Reasons to Sell China Stocks and ETFs

Stock-Markets / Chinese Stock Market Jul 22, 2010 - 09:48 AM GMTBy: Justice_Litle

In the aftermath of the $19 billion Agricultural Bank of China IPO, the dragon is struggling… and there are plenty of reasons to consider selling.

In the aftermath of the $19 billion Agricultural Bank of China IPO, the dragon is struggling… and there are plenty of reasons to consider selling.

A few months back we broke down the major China ETFs – FXI, HAO and PGJ. (You can access that piece here.)

Today the technical and fundamental picture looks bearish for all three…

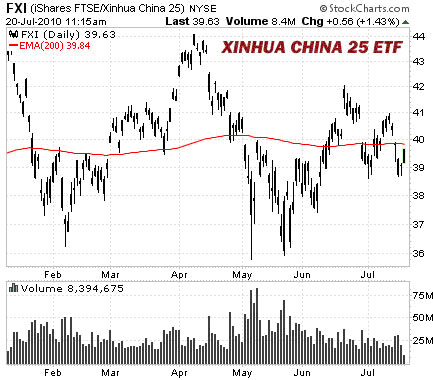

The chart above is for the most popular of the three ETFs, the Xinhua China 25 (FXI:NYSE). The red line represents the 200-day exponential moving average, a sort of key waterline for bullish and bearish sentiment. FXI is below that waterline and struggling.

After a sharp upward thrust in June, FXI quickly lost its mojo. A clean break of support in the $38.50 range could invite a new downdraft; on the fundamental side there are very good reasons for this.

A Country of Superlatives

China is, in many ways, a country of superlatives. For instance: Within 20 years, China’s urban areas are expected to swell by another 350 million people – more than the full population of the United States. There will soon be more Christians in China than anywhere else on Earth. And China’s steel consumption is more than twice that of the United States, Europe and Japan put together.

Adding to that list, the International Energy Agency (IEA) now reports that China has become the world’s largest energy user. “In 2000, the U.S. consumed twice as much energy as China,” says IEA chief economist Faith Birol. “Now China consumes more than the U.S.”

Indeed, the dragon is big… but the dragon also has some very big problems, many of which are coming to a head.

Subprime Redux

First and foremost among China’s worries is the growing rottenness of the banking system. Based on the evidence, it is not an exaggeration to say China is repeating the mistakes of the United States and Europe. Chinese banks are making dodgy loans, piling up toxic assets, and using various parlor tricks to keep the dreck off their balance sheets.

Fitch, one of the big three ratings agencies, released a report last week detailing how China is “distorting credit data.” (You can find a copy of that report here.)

As The New York Times reports, Fitch bluntly charges that “Chinese banks were increasingly engaging in complex deals that hid the size and nature of their lending, obscuring hundreds of billions of dollars in loans and possibly even masking a coming wave of bad real estate and infrastructure loans.”

Hmm. Sound familiar?

Along with that unsavory charge, Fitch further reports that “Chinese regulators understated loan growth in the first half of the year, by 28 percent, or about $190 billion, and that many banks continued to secretly shift loans off the books, creating a ‘pervasive understatement of credit growth and credit exposure.’”

Does human nature ever change? Nope. As Yogi Berra might say, it’s “déjà vu all over again.”

An IPO Hail Mary?

Some in fact argue that the initial public offering (IPO) for AgBank, the Agricultural Bank of China, was in fact something of a desperate cash grab, in the hopes of propping up an increasingly shaky structure. (Prior to the IPO, AgBank was “technically insolvent.”)

“Agricultural Bank of China's $19 billion IPO made a lackluster debut in Shanghai,” Reuters reports, “weighing on the market and underscoring the difficulty other Chinese banks will face tapping investors for billions more.”

"There's a lot profit-taking pressure from investors, who are not optimistic about the long-term prospects of China's economy or the banking sector," said Liu Jun, analyst at Changjiang Securities in Wuhan.

"The debut reflects worries over slower growth and rising bad loans at Chinese lenders, and continued weakness in the stock may prompt a renewed slump in the overall market."

As with the recent Tesla IPO, which put $226 million into the company’s coffers but burned late-to-the-party investors badly, the AgBank offering looks like another example of greater fool theory at work.

And just who are these fool-me-twice investors rushing to buy what insiders are selling? Did they not learn from the infamous Blackstone IPO of 2007, in which the proprietors quite literally top-ticked the market with their cash outs?

If you are, say, the Qatar Investment Authority (who invested $2.8 billion in the Agbank deal), there are at least theoretical reasons to justify participation: Mountains of excess cash, the sovereign relations motive, and so on. But if you are a nimble private investor, why oh why give up your two best edges – flexibility and selectivity – to throw precious capital at such a dog?

Bigger Fish to Fry

If China’s banks were the only reason to worry, the bulls might have a leg to stand on. Beijing is not shy, after all, about blurring the lines between public and private enterprise, and the dragon is theoretically cash-rich enough to absorb a deluge of bad debts.

The trouble, though, is that China’s dodgy banks are only the highly visible tip of a much bigger iceberg… and the macro level problems brewing in housing and labor markets are even more worrisome. We’ll talk about those next time…

Don't forget to follow us on Facebook and Twitter for the latest in financial market news, investment commentary and exclusive special promotions.

Source :http://www.taipanpublishinggroup.com/tpg/taipan-daily/taipan-daily-072110.html

By Justice Litle

http://www.taipanpublishinggroup.com/

Justice Litle is the Editorial Director of Taipan Publishing Group, Editor of Justice Litle’s Macro Trader and Managing Editor to the free investing and trading e-letter Taipan Daily. Justice began his career by pursuing a Ph.D. in literature and philosophy at Oxford University in England, and continued his education at Pulacki University in Olomouc, Czech Republic, and Macquarie University in Sydney, Australia.

Aside from his career in the financial industry, Justice enjoys playing chess and poker; he enjoys scuba diving, snowboarding, hiking and traveling. The Cliffs of Moher in Ireland and Fox Glacier in New Zealand are two of his favorite places in the world, especially for hiking. What he loves most about traveling is the scenery and the friendly locals.

Copyright © 2010, Taipan Publishing Group

Justice_Litle Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.