Silver Wheaton Call Options Move Up Today

Commodities / Gold and Silver 2010 Aug 19, 2010 - 02:41 AM GMTBy: Bob_Kirtley

As you know on the 29th May 2010 we purchased some Silver Wheaton (SLW) Call Options which are the September 2010 series, with a strike price of $21.00 and we paid $1.30 per contract for them. On Friday, 2nd July 2010 we decided to take advantage of a dip and so we doubled our position for a cost of $0.95, reducing our average price to $1.12. Having been under water for sometime its comes as a relief that today these contracts closed with the bid at $1.10 and the ask at $1.14.

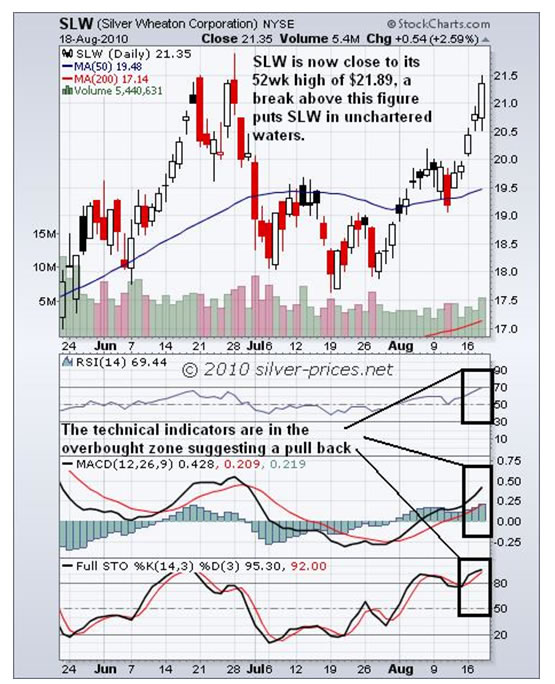

Now, there are couple of points to consider regarding Silver Wheaton’s progress so we will start with a quick look at the chart. Please note that the stock price is now close to its 52 week high of $21.89, a break above this figure puts SLW in unchartered waters with no overhead resistance so it could move higher.

However, also note that this rise has left a few gaps as the stock price has jumped ahead, not too many but often the stock price will will return to fill those gaps. Also against a move higher are the technical indicators which are in the overbought zone, suggesting a pull back. A closer look shows us that the RSI stands at 69.44, right on the door step of ‘70′ which generally tells us to expect some consolidation, but it can go a little higher. The STO is right up there and looks ready to turn and head south and finally the MACD is not too bad and could go a little higher.

Now throw into the pot that SLW has just released some very good figures which should be catching the eye of those investors looking to gain exposure to silver prices, however, they have to wrestle with the issue of timing, is now the right time or should they wait for a dip, etc.

Another observation is that silver prices went down today as they lost about $0.13/oz, however SLW moved higher gaining $0.54 or 2.59%, just maybe you guys are listening and acquiring a few of this stock!

In conclusion its a bit of a walk on a tight rope right now and the stock price could go either way so we are left sweating on this one while you can have a rare old chuckle at our conundrum. We will sleep on it with everything crossed for another good day tomorrow.

Silver Wheaton Corporation trades on the New York Stock Exchange and the Toronto Stock Exchange under the symbol of SLW and is currently trading at $21.35.

The Company has a market capitalization of $7.34 billion, with 344.00 million shares outstanding, a 52 week trading range of $9.10 to $21.89 with an average volume of 4-5 million shares traded, although spikes in trading have seen 14 million shares change hands.

Stay on your toes volatility will be the order of the day and have a good one

Got a comment then please add it to this article, all opinions are welcome and very much appreciated by both our readership and the team here.

Silver-prices.net have been rather fortunate to close both the $15.00 and the $16.00 options trade on Silver Wheaton Corporation, with both returning a little over 100% profit.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

Got a comment then please add it to this article, all opinions are welcome and appreciated.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Art Phelan

20 Aug 10, 16:46 |

silver

Looks like silver may turn out to be the anointed mineral on the stock market next year or two. Looking for best choice. |