Am I A Bit Too Pessemistic on the U.S. Economy?

Economics / US Economy Aug 17, 2010 - 03:18 AM GMTBy: Matthew_Ehrlich

A Follow Up To ‘Us Economic Outlook Update’ - I have often said that the best way to truly learn and understand something is to try to teach it. That way, you have to deal with the questions that come from a wide variety of different views. Presenting an article, similarly evokes questions that make us dig deeper to better define or improve our explanation. Several comments I received to my article “U.S. Economic Outlook Update, Is the Downturn Finally Over, if not, When it will end?” http://www.marketoracle.co.uk/Article21778.html said that I was way too pessimistic and that real estate bubbles usually last only a few years. They also questioned weather housing or employment were key issues to the recession as opposed to financial institutions causing the whole mess. So, here is my deeper explanation of why I think that this time it’s different and the intertwined housing/employment relationship has dictated the outcome.

A Follow Up To ‘Us Economic Outlook Update’ - I have often said that the best way to truly learn and understand something is to try to teach it. That way, you have to deal with the questions that come from a wide variety of different views. Presenting an article, similarly evokes questions that make us dig deeper to better define or improve our explanation. Several comments I received to my article “U.S. Economic Outlook Update, Is the Downturn Finally Over, if not, When it will end?” http://www.marketoracle.co.uk/Article21778.html said that I was way too pessimistic and that real estate bubbles usually last only a few years. They also questioned weather housing or employment were key issues to the recession as opposed to financial institutions causing the whole mess. So, here is my deeper explanation of why I think that this time it’s different and the intertwined housing/employment relationship has dictated the outcome.

In the usual housing bubbles we have seen, there is a core group or event at the center of the run up, speculators, home builders, banks/mortgage companies, changes in interest rates/government policy or a general upturn in the economy. Then, the core special interest groups push up the market continually until the smaller speculators and investors join in to keep feeding it until it all collapses. This is what we are afraid is happening in China right now. The new super rich are building huge apartment buildings and because there are lots of these new rich chasing each other to get richer, up and up and up prices go. If the bubble bursts, these new super rich and the few "small" rich speculators along with the lending banks will be the ones who are damaged. The "small" rich speculators will be wiped out, finished. The super rich will become only mildly rich and the banks will be under tighter government control, especially if they need to be bailed out. And, it is correct that this should only last less than two years. Where the US situation is different this time, and the point I was making in my previous article is that in the US, it was not the rich, super rich, speculators or even the banks who started the bubble, they all came later. It started with the 1992 Congress that strove to change the ‘American Culture’ to create this housing boom from coast to coast and in every city, town, village and small community as a minority equalization initiative. This was a cultural change not simply a business change. As I point out in my article, from the 1992 election onward, a concerted effort was made by special interest groups in Congress to fast track minority home ownership. Most notably, without rehashing the previous article, the changes made at Fannie Mae to reduce or eliminate many of the financial requirements mortgage seekers traditionally needed to provide to banks and mortgage companies in order to get financing for home purchases.

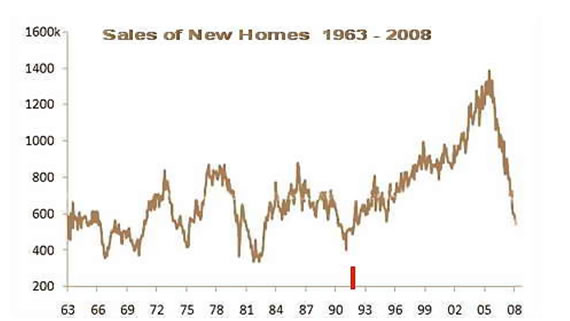

By 1999 we were breaking out into new uncharted territory in the home building industry. Reading further into an article in the September 1999 Mortgage Banker Magazine, about Fannie Mae’s $500,000 grant to the Congressional Black Caucus, it states,

“Fannie Mae's support of the CBCF is part of its Trillion Dollar Commitment to help finance more than 10 million homes for families and communities most in need through the end of the decade.”

(Emphasis mine) http://www.allbusiness.com/personal-finance/real-estate/390800-1.html

In 2002, President Bush also picked up on the wave announcing a $2.4 billion tax credit would be granted to housing developers to build low-income, single-family housing units over the following five years and vowed to raise minority home ownership by an additional 5.5 million units.

Unfortunately, this “Cultural Change” brought about the dire unintended consequences which are at the heart of the long term economic collapse we are experiencing today. This change not only affected the people it was initially intended to help by providing easily obtained homes, it affected ALL of American society. Within this shift was a re-evaluation of priorities of employment and national focus for decades to come. The addition of literally millions of new homes to accommodate this cultural change meant a shift in the career paths of a generation and changes in corporate investment for future economic growth of the United States. Between 1997 and 2007 the United States saw a shift of more than 3 million jobs from manufacturing to construction.

Now here is the key issue which I have not heard anyone mention. As people enter the workforce, they generally make a lifelong career path decision. This is not taken lightly as a working lifetime is about 35 to 40 years. Just as we see today, young people struggle with the decision as to where opportunities lie for a secure and lucrative career. In the mid 1990’s young people looked at the housing boom and listened to the government rhetoric about decades of expanding home ownership for everyone and made a very logical choice. Construction trades offered job security, good pay, good life style and a relatively low hurdle to entry (they also get off all major national holidays including the first day of Hunting Season). They made a career decision, with an expectation of 30+ years of steady and productive employment. On the losing side of this career path choice was the manufacturing industries that exemplified an industrialized America. As it turns out “The Giant Sucking Sound” Ross Perot spoke of in his 1992 presidential campaign was not to Mexico but to China.

Since 1998, manufacturing has been unrecoverably shifted overseas. Products are now cheaply sourced from China, Mexico and other countries while the lost jobs have been shifted to the building trades in anticipation of at least three decades of steady employment. Unfortunately, there was no foundation of economic responsibility and regulatory control to guide this Paradigm Shift. That is why this bubble bursting not only destroyed wealth, which could be rebuilt over a few years as it has in the past, it destroyed careers, employment that will take a decade to redirect. What is needed now is a way to revive this industry and at the same time find a replacement industry for the next generation. I will repeat it again, this economic crisis will not end until the spread between new home and used home (now better know as Bank Foreclosed home) prices starts to narrow enough for a sane person to by new construction.

We have become uncompetitive in Automobiles, textiles, light manufacturing and many other areas where the US has ceded industries to foreign countries, China, Japan, Germany, Korea. Additionally, this cultural shift to home construction overwhelmed the available supply of workers in the early 2000’s to the point where the general population and government, turned a blind eye to the illegal immigrant laborers coming across the border to help facilitate this housing boom and cultural change in American. And, those workers are not reflected in the charts above. All of this can not be reversed quickly. These are 30+ year career paths that have abruptly ended after only 10 to 15 years. Some of these building trades workers have been out of work for more than three years now with no relief in sight. The spread between new and resale home prices continues to widen due to ongoing foreclosures and unfortunately, many of the current round foreclosures is caused by the extended unemployment of these very workers. As I mentioned in my previous article, one idea might be what I call it the “(Ehrlich) Hybrid Home Stimulus Plan”. The plan calls for Federal, State and Local governments to grant a tax abatement or “stimulus” on the sale of existing homes that apply and are approved for the reconstruction of a specific percentage of the sale price. In other words, let’s say the Federal government sets a minimum reconstruction standard of 25% of the homes resale value to get a federal stimulus grant, then the local/states could set any amount greater than that for an additional tax relief. Possibly, keeping the previous home tax assessment for 3 to 5 years if the value of the reconstruction is 30% or more of the sale price. This would both take used home inventory off the market at the same time as getting the building trades back to work. It could also solve the problem of Chinese wall board dangers that has become an issue in resales.

As I sit here in Asia and watch CNBC and Bloomberg, I listen to the guru’s on TV predicting an end to the recession based on one or another companies quarterly earnings and I just shake my head. They watch increases in year on year sales without thinking about the origin of the products that are being sold. Yes, the sellers are making a profit but the American worker is no longer getting a pay check for making what they are selling and the American worker is no longer getting a paycheck for building the houses for those workers. And the restaurants and service industries are no longer benefiting from the spending by the now unemployed. The key is employment, creating jobs to put steady paychecks into the hands of the unemployed 10 percent (plus) of the population including those who's career path made them carpenters, plumbers, electricians, roofers, developers, tied to the housing boom culture that abruptly ended ten to fifteen years prematurely and can not switch over to manufacturing jobs which have been lost or given away to the parts of the world where the economies and employment are now growing. Yes, that is one of the main reasons why I am pessimistic.

By Matthew Ehrlich

Email: mattehrlich@msn.com

Matthew Ehrlich is an Economist and financial services professional, with more than 30 years experience on both Wall Street and throughout Asia . Experienced in the full spectrum of investment products including Futures, Hedge Funds, Derivatives, Alternative Investments, Foreign Exchange and Direct Investments. Mr. Ehrlich advises clients throughout Asian, particularly in Japan and Singapore. Mr. Ehrlich has broad and deep relationships with institutions, Exchanges, Banks, Brokerage Houses, High Net Worth investors and Insurance companies throughout the world.

© 2010 Copyright Matthew Ehrlich - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.