Stock Markets Pare Losses On Housing Data

Stock-Markets / Stock Markets 2010 Aug 31, 2010 - 10:49 AM GMTBy: PaddyPowerTrader

As I warned yesterday double dip fears returned to trump the temporary respite from Bernanke’s holding exercise at Jackson Hole & a flurry of M&A activity following yet more disappointing economic data which showed weaker than expected growth in US household personal income sending. This all helped push US equity indices to a 1.1% loss Monday. The 1020 area on the S&P 500 remains the key level to watch as this is the point from which we bounced back in early July. A break there I feel would see the market push substantially lower.

As I warned yesterday double dip fears returned to trump the temporary respite from Bernanke’s holding exercise at Jackson Hole & a flurry of M&A activity following yet more disappointing economic data which showed weaker than expected growth in US household personal income sending. This all helped push US equity indices to a 1.1% loss Monday. The 1020 area on the S&P 500 remains the key level to watch as this is the point from which we bounced back in early July. A break there I feel would see the market push substantially lower.

The US highlights today include the August FOMC minutes, Chicago PMI and consumer confidence data. The FOMC minutes will be particularly interesting to determine the divisions within the Fed with regard to further quantitative easing in addition to the recent decision to maintain the size of the Fed’s balance sheet. Although Fed Chairman Bernanke has noted that he stands ready to implement more QE, the size and stance of hawks within the Fed will be key to how they will react to further economic deterioration. Meanwhile the Chicago PMI is expected to slip in August to 57.0, albeit from a high level, whilst consumer confidence is likely to remain unchanged at a relatively low level around 50.4. The employment component of the consumer confidence data will be examined for clues ahead of Friday’s US jobs report.

The big macro focus tomorrow will be China as all eyes turn to the Chinese PMI data, with 51.5 the expected number. In Europe, markets opened negatively Tuesday following pronounced Asian weakness (see below) and as Meredith Whitney suggested banks may have to raise money because of the recent real estate price decline and Obama disappointed with another lack lustre speech on the economy. The bright spots of the session were solid earnings from Stroer, Amadeus and Iliad, while Vodafone gained on speculation they are ready to sell their 3.2% stake in China Mobile, But Austrian bank RZB, Greece’s Eurobank and Bavarian Nordic all posted disappointing numbers while miners and basic resources names were soft as copper prices eased on the LME. London Dockland’s light rail operator Serco shed 3.5% on a broker downgrade at BofA Merrill Lynch from Buy” to “neutral”

In early news from the US, shares of luxury-fashion retailer Saks have rallied 9.9% today in premarket trade on rumours from unidentified sources carried in the Daily Mail talking about a private equity consortium that is preparing a cash bid of $1.7 billion, or $11 a share, for Saks. Elsewhere Dollar General raised their 2010 financial outlook and Deere & co announced the sale of its wind energy unit to Exelon for $900m. Finally food play Monsanto gave lowered their full year 2010 guidance but Heinz beat the Street with an eps of 75cents against analysts expectations for a 73 cent print.

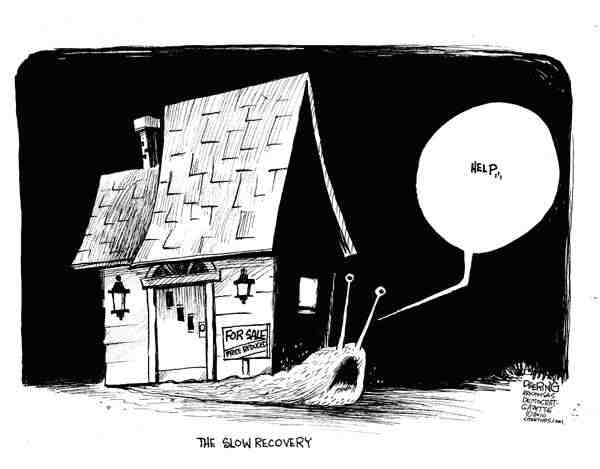

Data wise we just had the release of the Case/Shiller index of the 20 US cities house prices which showed a somewhat encouraging raise of 0.3%, slightly above market expectations. The annual rate of increase was +4.2%. From the trough in April 2009, the index managed to climb 6.3% (after a 33% plunge between mid 2006 and April 2009). However, keep in mind that the Case/Shiller index is a moving 3 months average, i.e. the June take is in reality an average of April, May and June data. These months were still influenced by the effects of the now expired tax credit. Judging from the recent plunge of home sales and high levels of inventories, house prices might turn south in autumn.

Today’s Market Moving Stories

•Overnight the Nikkei shed 3.55% with Asian tech names getting hammered on evidence DRAM pricing is accelerating to the downside and confirmation from Intel that PC demand is waning (I did think the market had missed the significance of this yesterday). The bears pointed to the high correlation between Intel revenues & global GDP. People seem to have given up on the BOJ, and USDJPY is heading back down to the lows. Sony which earns more than 70% of sales outside of Japan, declined 3.3%, Canon which that gets more than 80% of its revenue overseas, dropped 3.1% as the yen resumed its gain, threatening the nation’s export led recovery, even after the Bank of Japan moved to expand its lending program.

•U.K. consumers (perhaps surprisingly) have become significantly more optimistic about the outlook for the economy during August, driving the first pick up in confidence since February. Polling firm GfK NOP Tuesday said its headline measure of consumer confidence rose to 18 from 22 in July, surprising economists, who had estimated that the measure of confidence declined again to 24. The recovery in confidence will come as an encouragement to the government, which announced a series of austerity measures in its June 22 budget. Opposition politicians and some economists have warned that those spending cuts and tax hikes could push the U.K. back into recession if consumers curtailed their expenditure.

•The Bank of England will leave interest rates on hold until the second quarter of 2011 as government spending cuts increase the risk of a double dip recession, the British Chambers of Commerce said. Economic expansion may average 2 % in the next five years, lower than the 3% average in the 15 years through 2007, the London based group said in a statement today. It raised its growth forecasts for this year and next to 1.7% and 2.2% from a June projection of 1.3% and 2%. The U.K. economy grew the most since 2001 in the second quarter, as central bank officials split on whether there is a bigger threat from inflation or a slowdown in the recovery.

•UK MFI release this morning shows ongoing deleveraging by the corporate sector; and very weak growth in household borrowing. The trend in outstanding bank lending to individuals continues to be very weak, with some recent signs of decelerating. Meanwhile, the recent trend in the number of mortgages being approved has remained very low, with new housing mortgages in July at 48.7k, cf. an average of 49.3k in Q2 and 47.7k in Q1.

•The Bank of Japan’s decision to expand a bank-loan program was “too little and too late” as a means of halting the yen’s advance, said former central bank policy board member Nobuyuki Nakahara. The BOJ will boost the amount of funds in its lending facility by 10 trillion yen ($118 billion) to a total of 30 trillion yen, it said yesterday after an emergency meeting. The central bank is ready to take more action if necessary, Governor Masaaki Shirakawa said at a press briefing, citing risks to his view the economy will extend its recovery.

•President Barack Obama said in a speech last night that his economic advisers will examine “additional measures” to promote hiring and growth and urged Senate Republicans to drop their “blockade” of a measure to help small businesses. Obama called for congressional passage of initiatives he’s already outlined, including extending tax cuts for middle income Americans and a package of tax incentives and lending aid for small business. Obama said at the White House after a meeting with his advisers. He said there is no “silver bullet” that will undo the damage caused by the recession. His speech certainly seems to have underwhelmed markets (but no change there).

The FT is on Ireland’s case again today

Nothing new in the article but further evidence that Ireland is moving away from its status as the country who was ahead of the curve in terms of its approach to cutting government spending (the poster child of austerity) to one that the markets are increasingly focusing on as a weak link of the Eurozone Periphery. Ireland’s spread to Germany out over 350bp this morning and 20bp above Portugal, ouch. The banking bun fight with US rating agency Standard & Poor’s (who downgraded Ireland’s credit rating and left the country on negative outlook) continued today with Anglo Irish Bank’s CEO Mike Aynsley going out his way to state that the not insignificant sum of €25bn was as much capital as the defunct lender needed saying he’d not idea how S&P came up with their latest €35bn requirement to do the same job.

Some good news older adults who enjoy two glasses of wine or cocktails daily may drink a toast to researchers who confirmed that moderate drinkers live longer than teetotalers. A study of 1,824 adults ages 55 to 65 found that moderate and heavy drinkers were less likely to die than abstainers over a 20-year span, according to researchers at the University of Texas and Stanford University in Palo Alto, California. Moderate drinkers were defined as those who have one to fewer than three drinks daily, with heavy drinkers having three or more alcoholic beverages a day, according to the study in the journal Alcoholism: Clinical & Experimental Research.

Company / Equity News

•Offsetting to some extent the dire numbers from Anglo Irish this morning are better than expected results from Irish Life and Permanent , Grafton Group , Kerry Group and IFG

•Firstly to Irish Life and Permanent reported its H1 numbers this morning, posting a net loss of €26m, much better than the €215m net loss last year. Outlook for the 2nd half is pretty much that bank will continue to record losses and insurance continues to improve.

•Grafton’s interim results confirm stabilisation in H1 sales with a 1% yoy decline to €979m being reported. This is inline with pre close guidance of circa €980m. A first half operating profit of €14.8m compares favourable to the markets €11.1m expectation and represents a significant turnaround on the underlying loss of €4.1m reported in the same period last year. At the earnings level H1 eps is 5.6c. A flat interim dividend of 2.5c is to be paid. The group has this morning confirmed that the refinancing of net debt to 2013 has been completed. In addition, net debt was reduced by €41m to €281m leaving the group in a strong financial position with gearing of only 29%. Grafton is guiding that it expects further profit improvement in H2 which is consistent with a view for a full year operating profit of €50.1m.

•Best of the bunch is probably Kerry Group who have reported a strong 19% advance in adjusted eps for the six months to June 2010. It has also raised its full year earnings guidance to “mid single teen” percentage growth which implies eps of about 188c and compares with consensus forecasts of 186c. Dividends are up 14.3% to 8.8c. Given recent comments from a variety of food and retail groups that consumer demand was waning, and knowing the impact of a deep recession in Ireland, these numbers are highly credible. The outlook statement is positive, saying “Notwithstanding raw material/input cost headwinds, we now expect to achieve mid-teen growth in adjusted eps for the full year”.

•Lastly IFG today reported interim results for H1 showing a 16% increase in revenues to €57.4m well ahead of analyst expectations of €45.9m. Operating profits were also strong at €11.1m and the dividend was increased to 1.35c (2009 : 1.27c). Finally on outlook IFG is confident of meeting “market expectations” for the full year (€133m in revenues, EBITDA €28.1m) and continues to see its core business remaining strong.

•In other Irish related news Ryanair announced that it would close its Belfast City Airport base at the end of the current summer schedule on Sun 31 October 2010, following the airports confirmation that the public inquiry into the promised runway extension will be further delayed, thereby delaying yet again the launch of Ryanair low fare flights from Belfast City Airport to destinations all over Europe.

•Beyond these shores Research In Motion have averted a ban on its BlackBerry services in India that would have affected more than a million users and halted the Canadian company’s expansion in the world’s second largest mobile-phone market. India’s telecommunications department will test RIM’s monitoring solution for 60 days to see if it allows security agencies to tap its messenger and enterprise mail services, Onkar Kedia, an Indian Home Ministry spokesman, said yesterday. Officials had given the Waterloo, Ontario-based company until today to provide monitoring tools or face a possible ban.

•Media conglomerate Bertelsmann AG Tuesday said it swung to a first-half net profit and lifted its outlook for 2010. Net profit for the six months ended June 30 was €170 million compared with a net loss of €368 million in the same period a year earlier.

•Potash Corp. of Saskatchewan Inc. said BHP Billiton has been cold calling some of its customers as part of a $40 billion “hostile takeover effort.” BHP, the world’s largest mining company, made a $130 a share bid for Potash Corp. on Aug. 18 after the Saskatoon, Saskatchewan based fertilizer producer rejected an initial approach, calling the offer “grossly inadequate.” Potash Corp. Chief Executive Officer Bill Doyle said he’s seeking other offers.

•AstraZeneca , the drug maker has failed to win U.S. clearance to sell motavizumab, a new drug intended to succeed the $1bn a year respiratory medicine Synagis, which loses patent protection in five years.

•GlaxoSmithKline and Valeant Pharmaceuticals may have to wait an extra three months for a review of their experimental epilepsy medicine after U.S. regulators sought more time to study data. The FDA pushed back the targeted date under the Prescription Drug User Fee Act to review ezogabine to Nov. 30 from Aug. 30, the companies said in a statement.

•Carrefour, the world’s second largest retailer after Wal-Mart has reported first-half profit that fell short of analyst estimates, hurt by a decline in Latin American earnings. First half net income of €82m compared with the average analyst estimate of €292m. Carrefour confirmed its 2010 target for an activity contribution of €3.1bn. Activity contribution is a measure of operating profit.

And finally

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.