The Importance of Business Start-ups and When Did Thrift Become Bad?

Economics / US Economy Aug 24, 2010 - 04:52 AM GMTBy: John_Mauldin

This weekend I wrote about the problems of being an entrepreneur in our Muddle Through Economy. I would like to follow that up with two brief (but somewhat controversial) essays on two aspects of starting up small businesses. The first, by Vivek Wadhwa, points out that start-ups account for all of the net new jobs, and is a summary of a paper from the Kaufman Foundation. (You can read the 12 page paper at

www.kauffman.org/..)

This weekend I wrote about the problems of being an entrepreneur in our Muddle Through Economy. I would like to follow that up with two brief (but somewhat controversial) essays on two aspects of starting up small businesses. The first, by Vivek Wadhwa, points out that start-ups account for all of the net new jobs, and is a summary of a paper from the Kaufman Foundation. (You can read the 12 page paper at

www.kauffman.org/..)

The second is by my friend William C. Dunkelberg, the Chief Economist of the National Federation of Independent Business. He asks a very simple question: Why is thrift getting such a bad name? And if we take the potential savings from “the rich,” where will the savings come from to invest in start-ups?

Vivek Wadhwa is an entrepreneur turned academic. He is a Visiting Scholar at the School of Information at UC-Berkeley, Senior Research Associate at Harvard Law School and Director of Research at the Center for Entrepreneurship and Research Commercialization at Duke University.

The both make for thought-provoking reading, and offer some challenges to the conventional wisdom, which is what Outside the Box is supposed to do.

Your doing his part by creating start-ups analyst,

John Mauldin, Editor

Outside the Box

The Importance of Start-ups

The Importance of Start-ups

By Vivek Wadhwa, and William C. Dunkelberg

I knew I would be touching a raw nerve with my last two posts, on patents. But I was really surprised at the divergence of opinion. Entrepreneurs overwhelmingly supported my stance that software patents hamper innovation and need to be abolished, but friends at Microsoft, IBM, and Google were outraged at my recommendation. The big companies’ executives argued that abolishing patents would hurt their ability to innovate and thus hamper the nation’s economic growth. (They believe that companies like theirs create the majority of jobs and innovations, and they claim that without patents they cannot defend their innovations.) I am not convinced that software patents give Google any advantage over Microsoft and Yahoo, or make IBM’s databases any better than Oracle’s. But I do know one thing for sure: it isn’t the big companies that create the jobs or the revolutionary technology innovations: it is startups. So if we need to pick sides, I vote for the startups.

Let’s start with the question of who creates the jobs. This is one of the issues that I recently took Intel co-founder Andy Grove to task for, in BusinessWeek. Grove wrote a profound essay lamenting the loss of American manufacturing jobs. I share his concerns about jobs. But Andy’s protectionist recommendations for restoring America’s competitiveness were largely based on his flawed premise that companies like Intel create all the jobs—not the startups. I also discussed the tradeoff between bailing out companies like General Motors, AIG, and Citibank and nurturing startups in this BusinessWeek piece. This question is more important than it may seem.

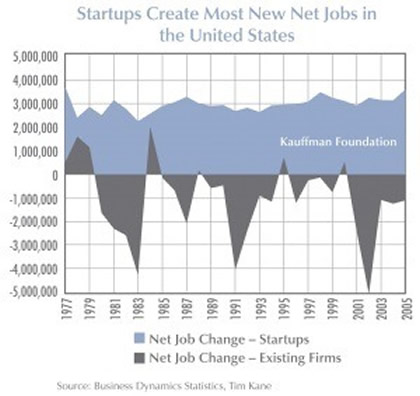

Kauffman Foundation has done extensive research on job creation. Kauffman Senior Fellow Tim Kane analyzed a new data set from the U.S. government, called Business Dynamics Statistics, which provides details about the age and employment of businesses started in the U.S. since 1977. What this showed was that startups aren’t just an important contributor to job growth: they’re the only thing. Without startups, there would be no net job growth in the U.S. economy. From 1977 to 2005, existing companies were net job destroyers, losing 1 million net jobs per year. In contrast, new businesses in their first year added an average of 3 million jobs annually.

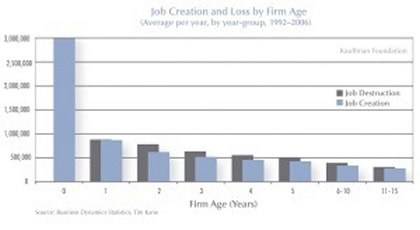

When analyzed by company age, the data are even more startling. Gross job creation at startups averaged more than 3 million jobs per year during 1992–2005, four times as high as any other yearly age group. Existing firms in all year groups have gross job losses that are larger than gross job gains.

Half of the startups go out of business within five years; but overall they are still the ones that lead the charge in employment creation. Kauffman Foundation analyzed the average employment of all firms as they age from year zero (birth) to year five. When a given cohort of startups reaches age five, its employment level is 80 percent of what it was when it began. In 2000, for example, startups created 3,099,639 jobs. By 2005, the surviving firms had a total employment of 2,412,410, or about 78 percent of the number of jobs that existed when these firms were born.

So we can’t count on the Intels or Microsofts to create employment: we need the entrepreneurs. And there is an important lesson here for the states and cities that offer huge incentives to companies like Dell, Google, and Intel to locate their operations there. The regions should, instead, be focusing on creating more startups, not providing life support to technology behemoths.

Now let’s talk about innovation. Apple is the poster child for tech innovation; it releases one groundbreaking product after another. But let’s get beyond Apple. I challenge you to name another tech company that innovates like Apple—with game-changing technologies like the iPod, iTunes, iPhone, and iPad. Google certainly doesn’t fit the bill—after its original search engine and ad platform, it hasn’t invented anything earth shattering. Yes, Google did develop a nice email system and some mapping software, but these were incremental innovations. For that matter, what earth-shattering products have IBM, HP, Microsoft, Oracle, or Cisco produced in recent times? These companies constantly acquire startups and take advantage of their own size and distribution channels to scale up the innovations they have purchased. They let the startups take the risk and prove the business models.

This raises an interesting question. Google and Microsoft have always prided themselves for hiring the cream of the crop of software developers. It is ridiculously hard to get a job at either company. But when technology’s top guns join these companies, they seem to make a smaller impact than those that don’t get hired. So would these companies be better served by releasing their most brilliant developers into the wild and arming them with seed financing to start companies? (They could negotiate partial ownership and right of first refusal on acquisition.) We would certainly get more innovation this way.

Simply put, if we are serious about lifting the economy out of its rut, we need to focus all of our energy on helping entrepreneurs. Provide them with the incentives (tax breaks and seed financing); education; and infrastructure. And gear public policy—like patent-protection laws—toward the startups. Let’s not bet on the companies that are too big to fail or too clumsy to innovate.

Editor’s note: Guest writer Vivek Wadhwa is an entrepreneur turned academic. He is a Visiting Scholar at the School of Information at UC-Berkeley, Senior Research Associate at Harvard Law School and Director of Research at the Center for Entrepreneurship and Research Commercialization at Duke University. You can follow him on Twitter at ;@vwadhwa and find his research at www.wadhwa.com.

When Did Thrift Become Bad?

By William C. Dunkelberg, Chief Economist

National Federation of Independent Business

Supporters of letting the “Bush tax cuts” expire, especially for those with incomes over $200,000 (the “rich”), argue that money given to the rich is mostly “saved” while money to the “poor” is spent 100%, thus stimulating the economy. We can infer from that position that the argument is that “savings” don't matter for the economy or that the rich somehow destroy the income they do not spend (i.e. save) and it has no impact on the economy. A Brookings report (August, 2010) reports “…most Bush tax cut dollars go to higher-income households and these top earners don't spend as much of their income as lower earners”. So, economic policy is to take money from the successful and savers and give it to those who will spend spend spend?

Savings is defined as “non-consumption”, if you don’t spend it (on government or personal consumption), it is saved, whether in your mattress, or in an insurance premium, or buying stocks and bonds or putting the money in a bank. Savings make up the pool of funds we use to finance “investment”, the creation of new productive assets like equipment, office or warehouse buildings, inventions, new vehicles for business purposes, things that raise worker productivity and income in the long haul.

If you don’t put money in the local bank (i.e. save and deploy the funds in the financial system somewhere), we can’t finance any of these investment expenditures. It’s that simple. We are already a nation of poor savers, with our consumer saving rate reaching near zero in the housing boom (p.s. new housing is counted as investment, a new asset, but it doesn’t have much impact on productivity). So, the notion that rich people waste their incomes by saving a significant percentage of it is so off the mark! We need savers, and policies that transfer income earned by the successful to those who will spend 100% of it and don’t save anything is a recipe for economic disaster.

Most small businesses when started are financed almost entirely with the savings of the entrepreneur and small firms grow and create jobs with earnings that are “saved and re-invested” in the firm. The Brookings report argues that ending the cuts will have minimal impact on small business growth because “Less than 2 percent of tax returns reporting small-business income are filed by taxpayers in the top two income brackets”. This “2 percent” number uses as a denominator about 29 million tax returns with schedule C business income. But most of these employ nobody, many are part-time businesses. There are only 6 million employer firms, 90 percent with fewer than 20 employees. These are the job creators and far more of them would be impacted by the expiration of the Bush tax cuts.

We have borrowed the savings of the rest of the world for years so that we could “party” and still invest in some real capital at the same time. The problem is that those lending us their savings reap the returns, not Americans, and eventually might expect to be repaid. Every time we go through these cycles, we pile on more and more debt which claims more earnings each year from investments financed by the debt (and by foreign direct and financial investment) and increases the total amount of debt that must be refinanced and repaid in the future. The longer we put off making governments and firms seeking subsidies accountable, the more devastating will be the day of “settlement”. And we all know it will come. Each “crisis” brings the day of reckoning closer.

John F. Mauldin

johnmauldin@investorsinsight.com

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2010 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.