Greenspan : Iraq War Was for Oil - The Age of Turbulence

Politics / US Politics Sep 16, 2007 - 04:37 PM GMTBy: John_York

Former Fed Chairman, Alan Greenspan states that the Iraq War was for primarily for Oil.

You may ask why is Greenspan now some 4 years after the invasion of Iraq making such statements ?

Is it because of there were tens of thousands of anti-war demonstrators in Washington this weekend ?.... Nope

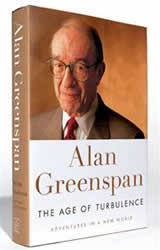

This statement as well as many others in recent days are in advance of the publication on Monday of Greenspan's memoirs in a new 500 page "The Age of Turbulence: Adventures in a New World,"

Quotes from the book:

![]() Critical of President Bush for pursuing an economic agenda driven by politics rather than sound policy, with little concern for future consequences.

Critical of President Bush for pursuing an economic agenda driven by politics rather than sound policy, with little concern for future consequences.

![]() "The Bush administration turned out to be very different from the reincarnation of the Ford administration that I had imagined. Now, the political operation was far more dominant,"

"The Bush administration turned out to be very different from the reincarnation of the Ford administration that I had imagined. Now, the political operation was far more dominant,"

![]() In 2001 testimony before Congress, Greenspan was widely interpreted to have endorsed Bush's proposed tax cuts. In the book, he characterized his testimony as politically careless and said his words were misinterpreted.

In 2001 testimony before Congress, Greenspan was widely interpreted to have endorsed Bush's proposed tax cuts. In the book, he characterized his testimony as politically careless and said his words were misinterpreted.

![]() Richard Nixon and Bill Clinton were the most intelligent, he wrote, while he found Ford the most normal and likable. Ronald Reagan was the most devoted to free markets, though his grasp of economics "wasn't very deep or sophisticated."

Richard Nixon and Bill Clinton were the most intelligent, he wrote, while he found Ford the most normal and likable. Ronald Reagan was the most devoted to free markets, though his grasp of economics "wasn't very deep or sophisticated."

![]() "The Republicans in Congress lost their way. They swapped principle for power. They ended up with neither. They deserved to lose,"

"The Republicans in Congress lost their way. They swapped principle for power. They ended up with neither. They deserved to lose,"

![]() "I was soon to see my old friends veer off in unexpected directions,"

"I was soon to see my old friends veer off in unexpected directions,"

![]() When Bush brought one-time Ford aides Cheney — whom Greenspan describes as having a "sphinx like calm" — and Donald Rumsfeld, back to Washington, the Fed chairman saw a "golden opportunity to advance the ideals of effective, fiscally conservative government and free markets."

When Bush brought one-time Ford aides Cheney — whom Greenspan describes as having a "sphinx like calm" — and Donald Rumsfeld, back to Washington, the Fed chairman saw a "golden opportunity to advance the ideals of effective, fiscally conservative government and free markets."

The book is available from Amazon.com for $23 (34% discount)

By John York

(c) http://www.marketoracle.co.uk 2007

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.