Chinese Real Estate The Mother Of All Bubbles

Housing-Market / China Economy Aug 09, 2010 - 02:09 AM GMTBy: James_Quinn

In the latest issue of The Casey Report Bud Conrad does a fantastic job analyzing the truth about Asia. Japan is a ticking demographic time bomb. The Chinese government has created the mother of all bubbles and when it pops, it will be felt around the world. The China miracle is not really a miracle. It is a debt financed bubble. Sound familiar?

In the latest issue of The Casey Report Bud Conrad does a fantastic job analyzing the truth about Asia. Japan is a ticking demographic time bomb. The Chinese government has created the mother of all bubbles and when it pops, it will be felt around the world. The China miracle is not really a miracle. It is a debt financed bubble. Sound familiar?

I picked out 4 charts from Bud's article that paint the picture as clearly as possible. The chart below shows that compared to the real estate bubble in Japan during the late 1980s and the current bubble in China, the US housing bubble looks like a tiny speed bump. The US has 20% to 30% more downside to go. For those looking for a housing recovery, I'd like to point out that Japan's housing market has fallen for 20 years with no recovery. I wonder if the National Association of Realtors will be running an advertisement campaign in 2025 telling us it is the best time to buy.

Take a gander at home prices in China. Since the 2008 financial crisis, the Chinese housing market has skyrocketed 60%. There are now 65 million vacant housing units. The question is no longer whether there is a Chinese housing bubble, but when will it pop. There is one thing that bubbles ALWAYS do. An that is POP!!!

The price of land in and around Beijing has gone up by a factor of 9 in the last few years. Delusion isn't just for Americans anymore. These two charts should be placed next to the word "bubble" in the dictionary. This will surely end in tears for anyone who has bought a house in China in the last two years.

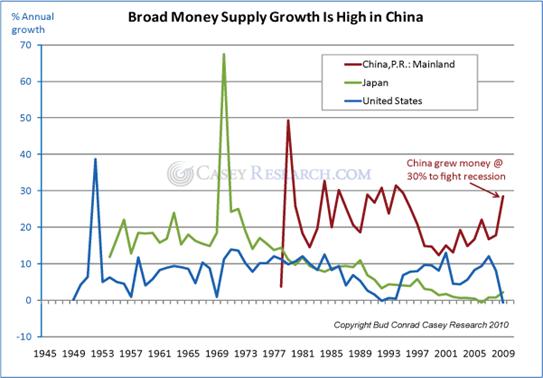

As Mr. Alan Greenspan can attest, bubbles can only form when monetary policy and/or fiscal policy is extremely loose. The bubble king supercharged the US housing bubble with his 1% interest rates in the early 2000s. The Chinese must have hundreds of Paul Krugman disciples running their economic bureaucracy. There can never be enough stimulus to satisfy a Krugmanite. The Chinese leaders feel they must keep their GDP growing at 10%. A slowing of growth to 5% would unleash social chaos among the hundreds of millions of peasants who have come to the cities from the countryside for jobs. The chart below shows that when you control the printing presses and the banks making the loans, you can make stimulus "work". In the U.S., the Federal Reserve has printed, but the banks have hoarded their cash and have not made loans.

The Chinese authorities have printed and instructed the banks to make loans for shopping malls, apartment buildings, office towers, and condo towers. Average citizens have bought as many as five condos. Every Wang, Chang, and Wong knows that real estate only goes up. Their $585 billion stimulus package was used to build entire cities that sit unoccupied. The 2.2 million square foot South China Mall, with room for 2,100 stores, sits completely vacant. The Chinese have taken the concept of "bridges to nowhere" to a new level.

Over a 20-month period, Chinese M2 grew 47%, reflecting the outrageous level of spending by the Chinese authorities. When you hand out $3.5 trillion to developers, they will develop. When a government official, who can have you executed, tells you to lend, obedient bankers lend. The Chinese authorities can hide the truth for a period of time, but the bad debt caused by the Chinese stimulus and malinvested in office buildings, condos, malls, and cities will eventually lead to a monumental collapse in the Chinese real estate market. This will result in a stock market crash and a dramatic slowing in economic growth.

The mother of all bubbles will Pop. Only the timing is in doubt. Based on history, the Chinese real estate bubble is in search of a pin.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2010 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.