The Golden Chalice and Gold’s Greatest Correction Since 1980

Commodities / Gold and Silver 2010 Jul 25, 2010 - 06:34 AM GMT Gold has been on a tear since the low in 1999 at $252.50 ($GOLD) per ounce, thrashing virtually every other asset class for over a decade as it soared to its $1265 high in June 2010. A solid case can certainly be made that as long as the dollar is being destroyed by loose fiscal and monetary policy that gold has a one-way ticket to higher prices. However, no market runs to the sky. There are always corrections, some major. Gold is now potentially facing its largest correction since 1980. Contemplating what happens when the golden chalice formation breaks is a worthy exercise. The Fibonacci golden ratio is the place to start.

Gold has been on a tear since the low in 1999 at $252.50 ($GOLD) per ounce, thrashing virtually every other asset class for over a decade as it soared to its $1265 high in June 2010. A solid case can certainly be made that as long as the dollar is being destroyed by loose fiscal and monetary policy that gold has a one-way ticket to higher prices. However, no market runs to the sky. There are always corrections, some major. Gold is now potentially facing its largest correction since 1980. Contemplating what happens when the golden chalice formation breaks is a worthy exercise. The Fibonacci golden ratio is the place to start.

It is always wise to step back and take in the big picture for any financial market. Checking for long-term patterns that do not show up in the midst of the current crisis typically provides valuable insight. Two of our favorite technical tools for both short term and long-term technical analysis are bowl formations and Fibonacci ratios. These technical approaches can provide just as relevant insight into gold as they do the S&P 500 for equity traders and investors.

The developed world is finally waking up to the reality of the potential for across the board deflation that brings the wholesale destruction of asset values. The forces of overcapacity and debt deflation present in the long wave winter season are now crashing into developed world economies and wreaking economic and financial destruction in their path.

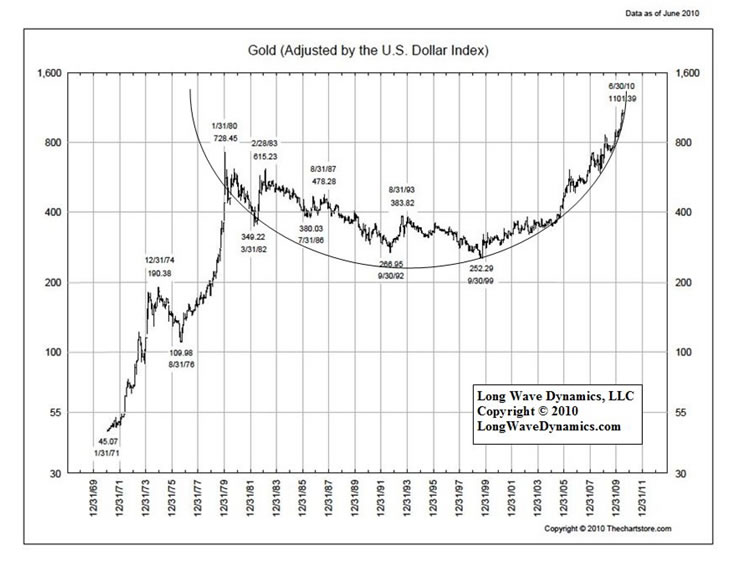

Look at the long-term gold chart below. The chart is gold adjusted by the dollar index. It reveals the golden chalice that has formed from the 1980 peak and the 2010 peak, with the imperfect double bottom in 1995 and 1999. Markets can climb the right side of such bowls and go vertical. If any market every deserved to go vertical, gold is it in this hour of global crisis. However, when such technical bowl formations break, they tend to break hard.

The realization that the loose monetary and fiscal policies have not banished deflation from developed economies is now growing reality. This trend could serve to push gold out of the 30-year bowl formation that has been taking shape since the top in 1980. When this bowl breaks, gold will have its greatest correction since 1980.

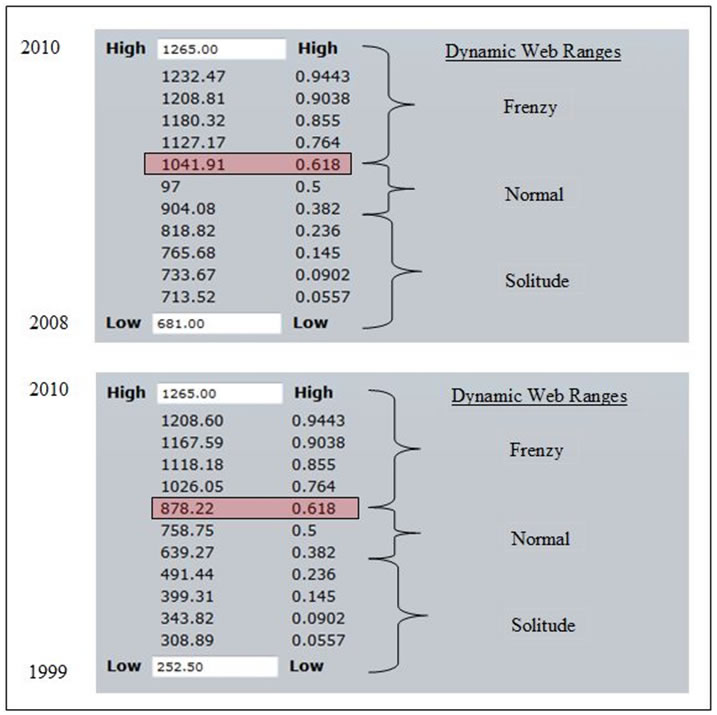

Gold could go vertical from here and take out the June high, but if June was in fact an important top of golden chalice that has been forming since 1980, then Fibonacci price grids require relevant consultation. Fibonacci price grids will reveal where a gold correction will find the most likely bottom. Below are two price grids for gold, one with the 2008 bottom and the 2010 top, and the other with the 1999 bottom and the 2010 top. Since our subject is gold, note the Fibonacci golden ratio price targets in these grids.

The global crisis is accelerating. Gold is stepping up to its inevitable role as the de facto world reserve currency. Under these circumstances I have to figure the golden ratio target at $1041 makes a lot more sense as a possible correction low than the lower $878 target. However, if deflation is severe, then the lower golden ratio price target cannot be ruled out as a possibility.

Regardless of how far the gold price corrects, the central banks and citizens of emerging countries will continue to accumulate gold for the long run. Gold will eventually continue its inexorable rise and rendezvous with destiny. The unfolding global financial crisis has taught the emerging world that the developed world does not have its act together in terms of financial and monetary stability. This means gold is destined to play a more important financial and monetary role in the future. Keynes was wrong, in the long run we are not just dead, we are back onto some form of modern high-tech gold standard.

Malaysia is in the news making its long rumored move toward at least a partial gold currency. I am not a fan of the way in which Malaysia is proposing to roll out a gold currency, but they deserve a gold star for effort. James Turk’s GoldMoney.com is the model for private and pubic digital gold currency (DGC) systems to emulate. Before this long wave winter season ends, I suspect various forms of private and public gold currency will be in use and rising in prominence around the world. Innovation in gold currencies may actually save the global economy by limiting government power over international free market capitalism and freeing individuals to achieve their full potential and protect the value of their contribution to society.

Let’s face it gold fans. Fiat central banking is not going anywhere anytime soon. However, a dual system of both digital gold currency (DGC), including both private and public systems, and fiat central banking, could actually make a great deal of sense. I realize it is a big stretch at present for most gold fans, but if Germany can actually pull off restoring fiscal discipline in Europe, and revitalize an export driven economy with a solid savings rate, the day may come where you will want to diversify some of your DGC into the euro.

Both India and China are adding to their official gold holdings and away for the U.S. dollar. Their citizens are also wisely buying gold. Emerging markets may find it necessary to introduce their own sovereign and private digital gold currency systems in the future. The Bank of International Settlements in Basel Switzerland would likely be more than willing to act as conduit and global clearinghouse for such public and private gold banks that serve to stabilize the global banking system and restore credibility to central banks.

This long wave deflationary global crisis is going to change the world in ways few imagine at the present time. In 1995 Irwin Professional, now McGraw-Hill, published my book that predicted the current global crisis in stunning detail, including a real estate collapse, deflation, and the rise of digital gold currency. That book was called The K Wave. There are a few used copies of that book available for around $1,000 on Amazon, if you are interested. However, that book has been greatly updated and expanded in a new edition as Jubilee on Wall Street; An Optimistic Look at the Global Financial Crash (2009).

In addition to the Kondratieff long wave the history and future of gold is reviewed in the book, along with the predicted rise of digital gold currency (DGC). The Long Wave Dynamics Letter covers the gold market, DGC and large cap gold stocks in every issue.

Keep and eye on the golden chalice. When it breaks and gold experiences its long overdue correction, global equity markets will likely be in free fall. The long wave winter is now locked and loaded for the next leg of the crisis into 2012. However, even as gold corrects, it will prove to be a valuable ticket to the other side of this long wave winter for investors and into a new long wave spring season. A new age is coming to international free market capitalism; I call it The Great Republic, and gold plays a lead role.

David Knox Barker is a long wave analyst, technical market analyst, world-systems analyst and author of Jubilee on Wall Street; An Optimistic Look at the Global Financial Crash, Updated and Expanded Edition (2009). He is the founder of LongWaveDynamics.com, and the publisher and editor of The Long Wave Dynamics Letter and the LWD Weekly Update Blog. Barker has studied and researched the Kondratieff long wave “Jubilee” cycle for over 25 years. He is one of the world’s foremost experts on the economic long wave. Barker was also founder and CEO for ten years from 1997 to 2007 of a successful life sciences research and marketing services company, serving a majority of the top 20 global life science companies. Barker holds a bachelor’s degree in finance and a master’s degree in political science. He enjoys reading, running and discussing big ideas with family and friends.

© 2010 Copyright David Knox Barker - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.