Potholes in the Economic Recovery, U.S. GDP Forecast

Economics / US Economy Jul 10, 2010 - 06:27 AM GMTBy: Paul_L_Kasriel

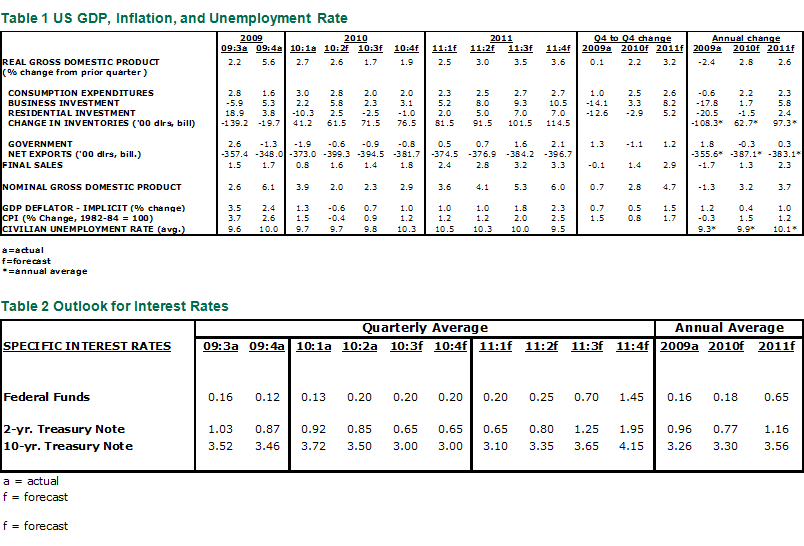

For various reasons that will be discussed below, we are lowering our 2010 real gross domestic product (GDP) forecast. At the same time, we are publicly unveiling our 2011 forecast - admittedly not nearly as anxiously awaited as LeBron's revelation. For the second half of 2010, we now are projecting annualized real GDP growth of 1.8% versus our May forecast of 2.5%. This lower second-half projection and the Commerce Department's revised lower first quarter growth reduces our Q4/Q4 2010 real GDP growth forecast to 2.2% versus May's forecast of 2.7%. As a result of our reduced 2010 real GDP growth projection, the forecast for the unemployment rate has been increased. For Q4:2010, we now place the average unemployment rate at 10.3% versus the May forecast of 10.0%. Our Q4/Q4 2011 forecast for real GDP growth is 3.2%.

For various reasons that will be discussed below, we are lowering our 2010 real gross domestic product (GDP) forecast. At the same time, we are publicly unveiling our 2011 forecast - admittedly not nearly as anxiously awaited as LeBron's revelation. For the second half of 2010, we now are projecting annualized real GDP growth of 1.8% versus our May forecast of 2.5%. This lower second-half projection and the Commerce Department's revised lower first quarter growth reduces our Q4/Q4 2010 real GDP growth forecast to 2.2% versus May's forecast of 2.7%. As a result of our reduced 2010 real GDP growth projection, the forecast for the unemployment rate has been increased. For Q4:2010, we now place the average unemployment rate at 10.3% versus the May forecast of 10.0%. Our Q4/Q4 2011 forecast for real GDP growth is 3.2%.

Before getting into the reasons for downgrading the 2010 GDP forecast, we think it is important for investors to realize that this past recession and current recovery are of a different nature than most others in the post-war era - an exception being the recession/recovery/expansion of 1990-93. Most postwar recessions were brought on by the Federal Reserve intentionally tightening monetary conditions in order to extinguish undesired increases in the prices of goods and services. In this event, the nonfinancial sectors of the economy bear the brunt of monetary policy tightening. However, the financial sector, although also adversely affected, remains able to resume credit creation when the Fed adopts an accommodative policy after goods/services price increases moderate. The Fed lowers its policy interest rate, in effect providing cheaper credit to the financial sector, which, in turn, provides cheaper credit to the private nonfinancial sector. Credit growth created by the private financial sector picks up, growth in private sector spending picks up, and a robust recovery ensues.

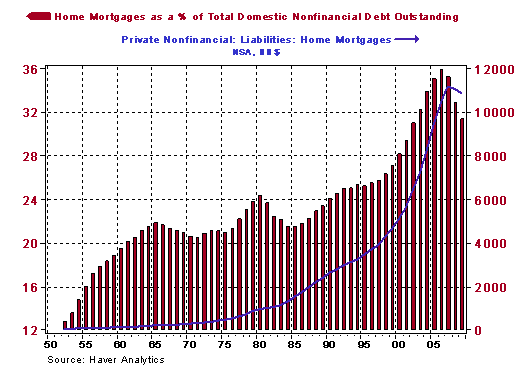

Although the onset of the recent recession unfolded in a similar fashion as described above - the Fed intentionally tightening monetary conditions to restrain undesired increases in the prices of goods and services - the financial sector was more adversely affected in the recent recession than in prior ones. Of course, the reason for this was the post-war unprecedented decline in residential real estate prices. With home mortgages outstanding rising to both absolute and relative record highs in this past cycle (see Chart 1) and with the value of the collateral backing this debt falling precipitously, the financial sector experienced its biggest losses in the post-war era. These losses, which resulted in the massive "evaporation" of capital, rendered the financial sector unable to create net new credit for the private nonfinancial sector when the Fed slashed the cost of its credit.

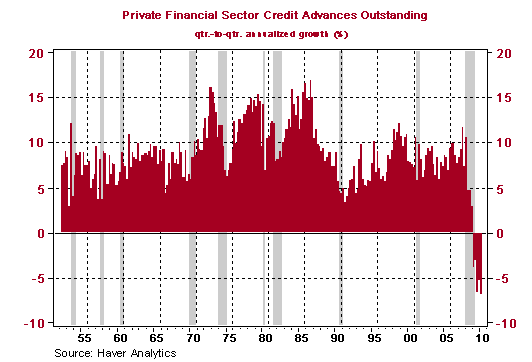

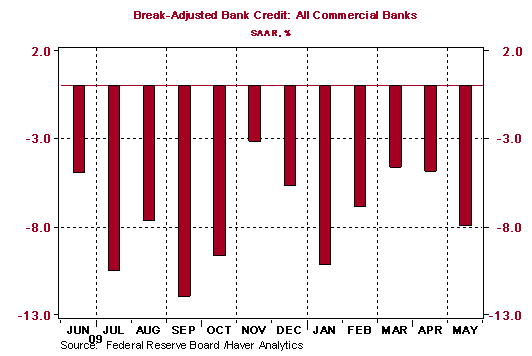

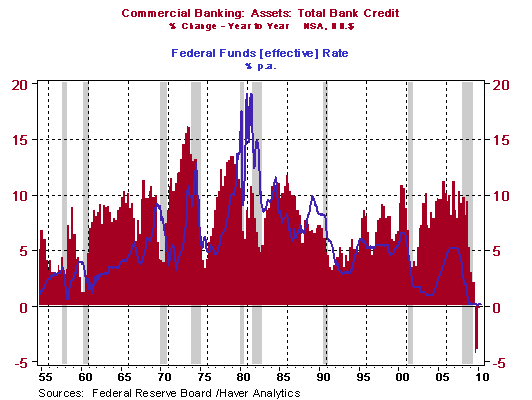

Chart 2 shows that starting in Q1:2009 and continuing through Q1:2010 (the latest data point available) outstanding loans and investments on the books of private financial institutions contracted. In prior post-war recessions, loans and investments slowed in their rate of growth. But this is the first instance of an outright contraction in private financial sector issued credit. Judging from the annualized rate of contraction in bank loans and investments of 4.9% in April and 8.0% in May (see Chart 3), private financial sector credit creation likely contracted again in the second quarter of this year.

Chart 1

Chart 2

Chart 3

What all this means is that the transmission mechanism between the Federal Reserve and the nonfinancial sector of the economy is malfunctioning. The Fed is revving up the monetary engine, but these high rpms are not being transferred to the wheels of the economy. With regard to the revving up of the monetary engine, the Fed has reduced its effective policy rate to a level below 0.25% and has increased the amount of assets on its balance sheet from $877 billion at the end of 2007 to over $2.3 trillion today. Under normal circumstances, if the private financial system were functioning properly, this cheap and abundant Fed credit would have been transformed into cheap and abundant credit for the private nonfinancial sector. But this is not happening because the private financial sector monetary transmission mechanism is malfunctioning.

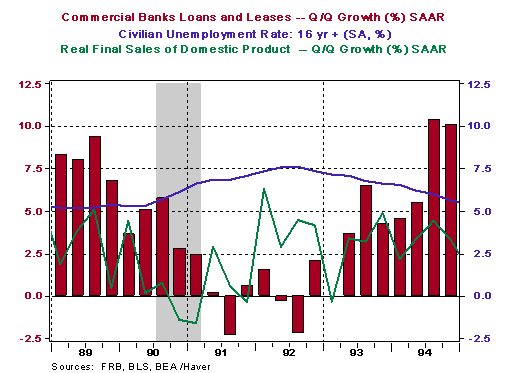

Qualitatively, but not of the same magnitude, the private financial sector transmission mechanism also was malfunctioning in the early 1990s. The commercial banking system incurred relatively large losses associated with falling commercial real estate values in the late 1980s. Because of capital constraints resulting from these losses, banks could create relatively little credit for the private sector. (An increase in private sector loans and investments incurs a charge against risk-based capital.) As shown in Chart 4, quarter-to-quarter growth in real final sales was very weak in the three quarters of the recovery. Subsequently, growth in real final sales accelerated, only to contract again in Q1:1993. The unemployment rate did not peak until the Q2:1992 and declined rather slowly in 1993. The Fed continued to reduce its federal funds target through September 1992, a full 18 months after the trough of the prior recession (March 1991). First associated with the weak and uneven recovery following the 1990-91 were terms such as "jobless recovery," "double-dip," and who could forget the Maestro's phrase, "financial market headwinds." Sound familiar?

Chart 4

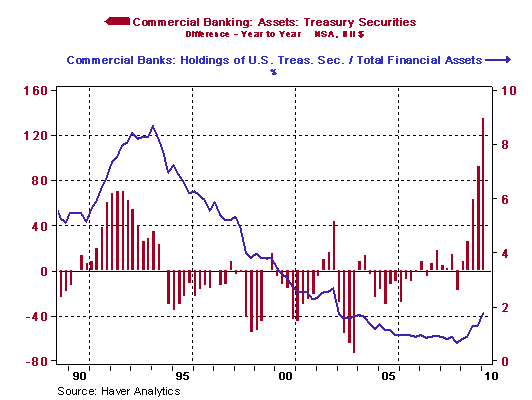

In the past two years, the U.S. banking system has been recapitalized either through institutions raising capital in the financial markets or through taxpayer-injected capital (TARP). The U.S banking system is generally perceived to be at least adequately capitalized, if not well capitalized. Why, then, is bank credit continuing to contract? Yes, credit demand from large corporate potential borrowers is relatively weak. But are there not some small businesses that desire to borrow? With mortgage rates the lowest in decades and house prices exceptionally low relative to household income, are there not some households that desire to borrow? And even if there are not small businesses and households that want to borrow, there is one borrower out there with a near infinite demand for credit - the U.S. Treasury. Although commercial banks increased their holdings of U.S Treasury securities by $135 billion in the four quarters ended Q1:2010 - an absolute larger increase in their holdings than what occurred in the early 1990s, relative to the size of their balance sheets - bank holdings of Treasury securities in Q1:2010 pale in comparison to what they were in the early 1990s (see Chart 5).

Chart 5

Why are banks reluctant to commit their capital to new loans and investments, even U.S. Treasury securities? We think there are two reasons. First, as was reported in the July 8 edition of the Wall Street Journal (Bank Fix for Unpaid Commercial Property Loans: 'Extend and Pretend' - WSJ.com) there are $176 billion of commercial real estate loans of questionable value on banks' books. Depending on the amount of these loans that must be written off, a currently well-capitalized bank could become an under-capitalized bank down the road. Second, domestic and international bank regulators are expected to increase required capital ratios. There is uncertainty, however, as to by how much required capital ratios will be raised and when these higher capital ratios will take effect. Again, depending on these regulatory factors, a currently well-capitalized bank could find itself undercapitalized in the not-too-distant future. We believe that for these two reasons, banks are hoarding their capital rather than committing it to new loans and investments. Until the banking system starts creating credit, we expect growth in both real and nominal economic activity to be weak and uneven.

Now this factor of contracting bank credit is not something that just occurred, or occurred to us since our May forecast. It has been an important factor explaining why our real GDP forecast has been below that of the consensus for some time now. But there are new factors which have caused us to lower our real GDP forecast even further below that of the consensus. One of these factors is the condition of state and local government budgets, which has obvious implications for growth in state and local government spending. Although we had projected declines in state and local government spending for 2010, the budgetary problems are even more serious than we had assumed. As a result, we have lowered our forecast for this important component of aggregate demand. In the 30 years ended 2007, real state and local government expenditures averaged 12.9% of real GDP. This compares with average real GDP shares of real exports at 8.1% and real business equipment and software expenditures of 5.4%. And state and local government employment accounts for a relatively large share of total nonfarm employment. In the 30 years ended 2007, state and local government's share of total employment averaged 14.2%. This compares with 15.6% for manufacturing and 20.2% for trade, transportation (shipping) and utilities. No other major employment category share comes close to that of state and local government.

Another sector of aggregate demand we are revising down for 2010 is housing. Although we thought there would be some payback in residential real estate expenditures after the expiration of the home-purchase tax credit, the recent declines in home sales and housing starts have been more severe than expected. Thus, we suspect that there is a more fundamental weakness in housing, despite our view that owner-occupied housing is incredibly affordable now - incredibly affordable if a potential buyer is able to qualify for a mortgage.

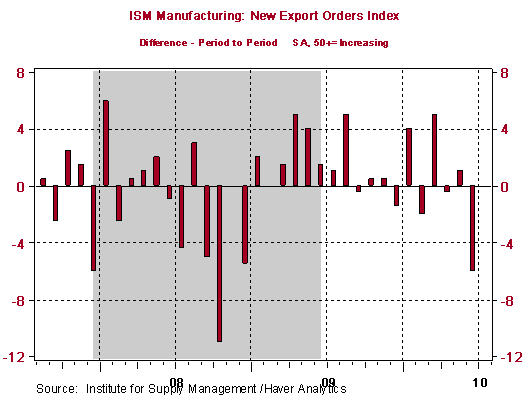

Our forecast of exports has been revised lower. Two of the largest developing economies - China and Brazil - are experiencing a slowdown in their economic growth rates - not severe, but noticeable. Because a significant increase in U.S. exports in the past year has been to Asia excluding Japan and Latin America, these growth moderations in China and Brazil will likely lead to a slowdown in U.S. export growth. The first sign of this was a six-point drop in the June ISM New Export Orders index (see Chart 6). In addition, the fiscal austerity being embraced by Germany and the UK is likely, in our view, to slow domestic demand in western Europe. This, in turn, will have an adverse effect on global economic activity, and thus, an adverse effect on U.S. exports.

Chart 6

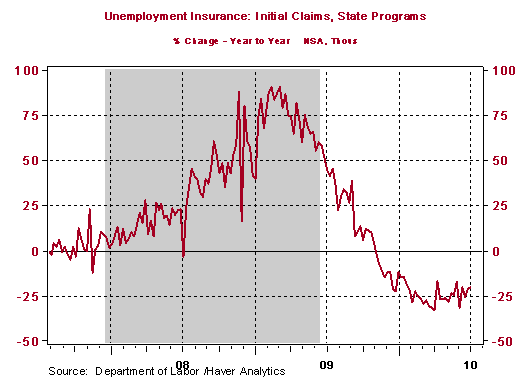

Our downward revision to second-half real GDP growth implies a weaker labor market. The month-to-month changes in the headline unemployment rate are difficult to forecast, given the month-to-month volatility in the labor force and the participation rate. So, if the participation rate were to fall, the headline unemployment rate might not move up as much as we are projecting. The important message we are attempting to convey to investors is that we see some renewed weakness developing in hiring and perhaps some renewed firing, assuming there is any one left to fire. Reinforcing this view is the fact that the year-over-year decline in initial unemployment insurance claims is moderating (see Chart 7).

Chart 7

The pick up in real economic growth we are projecting for 2011 is based on the assumption that the financial sector begins to create a modicum of credit. In addition, we expect that the sectors contracting in the second half of this year - state and local government spending, residential investment expenditures and non-residential investment expenditures - will begin to post modest growth in 2011. So, it is not that any one sector is exceptionally strong, but that all sectors are on forward gear.

The rate of increase in the prices of consumer goods and services is expected to remain muted. With bank credit continuing to contract, the unemployment rate staying high and factories continuing to run well below capacity, it is difficult for price increases to ramp up on a sustained basis.

All of which leads us to the outlook for Fed policy. With our downwardly-revised real GDP forecast for the second half of 2010, we have pushed out our forecast for the beginning of Fed tightening from early 2011 to mid-2011. And the risk is that the first tightening does not occur until early 2012. In fact, we would not be surprised to see the Fed take some actions in the direction of a more accommodative policy. Such actions might include reducing the interest rate it pays on bank excess reserves from 25 basis points to zero, resuming open market purchases of mortgage-backed securities and reactivating the Term Asset Liquidity Facility.

What about the prospects for another sustained contraction in real GDP in the next year?

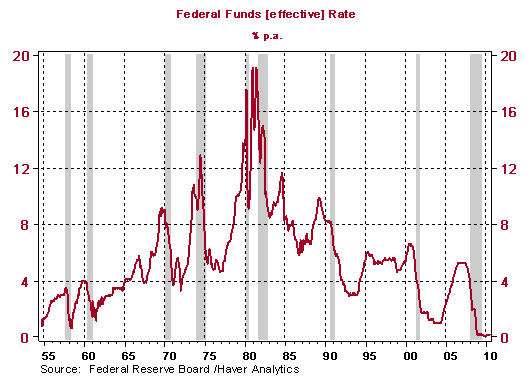

Chart 8 shows that every recession since the one in 1957 has been preceded by an increase in the federal funds rate - an interest rate controlled by the Fed. If we are correct in our forecast that the earliest the Fed will start to raise its policy interest rate is June 2011, then, based on the historical precedent shown in Chart 8, it is unlikely that a recession will commence this year or next. But, as we discussed at the outset, this is a business cycle unlike any other in the post-war era. In prior cycles, as the Fed raised the funds rate, growth in bank credit slowed (see Chart 9). In the current environment, even with the Fed holding the funds rate at less than 25 basis points, bank credit continues to contract. Thus, we are going to utter the six most dangerous words in economic forecasting: This time it might be different.

Chart 8

Chart 9

by Paul Kasriel

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2010 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.