Gold New All Time Highs in Euros Likely

Commodities / Gold and Silver 2010 Jul 15, 2010 - 08:45 AM GMTBy: GoldCore

Gold continues to consolidate above the $1,200/oz level and traded in a range between $1,207/oz and $1,215/oz overnight in Asia. Gold has risen slightly in European trade as the dollar has come under pressure. The poor retail sales have created concerns about the health of the US consumer and the other poor recent data on jobs and trade and budget deficits may see the dollar come under pressure again. Support for gold is at $1,195/oz and resistance is at $1,217.90/oz.

Gold continues to consolidate above the $1,200/oz level and traded in a range between $1,207/oz and $1,215/oz overnight in Asia. Gold has risen slightly in European trade as the dollar has come under pressure. The poor retail sales have created concerns about the health of the US consumer and the other poor recent data on jobs and trade and budget deficits may see the dollar come under pressure again. Support for gold is at $1,195/oz and resistance is at $1,217.90/oz.

Gold is currently trading at US$1,213.55/oz. In EUR & GBP terms the metal is at €947.32/oz and £790.66/oz respectively.

Gold in EUR - 3 Month (Daily) - Showing Support (Green line) and Resistance (White line)

After the euro's recent rally, gold in euros fell from the record high (nominal) high of €1,040/oz back to €948/oz. Support can be seen at the €936/oz (green line). A fall below this level of support could lead to a pullback to €900/oz.

However, given the degree of banking system and sovereign debt risk in the eurozone, this seems extremely unlikely. Especially as the risk of a European sovereign default remains high and the possibility of a eurozone member leaving the single currency remains real. This would obviously lead to a new crisis in the eurozone which would see the price of gold in euro terms surge.

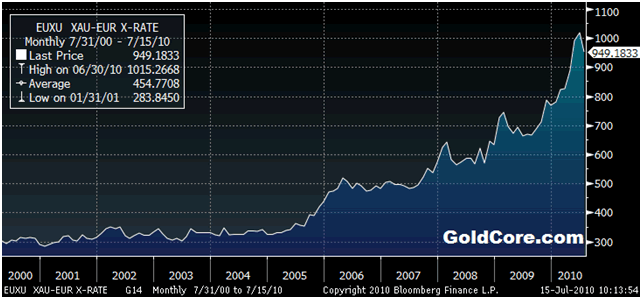

Gold In Euros - Monthly (10 Years)

The level of macroeconomic, systemic and monetary risk in Europe and internationally today is far greater than that experienced in the stagflation of the 1970s. Thus, gold performing as it did in the 1970s and rising by more than 25 times in less than 10 years (from $35 in 1971 to over $850/oz in 1980) remains a real possibility.

Gold in euros was trading at less than €300/oz at the dawn of the millennium and given the significant risks mentioned above, not to mention worsening fiscal situations in the UK, the US and most western nations, it seems quite possible that gold could rise to €7,500/oz in the coming years.

This may seem outlandish and overly bullish now, as similar sentiments about gold would have in 1974 when the metal had risen from $35 to $200/oz. Bull markets tend to surprise even the most bullish and arguably the challenges facing the international financial and economic system are more bullish for gold today than they were in the 1970s.

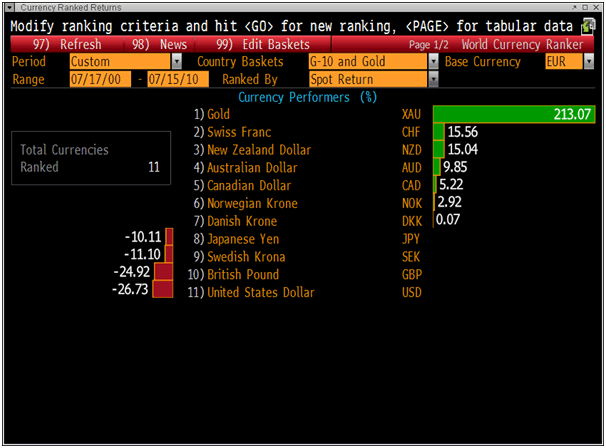

Euro Performance Versus G10 Currencies and Gold - 10 Years

Silver

Goldman Sachs sees silver rising by more than 15% in the next 6 months and has raised its 6 month silver forecast to $21.50/oz.

Silver is currently trading at $18.39/oz, €14.35/oz and £11.97/oz.

Platinum Group Metals

Platinum is currently trading at $1,524.00/oz, palladium is at $466/oz and rhodium is at $2,275/oz.

News

(Financial Times) - Lex: Silver

Sail on, silver girl. The white metal may not have quite the fabled haven allure of gold, but its recent rise has tracked the yellow metal's surge, rising to about $18 an ounce. Like gold, silver is being propelled by demand from exchange traded funds as investors dump eurozone sovereign debt and bank equity. That is in marked contrast to silver's sell-off in 2008, when investment demand failed to halt its slide with the downturn to below $15 an ounce.

Investment interest is on top of a revival in industrial demand. Silver is used in mobile phones; in medical applications, for its anti-bacterial properties; and by Tour de France cyclists, in their high-tech clothing. Then there is jewellery.

(Bloomberg) - Goldman Sachs Group Inc. raised its six-month gold forecast to $1,290 an ounce from $1,275 and its 12-month estimate to $1,355 from $1,335. The new forecasts were made in a report dated today and the previous estimates were from a note dated June 22. The six-month silver forecast increased to $21.50 an ounce from $21.30.

(Bloomberg) - Silver held in ETF Securities Ltd.'s European and Australian exchange-traded products added 0.1 percent to a record 28.534 million ounces yesterday, according to the company's website. Goldman Raises 6 Month Silver Forecast to $21.50/oz.

(FT) - Cocoa soars on strong demand data

Cocoa prices rose above £2,700 a tonne on Wednesday for the first time since 1977 as better-than-expected data on demand gave an already tight market fresh impetus.

A number of European cocoa groups have alleged that cocoa prices are being distorted. In a letter to NYSE Liffe earlier this month, 16 cocoa companies and trade associations complained that "a manipulation of the contract" was "bringing the London market into disrepute". The Liffe July cocoa contract, which expires on Thursday, jumped 4.8 per cent to a peak of £2,725 a tonne, its highest since September 1977. The second-front month contract, usually regarded as the industry benchmark, was pulled 2.8 per cent higher to £2,465, its own 33-year peak. In New York, ICE September cocoa rose 3.3 per cent to $3,145 a tonne.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.