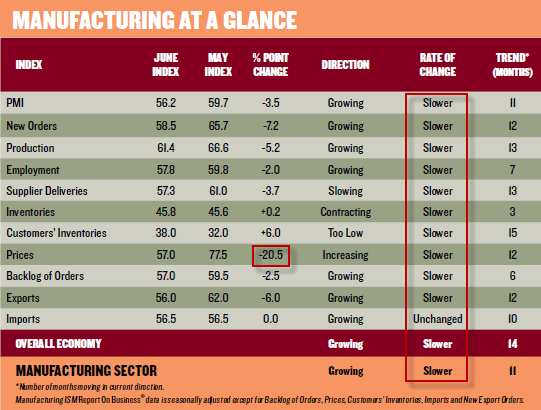

There is really not much to like in either of the ISM reports.

Inquiring minds also note Factory Orders Fall More Than Expected; Recovery Withers on the Vine

You should not have to be a genius to figure out the rebound in manufacturing was a result of four factors now withering on the vine.

- Inventory replenishment

- Unsustainable stimulus

- Housing incentives pushing demand forward on appliances

- Rebound in auto sales from extremely depressed levels

Is Europe going to lead the world recovery? China? US Consumers?

The answers are No, No, and No

Manufacturing was the one bright spot but its best days are now long gone. Moreover China Manufacturing Slows for Second Month; US ISM Weaker than Expected; Weekly Unemployment Claims Stubbornly High; Existing Home Sales Plunge

Budgetary Murder

This depression (and we are in one, masked only by safety nets galore), is The Price We Pay For Budgetary Murder.

Unfortunately, the budgetary murder continues unabated, and that will prolong this depression.

Japan is in its mess because of Keynesian and Monetarist stimulus, we are in this mess because of Keynesian and Monetarist stimulus, and the UK is in its mess because of Keynesian and Monetarist stimulus. Yet the Keynesian clowns want more Keynesian stimulus and the Monetarist clowns want more Quantitative Easing.

No policy ever performs badly enough to cause its disciples to abandon it.Manufacturing ISM vs. Non-Manufacturing ISM

Of the two reports, Non-Manufacturing ISM is the more important. Here are a couple of key points from a Video Discussion by Bloomberg Economist Rich Yamarone about the Services ISM.

1. 55% of all consumption is services based

2. Private employment is well over 85% in services

Contracting services employment is a big thing. Yamarone noted that contracting employment will affect consumer attitudes which in turn will affect consumer spending.

Actually, consumer attitudes affect consumer spending which in turn affects business hiring plans. Attitudes lead the way.

This report was weakest where it matters most: employment, imports, and exports.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.