Gold Prices to Challenge All Time High

Commodities / Gold and Silver 2010 Sep 03, 2010 - 04:45 AM GMTBy: Bob_Kirtley

So much for a lackluster summer and the summer doldrums as gold prices increase by around $100/oz in August 2010, to close at $1251.20/oz . As the chart shows August has been a great month for gold prices setting the stage for a ‘Fall’ rally which we expect to be dramatically to the upside. The technical indicators are now in the overbought zone and we would normally expect gold to take a breather, however, these indicators have been known to stay high for prolonged periods of time.

So much for a lackluster summer and the summer doldrums as gold prices increase by around $100/oz in August 2010, to close at $1251.20/oz . As the chart shows August has been a great month for gold prices setting the stage for a ‘Fall’ rally which we expect to be dramatically to the upside. The technical indicators are now in the overbought zone and we would normally expect gold to take a breather, however, these indicators have been known to stay high for prolonged periods of time.

By now you should have analyzed your portfolio and weeded out some of the laggards and acquired a few more of your favourite stocks or indeed added some new faces in preparation for the next up leg. Oh yes, it is coming and its coming fast so ignore your day job for an hour or two and and do some thinking that will set you up until at least New Years Eve.

Next week sees the celebrations of Labour Day, 6th September, in the United States and the return to their desks of the bigger players. Sipping pink champagne on the back of a yacht in the Caribbean eventually loses its appeal, so they tell me!

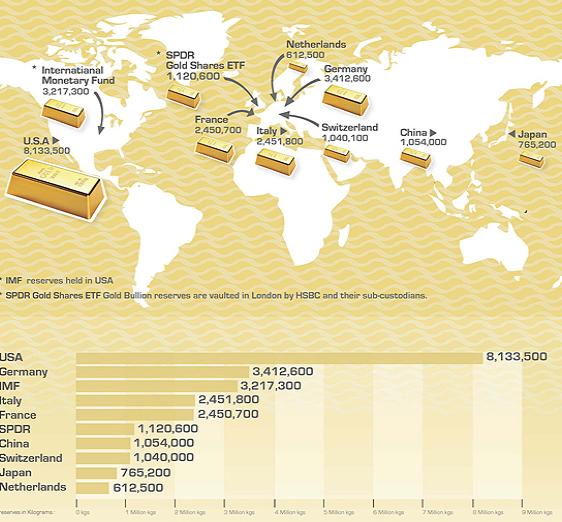

Now, heres a graphical representation of just where gold resides kindly sent to us by money choices which may be of interest to you.

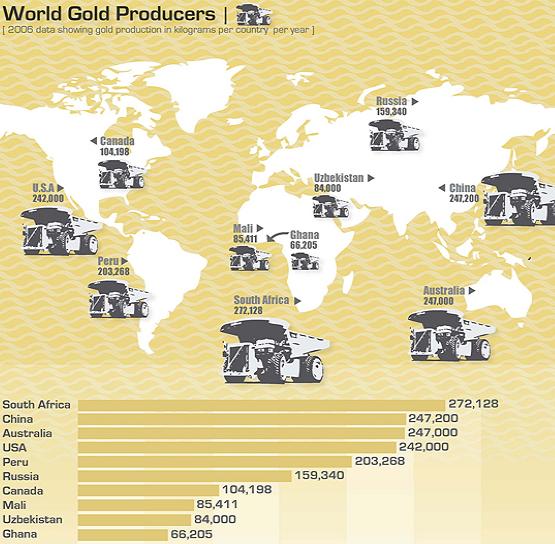

Followed by a map of the worlds gold producers which is also neat.

Keep an eye on silver prices as they are also on the move and will present us with a few opportunities to make a a buck or two, either through positioning ourselves in those stocks that are very responsive to any movement in silver prices or via a well thought out trade in the options sector. As you know on Friday, 27th August 2010, we closed another successful trade banking a profit of 79.46% on Call Options on Silver Wheaton.

We are overweight on Silver Wheaton and today we were pleased to see it add 2.84% on the back of rising silver prices. Keep making comparisons between various stocks and option trades to ensure that you are getting the best bang for your buck. Percentage gains is the name of the game so focus on them and don’t fall in love with a stock, its just a vehicle to protect yourself in these times of madness and return to you a profit. That’s its job so expect it to perform. If it doesn’t, then find the courage to wield the axe.

Stay on your toes and have a good one.

On Tuesday the 11th May we bought back the puts for just $0.05, making a 44.44% profit in just 4 days.

Silver-prices.net have been rather fortunate to close both the $15.00 and the $16.00 options trade on Silver Wheaton Corporation, with both returning a little over 100% profit.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

Got a comment then please add it to this article, all opinions are welcome and appreciated.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.