21st Century Gold Rush

Commodities / Gold and Silver 2010 Jul 08, 2010 - 02:37 AM GMTBy: GoldSilver

With the prices of gold and silver rising and more currency flooding into the mining industry, won't supplies of gold and silver rise? Is there a potential for such a rise to outstrip demand?

With the prices of gold and silver rising and more currency flooding into the mining industry, won't supplies of gold and silver rise? Is there a potential for such a rise to outstrip demand?

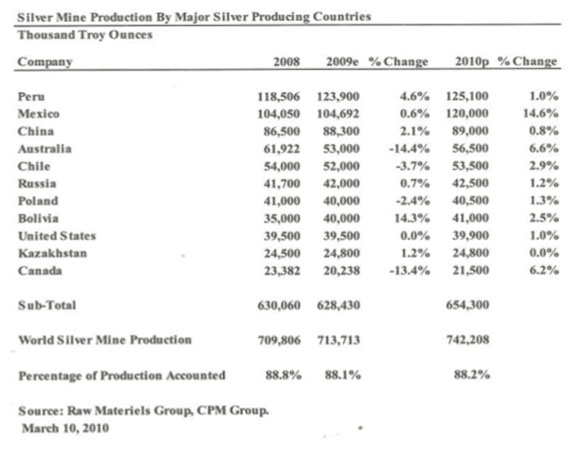

Production capacities are not likely to be expanded in the short run. Higher costs for energy, personnel, and environmental regulations have helped to offset the increase in both gold and silver prices.

Easily extractable gold and silver is nearly nonexistent, consequently mining deeper into the Earth for reserves is more difficult and expensive.

"Everybody stopped teaching hard rock mining in schools. Over the past 20 years, all of the classes that used to teach this have disappeared. Even if you do have this big gold rush, who's going to show you how to dig it up? When the price got suppressed below mining costs it caused all the schools to stop teaching hard rock mining because there wasn't any market for it. It takes about five to seven years to go from discovery to production, even if you do have the geologists!" -Mike Maloney

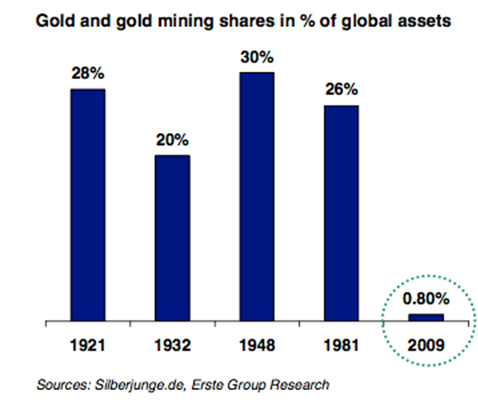

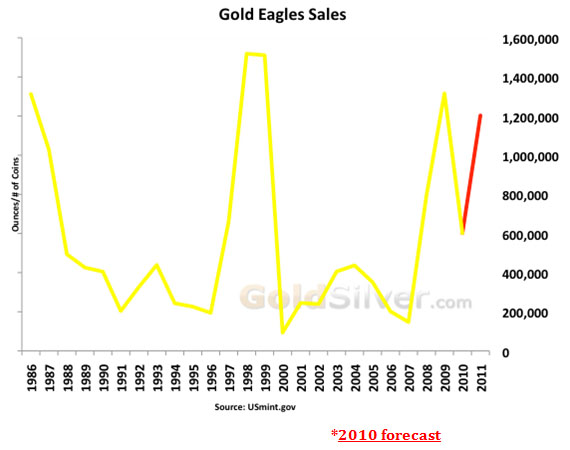

Governments, institutional investors, public funds, and many oil producing countries are still underweight in gold reserves. Investment demand should continue to outstrip investment supply in the near term.

The remonetization of gold has begun for it is not uncommon now to see both the US dollar index and the gold price appreciate simultaneously.

Geopolitical risks continue to mount in Iran, Pakistan, Korea, and Afghanistan. The world seemingly teeters one missile launch away from a potential doubling of oil prices, making safe havens tangible investments like physical gold and silver must haves.

Silver and gold stand as historic financial bedrocks in both inflationary and deflationary environments.

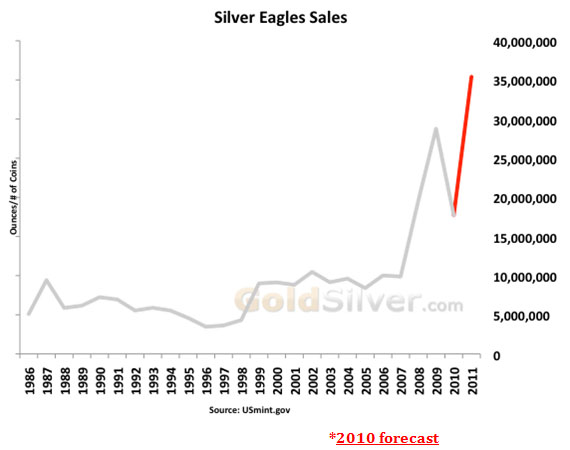

Silver Eagle coins are to be struck using newly mined silver obtained from domestic mining, meaning the coins are to consist of silver newly mined within the United States.

Investor demand is on pace for more than 36,000,000 Silver Eagles to be struck and sold in 2010. In the USA we mine roughly 40 million ounces of silver annually, this means we are on pace to use 90% of this year's domestic silver production for Silver Eagle investment demand alone!

The public is hardly aware of the silver story yet Silver Eagle sales are reaching their legal supply threshold. It is our firm belief that in the coming years ahead, shortages of physical silver and gold will become the norm, not the exception.

Those who hold physical gold and silver bullion coins and bars should greatly benefit.

To us as investors, what means the absolute most as we prepare for the inevitable increase in prices?

The total amount of ounces of silver and gold we hold.

The question we suggest everyone ask of themselves is “How many ounces do I currently hold and is this enough?”.

- Mike Maloney

Mike Maloney is the owner and founder of GoldSilver.com, an online precious metals dealership that specializes in delivery of gold and silver to a customer's doorstep, arranges for special secured storage, or for placement in one's IRA account. Additionally, GoldSilver.com provides invaluable research and commentary for its clients, assisting them in their wealth building endeavors.

© 2010 Copyright GoldSilver - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.