Stock Market Performance, The Efficient Transfer of Wealth

Stock-Markets / Investing 2010 Aug 12, 2010 - 02:18 AM GMTBy: Doug_Wakefield

The following is a test. This will take less than a couple of minutes to test your mental sanity. Based on our current juncture in history, I believe this will prove of value.

The following is a test. This will take less than a couple of minutes to test your mental sanity. Based on our current juncture in history, I believe this will prove of value.

Question number one; when looking at the swings of the S&P 500 over the last 13 years, has it been wise to place your funds in a strategy that seeks to mirror this index ALL the time?

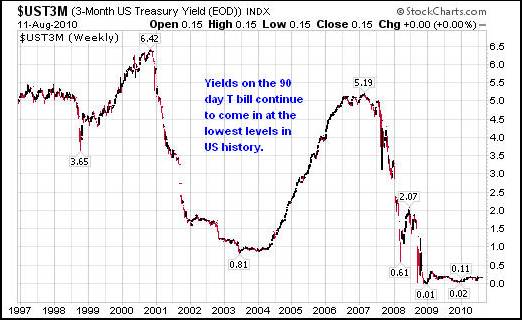

Question number two; if you have kept the majority of your funds in US Treasury bills, considered in the world of investing to be safer than certificates of deposits in FDIC banks, have the yields kept up with the rising cost of living over the last decade? If not, does the word “safe” adequately convey the risk of placing sizeable funds in this one asset category?

Question number three; From looking at the chart above, would you come to the conclusion that based on the last 13 years of history, a portfolio whose objective is to match the performance of the Dow Jones Corporate Bond Index is the utopia of all investments in the financial world?

The test is now complete. If you answered no to all the questions above, you have passed the Best Minds Inc basic financial sanity test, and should continue to read the rest of this article. If not, I doubt you will find anything of value beyond this point.

Changing My Own Views

Seven years ago, the emphasis of my day-to-day routine changed. Whereas I had always been a reader, I became much more critical of every aspect of the financial world around me. I had lived through the tech meltdown and that experience would prove life changing. While I turned to the various companies I worked with for answers, the mantra of “diversify and hold on for the long term” continued to be repeated to me. It was as though as long as I could convince my mind that I was NOT cutting my leg with a knife, the blade would never penetrate the skin. Yet month after month, no matter how much I “reallocated” portfolios, the bottom to this massive decline in equities continued to prove very illusive. By July 2002, I wondered why anyone was paying me to tell them anything.

However, by the spring of 2003, my quest to learn all I could about the world of money was in full gear. No, not just trading, or economics, or monetary history, but how we arrived at a period in time that had all the markings of a classic mania in human history, and why things I believed should have been obvious, were still dismissed by my industry, most of my peers, and millions of investors. That is, until we watched the greatest financial crash of our lifetimes in the fall of 2008, followed by the largest and fastest expansion of government debt in history.

What I have found from discussions with individuals of all walks of life in the last few months is that most are concerned about the rapid explosion of debt, and the direction things are taking us in the world. It is clear to all that we are not talking about a problem confined to the United States but one that is impacting the entire globe. We understand that no matter how powerful a position one holds in the world of money and politics, if you believe that “unlimited debt” is the answer to our future problems, you should be checked for your own sanity.

Yet, because the size of the problems are so large, and so complex, it is easier for us to dismiss the gravity of the current situation, expecting someone to fix this mess soon so that our individual lives can “return to normal’.

In this short piece, like many written for the public since 2005, I will seek to convey some ideas for you to explore further. I am confident, you will find that the material we cover will not be hard to understand (like the test above), just painful to accept. My goal today is the same as when I began releasing my research material; to help those seeking to increase their odds in this highly dangerous game we call “investing” by stepping outside the “urgent news” mentality, and connecting the dots across disciplines and through a historical perspective that is longer than the last few years. As always, it requires us to use one of the greatest gifts God gave man, our ability to think.

Theoretical Conceit or Denial of Reality

One of the most widely taught theories in the field of modern finance is the Efficient Markets Hypothesis (EMH). A larger portion of the academic world teaches its students this hypothesis. The following is found in the August ‘06 issue of The Investor’s Mind:

Indeed, the investments textbook for the College of Financial Planning states:

“The efficient market hypothesis (EMH) suggests that investors cannot expect to outperform the market consistently on a risk-adjusted basis. EMH is based on several assumptions including (1) the fact that there are a large number of competing participants in the securities markets, (2) information is readily available and virtually costless to obtain, and (3) transaction costs are small.” (Italics mine) 1

And this statement, found in the same textbook, reveals that anyone who challenges this widely taught hypothesis is ridiculed:

“Perhaps it is conceit that makes some individuals think they can use the dividend-growth model, or P/E ratios or price-to-book ratios or any other technique to beat the market.” 2

And yet, considering these next two examples, it would appear that there are some very well recognized names who continue to have a good laugh on those indoctrinated in the Efficient Market’s Hypothesis:

“Buffet stated in his 1988 Annual Report, ‘Observing correctly that the market was frequently efficient, they [EMT proponents] went on to conclude incorrectly that it was always efficient. The difference between these propositions is night and day.’ Buffet went on to say, ‘Berkshire illustrates just how foolish EMT is. Naturally the disservice done students and gullible investment professionals who have swallowed EMT has been an extraordinary service to us.’” 3

What about the big banks? Do they place large resources into action every day in an attempt to beat other market participants? The following story comes from one of the most recognized mathematicians in the world, Dr. Benoit Mandelbrot, who is credited for the discovery of fractal geometry, in his book, The (Mis) Behavior of Markets:

“If money is an idol, then one of the largest temple compounds of this modern faith sits on a tight bend of the River Thames, a few miles downstream from central London. There in the Canary Wharf business district rise eighteen steel and glass towers to which, each working day, 55,000 people commute to play their part in the international money market…This is where financial theory, from Bachelier to Black, meets financial reality.

Citigroup runs one of the biggest foreign-exchange operations at Canary Wharf. Each day, the multinational bank moves about one-ninth of the entire world’s internationally traded dollars, yen, euros, pounds, zlotys, and pesos. About a third of its global ‘FX’ business happens on the second floor of the London office. …

Seated at one row of desks, a pair of analysts spends their days studying the orders of the bank’s own customers. They are looking for broad patterns they can report back to the clients in regular newsletters. Theirs is the sort of market insider information that, one form of the Efficient Market Hypothesis says, should not be useful; any profitable insights into trading data should already be reflected in the prices. But they do not buy that notion: ‘The biggest edge you can have is the private information of who’s buying what’, says one of the analysts, ‘We do not believe that the market is efficient’.” 4

When one considers the fact that high frequency traders, through the use of the fastest computers in global markets, can trade up to 1,000 trades per second, and in 2009 were believed to control 50-70% of the activity in the electronic futures and options markets, how can any hypothesis be based on “the fact that there are a large number of competing participants in the securities markets” and that “information is readily available and virtually costless to obtain”? 5 Even George (Gus) Sauter, who oversees $920 billion for the Vanguard Group, a company known in the financial services industry as one of the largest providers of index mutual funds, stated in 2009, that “ We do not think [high-frequency trading] enhances the marketplace for all traders’. 6

The following statement, from the Bloomberg article, ‘Perfect Quarter’ at Four U.S. Banks Shows Fed-Fueled Revival, makes it clear that “perhaps it is conceit” to think that there are certain players who can NOT beat other participants in the markets:

“Four of the largest U.S. banks, including Citigroup Inc., racked up perfect quarters in their trading businesses between January and March, underscoring how government support and less competition is fueling Wall Street’s revival. Bank of America Corp., JPMorgan Chase & Co. and Goldman Sachs Group Inc., the first, second and fifth-biggest U.S. banks by assets, all said in regulatory filings that they had zero days of trading losses in the first quarter. Citigroup Inc., the third-largest, doesn’t break out its daily trading revenue by quarter. It recorded a profit on each trading day, two people with knowledge of the results said. ‘The trading profits of the Street are just another way of measuring the subsidy the Fed is giving to the banks,’ said Christopher Whalen, managing director of Torrance, California based; Institutional Risk Analytics. ‘It’s a transfer from savers to banks.’ [Italics- mine]

If you are optimistic that the new financial reform bill is going to level the playing field for a “large number of competing participants” in the future, rather than a small number of players that continue to dominate global capital markets, think again. According to a recent article in Business Insider, Logic Gates: The Next Phase of High-Frequency Trading, themove toward even faster trading is in the works even now, and could take the most powerful players to “infinity and beyond” in a few years:

“It will take high-frequency trading into the range of nanoseconds as opposed to microseconds or milliseconds. Think about that for a minute. We're talking one billionth of a second, here. … to summarize, in five years, we're going to have light speed trading.” [Bold- authors]

When I consider the movement of markets in the last few months, where the Dow climbs and falls hundreds of points in a matter of 2-4 weeks, I am reminded of a lesson that is ingrained in my mind from Dr. Larry Parks, a brilliant monetary historian and one of the most passionate advocates for an honest monetary system; businesses and individuals need a stable money in order to make plans for their futures, Wall Street banks need volatility.

In the months ahead, I believe it will be critical, that investors understand that REALITY, based on history, reveals that our markets have been moving for decades at an ever faster pace, where the big get even bigger and gain even more influence over the lives of the millions who depend on them worldwide. When we consider that this growth could only have been accomplished with the assistance of central banks around the world, then we understand why the term “free markets” is a farce. How can the concept of “free markets” be taken seriously, when only a handful of very powerful players were able to hand their institutions hundreds of billions of newly created Treasuries?

I believe these comments, found in the newly released The Global Economic Crisis: The Great Depression of the 21st Century, make it painfully clear that market manipulation by a few key players is a much better description of our markets than “efficient markets”, that is unless “efficient markets” is synonomous with “survival of the largest”:

“Public opinion had been misled. A diabolical circular process had been set in motion. The U.S. government is in a sense financing its own indebtedness; the money granted to the banks is in part financed by borrowing from the banks. To finance the 1.45 trillion dollar bailout, the government needs to borrow, through the emission of public debt.

Where does the government go? To the banks. In other words, with the money the banks lend to the government, the Treasury finances the bailout in favor of the banks. 7 To understand what has happened, follow the money trail of electronic transfers with a view to establishing where the money has gone. What is at stake is the outright criminalization of the financial system, financial theft on an unprecendented scale.” 8

As geologist Dr. Jared Diamond says in his work, Collapse: How Societies Choose to Fail or Succeed,

“Many of the reasons for such failure fall under the heading of what economists and other social scientists term, ‘rational behavior’, arising from clashes of interest between people. That is, some people may reason correctly that they can advance their own interests by behavior harmful to other people. Scientists term such behavior ‘rational’ precisely because it employs correct reasoning, even through it may be morally reprehensible.”

9

Be careful my friend. Our ability to understand our current juncture doesn’t require PhD credentials, but it does require the courage to examine the historical record. While we may not be able to change the world at the global level, we certainly have the ability to change our own minds and actions.

Sources

[1] The Investors Mind, August 2006, pg 2, from Investments: An Introduction, Seventh Edition – Custom Edition for the College for Financial Planning (2002), pg 272

[2] Ibid, pg 272

[3] Riders on the Storm: Short Selling in Contrary Winds, Doug Wakefield w/Ben Hill (2006), pg 30, from http://www.berkshirehathaway.com/letters/1988.html

[4] The (Mis) Behavior of Markets: A Fractal View of Risk, Ruin, and Reward, Benoit Mandelbrot and Richard L. Hudson (2004), pg 79-81

[5] The New Masters of Wall Street, Forbes, Sept 21` ‘09]

[6] Ibid

[7] The Global Economic Crisis: The Great Depression of the XXI Century (2010) Michel Chossudovsky and Andrew Gavin Marshall, Editors, pg 55

[8] Ibid, pg 55 & 57

[9] Collapse: How Societies Choose to Fail or Succeed (2005) Jared Diamond, pg 427

Doug Wakefield President

Best Minds Inc. , A Registered Investment Advisor

3010 LBJ Freeway

Suite 950

Dallas , Texas 75234

doug@bestmindsinc.com

phone - (972) 488 -3080

alt - (800) 488 -2084

fax - (972) 488 -3079

Copyright © 2005-2010 Best Minds Inc.

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology.

Disclaimer: Nothing in this communiqué should be construed as advice to buy, sell, hold, or sell short. The safest action is to constantly increase one's knowledge of the money game. To accept the conventional wisdom about the world of money, without a thorough examination of how that "wisdom" has stood over time, is to take unnecessary risk. Best Minds, Inc. seeks advice from a wide variety of individuals, and at any time may or may not agree with those individual's advice. Challenging one's thinking is the only way to come to firm conclusions.

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.