The Overvalued Part of a Stock Market Cycle

Stock-Markets / Stock Market Valuations Aug 18, 2010 - 05:30 AM GMTBy: Richard_Daughty

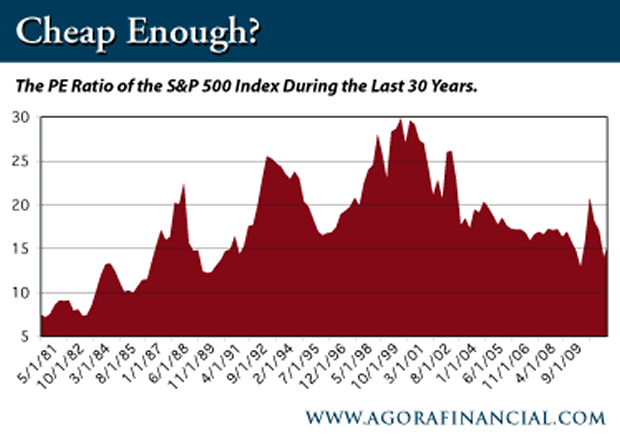

I had just gotten home from arguing with the in-laws about how they were idiots for not buying gold instead of those stupid stocks and mutual funds, and their laughter was still ringing distastefully in my ears when Eric Fry here at The Daily Reckoning put up a chart of the P/E ratio of the S&P500 over the last 30 years since 1981.

I had just gotten home from arguing with the in-laws about how they were idiots for not buying gold instead of those stupid stocks and mutual funds, and their laughter was still ringing distastefully in my ears when Eric Fry here at The Daily Reckoning put up a chart of the P/E ratio of the S&P500 over the last 30 years since 1981.

Interestingly, in 1981 the stock market was in a kind of a funk and the Price/Earnings ratio was hitting about 7, which is on the low side, whereupon (thanks to Congress authorizing tax-deferred retirement accounts in 1982) the stock market proceeded for the next 20 years or so, in fits and starts, to rise to, stunningly, a P/E ratio of almost 30 in 2000, whereupon it promptly turned over and has been falling, in fits and starts, for the last 10 years as the price of the S&P went down. Wow! What a ride!

Of course, it has been an entire paragraph where I did not snarl at something, or heap Mogambo Disdain And Scorn (MDAS) on the despicable Alan Greenspan, Ben Bernanke and the whole worthless Federal Reserve, Congress and Supreme Court, so let me say that buying the S&P500 in 2000 for $1,600 to get a P/E of 30 was, if you are even fleetingly familiar with P/E ratios over the last century, absolutely ridiculous, and the morons buying the S&P500, or recommending it, at such stupidly-overvalued prices should have their names and faces posted somewhere in a database of "investing idiots and miscellaneous dangerous lunatics."

I say this because the historical record is crystal-clear: When the P/E ratio goes above 22 or so, it won't be long until the price of the stock falls enough so that the Price/Earnings ratio is back down in the upper teens in a bull market, and back down to around 5 in a severe bear market, whereupon it won't be long until the price rises again on its way to "overvalued" status. That's the nature of cycles.

There are those who think that this historical record-stuff is just old history, now rendered meaningless in an age of monumentally stupid governmental deficit-spending, pandemic crushing debt, and a despicable Federal Reserve always, always, always creating yet more, staggeringly more, tragically more, catastrophically more excess money, which is what caused the problems in the first place!

On the other hand, there are those who do NOT regard the lessons of a couple of centuries of P/E ratios to be irrelevant, and who last think that Wednesday is still considered "current events."

Like, for instance, my wife, who wanted to question me about where I was until almost midnight last Wednesday, which is, I figure "the past" because I have forgotten almost all of it.

So, I told her, "Hey! Hold on! That's ancient history! Why even bring up that old, useless stuff unless you are spoiling for a fight with me, which leads me to ask a question of my own, which is 'Hey! You want get into a fight with me? Huh? Is that what you really, really want? Huh? Is it? Huh? Huh?"

Well, it was, alas, as she is one who also thinks there is valuable information in old data, like what happened last Wednesday or, if you ask her, what happened with this whole P/E thing. And she would be right, as I note that the S&P500 is currently sporting a P/E of around 15 - which is surprising in that we are in a recession and the S&P 500 is still 30% below its high of over 1500 in 2000, ten years ago! Hahaha! Idiots!

So, with every stinking ounce of Unshakable Mogambo Certainty (UMC) I can muster, I say that the price of the S&P500 will fall, in fits and starts, until its P/E ratio gets down to less than 7, probably less than 5, and maybe less than 4.

And this is assuming that earnings don't fall, which they will, and so I wouldn't be surprised if the S&P500 fell to less than 200.

And, with special emphasis to in-laws everywhere, anyone buying a broad basket of common stocks and bonds, but not buying gold, silver and oil to protect themselves against the roaring inflation in consumer prices that will result from an idiot Federal Reserve creating massive amounts of money so that the government can deficit-spend those massive amounts of money, is a moron.

Surprisingly, buying gold, silver and oil is an investing strategy made especially for us morons, because it requires no thinking and, "Whee! This investing stuff is easy!"

Richard Daughty (Mogambo Guru) is general partner and COO for Smith Consultant Group, serving the financial and medical communities, and the writer/publisher of the Mogambo Guru economic newsletter, an avocational exercise to better heap disrespect on those who desperately deserve it. The Mogambo Guru is quoted frequently in Barron’s, The Daily Reckoning, and other fine publications.

Copyright © 2010 Daily Reckoning

© 2010 Copyright The Daily Reckoning - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.