Gold Higher on Portuguese Downgrade and Lingering Concerns of Debt Contagion

Commodities / Gold and Silver 2010 Jul 13, 2010 - 08:35 AM GMTBy: GoldCore

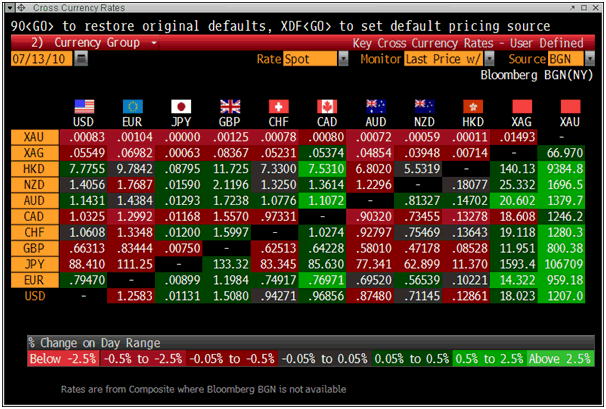

Gold spiked higher today in all currencies as Portugal's downgrading and prices below $1,200/oz led to buying. The euro fell against both the dollar and gold (from €954 to €960 per ounce - see chart) on Moody's two-notch downgrade of Portugal. The downgrade was expected but it has ignited concerns that the European sovereign debt markets remain vulnerable, leading to continuing safe haven demand for gold. Lingering concerns over the European bank stress tests and the European banking system are also supportive.

Gold spiked higher today in all currencies as Portugal's downgrading and prices below $1,200/oz led to buying. The euro fell against both the dollar and gold (from €954 to €960 per ounce - see chart) on Moody's two-notch downgrade of Portugal. The downgrade was expected but it has ignited concerns that the European sovereign debt markets remain vulnerable, leading to continuing safe haven demand for gold. Lingering concerns over the European bank stress tests and the European banking system are also supportive.

Gold is currently trading at $1,207.58/oz, €959.69/oz and £799.30/z in US dollar, euro and GBP terms respectively.

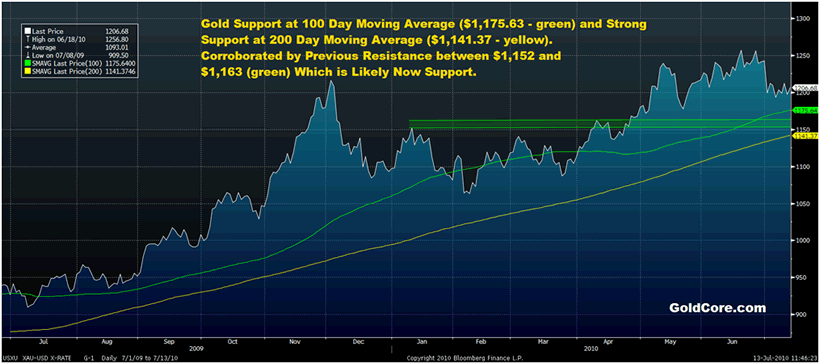

Gold - 1 Year (Daily) - Daily Moving Averages and Previous Resistance Showing Support

Gold fell 1% to $1,198.20/oz yesterday (fell by less in euros and pounds) as the dollar was stronger and risk appetite saw equities rally in Europe and tentatively in the US. Asian equities were mixed but European markets have resumed their upward trend despite the Portuguese downgrade. Greece is due to borrow €1.25bn in short-term loans today and analysts say it may pay a rate around the 5pc earmarked for funds from the European rescue fund. A disappointing earnings season in the US could see the broader market come under pressure. While companies may beat consensus earnings forecast there are worries that negative guidance may lead to falling share prices.

Of more importance than earnings season are the continuing risk of contagion in the European banking system and sovereign debt markets. There is a sense that the root cause of the global financial and economic crisis - debt - has not been addressed. Rather the disease of too much debt and leveraged finance is being replaced with the cure of more debt - but this time public debt. This may be a case of rearranging the chairs on the Titanic and appears to have delayed the crisis temporarily: but we may be storing up more serious problems in the long term.

Gold in EUR - 5 Day (Tick) - Showing Spike on Portuguese Downgrade

Silver

Silver is currently trading at $18.04/oz, €14.34/oz and £11.94/oz.

Platinum Group Metals

Platinum is trading at $1,527.00/oz and palladium is currently trading at $462/oz. Rhodium is at $2,325/oz.

News

(The Telegraph) - Chinese rating agency strips Western nations of AAA status

China's leading credit rating agency has stripped America, Britain, Germany and France of their AAA ratings, accusing Anglo-Saxon competitors of ideological bias in favour of the West.

Dagong Global Credit Rating Co used its first foray into sovereign debt to paint a revolutionary picture of creditworthiness around the world, giving much greater weight to "wealth creating capacity" and foreign reserves than Fitch, Standard & Poor's, or Moody's. The US falls to AA, while Britain and France slither down to AA-. Belgium, Spain, Italy are ranked at A- along with Malaysia. Meanwhile, China rises to AA+ with Germany, the Netherlands and Canada, reflecting its €2.4 trillion (£2 trillion) reserves and a blistering growth rate of 8pc to 10pc a year. Dominique Strauss-Kahn, chief of the International Monetary Fund, agreed on Monday that the rising East is a transforming global force. "Asia's time has come," he said.

(Reuters) - SPDR Gold Trust holdings up first time since late June

The world's largest gold-backed exchange-traded fund, the SPDR Gold Trust (GLD.P), said holdings rose to 1,314.819 tonnes as of Monday, up 0.304 tonnes from the previous business day. It was the first rise since the holdings retreated from a record 1,320.436 tonnes marked in late June. SPDR Gold Trust holdings up first time since late June.

(Bloomberg) - Gold ETP Holdings Increase 11-Fold to $11.6 Billion

Gold exchange-traded product inflows surged more than 11-fold in the U.S. and Europe in the second quarter, according to Deutsche Bank AG. Investment climbed to $11.6 billion, the bank said in a report dated today and given to reporters in London. In the prior quarter, inflows were $224 million in the U.S. and 547 million euros ($687 million) in Europe, or about $981 million based on the average currency rate in the period. The second-quarter total "easily surpassed the cumulative gold inflows of the past five consecutive quarters put together," strategists including Christos Costandinides said in the report. Assets in gold-backed products and bullion pricesclimbed together to a record in the past month on investor demand stoked by Europe's sovereign-debt crisis and on concern that the global economic recovery may slow. The MSCI World Index of equities slid 13 percent in the second quarter and the Reuters/Jefferies CRB Index of 19 raw materials declined 5.4 percent. Gold-product inflows in the U.S. fell 52 percent to $2.31 billion in June, while European investment slid 61 percent to 687.7 million euros, Deutsche Bank said. In May, inflows more than quadrupled in both the U.S. and Europe compared with April. Deutsche Bank is one of the five lenders that carry out the twice-daily "fixing" of gold prices in London, along with Barclays Plc, HSBC Holdings Plc, Bank of Nova Scotia and Societe Generale SA. Global gold assets held by exchange-traded products were little changed near a record at 2,072.4 metric tons on July 9, according to Bloomberg data from 10 providers. Bullion for immediate delivery traded at $1,204.65 an ounce at 3:19 p.m. in London. The metal reached a record $1,265.30 on June 21 and is up 9.8 percent this year, headed for a 10th annual gain.

(Dow Jones) - GLOBAL MARKETS: European Stocks Up Despite Portugal Downgrade

European stocks rose Tuesday, helped by a solid start to the U.S. earnings season, while the oil majors supported prices after a further rise in BP shares. However, the euro sank across the board on Moody's two-notch downgrade of Portugal. By 0750 GMT, the Stoxx Europe 600 index was up 0.6% at 252.59. The index came off its initial highs, but only by a whisker, after the Moody's credit-rating agency downgraded Portugal's long-term debt to A1 from Aa2, adding that the rating outlook is now stable. Traders said the downgrade came as no surprise. Meanwhile, London's FTSE 100 index was up 0.7% at 5202.36 despite a sobering report on the housing market from the Royal Institution of Chartered Surveyors. The report indicated that U.K. house prices rose at a sharply slower pace in June from a month earlier and at the lowest rate since July 2009. Elsewhere, Frankfurt's DAX gained 0.6% to 6112.12 and Paris's CAC-40 was 0.5% higher at 3585.64.

(Bloomberg via Irish Independent) - Debt crisis won't collapse euro, says Nobel economist

Ireland, Spain and Portugal face a 20pc risk of having to restructure their public debt, but the euro area will not break up, even if some countries do renegotiate their debt, Nobel Prize-winning economist Robert Mundell has said.Prof Mundell, sometimes known as the "father of the euro" because of his work on monetary union, also predicted a 40pc chance of restructuring for Greece and 10pc for Italy."I don't think it's going to happen immediately, but it might come in the next year or so," Prof Mundell said. "I suppose the risk countries include Portugal, Ireland and Spain," he added. However, Prof Mundell warned that investors betting on a euro break-up, "are going to lose their money"."And I think also those people who were betting on the price of gold going up to $2,000 an ounce are going to lose their money, too," he added. Greece is due to borrow €1.25bn in short-term loans today and analysts say it may pay a rate around the 5pc earmarked for funds from the European rescue fund.

Exposure

"There's likely to be some moral suasion at work to encourage domestic players to get involved," said Padhraic Garvey, a fixed-income strategist at ING Groep in Amsterdam. "My guess is that the funding cost will come closer to that of the rescue package at 5pc than to the current market rate, which is partly inflated by lack of liquidity (trading). A 26-week Greek loan was bid at 5.7pc percent at the end of last week." The European Commission told EU governments that failure to publish individual banks' exposure to sovereign debt in the current stress tests could damage investor confidence. "There is considerable opposition to the publication of individual exposures to sovereign debt," the commission said in a confidential letter seen by Bloomberg News last week. "Stepping back" from planned publication of this information "would give the impression that we have something to hide", the letter said. EU regulators are examining the strength of 91 banks, including AIB and Bank of Ireland, to determine if they can survive potential losses on sovereign-bond holdings. EU finance officials are currently debating how much detail from the tests to disclose. The results are due to be released on July 23.Bond investors are gaining confidence in the ability of the banks to ride out the government deficit crisis, with the difference in the cost of insuring financial and corporate debt from default declining to almost the lowest level in three months.

(Bloomberg) - Greece Sells 1.625 Billion Euros in 26-Week Bills at 4.65% Yield

Greece sold 1.625 billion euros of 26-week Treasury bills at a yield of 4.65 percent, the debt agency said today. Investors bid for 3.64 times the securities offered, the Public Debt Management Agency in Athens said.

(Bloomberg) - U.K. Inflation Slowed Less Than Economists Forecast in June

U.K. inflation slowed less than economists forecast in June as higher costs of goods from fuel to food kept the rate of price increases above the government's 3 percent limit. Consumer prices rose 3.2 percent from a year earlier, compared with 3.4 percent in May, the Office for National Statistics said today in London. Economists predicted 3.1 percent, according to the median of 27 forecasts in a Bloomberg News survey. The persistence of inflation may bolster the case of Bank of England policy maker Andrew Sentance, who pushed in June to raise the interest rate for the first time in almost two years. Officials this month kept up emergency stimulus and held the benchmark at a record low to aid the recovery during the deepest public spending cuts in half a century.

(Press TV) - Iran produces 24-karat pure gold

An Iranian scientist and his team have produced gold that is 99-point-9 percent pure, ranking Iran among 24-karat gold producing countries. Previously, the 24-karat gold market belonged to only 10 developed countries, but now Iran has made access to the technology for producing pure gold, a PressTV correspondent reported. Iranian scientists say purifying gold also prevents other precious metals like platinum from being exported out of the country in low-karat gold products.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.