The Special Science of Rare Earth Metals Investing

Commodities / Metals & Mining Aug 02, 2010 - 05:29 PM GMTBy: The_Gold_Report

The ability to separate the science from the promotional claims is among the expertise that Geological Consultant Tony Mariano, PhD, brings to the rare earth elements (REE) table. Tony, who for decades has combined long hours in the lab with even longer field visits to evaluate mineralization in its natural environment, is among the rare ones who can help companies evaluate a deposit for grade, tonnage and the prospects for economic recovery. A sharp technician who manages to keep his head out of the clouds and his feet on the ground, Tony shares some of his secrets, and some of his opinions about the hottest prospective properties, in this exclusive interview with The Gold Report.

The ability to separate the science from the promotional claims is among the expertise that Geological Consultant Tony Mariano, PhD, brings to the rare earth elements (REE) table. Tony, who for decades has combined long hours in the lab with even longer field visits to evaluate mineralization in its natural environment, is among the rare ones who can help companies evaluate a deposit for grade, tonnage and the prospects for economic recovery. A sharp technician who manages to keep his head out of the clouds and his feet on the ground, Tony shares some of his secrets, and some of his opinions about the hottest prospective properties, in this exclusive interview with The Gold Report.

The Gold Report: Jon Hykawy, technology analyst at Byron Capital Markets, recently told us that short supplies of heavy rare earths (HREEs) will be driving up their price and shifting the economies of mining projects in favor of companies that can produce large quantities of heavy rare earths. To what extent do you agree with that assessment?

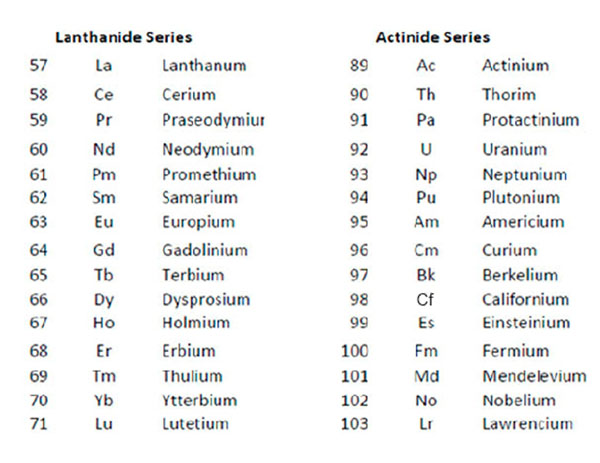

Tony Mariano: I believe that this may be true, however we must define our demarcation of the light rare earth elements (LREEs) and heavy rare earth elements. Individuals have their own ideas of where to start defining the heavies as opposed to the lights.

Currently the lanthanides in greatest demand are neodymium, europium, gadolinium, dysprosium and terbium; however, the demand for particular REEs is dynamic and can change at any time. Praseodymium is also of value because of its similar properties to neodymium.

When companies promote their deposits, they tend to come up with something along the lines of, "We have a certain percentage of the heavies and a certain percentage of the lights." The greater the percentage of the heavies they show, the more it is to their advantage, so they tend to start counting in areas that I would qualify as light rare earth elements.

When REEs are being discussed, people should define what they mean by the light and heavy rare earths. For me, the lights go midway through gadolinium. I would classify the heavies as terbium through lutetium. If you attempt to synthesize each of the REEs with a certain complex, phosphorus pentoxide (P2O5), for example, lanthanum through gadolinium will assume a monoclinic structure. Terbium through lutetium will assume a tetragonal structure similar to yttrium phosphate, and also similar to the mineral zircon. For me this demarcation is more rigorous from a scientific point of view. Otherwise the distinction between the LREEs and HREEs is arbitrary.

TGR: So the generally accepted notion that the HREEs are less common and therefore rarer and more valuable isn't accurate?

TM: No, that's not accurate. They're heavies or they're lights, period. Some are common. Some are not. Some of the heavies tend to be much rarer. Lutetium is a rare element, but yttrium—which always accompanies the heavy lanthanides—is not a rare element. In many areas, dysprosium, erbium and terbium are not that rare.

TGR: When investors hear the terms light rare earths and heavy rare earths, how should they be thinking as far as the economic viability of a deposit?

TM: I would imagine they have to pay attention to those that are currently in demand and place that into the equation. When they hear that a deposit has a certain amount of tonnage of certain elements, nowadays people tend to sit down and look at those elements' market prices. Then they decide that they've got something great. To me this approach can be very misleading.

TGR: Why?

TM: You can find many deposits that show good grade and tonnage consisting of a large quantity of valuable elements. If one calculates the elements' value based on current prices, the deposit looks like it's of great value. However, those elements must be mineable and economic to process so they are competitive in the marketplace. In many occurrences that might not be the case.

TGR: The Chinese have become very good at finding rare earth deposits and processing them, and are dominant in this space. Recently they announced they will begin restricting rare earth exports, which seems to have created a rush to find deposits throughout North America. In general, where do you think the prospects look good?

TM: We know of a number of deposits in North America where we can acquire the light lanthanides. We can do well going from lanthanum into the mid-atomic number lanthanides. That would include deposits such as Molycorp Mineral's (NYSE:MCP) Mountain Pass in California, Rare Element Resources Ltd.'s (TSX.V: RES) Bear Lodge carbonatite in Wyoming, and Wicheeda Lake in British Columbia, which is run by a private company, Spectrum Mining Corporation. [Editor's note: Molycorp Minerals (NYSE:MCP) went public 7/29/2010. See press release.]

The Mountain Pass deposit is rich in LREEs with ample grade and tonnage, and Molycorp has the technology to produce excellent REE concentrates for lanthanum, cerium, praseodymium, neodymium and samarium. And based on work that I have done in Wicheeda Lake, that mineralogy is amenable to physical concentration and there should be no problems in chemical processing.

Although we have sources in North America for LREEs in addition to those I just mentioned, to me they may have the best potential.

In terms of the heavies, we have several interesting HREE occurrences with some potential that are currently being investigated.

TGR: What are some of the deposits with the high ratio of heavies to lights that you're interested in?

TM: I've been working for Ucore Rare Metals Inc. (TSX.V:UCU) on Bokan Mountain in Alaska. It's on the southern tip of Prince of Wales Island. The accessibility there is the best of almost any deposit. It's principally heavy rare earth enriched with yttrium and dysprosium, gadolinium, erbium and ytterbium. The heavy lanthanides dominate the mineralogy. At this time they are working to establish whether they have sufficient grade and tonnage, and whether it's amenable to economic recovery.

They're in the exploration process right now. As a matter of fact, I'm scheduled to go there August 8–13, with Ucore people and a number of others from the United States Geological Survey. The U.S. government is quite interested in these minerals because they are of military importance.

TGR: Let's move on to some of the other deposits you'd like to talk about.

TM: I started the mineral exploration in Kipawa, Quebec, for Molycorp in the mid-1980s. Kipawa is enriched with the mineral eudialyte, which means "well decomposable" in Greek. I was able to establish that eudialyte contained yttrium and HREEs in anomalous amounts.

A number of years ago Matamec Explorations Inc. (TSX.V:MAT), a Canadian company from Québec, acquired the mineral rights on Kipawa. I've been basically working with Matamec and they are beginning to get some very interesting results.

TGR: What are you finding?

TM: First of all, it's going to be very easy to make a eudialyte physical concentrate in Kipawa. In fact, the way I see it, it's going to be easier to do this than in any other eudialyte deposit that I've worked on thus far. They are working on establishing that they indeed can process the eudialyte concentrate chemically to remove all of the lanthanides and yttrium and be able to bring them into the market. And do it at a cost that's competitive.

TGR: So the ease of creating that eudialyte concentrate translates into a lower cost of production?

TM: Yes. But there are a lot of other additional costs. Using common sense, if a deposit is in a certain type of geologic occurrence where the rocks are very difficult to crush and separate, it's going to be much more costly. And if a deposit is in a remote place it's going to cost a lot more to mine and you need to get power, too. You need to get reagents. You need qualified people to do the mining. Also, speaking of other complications, the Parajito is currently owned by First Nations groups who have not allowed requests for access to the land and have yet to partner with a public company, so investment there is not possible at this time.

TGR: TGR: You mentioned Rare Element Resources' Bear Lodge a bit earlier. What's the story there?

TM: Bear Lodge is a light lanthanide deposit. I did the initial work on Bear Lodge in the '70s—again for Molycorp. I did all of the mineralogy. I just came back from there in mid-July. Bear Lodge can provide light lanthanides and some of the mid-atomic number lanthanides in greater quantity than Mountain Pass, so that deposit has very good potential.

TGR: Now what about that deposit in South Africa? I'm not sure I can pronounce it.

TM: Steenkampskraal. That belongs to Great Western Minerals Group Ltd. (TSX.V:GWG; OTCQX:GWMGF), out of Saskatchewan.

TGR: Have you visited that site?

TM: No, I've never been there. I've worked on some of the minerals. Many years ago a Brazilian colleague of mine visited the occurrence there and he brought back minerals. I've done a lot of work on monazite from all over the world, including Steenkampskraal. So I know quite a bit about the mineral.

TGR: Hasn't GWG entered into an option agreement with Search Minerals Inc.'s (TSX.V:SMY) wholly owned subsidiary, Alterra Resources, for a 50% working interest in Alterra's Red Wine property in Labrador, too?

TM: Yes. Great Western Minerals Group is there. Medallion Resources Ltd. (TSX.V:MDL) also has an option agreement going in the Red Wine, and I'll be going to visit the Medallion area shortly and will be able to give my opinion on this deposit and rank it relative to other eudialyte deposits. As a matter of fact, I'm working on 15 polished thin sections and slabs from the Red Wine that I obtained. This is principally a eudialyte deposit and it also contains alkali zirconosilicates—AZS—that have the heavy rare earths and may be amenable to economic recovery.

TGR: Is Medallion's Eden Lake deposit primarily light earths?

TM: Yes, but it appears to have an interesting showing of some of the heavies as well. However, these things don't come to you. It needs to be evaluated and it costs money to do that. These people are aware of that. They try to acquire people with the best background who are equipped to do these evaluations, such as Jim Clark, who is vice president of exploration for Rare Element Resources. He will join me on a field visit to collect rocks and evaluate Eden.

Plenty of academic people have worked on these things, but the academics are not exploration geologists. Even economic geology professors don't make their living on exploration and true economics. They make their living teaching, hopefully teaching students and publishing academic papers. They make great contributions, but when they look at a deposit, they don't focus on the things we geologists have to focus on in order to evaluate a deposit from an exploration and economic point of view.

So academic people have looked at Eden Lake and perhaps to some extent, some exploration people as well, but not exploration people with a background on rare earth deposits. By background I mean in the laboratory and in the field, areas in which Jim Clark and I both have expertise.

One has to look at these deposits. Once you study and understand them in the field and in the laboratory, you can make a value judgment about which have the best possibility of being able to take over the marketplace. These include Pajarito, Kipawa, Bokan Mountain, the Red Wine complex and the Norra Kärr project in Sweden.

TGR: That's Tasman Metals Ltd.'s (TSX.V:TSM) project?

TM: Yes. I just visited there with Tasman, and I'm busy working on that also. Eudialyte deposits include the Ilimaussaq Intrusion in southern Greenland and eudialyte deposits in the Kola Peninsula of Russia as well. These occurrences have a lot of potential and they are very interesting deposits, but they have to be looked at.

TGR: Right. Now let me ask you about one more project and that is Strange Lake. You've obviously visited Strange Lake.

TM: I did a considerable amount of work in the early 1980s on Strange Lake. It's a large A-type granite circular structure, close to 5 kilometers in diameter. I believe it was first discovered by Iron Ore Company of Canada (IOC). Now Quest Rare Minerals Ltd. (TSX.V:QRM) is exploring and defining Strange Lake.

This deposit is made up of a complexity of a number of different rare earth-bearing minerals that are very fine grain and are locked mostly in quartz and feldspar. So there are problems in processing, to say nothing of the remoteness of the deposit and some other issues that go beyond what I specialize in—like cost of transportation and social and political issues. However, recently they have made considerable progress in their drilling program, uncovering some areas of very attractive mineralization.

TGR: We've talked about Eden Lake, Mountain Pass, Bear Lodge, Wicheeda Lake, Bokan Mountain, Strange Lake, Pajarito, Kipawa, Red Wine, Steenkampskraal, Norra Kärr, the Ilimaussaq Intrusion and the Kola Peninsula. Have we left off any?

TM: There are so many deposits, it's hard to keep them all in mind. The deposits I currently think have the most potential and deserve a closer look from the point of view of the heavy lanthanides are Pajarito and Kipawa. We need to look into the Red Wine to find out what indeed is there. And I hear there are some interesting things at the Douglas River deposit. I have a pretty good idea what the geology is, but I've never been to the Douglas River. I'm scheduled to go there August 23–30.

TGR: Where is Douglas River?

TM: It's in Saskatchewan. It's similar to the Maw zone in the lower part of the Athabasca—the uranium occurrence. It's supposedly mineralized with xenotime. The mineral xenotime has about 29% to 31% yttrium oxide. About another 30% includes the other heavy lanthanides. So it's a very attractive mineral. But again, it needs to be found in grade and tonnage to make it a bona fide deposit.

TGR: If Pajarito and the Kipawa are developed and begin to produce, will they deliver enough supply to satisfy the demand or will we need additional mines?

TM: I think they'd be able to satisfy the conditions for a number of years. Meanwhile, we're very busy looking all over the world for more of these. Particularly since the lanthanides, the heavies and including the lights, as far as I'm concerned, have unique properties. This is particularly true of the lanthanides, where the valence electrons are suborbital, which imparts very special properties. And they're being used extensively in many ways.

TGR: Early on in the conversation we touched on China beginning to restrict exports of the various rare earths. With some of these deposits potentially coming into production, are the fears that are being generated unfounded?

TM: Well. . .Bear in mind, once you find the deposit it's very costly to get it going, to reproduce a Mountain Pass. So suppose people do find these different deposits and finally establish that they have the grade and tonnage and that the deposit is amenable to economic recovery. At that time a large capital is required to start a mine.

TGR: Tony, this has been a great education in the world of rare earths. We appreciate your time.

Anthony N. (Tony) Mariano, PhD, is a geological consultant on rare earths and other rare metals. For decades, he has been the "go-to" expert on the geology and mineralogy of rare earths, niobium-tantalum and other rare metals. A seasoned mineralogist and petrographer, Tony integrates his strong knowledge of geology and extractive metallurgy ("geometallurgy") to predict success or failure of proposed rare earth ventures. Companies around the world depend on his professional opinions on the potential economic viability of deposits based on mineralogical examination, lab work and field visits. After earning his PhD in geology from Boston University, Tony worked a number of years at Kennecott Research's lab in Massachusetts, after which he began his career as a consulting geologist, specializing in carbonatite-hosted rare earth and niobium deposits.

Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Expert Insights page.

DISCLOSURE:

1) Brian Sylvester of The Gold Report conducted this interview. He personally and/or his family own the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Gold Report: Timmins.

3) Ian Gordon: I personally and/or my family own shares of the following companies mentioned in this interview:Timmins Gold, Golden Goliath, Millrock and Lincoln. My company, Long Wave Analytics is receiving payment from the following companies mentioned in this interview, for receiving mention on my website, Golden Goliath, Millrock and Lincoln Gold.

The GOLD Report is Copyright © 2010 by Streetwise Inc. All rights are reserved. Streetwise Inc. hereby grants an unrestricted license to use or disseminate this copyrighted material only in whole (and always including this disclaimer), but never in part. The GOLD Report does not render investment advice and does not endorse or recommend the business, products, services or securities of any company mentioned in this report. From time to time, Streetwise Inc. directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.