Gold Paradox, Performs Well In Both Monetary Inflation and Deflation

Commodities / Gold and Silver 2010 Jul 11, 2010 - 01:55 PM GMTBy: Jesse

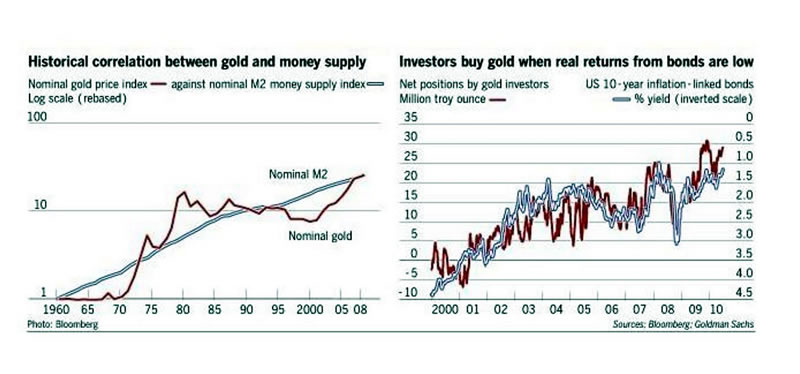

The average punter understands the first graph. Gold increases in price in times of monetary inflation, because as an alternative store of wealth it provides a safe haven from central bank debasement of the currency.

But notice the second chart, and this is the one which so many speculators and economists miss. Gold tends to perform well when the inflation adjusted returns on the longer end of the curve are low. In other words, when the real returns on bonds are inadequate to the risk. But the risk of what?

Inflation, pure and simple. Deflation is a prelude to inflation, and sometimes a brief hyperinflation, in a fiat currency regime. The smarter money is not chasing the latest wiggles in the Elliot waves, or the price manipulation shenanigans of the central bankers and their minions at the bullion banks.

The underlying value of the dollars are deteriorating. So even though there might be fewer dollars nominally, in fact there should be much fewer dollars because of the contraction in GDP. And the quality of the assets underlying those fewer dollars are much lower quality than only a few years ago.

Gold seems to perform less well, that is, most stably, in a healthy economy where the growth of money is more related to the organic growth of real production and not to financial engineering. I would suggest that the extraordinary price in gold is because for many years the central banks artificially suppressed the price and the means of production for gold by selling their holdins in a conscious attempt to mask their monetization and the unreasonable growth of the financial sector.

In other words, gold will be topping when it appears that the real economy is becoming organic and healthy, without subsidy from the Federal Reserve, or the draconian taxes of an outsized fiancial sector.

When people are no longer interested in what Goldman Sachs and their ilk are doing, or what Bernanke and his merry pranksters have to say, then will be the time to start taking profits in your gold holdings.

This is no top, although sentiment is unusually bearish. This is the base for a new leg up that is going to surprise all but a few.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2010 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.