BP Abandoning the Capped Gulf Oil Well, What Could Possibly Go Wrong?

Politics / Environmental Issues Jul 24, 2010 - 09:30 AM GMTBy: Washingtons_Blog

BP will leave the cap on the oil well while it vacates the area for a number of days to avoid the coming tropical storm.

BP will leave the cap on the oil well while it vacates the area for a number of days to avoid the coming tropical storm.

What could possibly go wrong?

One expert warns that increasing pressure might have an unintended danger:

Bill Gale, a California engineer and industrial explosion expert who is a member of the Deepwater Horizon Study Group, said… that gas hydrate crystals could be plugging any holes in the underground portion of the well, and they could get dislodged as pressure builds.

(Gale was formerly Chief Loss Prevention Engineer for Bechtel in San Francisco, obtained his undergraduate degree in Chemical Engineering, Masters in Civil Engineering and PhD in Fire Safety Engineering Science from the University of California, Berkeley. Gale is a registered professional engineer in both mechanical engineering and fire protection engineering, and has more than forty years of industrial loss prevention, process safety management, and fire protection/fire safety engineering experience.)

In other words, there may have been a destruction of a portion of the steel well casing which was temporarily plugged by methane hydrate crystals. Leaving the well cap may slowly raise the pressure in the well to the point where the hydrate crystals are dislodged, in which case the well might really start leaking.

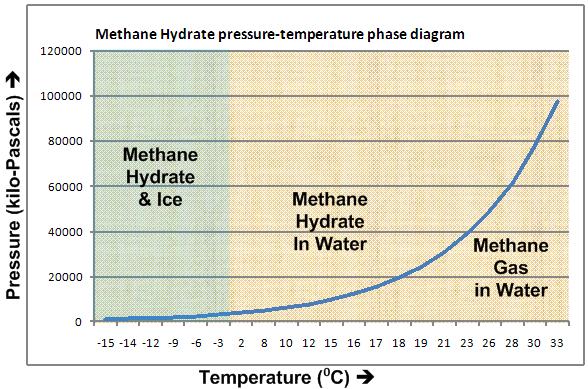

Indeed, the relationship between methane hydrate, pressure and temperature is well-known:

Sound farfetched?

Maybe.

But remember that the "top hat" containment dome failed because it got plugged up with methane hydrate crystals.

And remember that there's a lot of methane down there. Indeed, while most crude oil contains 5% methane, the crude oil gushing out of the blown out well is 40% methane.

Although even less likely, scientists say that the methane could disturb the seafloor itself. As the St. Peterburg Times points out:

Disturbing those [methane hydrate] deposits — say, by drilling an oil well through them — can turn that solid methane into a liquid, leaving the ocean floor unstable, explained [Carol Lutken of the University of Mississippi, which is part of a consortium with SRI which has been conducting methane research in the Gulf of Mexico for years].

***

Generally the oil industry tries to avoid methane areas during drilling for safety reasons. But the U.S. Energy Department wants to find a way to harvest fuel from those methane deposits, Lutken said. [I've previously discussed that issue in detail.]

So what's the bottom line?

I am not predicting that anything bad will happen. Hopefully, when the storm is over and the underwater ROV submersibles return to the spill site, everything will be peaceful and stable.

But there are many variables such as methane hydrates which - in a worst-case scenario - could complicate matters.

Global Research Articles by Washington's Blog

© Copyright Washingtons Blog, Global Research, 2010

Disclaimer: The views expressed in this article are the sole responsibility of the author and do not necessarily reflect those of the Centre for Research on Globalization. The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible or liable for any inaccurate or incorrect statements contained in this article.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.