Gold Prices Have Peaked?

Commodities / Gold and Silver 2010 Jul 12, 2010 - 05:19 AM GMTBy: Money_Morning

Jon D. Markman writes: If you think gold prices have peaked, think again. Gold may have fallen from its June 18 record high of $1258.30 an ounce, but the yellow metal is in for the long haul.

Jon D. Markman writes: If you think gold prices have peaked, think again. Gold may have fallen from its June 18 record high of $1258.30 an ounce, but the yellow metal is in for the long haul.

In fact, Credit Suisse Group AG (NYSE ADR: CS) has increased its long-range forecast for gold, arguing in a new report that prices should remain near current levels for at least the next four years.

CS analysts' 2014 target is now $1,300 and ounce, compared to their previous forecast of $1,120. That may not seem like a very brave forecast since gold is already trading at nearly $1,200 an ounce. But it has profound implications for gold miners, because mining stocks are priced based on expectations of future earnings. Removing the expectation that gold futures prices could slide way back removes an impediment to shares going higher.

The rationale for the change: Credit Suisse believes there is an 80% chance of a renewed quantitative easing - or money printing - due either to a full-blown sovereign debt crisis or a new recession. This enthusiastic and inflationary activity would rev up the safe haven buying that has pushed up gold prices over the past few years. The feeling is that companies and government officials may cheat and lie, but gold is as steady as a rock as an irrefutable, trusted source of value.

Additionally, the ultra-low interest rate policy of the world's central banks will keep gold prices on the move. Historically, gold prices tend to rise when short-term interest rates are below 2%. And this relationship has been particularly strong over the last few years.

With the U.S. Federal Reserve likely to keep rates on hold through 2012, and the potential for inflation-adjusted interest rates to move further into negative territory with another round of quantitative easing, there's little reason to think gold's run higher will end anytime soon.

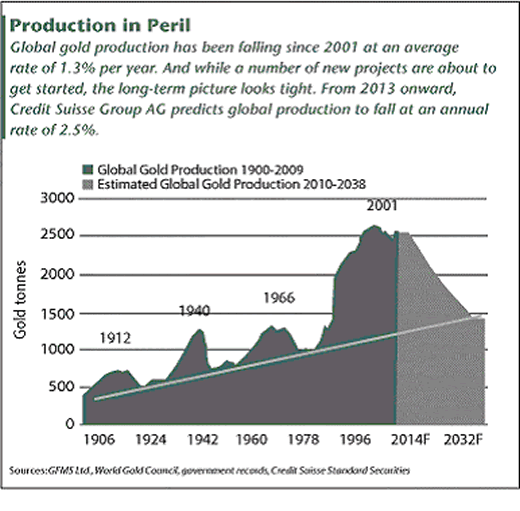

Complicating matters is the decline in new gold production. Since 2001, global gold production has fallen at an average rate of 1.3% per year. Increased demand and less supply means higher prices.

Credit Suisse research in 2003 and 2005 indicated that the decline was being caused by a reduction in exploration targets and exploration efficiency. In other words, it was becoming harder and more expensive to find new untapped sources of gold.

While a number of new projects are about to get started, the long-term picture looks tight. From 2013 onward, CS predicts global production will fall at an annual rate of 2.5%. Gold has always had allure based on its scarcity and it's about to get a heck of a lot scarcer.

As a result of the increased price outlook, CS analysts covering the gold mining sector upgraded their ratings of big players like Barrick Gold Corp. (NYSE: ABX) and Agnico Eagle Mines Ltd. (NYSE: AEM). Our position in the Market Vectors Gold Miners ETF (NYSE: GDX) gives us sector-wide exposure to this trend, and I will recommend that you add to the position once there is some weakness.

Source : http://moneymorning.com/2010/07/12/gold-prices-12/

Money Morning/The Money Map Report

©2010 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.