Making Sense of the Economic Puzzle

Economics / US Economy Jul 24, 2010 - 03:57 PM GMTBy: Clif_Droke

You can tell a lot about the state of the economy by simply looking at the covers of national news magazines. Or perhaps a better way of saying it is that you can get a good sense of how most Americans perceive the state of the economy by perusing the mainstream magazines.

You can tell a lot about the state of the economy by simply looking at the covers of national news magazines. Or perhaps a better way of saying it is that you can get a good sense of how most Americans perceive the state of the economy by perusing the mainstream magazines.

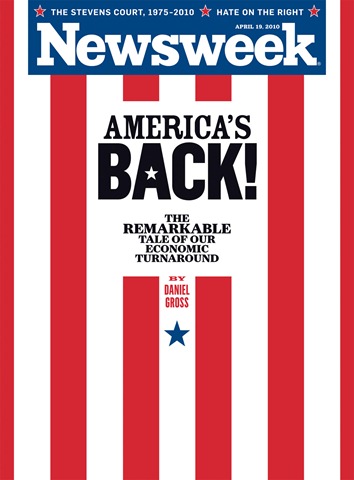

With much fanfare Newsweek magazine proclaimed back in April, “America’s Back! (The Remarkable Tale of Our Economic Turnaround)” as it trumpeted what was widely perceived by Keynesians as a legitimate economic recovery based on the latest government data. No sooner had this sentiment been proclaimed than the stock market did an about face and the “flash crash” of May sent equity prices tumbling and had many economists wondering if the market was pricing in a “double dip” recession.

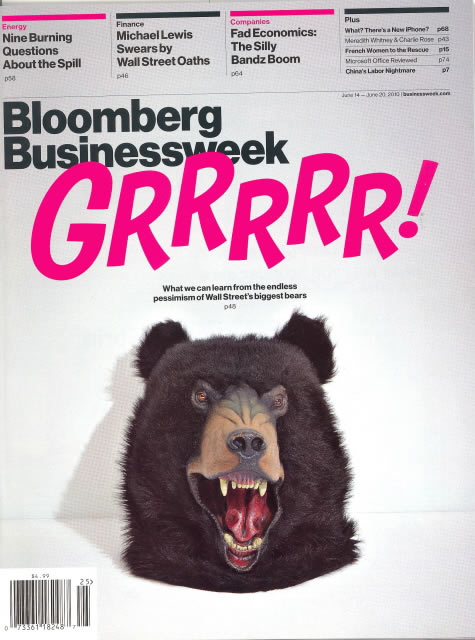

Just like that, the economic news headlines went from exaltation to despair. In June, Business Week magazine put the big black bear on its front cover with the words, “Growl! (He’s Back!)” and gave play to the bearish scenario for the financial market and the economic outlook.

As if thing weren’t confusing enough, Time magazine published this cover in its latest issue earlier this week.

The Time magazine piece highlighted both the bull case and the bear case. The bull case was bolstered by an increase in corporate earnings, manufacturing growth and a positive reversal in the unemployment trend. The bear case was underscored with the currently high long-term jobless rate, the budget shortfall of the individual states and the recent plunge to new lows of single-family-home sales.

All of this brings to mind the scarecrow in the Wizard of Oz movie who, when asked which way to the Emerald City, couldn’t decide which path to point out and said, “Maybe it’s both ways.” Of course we can smile at this naïve evasiveness coming from the mindless scarecrow. When it comes from the mouths of professional economists, however, we tend to be less than forgiving. But what if, for once, both sides of the economic debate are right and it really is “both ways”? What if the economic bulls and the bears have an equal share in legitimately claiming their respective cases? In this commentary we’ll look at a scenario that involves simultaneously a continuation (and potential deepening) of the recession for one segment of the economy and a continued recovery for the other segment.

The underlying basis for a bifurcated economy can be found in the Kress Cycles. The context for the recession that a goodly part of the U.S. economy still suffers from is found in the fact that the dominant long-term 120-year cycle (of which the 60-year Kondratieff “Wave” is a component) is leaning against it. On a shorter-term basis, the nearest yearly cycle of significance, the 6-year cycle, is still peaking and after September of this year the 4-year cycle will also join the 6-year cycle in its rising phase. Between the rising 4-year and 6-year cycles, that’s enough of a counterbalance to create economic turbulence, hence the dual economic trends we’re now witnessing. If the Kress Cycles have any near-term economic forecasting validity, then we can expect more or less a continuation of the range bound economy we’re seeing with some segments continuing to improve while others lag behind.

The previously mentioned Time magazine article drew attention to the two major sides of the debate, namely the pro-stimulus camp and the austerity camp. After last year’s government’s stimulus program failed to bring immediate results, the pro-austerity camp took the moral high ground and began calling for an end to any further stimulus efforts. Time’s own opinion poll found that 67 percent of Americans oppose further stimulus compared with only 24% who favor it, which clearly shows that the austerity camp represents the prevailing thought among Americans. Time emphasized that the Obama administration is under pressure from both sides and must now carefully tread a moderate path until the November elections allow for greater clarity for the fiscal policy outlook.

Time also noted that there appears to be little room for compromise in the current economic recovery debate. “Could,” Time asks, “Democrats and Republicans come together on a plan to increase short-term discretionary spending while limiting long-term entitlements?” Time concludes that while such deals aren’t unprecedented, they are rare and tend to happen only when the economy is booming. “But if gloomier forecasts are correct, then we may be in even more trouble than we know,” Time adds. “And there’s little evidence that a deeply divided Washington can save us.”

What does all of this mean to the individual investor? The government stimulus, contrary to popular belief, wasn’t a complete failure. It did succeed in providing a much needed boost to some key industries, an improvement that likely would have taken considerable time without the stimulus. Yet the size and scope of the credit crisis was too great for the stimulus to completely resuscitate every segment of the economy. Since political pressure is being brought to bear against any further stimulus, investors will have to content themselves with the present bifurcated economic situation. That means essentially focusing on those sectors of the economy that are currently strong or showing sustained improvement while ignoring the lagging sectors.

Since uncertainty will most likely continue to plague the economic outlook for some time to come, the gold price will continue to be among the very best barometers for the intermittent tides of fear and uncertainty. In other words, gold should retain its long-term upward bias and continue as a favored safe haven for investors until the economic situation becomes less cloudy (which could be a long time in coming).

Cycles

Over the years I’ve been asked by many readers what I consider to be the best books on stock market cycles that I can recommend. While there are many excellent works out there on the subject of technical and fundamental analysis, chart reading, etc., precious few have addressed the subject of market cycles. Of the relatively few books on cycles that are available, most don’t even merit mentioning. I’ve read only one book in the genre that I can recommend – The K Wave by David Knox Barker – but even that one doesn’t deal directly with stock market cycles but instead with the economic long wave. I’m pleased to announce, however, that after nearly 10 years of research and one year of writing, I’ve completed a book on the subject that I believe will meet the critical demands of most cycle students. It’s entitled, The Stock Market Cycles, and is available for sale at:

http://clifdroke.com/books/Stock_Market.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.